My name is Maj Soueidan and I’m a full-time investor of 30 years. I work with and manage the GeoInvesting Research Team on a daily basis to increase our bullish and bearish equity research pipeline.

I co-founded GeoInvesting in 2007 to bring long based institutional quality investment research to the individual investor. To get to know me a little more and learn about my father’s influence on my full-time microcap investing career, please read my article titled, “Stock Investing, Work Ethic & Dad All Rolled into One”.

In 2010, we expanded our research to investigate and short-sell fraudulent China-based companies that had gone public in the United States through traditional IPO processes and other “back-door” mechanisms. Our article, “The Evolution of U.S. Listed China Based Frauds,” discusses our inauguration into the China short trading strategy.

We have:

- 25k twitter followers between GeoInvesting (@geoinvesting) and my personal handle (@majgeoinvesting)

- Nearly 30k Seeking Alpha followers

I speak regularly at conferences to deliver stock pitches, educate investors about the advantages of investing in microcap companies, chat about the status of regulatory issues affecting the microcap space and the status of China fraud.

Tier One Microcaps (our core strategy)

Before the China short trade became an important focus of the company, we launched GeoInvesting to educate individual investors about the advantages of investing in microcaps. We strongly believed, and still do, that the negative stereotypes associated with microcaps should not be blindly applied to the entire universe.

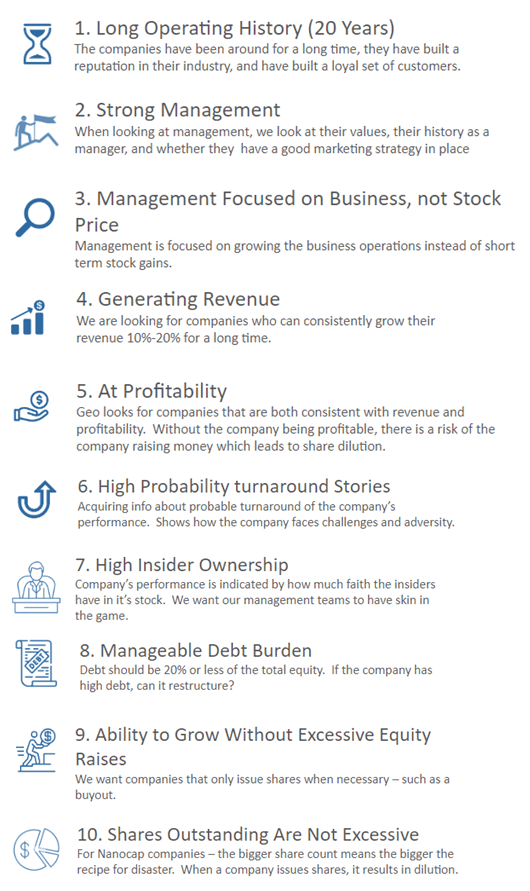

Our main microcap focus is to create long-biased equity research on what we call Tier One quality microcap stocks. We generally define Tier One microcaps as 25+ year-old, revenue-generating companies with market capitalizations of less than $300 million and clean capital structures. Some key characteristics of what we consider to be tier one include:

- Strong management

- Management focused on business, not stock price movement

- Generating revenue

- At or near profitability

- High probability turnaround stories

- High insider ownership

- Manageable debt burden

- Ability to grow without excessive equity raises

- Shares outstanding are not excessive

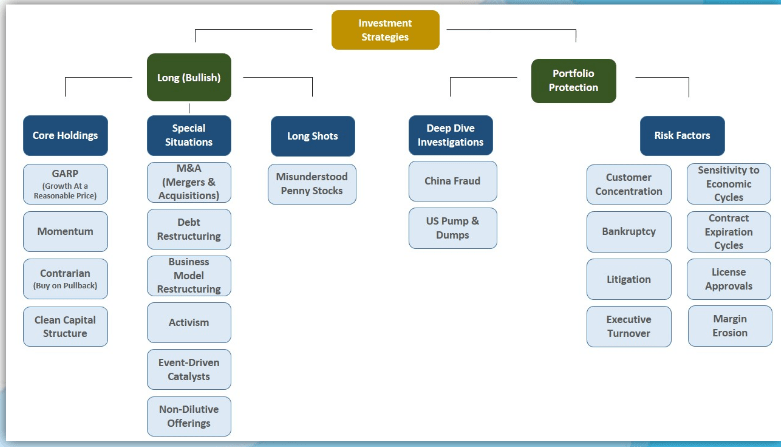

Our core strategy is to build large longer term (some will be multiyear) positions in tier one quality microcaps and nanocaps. Around this strategy, we take short-term bets based on special situations or lesser tier companies that have some positive catalysts occurring, as well as an occasional short selling position. Here is a summary of our research buckets:

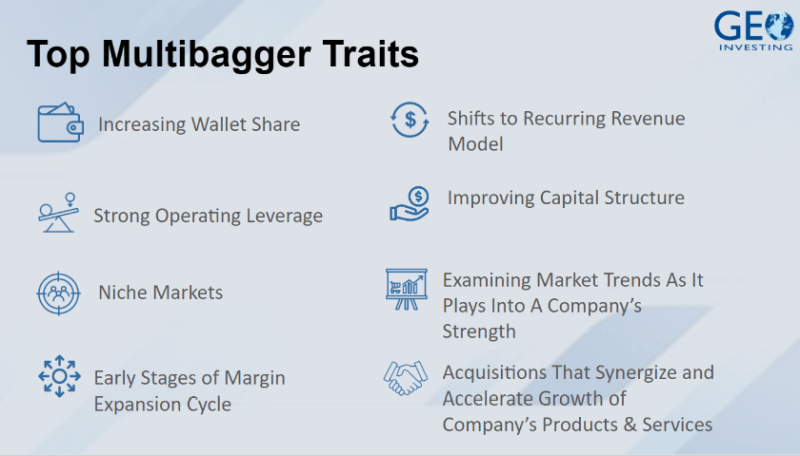

Our multi-bagger criteria revolve around:

Finally Tier One Quality companies in our universe typically adhere to the following:

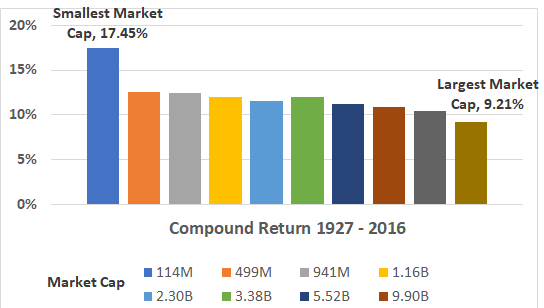

The microcap advantage exists because most investors simply ignore them. It’s this lack of competition that creates the advantage. For example, between 1927 to 2016 the compound annual return of the smallest subset of micro-cap stocks outperformed the largest capitalized subset of stocks by 8.24%. (Source: What Works on Wall Street, by James O’Shaughnessy)

That might not sound like a lot, but to put into perspective, even over a just 20 year period within that date range, a $1,000 investment in microcaps across the board reaped a $23,950 profit, or a return of 2,395%. That means a greater than 24x return on your investment. This beat their big cap counterparts by 1,913%.

The outperformance is more concentration

However, with the rise of ETF and passive (index funds) investing, instruments that don’t include microcaps, we believe that the individual investor’s edge exists in the ignored microcap space. In fact, Big Short legend, Michael Burry agrees:

“Burry is investing in small-cap stocks as they’ve been neglected by money flowing into index funds that track large companies, he told Barron’s.”

I spend a lot of time discussing why microcaps have been out of favor, including why investors are more short-term oriented and, ironically, more attracted to riskier stocks and to “investing” in fraud than they were prior to 2008. A combination of the obliteration of retail investors in 2008, investors being more short term orientated, the increase in passive investing, changes in the regulatory climate and brokerage firms limiting the ability of investors to invest in microcaps have hurt the flow of funds into microcaps, especially higher quality names where pump and dump campaigns don’t occur.

In an era where information is easy to access and abundantly available, the above obstacles are actually giving investors a better chance to take advantage of areas that the market is ignoring. This is because big caps are where most investors are hunting for ideas. In other words, microcaps are where you can get the last true edge in investing.

