Hello, my name is Maj Soueidan. I’ve been a full-time investor for over 30 years and founded Geoinvesting 15 years ago. I would like to introduce you to my company.

From time to time, you will hear me talk about how great GEO is at what we do. However, the 138 testimonials we’ve received from investors is what really validates this opinion.

But, nothing speaks volumes more than when a CEO of a $100M revenue generating public company throws you a shout out. We invited the CEO to be a guest on our Premium Subscriber Management Interview Skull Session series. At the conclusion of the interview, he commented:

“Obviously you’ve done your homework and that’s a breath of fresh air. Sometimes you get on these calls and folks don’t even know anything about the company and you’ve obviously spent a lot of time looking at it.“…

GeoInvesting has worked diligently over the last decade to understand and benefit from working in areas that the Wall Street “crowd” has avoided – namely, microcap stocks. This niche of the market, while mostly ignored by analysts and financial media, is still often quietly invested in by many well-known billionaires.

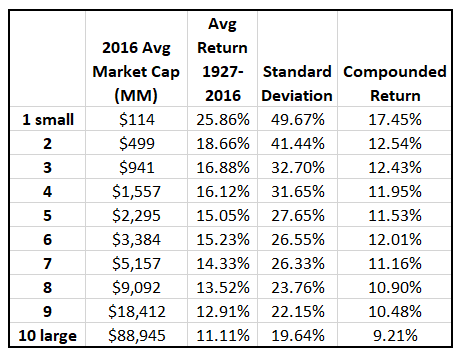

Empirical evidence proves that investing in microcap stocks beats the returns of large cap stocks by 8.24% per year. Even Warren Buffett and Peter Lynch have said that if they were to invest in one type of stock, it would be microcaps. In fact, Warren Buffett made 50% plus returns in micro-caps in the 1950s for his own account.

“Over time, it’s been more profitable to invest in small companies than in large companies. The successful small companies of today will become the Wal-Marts, Home Depots, and Microsofts of tomorrow.” – Peter Lynch

“Investing in small stocks still has some major advantages over investing in larger-cap companies. These stocks, because of their smaller size, are subject to less research from both institutional and individual investors.” – Joel Greenblatt

“I do think if you’re working with very small amounts of money that there are almost always some significant inefficiencies someplace. When I started out I went through all the Moody’s manuals, page-by-page. There were many things that popped out and none of them were in any brokerage report of any sort. They were just plain overlooked.” – Warren Buffett

We combine the microcap investing edge with our own premium research to find the best stocks that are experiencing profit growth along with other catalysts to provide our subscribers with an even bigger edge. Our approach is based on qualitative and quantitative factors.

We apply our own deep-dive analysis to find pockets of information arbitrage and unnoticed opportunities that have served as the backbone for our investing success for over a decade.

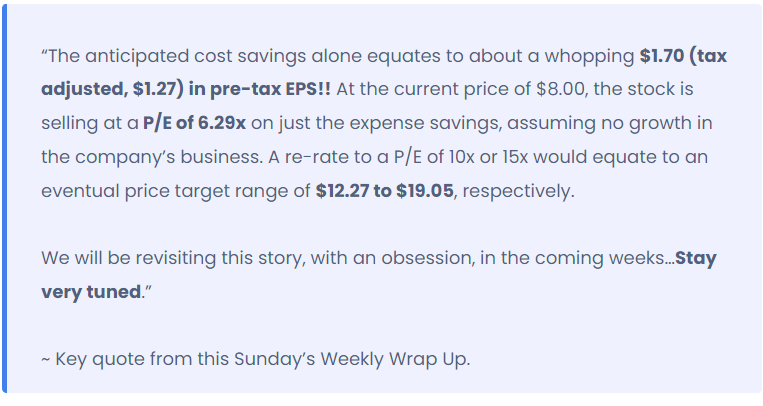

We define Information Arbitrage as a noticeable disconnect between stock prices and available public information on a company, and which is monetarily worth pursuing. Sometimes, the mispricing of micro-caps can be substantial.

