A great advantage you can get from my 30+ full-time investor journey and GeoInvesting’s 15 year history (and counting) is a wealth of case study history we can bring you to help you identify great stocks and lessons learned. These new case studies will be able to help you across the entire market cap spectrum by letting you know what type of set ups and catalysts routinely arise in multibaggers. ~Maj Soueidan

All CategoriesVideo Case StudyWritten Case Study

🔍

Load More

All CategoriesVideo Case StudyWritten Case Study

🔍

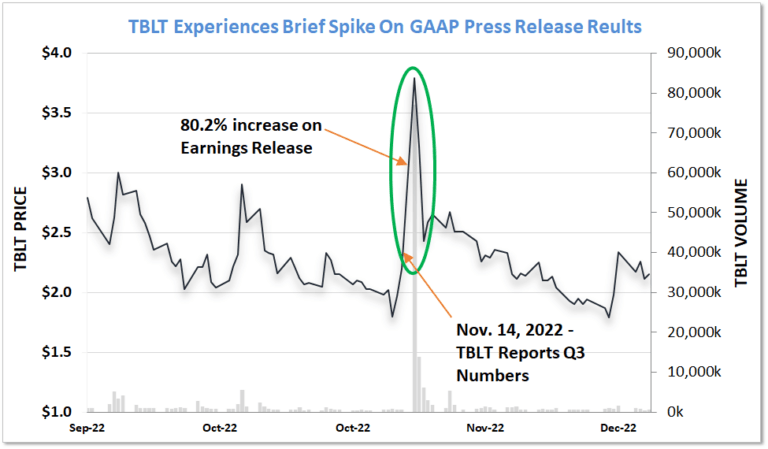

Decades of micro-cap research taught me that hidden details in press releases can reveal opportunities that result in outsized investment gains. To capitalize on this, my team and I developed a...

As part of our ongoing series on multibagger Case Studies, private investor and GeoInvesting contributor Thomas Birnie was kind enough to offer up his second video explaining more on the dynamics of...

Understanding the anatomy of a multibagger stock—one that multiplies its initial investment value several times over, defined as gaining 100% or more—can be transformative for investors. Multibaggers...

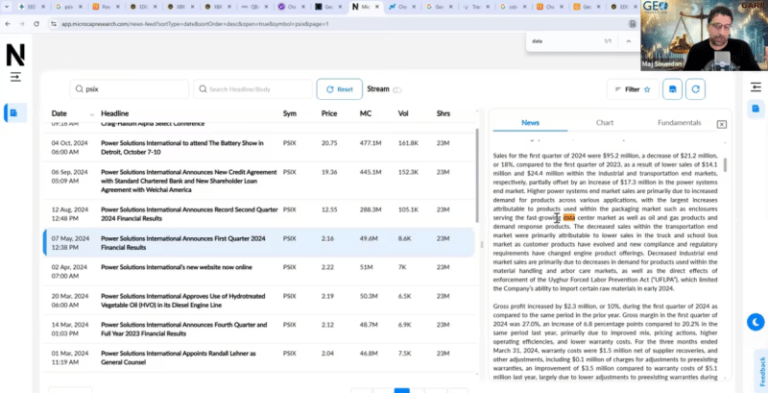

After interviewing the CEO, we learned that the company's data center product is an enclosure designed to protect power systems. This caught our attention because power is one of the biggest growth...

Thomas Birnie, a part-time investor and GeoInvesting contributor, presented a case study on $NFLX as a multi-bagger investment opportunity, focusing on the period around 2011-2012. During this time...

Friday after close $MUEL announced its 2023 financial results, where it reported earnings per share of $4.32 for the fourth quarter and $15.75 per share for the year.

Most importantly, the company...

It’s been an interesting 15 years for GeoInvesting. Those who have grown with us probably know our history pretty intimately. They know that we began as a research firm offering free bullish biased...

