Before I get into my discussion on my Orion Energy Systems, Inc. (NASDAQ:OESX) case study, my message to you this week is simple – Information Arbitrage is one of the easiest tools for beginner microcap investors to gain an edge:

“Microcaps appeal to me due to the information arbitrage opportunities they provide. An arbitrage exists when a disconnect between stock prices and available public information on a company is noticeable, and monetarily worth pursuing. Sometimes, the mispricing of micro-caps can be substantial. This strategy has “paid dividends” for many investors. Part of the reason the “Info. Arb.” opportunity exists is because investors often associate microcap stocks with pump & dump companies with no revenues and profits. But there is no better strategy in the stock market than to look for opportunity where others are not looking. There are many good microcap companies with real revenues, some even with blue chip customers.”

The trick to using Information Arbitrage (InfoArb) to your advantage is knowing where to look to find it. Technology and social networking avenues have increased the number of places where information can be found and have also improved the ease with which information can be accessed. I have been investing for a long time, since the late 1980s to be exact, and I have never observed a time where investors are as more impatient and short-term oriented than today. This means they are unwilling to look past sources where information is disseminated instantly, like Twitter, headline alerts and press releases.

In other words, people want the easy way out with what’s right in front of their eyes, but that does not always equate to the best information. This reality opens the door for you to search for opportunity where the lazy are unwilling to go. That is why old-fashioned SEC filings are superior places to look for nuggets of hidden information. Live earnings conference calls and conference call transcripts can further boost your InfoArb intelligence.

Many microcap and small cap management teams discuss intel in SEC filings and conference calls.In many instances, they omit this intel from press releases. To be fair, not all investors that ignore InfoArb research are lazy. If you are not a full-time investor or if you have a family or full-time job, you just don’t have time to sift through volumes of SEC filings. Furthermore, you may assume that reading filings and conference call transcripts are intimidating tasks. However, if you ever feel like you want to explore the concept of InfoArb, we produce a wealth of content and actionable ideas on this subject. Actually, InfoArb is a perfect concept for YOU to utilize to save time. After reading the remainder of this article, you can begin by opting in.

Beating a Dead Horse is not Such a Bad Thing When It Comes to Information Arbitrage

I know we continually express an opinion that there is no better place to search for Information Arbitrage than in the “left for dead” microcap universe. But it’s true, so we don’t mind beating this dead horse. I’d like to drive this point home by highlighting some real-life scenarios where hidden information could have helped you make money or prevented you from losing it.

In January 2017, I wrote an article, Multi-Bagger InfoArb Opportunities Hide Out In These Easy Money Places. I do still owe you a Part 2 follow up to this article to discuss 5 more places where hidden information can be found such as:

- Late SEC Financial Filing Notifications

- SEC filings Filed Before Press Releases

- Ordering Annual Reports Directly From the Company

- SEC Filing Analysis – Use of Proceeds

- Risk

However, right now I want to give you some “CliffsNotes” to show how you could have applied conference call information arbitrage to your advantage during the 2019 Q2 earnings season.

Conference Call Information Arbitrage – Comparing Information Disclosed in Earnings Press Releases to The Related Conference Calls

The Confusion

Orion Energy Systems, Inc. (NASDAQ:OESX) Is a provider of enterprise-grade LED lighting and energy project solutions. The company has been implementing a multi-year turnaround strategy to transition its business from offering fluorescent lighting solutions to helping companies retrofit to Internet of Things (IoT) LED lighting solutions.

Orion Energy has a long operating history and an impressive customer list, but management acknowledges that it was late in making the move to adopting an LED product offering. You can see more about that strategy here, but shares had been strong since the company announced on May 20, 2019 a big contract win with a customer that’s going to generate a significant amount of revenue for the company for their fiscal 2020 year that ends March 31.

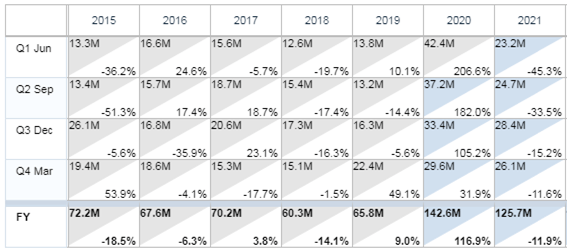

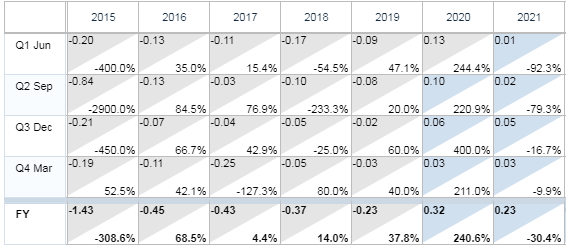

Specifically, the company has been guiding for Fiscal Year (FY) 2020 EBTDA margin to be at least 10%, on a revenue range of $135 to $145 million, compared to 2019 revenue of $65.8 million and a loss. The obvious risk that investors will place on the story is related to uncertainty over whether or not the company will be able to continue to win large projects moving forward. This is because most of the revenue from this new contract is expected to be recognized in FY 2020.

On August 5, 2019, the Orion Energy announced its Q1 FY2020 results, crushing analyst estimates:

- Sales of $42.4 million vs $13.8 million in the prior year and well ahead of analyst estimates of $28.3 million

- EPS of $0.13 vs a loss of $0.09 in the prior year and also way ahead of analyst estimates of $0.02

Basically, the big contract the company was recently awarded was front-end loaded versus back-end loaded, contrary to what analysts had assumed. So, why did the stock fall from 3.49 to hit a low of $2.41 on earnings day?