Unlike most investment banks and sell-side analysts, we don’t get paid by companies to write about them. Armed with analysts,my three decades of full-time investing experience, and real-time fintech tools from MS Microcaps, GeoInvesting gives you the power to make educated investing decisions with confidence. Whether you’re an experienced investor looking for high-impact idea generation or just looking to broaden your knowledge of investing, GeoInvesting can help with actionable insights on the most promising microcap stocks.

Our microcap stock coverage universe encompasses 1500+ companies, 1900+ spotlight research notes, 2700+ email bulletins, 200+ articles, & over 200+ videos and clips.

Since 2014 some of our microcap expert subscribers have been publishing microcap stock research reports on our website. Since then, they have published over 100 reports.

Our Services

Since GeoInvesting’s inception in 2007, we’ve been helping investors understand companies better by interviewing management teams, dissecting earnings conference calls, interacting with our wide network of investors and scouring financial documents for hidden clues that could have a large impact on the price of a stock. GeoInvesting provides quick, concise and efficient research instead of hundreds of pages of meaningless boilerplate jargon to pour through. You will no longer have to sift through these documents to find the most relevant aspects of a company’s operations, results and guidance – that’s our promise.

GeoInvesting provides a subscription service at a fixed rate annual, bi-annual or quarterly basis that provides you with relevant and timely stock research in the microcap universe:

- Up-to-date stock ideas backed by reports and updates based on in-depth research from our team of analysts, sent to you via premium tweets and emails.

- Curated morning emails to get your investing day started.

- 15 Years of archived research on over 1500 companies.

- A front row seat to Live Fireside Chats and CEO Interviews that give you a peek into what’s going on inside some of today’s most promising microcaps.

- Information Arbitrage when we see it: Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- A weekly Premium newsletter with a timely feature and a recap of the previous week’s coverage, just in case you missed it.

- Stock pitches from our expert subscriber investor network.

- Education on investment process and case studies

Smaller Cap Advantage

There are several advantages to investing in Smallcap, Microcap and Nanocap stocks. Some of them are:

- Barriers to entry: Large capital requirements lead to multi-billion dollar institutions facing difficulties with investing in microcap companies, providing individual investors with an advantage.

- Insulation from market gyrations: Microcaps are less affected by market downturns compared to large caps because they are not heavily influenced by funds and ETFs that indiscriminately sell off holdings.

- Limited competition: The negative stigma surrounding microcaps and the barriers to entry create a niche market with less competition, allowing individual investors to dominate and access unique resources like management team interviews and conferences.

- First mover advantage: Individual investors can invest in promising microcap companies before institutions, allowing them to potentially benefit from significant price appreciation when these companies grow to the size required for institutional investment.

- Inefficiencies and return potential: Limited institutional participation in the microcap space leads to greater inefficiencies and return potential, as not every stock is heavily valued down to the penny by high-powered institutions.

- Less competent competition: Successful investors in the microcap space often outgrow the niche, leaving behind less competent competition and potentially increasing the opportunities for superior returns.

An 89 year study provides us with the Empirical Evidence to prove that investing in microcap stocks beats the returns of large cap stocks by 8.24% per year.

For more information on the microcap advantage, please read through the article on our website entitled “Microcaps”

