Model Stock Portfolios That Can Connect With Your Investing Style

GeoInvesting’s Model Portfolios, launched in 2016, make it easy for you to know what stocks in our 1500+ microcap coverage universe (United States and Canada) to pay attention to.

These Model Portfolios have consistently delivered high returns and easily beaten the market.

GeoInvesting Premium subscribers use these portfolios to build their own quality microcap multi-bagger portfolios or perform their own research.

Get Access To GeoInvesting Model Portfolios For 30 Days

Most Popular GeoInvesting Model Portfolios

New High Conviction Monthly Open Forum Focus Model Portfolio

This NEW Model Portfolio includes stocks that we predict can rise 50% to 100% in the near-term, while also having long-term multi-bagger potential. In essence, these are our favorite core stocks. We announce new additions to the portfolio during our live open monthly forum events conducted at the beginning of each month.

There are currently 7 stocks (as of 10/26/2024) in this model portfolio, here’s an example focus stock addition from our 9/5/2024 monthly open forum, in which Acorn Energy, Inc. (OTCQB:ACFN) was highlighted:

Notably, one third of the stocks in this portfolio have eclipsed at least a 50% return. (As of Sept. 28, 2024)

Join today with an annual two week free trial or a monthly subscription.

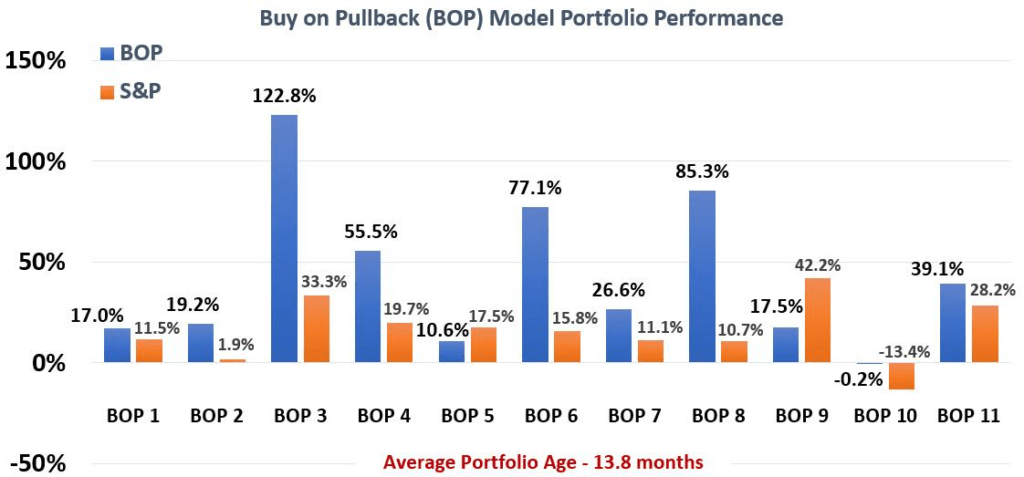

High Conviction Buy On Pullback Model Portfolio

The Buy on Pullback Model Portfolio employs a strategy that identifies high-potential microcap stocks that have recently experienced a price dip, or “pullback,” often due to market volatility or temporary factors rather than fundamental issues with the company. This creates an opportunity to enter a position with expectations that the dip is temporary.

Nine out of our first 11 Buy on Pullback Model (BOP) Portfolios beat the major stock indexes.

Join today with an annual two week free trial or a monthly subscription.

Speculative Run to $1 (R21) Model Portfolio

Throughout the last three decades, our founder, Maj Soueidan, has come to enjoy placing speculative bets on stocks trading under one dollar to complement his long-term portfolio of high-quality microcap stocks.

Maj also enjoys proving all the microcap haters and skeptics wrong. That’s why we created the GeoInvesting Run to $1 Model Portfolio in 2013.

For example, GeoInvesting’s Run to $1 Model Portfolio has an average return of 45% over an 11-year span across nearly 50 stocks. (As of Sept. 28, 2024)

Simply, the R21 contains stocks trading under $1 that we feel have what it takes to eventually eclipse the one dollar mark in the future.

Here’s a nice summary of our Run to $1 Model Portfolio journey, including our biggest winner that went onto increase over 6395%.

a One tweet says it all:

“Our Run to $1.00 Model Portfolio holds sub-$1 stocks we flag for potential multi-baggers. We’re on the lookout for real Cos. being mislabeled by the crowd. Cos. with real revenues, profits & solid Mgmt. vs pump & dumps.”

Join today with an annual two week free trial or a monthly subscription.

