I wanted to pass along an excellent video for you to watch or listen to in your spare time. It’s packed with great perspectives by Chuck Akre about how to approach stock picking strategies to find serial compounders. I love that he started his successful investment career later in life, proving that investing can be a developed skill at any point in one’s life.

Mr. Akre’s idea is straightforward: find companies that earn high rates of return on the money that management invests in their businesses, and you will come across stocks that increase by 2x, 3x, 4x, and more, otherwise known as multi-baggers. You can get clues on this rate of return by looking at a company’s net margins (sales minus expenses = net income, net income divided by sales = net margins).

You can also search for companies that have a high return on invested capital (ROIC), a calculation I will address in another post.

Source: Talks at Google (Transcript)

Companies with high margins and/or ROICs rank high on our research hierarchy. In fact, in our last email we talked about one we believe is on the verge of hitting some key growth inflection points.

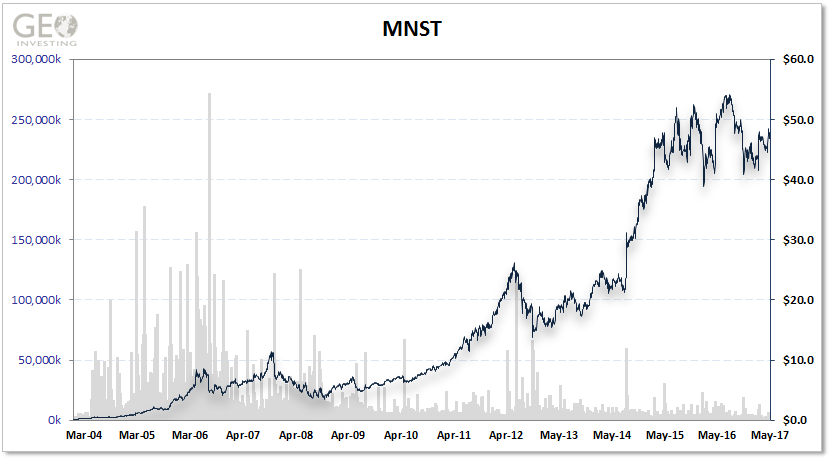

Stocks like credit card giant Visa Inc. (NYSE:V) and Red Bull competitor Monster Beverage Corporation (NMS:MNST) are great examples of companies that kept reinvesting capital at favorable returns for long periods of time. The effect is extraordinary!

Just look at the returns you could have captured with the discipline to buy and hold these stocks.

I know it’s easier said than done to hang on to stocks in time of increased volatility, but that does not mean we should stop looking for these opportunities, if not just to capture part of a long-term multi-bagger. We’ve uncovered over 50 of them since GeoInvesting was founded a decade ago. Consider giving Geo’s premium subscription a try and we know it will be worth your while.