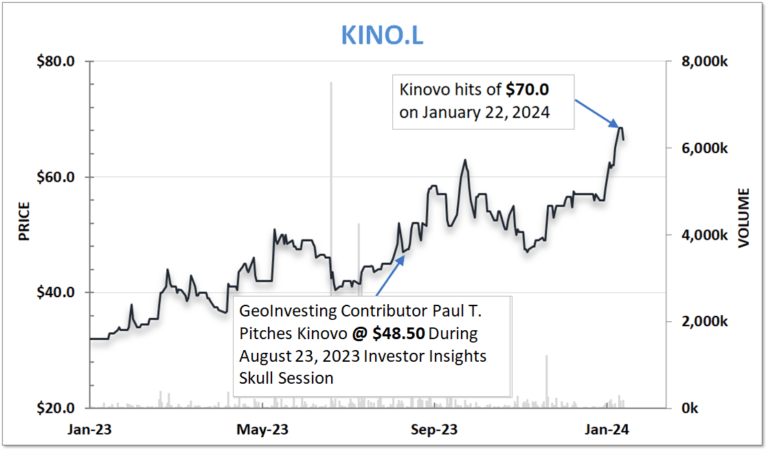

Contributor Pitch On London Based Building Services Stock Proves Timelier Than Expected [Case Study]

Congrats are in order for Paul T. His microcap stock pitch he made on GeoInvestng’s Pro Portal has risen 44.32%.

On August 23, 2023 Paul made his first ever appearance on our Investor Insights...

Some people have this idea that microcaps are all tiny development stage companies with little revenues. However, that is not the case. SMID generates annual revenue of about $50 million, employs a...

On Tuesday, BLBD, the largest American manufacturer of school buses, reported that its fourth quarter earnings per share (EPS) rose to $0.66, reversing a prior year loss, on a 17% increase in revenue...

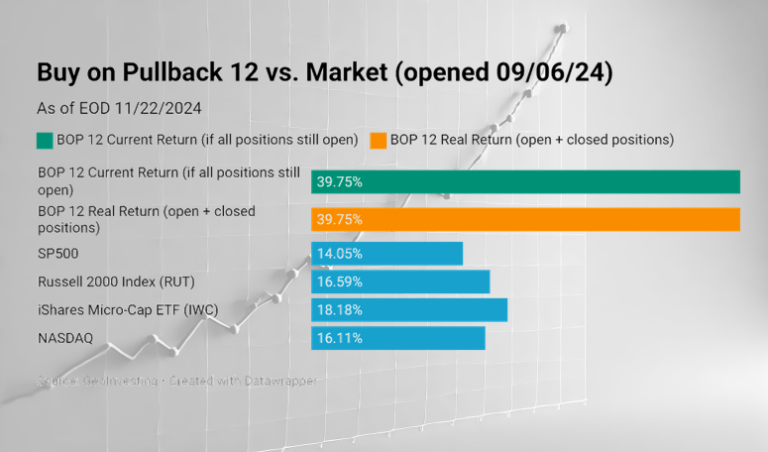

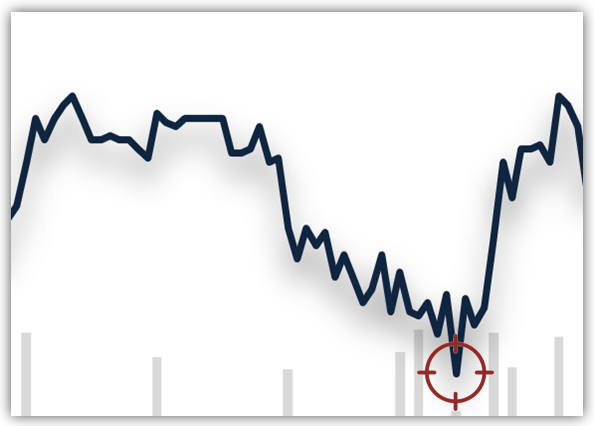

As you may know, on November 16 2023 at 2pm, we hosted a webinar about our contrarian or Buy On Pullback strategy to take advantage of volatility in stock prices, seeking to buy stocks that fall...

IEC Electronics (Nasdaq:IEC) came into our crosshairs in January of 2018. We started covering the company at around $6 a share. This is a classic case study of betting on a jockey - betting on...

Load More

Get More Multibagger Case Studies Like This by Opting in Here. There’s More On The Way Soon!

![Retractable Technologies, Inc. (RVP) – A Classic MicroCap InfoArb Journey [Case Study]](https://geoinvesting.com/wp-content/uploads/2020/12/retractable-technologies-inc-rvp-a-classic-microcap-infoarb-journey-case-study-768x432.jpg)

![Protect Your Portfolio By Knowing Risk Factors [It Also Helps You Profit From Short Selling]](https://geoinvesting.com/wp-content/uploads/2019/10/hqdefault.jpg)