More than Just A List

Please understand that our model portfolios aren’t just lists of stock picks; they’re roadmaps.

Each stock in these portfolios is selected based on our rigorous analysis to build model portfolios that give investors a blended exposure to undervalued stocks with themes like growth, GARP, contrarian, momentum, special situations, turnarounds and dividends/income that are undervalued.

Regular updates ensure that Geoinvesting Premium subscribers have access to new stocks added to these portfolios, as well as ongoing updates and removals, backed by research from our analyst team.

We now have 16 years of our own Research Archives to be able to quickly pull from our 1,500 microcap stock universe, as opportunities arise.

When you combine this with scores of other stock pitches from our investor community, GeoInvesting Premium subscribers get a huge competitive advantage against other stock picking sites, newsletters and research platforms.

👇Start building your high quality microcap portfolio today👇

$34.97

Contact Us

Address

P.O. Box 536 Skippack, PA 19474

Email:

support@geoinvesting.com

Phone:

800-891-1526

Testimonials

I am a relatively new member. I am really enjoying the service. Even more importantly, I am learning a lot. I like the GeoInvesting approach, where you guys just demonstrate your trades, rather than providing buy/sell recommendations. This is great because this allows the subscriber to proceed and do his/her own research on these names. I do not have a great amount to invest. I have allocated 10 thousand dollars for GeoInvesting ideas and for future membership fees! Keep up the great work guys. Es

Eswaran W.

Hi Maj, Been a GeoInvesting member since Summer 2018. You opened my eyes to the inefficiencies and opportunities in the microcap market. Looking forward to learning more from you and the GeoInvesting team.

Ani V.

7 Reasons to Love @GeoInvesting: * Maj Soueidan is a kind and generous mentor * Experienced and proven tea * Brings you quality microcap ideas * Helps you avoid deceptive companies * Quick and concise research * Deep due diligence * Maj is a top ranked @MicroCapClub member

Thomas B.

Thank you for your e-mails. I am glad that I was able to join GeoInvesting. Microcaps are one of the very few niches where a retail investor can do well, and your service looks sincere and solid. I learnt to know about it from a podcast interview with Nate Tobik and Fred Rockwell. I’ve bought a small bucket of stocks that are in the portfolios but haven’t run up yet. From now on I will focus on the daily morning newsletters and add something new that looks promising. I’m grateful that you make the information available through e-mail and not only through Twitter.

H. Narrog

Hi, I have already taken some action and purchased some shares in some of the stocks you cover. So far with the information from the GEOinvesting portal I have been able to monitor and understand those shares and navigate the web page easily. The information I am getting from the portal is extremely helpful in understanding why stocks go up or down. Thank you so much for helping me get started and coaching me through this, I appreciate everything Maj, and the Geo team have provided me with.

Austin G.

GeoInvesting is the most valuable microcap research service available today. Their breadth of coverage, when considering depth of analysis, is the most expansive we have yet to encounter. Their coverage focuses on actionable ideas. Their analysis includes considerations of timing and most importantly their thesis and corresponding granular support for their views; and they are transparent with respective to their own positions in the names they cover. GeoInvesting’s principal, Maj Soueidan, is one of the best microcap investors in the equity markets today.

David Baker, VideoXRM

I personally really, really believe that you have the best personal approach to speculation…best odds by far …than anyone else I’ve seen in my 40 yrs at this….no kidding Maj… the fact that it is the closest to my own has something to do with it…as I have been hurt so many times that I only take the smallest risk possible in choosing an investment campaign.

Mario Rinaldi

GEOINVESTING has a fantastic team that does amazing due diligence to find potentially explosive opportunities in the microcap space. I have tremendous respect and admiration for Maj the CEO and co-founder of GEO. He is one of the most humble and hardest working, all around stand up guys in the business. GEO has had some amazing calls over the years that makes their service a steal in my opinion. If you aren’t afraid of the space and you understand the risk and potential rewards of microcaps.

AlphaWolfTrading.com

“@GeoPremium I have bought calls based on your report, made 100% on my money, could have made 200%. Anyway, great call as always!”

bednar_filip (Twitter)

“First off, great site – love the depth of info you give out on my favorite sector — micro-caps”

Matt M.

“Your service is excellent. I have been doing quite well with your recommendations in the ‘buy on pullback” mock portfolios.”

Gary D.

I am glad that I was able to join GeoInvesting. Microcaps are one of the very few niches where a retail investor can do well, and your service looks sincere and solid. I learnt to know about it from a podcast interview with Nate Tobik and Fred Rockwell.