Essentially, some of the following comments by management during the Q2 conference call spooked or confused investors:

“We are in the early stages of dialogues with new account opportunities and are also working to finalize the scope of projects for existing customers, particularly in historically strong areas such as automotive and public sector accounts. We are also making selected investments in the expansion of our senior sales team. While it will take some time to advance our sales dialogues into concrete order activity, we feel very confident in our ability to build a strong pipeline of business for FY’21 and beyond.”

“Orion is maintaining its prior FY’20 revenue goal of $135M to $145M, representing expected growth of more than 100% over FY 2019 revenue of $65.8M. While the timing of revenue remains highly dependent on customer schedules, Orion anticipates revenue in the first half of FY’20 to potentially be higher than revenue in the second half of FY’20. Orion also reiterates its expectation of achieving an EBITDA margin of at least 10%, as well as positive net income and EPS, for the full FY’20.”

We All Know the Saying, Ignorance Is Bliss. But This Is Not Always the Case.

Most investors are short-sighted and hypersensitive to quarterly results. Investors who don’t understand Orion Energy and its turnaround initiatives likely annualized Q1 numbers as a new run rate and were upset that management did not increase sales guidance for the year. But the company is still on track to meet its guidance. The difference is that quarterly sales and earnings per share will be distributed differently throughout the year than analysts had estimated. Really, it’s just stupid. Orion Energy quarterly growth or FY2020 is still going to look favorable and the annual growth rate it still at least the same.

Orion Energy Systems, Inc. Revenue

Orion Energy Systems, Inc. EPS

The more of pressing concern is that analysts are estimating FY2021 sales and earnings to decline from FY2020 estimated figures, since OESX won’t have the benefit of the large contract win.

Still, in a note to GeoInvesting premium members, I and my team conveyed that it would be prudent to listen to the conference call to see if we can could gain any nuggets of Information Arbitrage to help us assess the FY2020 and FY2021 growth outlooks. We stated:

“We plan on being on the earnings call scheduled to start at 10 AM EST to determine if we can gain some clarity into the near-term to medium-term growth outlook and if the company can at least maintain profitability in all quarters.”

Orion Energy Sheds Additional Light on Growth Prospects

Luckily, as is often the case, the conference call shed some additional light on the growth prospects of the company. Management offered commentary indicating that there is a good chance that more business could soon be on the way, from the company that awarded Orion Energy the large contract. Verbiage from conference call on a recent contract reads:

“So given the particular situation, timing of the contracts and fiscal years that if there is additional follow-on business with this particular customer, some of that could hit in our fiscal 2020. At the same time, we’re always cautious to tell people that while we’re very pleased with the progress we’re making on this project and we believe it’s going very, very well and we’ve got a substantial amount yet to do in this fiscal year, at times, things can happen, and customers might push things back somewhat for particular business reasons they may have. So we continue to believe that the contract we’ve announced will most likely hit during our fiscal 2020. We believe there’s opportunity beyond that, and that follow-on opportunity some of which could fall into fiscal 2020, but we’re primarily focused on building our opportunities and additional business for fiscal 2021.”

Three days after the earnings release, by August 8, 2019, shares hit a high of $3.23, helped along by Craig-Hallum’s announcement that it was maintaining its buy rating on Orion Energy stock, while increasing its price target by 14%.

We issued the following alert to our Premium Members:

“Shares fell ~15% in yesterday’s session. However, we were on the conference call and the call was a little more bullish than we anticipated. The company definitely left the door open for further contract wins with its recent large customer and also mentioned some product expansion news. We believe that long term investors will view the sharp pullback as a buying opportunity.”

This is just one example of how you could have used Information Arbitrage to make a substantial amount of day or swing trading profits, even if you are not an avid trader. Due to the uncertainty regarding FY2021 growth prospects, establishing a long-term position probably requires more insight or news from the company regarding additional, large contract wins.

Similar Q2 2019 conference call Information Arbitrage profit-making opportunities occurred in many other microcap stocks because of bullish commentary contained in their conference calls that was not present in related earnings press releases.

For example, Fulgent Genetics, Inc. (NASDAQ:FLGT) opened flat at $8.06 on August 6, 2019 when it reported strong sales and earnings

- Sales of $8.4 million vs $5.4 million in the prior year

- EPS of $0.06 vs a loss of $0.01

The conference call was extremely bullish, which included the issuance of strong guidance by management. Astute investors would have noticed that the press release mentioned that the company would issue guidance on the call – your first clue to tune into the call. As the day went on, the stock gradually rose, hitting a high of $10.75. A few days later, the stock reached ~$12.50.

Unfortunately, I screwed this one up. The stock was on my watchlist. I just didn’t pay close enough attention to the release, since I was traveling to meet a management team of a stock I already own. C’est la vie.

Luckily, there are plenty of other stocks that still have not substantially moved up on very meaningful positive Information Arbitrage available via their conference calls, but absent in related Q2 earnings press releases.

If you’d like to become a premium member and learn more about these companies and our InfoArb process, I invite you to join GeoInvesting today.

Next week, I’m going to highlight an Information Arbitrage that could have had you thinking twice about loading the truck on a company that had a great earnings report, but where the related 10-Q SEC filing contained negative information about the quarter – information that was not contained in its press release. When this happens, we make sure to keep a list of management teams that act in this manner, so we know to look for Information Arbitrage when they issue earnings press releases. Of course, GeoInvesting Premium members gain the benefit of this research journal.