I have spoken at several conferences and been interviewed on this subject on numerous occasions:

- Reference this Real Vision video

- Reference the beginning of this 2016 article and related video presentation (3:00 to 8:00 minute mark)

- Reference this panel video discussion on the changing regulatory environment

Shorting China Fraud and U.S. Pump and Dumps

Regardless of the microcaps advantage, we understand that fraud and material misrepresentations are prevalent in the stock market, especially in the microcap space. So, in 2010, GeoInvesting also embarked on a mission to protect investors from fraudulent China based stocks trading on U.S. exchanges and U.S. based pump and dump schemes. This catalyzed GeoInvesting to build a China analyst and on-the-ground research team, enabling us to publish short thesis reports on Hong Kong listed stocks, U.S. listed China-based stocks and U.S. listed pump & dumps. This earned us a level of respect from investors who understand that we are a long-biased research firm willing to admit that stock market deceit is real and rampant.

I introduced “China fraud” to GeoInvesting in 2010. Since then, GeoInvesting has played an undeniable role in exposing fraud and harm that management teams of China-based companies are inflicting on U.S. investors. We estimate that this fraud related to U.S. listed China-based stocks has cost U.S. investors at least $15 billion, and is still increasing. Through GeoInvesting’s research process, supported by exhaustive on-the-ground due diligence, we have identified and written about dozens of U.S. listed China stocks that turned out to be frauds. Twelve Of these companies were eventually halted and delisted from major exchanges.

We are very proud that GeoInvesting was one of several companies highlighted in a 2018 documentary, financed by Mark Cuban, called The China Hustle, helping to bring the China fraud issue some publicity. In June of 2019, Senator Marco Rubio helped bring awareness to this issue by playing the lead role in introducing the Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges (EQUITABLE) Act. Senator Rubio had actually mentioned GeoInvesting in a press release discussing the U.S. Listed China Fraud Issue:

“In its 2017 annual report to Congress, the U.S.-China Economic and Security Review Commission stated that “U.S. regulators have struggled to deter sophisticated efforts by some Chinese companies to defraud U.S. investors” and cited a report by GeoInvesting, a financial information website focused on small-cap stocks, that “found [that] China-based companies have perpetrated dozens of frauds on U.S. exchanges totaling at least $5 billion in losses.””

Being exposed to the China fraud “game” also opened our eyes to all forms of deception taking place in the stock market, which led us to start monitoring and writing about U.S. based pump and dump schemes. Accordingly, our published research exposed 22 U.S. pump and dump schemes.

Educational Content

We provide our Premium Members with educational content so they can learn to how to make their own decisions based on facts – and avoid decisions based on emotions. Here are some tips you might find helpful:

At your leisure, I would recommend that read the following books:

- One Up On Wall Street by Peter Lynch, to help you understand the art of stock picking in the simplest presentation that I am aware of

- Good to Great by Michael Collins, to help you understand management styles of great companies

- Zero to One by Peter Thiel (founder of PayPal), to help you understand what makes great companies tick

You can also check out the following links regarding process:

- So You Want To Be A Full-Time Investor, Follow These Ten Tips – Link

- I’m A Bull At Heart, But I Have To Keep It Real (for intermediate to advanced) – Link

- Multi-Bagger Info Arb Opportunities Hide Out In These Easy Money Places (for intermediate to advanced) – Link

- Form 4 Filings: Insider Buying 101 – Link

- Vintage Peter Lynch – Link

- Chuck Akre video: it’s never too late to start investing – Link

And here are some links regarding behavior:

- Professor Andrew Lo Video – Link

- Lauren Templeton Video – Link

- 5 Tips to Become a Better Investor – Link

Why Microcaps:

- Perritt Capital White Paper on Microcap Advantages (section on why lack of liquidity is not a bad thing is included) – Link

- A video interview I conducted as a guest on Real Vision: Link

- Another article on Why Microcaps: Link

- Why big returns come in small packages: Link

- Recent presentation I gave to an investment club: Link

I hope this helps you. I know it’s a lot of information. Please don’t hesitate to reach out if you have any questions or to schedule a follow up call.

Our services include a premium retail newsletter that brings our research to investors, on a nearly daily basis, as well as product offerings to help clients with their own research needs and provide them with research tailored to their strategies.