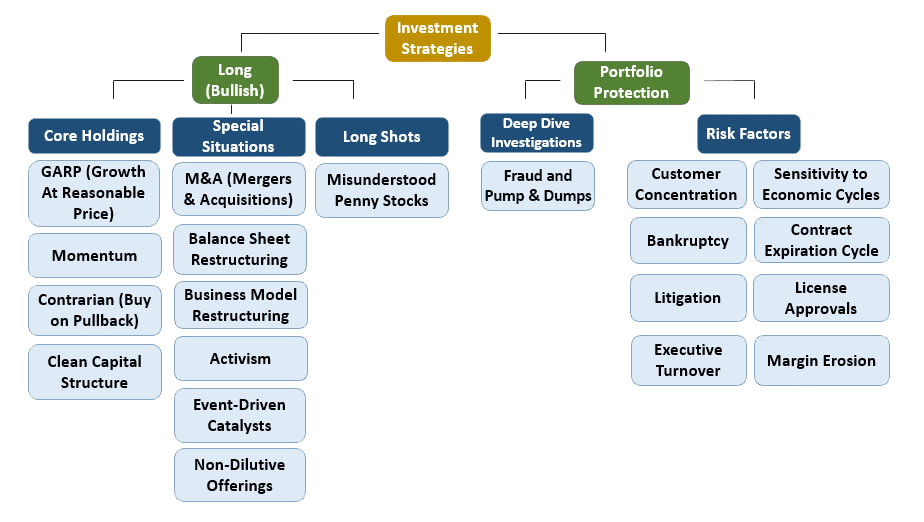

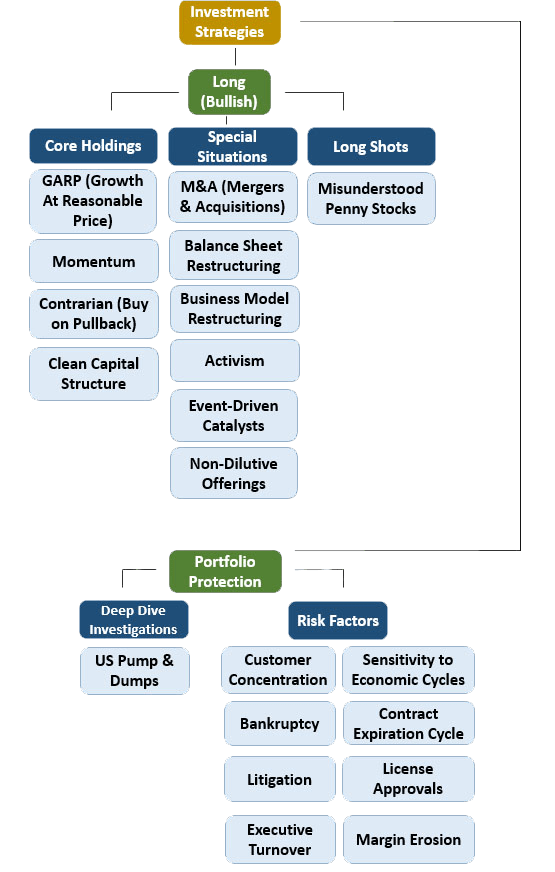

Strategies Based on Short to Long Term Time Horizons

Our strategies span the entire short-term to long-term spectrum. However, everything we do is based on fundamental research. We’ve also developed criteria to help us choose the best stocks from the 10,000 microcaps in North America that we follow.

Tier 1 Quality Microcaps – A list of top 10 qualities to look for in a microcap company before considering investing in one.

Multibagger traits – A guide to identifying multibaggers (stocks that generate substantial returns, typically many times their investment value) by looking at 8 traits that most multibaggers share.

GeoPowerRanking – A powerful recipe we have devised that can be used to identify opportunities through the use of analyst EPS estimates as well as our own estimates when there is no analyst coverage.

Information Arbitrage – Pockets of little known market-moving information and knowledge that provide us with profitable opportunities before the rest of the investing public. Therein lies the investing edge and is a great strategy for reaping short-term profits.

Sincerely,

Maj Soueidan, Co-founder GeoInvesting

![While Multibagger Turnaround Candidate CAWW And CANOF Performance In Focus, A New Potential Data Center Play Emerges [GeoWire Weekly No. 145]](https://geoinvesting.com/wp-content/uploads/2024/07/Turnaround2-768x756.png)