Director Joseph Manko of Horton Capital Management was an insider that we came to know as a recurring Form 4 filer for Repro-Med. His filings helped shape the way we viewed Repro Med Systems (OOTC:REPR) as an investment, especially through the tumult that the company had to endure over a several-year period.

We’ve covered REPR ad nauseam, with a persistence we feel might be largely unparalleled in the microcap research service space. Although it has been on our radar since 2009, our affinity for the stock ramped up in 2014 when we issued a brief RFT (Reasons for Tracking) on it, as more of an inaugural look at the company for our members.

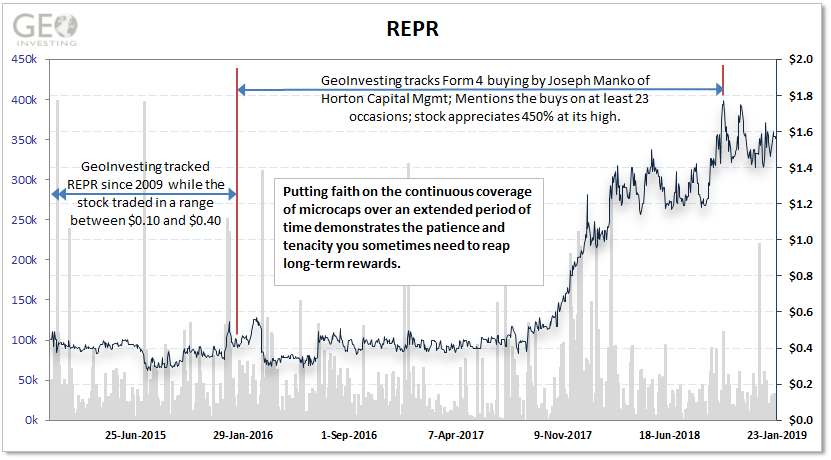

REPR engages in the design, manufacture, and marketing of proprietary medical devices primarily for emergency medical applications and ambulatory infusion therapy worldwide. We have been tracking REPR since 2009. Since then shares have traded in a range between $0.10 and $0.40. Although the company has maintained profitability since 2009 it has not grown its bottom line. We believe this is because the company is reinvesting into its marketing initiatives.

The company has also been altering its distribution model which results in higher sales but lower gross margins.

Reasons we are tracking:

- Its product has been around since 1994.

- No debt, current ratio of 6.9, positive non-GAAP EPS of $0.02 for FY 2014 and cash flow positive

- The number of pumps shipped has steadily increased since 2009

- 2009- 2300

- 2010- 3000

- 2011- 4300

- 2012- 4800

- 2013- 5600

- 2014- 6300

- We interviewed the company several years ago where management stated that their product was safer, more reliable and cheaper than competing products. Specifically, the company claims that its pump creates consistent pressure as opposed to competing electric pumps where pressure can vary , potentially causing harm to the patient.

“For the home care patient, FREEDOM60® is an easy-to-use lightweight mechanical pump using a 60ml syringe, completely portable, cost effective and maintenance free, with no batteries to replace and no cumbersome IV pole. For the infusion professional, FREEDOM60® delivers accurate infusion rates and uniform flow profiles providing consistent transfer of medication. The FDA approved a Form 510(k) Pre-market Notification for initial design of the FREEDOM60® as a Class II device in August 1994.

With the respect competition: the patient is at risk from damaging pressures or not receiving the medication required.”

- Furthermore, the company claims that its safety/alarm mechanism is superior, reducing cases of false alarms which can result in the infusion therapy powering down.

- Its flagship product, Freedom 60 seems to have found a permanent place in its market. Company revenues in 2003 were around $1.5 million and have been gradually increasing over time, finishing at $8.7 million in 2014. The company achieved profitability in 2009 when it earned EPS of $0.03.

- Revenues are continuing to increase in Q1 2015, increasing 41.1% to $2.65 million.

- Just announced appointment of COO, which could help build investor confidence in the story.

- Medicare reimbursement code change has been favorable for the company.

“The new code significantly increases the reimbursement for the FREEDOM60® for billable syringe pump application approved by Medicare.”

