By Maj Soueidan, Co-founder GeoInvesting

There are seven stocks in our Buy On Pullback (BOP) Model Portfolio #11. Before the beginning of last week, three had risen at least 30%. Now, in light of a fourth stock reaching a return of 39.70% on Wednesday, we’d venture that it is time for another update.

This stock is Blue Bird Corporation (NASDAQ:BLBD), the largest American manufacturer of school buses. Despite generating over a billion dollars in revenues, the company is finding new ways to grow by making electric vehicle (EV) buses.

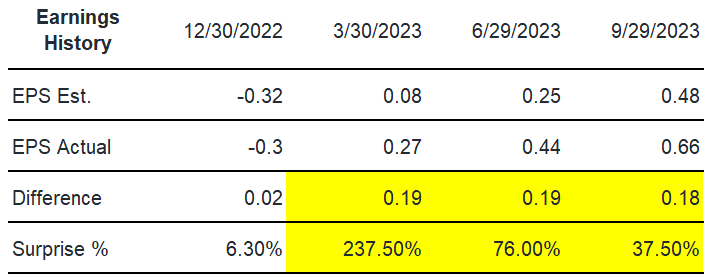

On Tuesday, BLBD reported that its fourth quarter earnings per share (EPS) rose to $0.66, reversing a prior year loss, on a 17% increase in revenue. Furthermore, they demolished analyst EPS estimates of 48 cents per share, the third quarter in a row in which they beat EPS estimates by a wide margin:

By the way, BLBD has a market-cap of $1.9 billion. So, once in a while I showcase ideas at GeoInvesting that are not microcaps (market caps under $300 million), since I know that some of our premium subscribers like to also buy liquid stocks.

I also wanted to use this moment to show you an example of my personal cliff note process that I have used for over 30 years to summarize the best stocks from my research pipeline to highlight.

My cliff notes are quick to the point summarizations of a story, as it forces me to “get right to the point.”

- Themes of the story

- Why I am tracking a stock

- Quick valuation assessment

- Caveats

- Research tasks

If I met you at a barbeque, I would want to be able to tell you why I like a specific stock in under 5 minutes, maybe even in one sentence, as I did in this tweet on our most recent idea highlighted at GeoInvesting.

I love distilling a new stock idea to a few sentences, forcing me to understand the core of a bullish thesis.

“Management’s new biz plan to target less cyclical markets & drive material improvements in margins is getting no respect from investors. 300% upside.” @GeoInvesting

— Maj Soueidan (@majgeoinvesting) December 1, 2023

Peter Lynch applied the Cliff Notes approach while managing billions of dollars as the portfolio manager of Fidelity’s Magellan Fund.

His use of Cliff Notes was discussed extensively in an August 7, 2023 interview I had with private investor Tim Heitman, who worked at Fidelity while Lynch was at the helm.

Below, pay particular attention to 1:16 – 4:04 from a clip of that discussion covering Lynch’s philosophy on pitching a stock:

“…One, he had so many stocks to pay attention to. But two, his premise was, “If you can’t tell me in three minutes, what the investment thesis is, in a clear and concise way, clearly there isn’t one, right?” I think a lot of people like to be dazzled by a 20 or 30 page in-depth report – “Oh, wow, this guy knows everything” – sometimes it’s just as simple as they’re number one in the industry. And here’s how their margins are higher than everybody’s, and it looks like this is gonna continue for a while. I think sometimes people get too involved in complicated thinking, and that they think their edge is that they know a company better than anybody else. And I don’t, I don’t think that’s true.”

Lynch crushed the S&P 500′s performance, more than doubling it with an annualized return of over 29% over 13 years.

Standard and Poors and the Value Line use a tear sheet approach to give investors a quick glimpse at the essence of a company’s fundamentals, growth outlook and risks. I cut my teeth in investing using the Value Line, religiously. So, it’s no surprise that I still use the cliff note methodology today.

Here is what my Original BLBD Cliff Note looked like from July 11, 2023, which allowed me to quickly assess the stock before we introduced the idea to GeoInvesting Premium subscribers when we launched BOP #11 in September and set a 2024 year end price target of $27.80. Well, we almost got lucky, as the stock hit a high of $26.96 on Wednesday.

BLBD Cliff Note

Themes: Restructuring – Strong Strong EPS Power Ranking; Non-dilutive Trading Opportunity

BLBD Designs, engineers and manufactures school buses.. The Company is the market leader in low- and zero-emission school buses with more than 20,000 propane, natural gas, and electric powered buses in operation today.

The company has a history of inconsistent growth and is very expensive on a trailing P/E basis. However, it seems that the company is about to enter a new growth cycle.

Reasons to Track

- Blew out Q2 sales and EPS estimates, when they reported EPS of $0.27 vs an estimate of $0.08. Sales rose 44%.

- Earnings Power Ranking (EPR) of 10, meaning that earrings are expected to grow for 10 quarters in a row (one of the best EPRs in our coverage universe).

- The new growth cycle seems to be coming from demand for its new EV bus line.

- Positive momentum is also coming from restructuring moves such as increasing pricing and reducing fixed costs.

- The stock had a huge run from about $20 to $28.80 after it reported Q2 results. However, the stock has retraced most of that move due to secondary offering priced at $21.00 that is just about to take place. The shares related to the offering are not new shares, but are from a large private equity firm that is selling (possibly has to due to its by-laws). We see this as a perfect set-up for the stock to quickly get back to its highs.

Valuation: EPS are expected to grow to $1.49 in 2024 and $2.33 in 2025. Given the new growth cycle the company is entering, we believe the stock could minimally trade at a P/E of 20x 2024 EPS estimates, or $29.80.

Caveats: 1. Large debt burden 2. Debt burden could keep valuation low 3. More selling pressure from private equity firms who need to get out to their by-laws

Research Tasks: 1. What are plans to reduce debt? 2. How many years of growth does the company expect it can get from the new EV bus strategy? 3. Any more opportunities for further cutting expenses?

You can read more about why we launched BOP #11 and how the strategy works, here

We are on the cusp of releasing BOP #12, which you can get early access to by joining GeoInvesting today.

In fact, we’ve already identified 1 stock that has fallen sharply that we think has 56% upside.

By joining, you will get access the full Tim Heitman video reverenced above and research on all GeoInvesting’s covered stocks, which now exceeds 1500.