Caveats: We need to interview management again to become more familiar with

- Regulatory environment

- Product expansion goals

- Customer expansion goals

- Need to perform industry analysis

- Although the company does not indicate it needs to raise money, we are not ruling this possibility out until we speak to management.

We have patiently owned this stock for a few years

We urge interested investors to read the company’s 10K filings that do an excellent job detailing product advantages and its marketing opportunities. The company does not indicate that it needs to raise money in liquidity and capital resource segment in its 10K.

Trading at a trailing EV/Sales of 0.84, I think that given that the company is profitable and growing revenues, the EV/Sales multiple could expand. When we Annualize Q1 2014 sales, shares are trading at an EV/S multiple of 0.74

Skepticism vs. Optimism in REPR

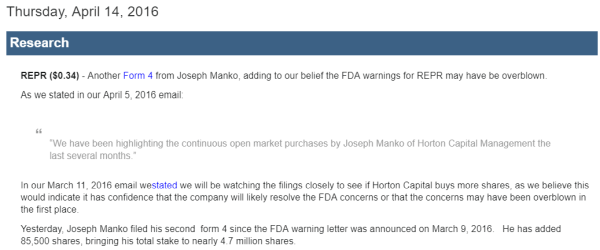

Unfortunately, we were given a reason to be skeptical of Repro Med’s future when they were met by a letter issued to them by the FDA warning them that there were some slight deficiencies in the company’s documentation.

REPR put out a press release responding to an FDA warning letter, where they stated:

“On February 26, 2016, RMS Medical Products, Inc. (“RMS”) received a Warning Letter (WL NYK-2016-26) from the New York District Office of US Food and Drug Administration (“FDA”) based on the observations of an FDA inspection which occurred in June 2015.

During the audit, the FDA identified several areas of improvement; many of those items have been completed to the agency’s satisfaction. There are three items that require additional clarification and RMS Medical Products is in the process of addressing these issues and providing the additional documentation needed.

There were no safety concerns raised by the points made in the warning letter.

“While we anticipate one item taking a bit longer to resolve, the others are merely an exercise in better communicating our thorough processes and premium safety standards to the FDA,” said Dr. Fred Ma, Chief Medical Officer at RMS Medical Products. “As always, we remain committed to uncompromised safety and quality for all of our products.”

Given REPR’s response, we remained cautiously optimistic. Then something totally unexpected occurred that solidified our confidence in REPR’s future. That something was someone named Joseph Manko.

[layerslider id=”24″]

Why Joseph Manko Form 4s Were So Important

While it’s not always true, consistent insider buying can be like a warm security blanket for investors or prospective investors. With it sometimes comes a forthright sincerity that may give you the confidence to move forward in the face of certain adversities.

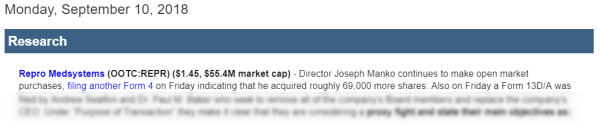

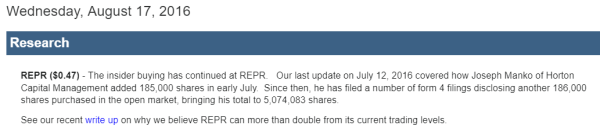

Even in the face of the FDA Warning Letter adversity, Manko bought shares in the open market at least 2 dozen times (we highlighted 23 of those) when he continued to add to his already large stake in REPR. There was no guarantee that the letter would ever be resolved, but the consistency of Manko’s purchases were always lingering in the background, keeping us, as well as our new and long-time members, engaged.

The chart above represents what happened in parallel with the recurring accrual of shares by Manko. Although we had already noticed some inside buys at depressed prices in REPR, this buying did not stop even as shares remained stable and eventually continued to climb to new highs in November 2017. The warning letter was eventually lifted, but not before an admittedly long wait, and rest of the stock’s climb finally played out as we had expected it would all along.

Below are a few screenshots from our pro portal where we figuratively pounded our fists on the table to draw attention to Manko’s insider activity.

Repro Med is one of GeoInvesting’s most prolifically covered stocks. We are glad it all worked out in the end, and it gives more confidence than ever that we have to increase our efforts to point out Form 4 activity in fundamentally strong microcap companies that have entered our radar.

W

Great example. Good to see how much patience is required too