In my last article about how multi-baggers hide out in “easy money” places, I discussed five strategies microcap investors can add to their tool box. Deep “in the trenches” microcap and nanocap investors are always looking for an information edge to exploit positive or negative information and to make money or protect portfolios. One of these Information Arbitrage (“InfoArb”) tools is tracking buy and sell stock transactions disclosed in Form 4 filings (Form 4’s) by Management, Employees, Board of Directors or 10% Owners (MEBO). I wrote this article for beginner investors, and for those who may still have a vague understanding of the overall layout of Form 4 filings, including related codes contained within them.

“The insider anomaly advantage has been estimated to be as much as 11 percentage points over the market return annually. The advantage tops out closer to seven percentage points, says Ian Dogan, founder of Insider Monkey, who wrote his doctoral dissertation on insider trading.”

Tracking Form 4 Filings

I monitor Form 4’s for several reasons:

- To see when insiders or large investors start loading the boat after shares have fallen hard

- To see if insiders start buying stock after a hit piece has been published

- To see if management is buying stock near new 52 week highs

- To find patterns that set a near-term bottom in a stock

- To see if insiders are selling as they glowingly talk about their company

[layerslider id=”24″]

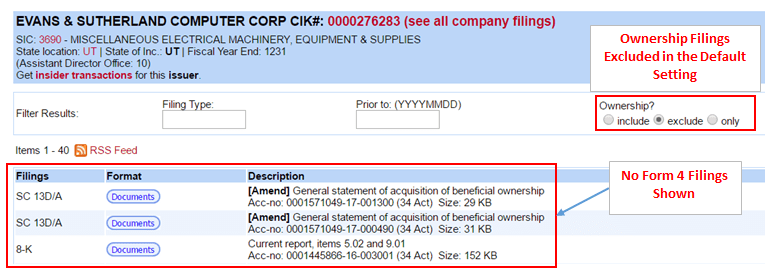

Why do I consider the Form 4 as a type of InfoArb? The default view at SEC.gov that lists a company’s filings does not include Form 4’s. The example below is that of Evans & Sutherland (OOTC:ESCC).

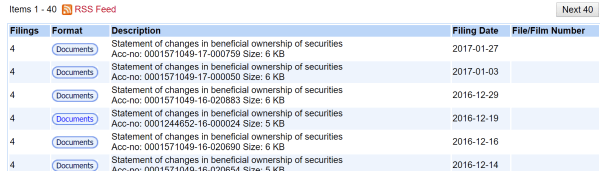

I even bet that some beginner microcap and nanocap investors may not even know that they can track Form 4’s. However, all you need to do is select “include” or “only” under the “Ownership” header to view Form 4 and other types of ownership filings.

I know it’s subtle, but any task that takes the slightest extra effort for other investors can be your investing advantage. Luckily, there are some services that allow you to track Form 4 activity such as SECFilings.com, where you can track stock symbols for free (to a limit). You can also set up an RSS feed from the SEC website that will send Form 4 filings to your email, free of charge. Or you can link to the RSS feed directly from the page that lists the Form 4 filings of a target company (see above). However, you can’t really customize your searches.

We conveniently track the last handful of Form 4’s at GeoInvesting here, and are planning to address some of the shortcomings of different services that allow you to track Form 4 activity in the microcap universe.

It really irks me when a microcap management team does not have skin in the game as opposed to just “acquiring” shares through indirect methods with little cash outlay. That’s why it’s important to learn how to read a Form 4 filing.

The Form 4

The Form 4 must be filed before the end of the second business day after the execution of a transaction resulting in a change in beneficial ownership. There are many transactions that can result in purchases by MEBO. Some of these include “FREE” or below-the-current-price instances such as options, warrants, share based compensation and other indirect transactions. Boiling it down to what it is important, we focus on the buys that took place directly in the open market where MEBO is taking on the same risk as any other market participants.

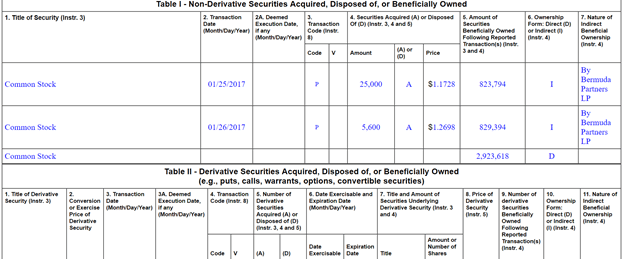

Below is an image of a Form 4 filed on January 27, 2017 by billionaire Peter Kellogg on microcap ESCC, highlighting two open market purchases made on January 25 and 26:

The first thing to take note of is that Mr. Kellogg bought his shares through one of his companies, Bermuda Partners. Still, “cold hard cash” was laid out to execute these two purchases at open market prices. The “I” in column 6 signifies that the recent purchases were indirect (through Bermuda) and shows that he also owns 2.9 million shares acquired in his own name (“D”). Column 5 shows how much a filer owns after each transaction.

We began to take notice of Mr. Kellogg’s purchase of shares on September 16, 2016 when the stock was trading at $0.83. Looking into it further, we saw that he already had a sizable ESCC position. Whenever we notice large blocks or high volume in ESCC, we speculate that “Peter is back in town.”

Next, notice that the filing is divided into two sections

- Non-Derivative Table

- Derivative Table

The non-derivative section is what you want to focus on when searching for bullish signals related to purchases by insiders at market prices. This is where it gets a little tricky, as you can’t automatically assume that a transaction outlined in this section did not originate from a derivative security.

For example, insiders often own stock options or warrants awarded to them by their company (approved by the Board). The initial grant of these derivatives is first recorded in the Derivative section of a Form 4. But when/if insiders convert them (also referred to as exercise) into ownership of common stock at predetermined prices (usually below market prices and sometimes at zero), the transaction shows up in the Non-Derivative table. That is why it’s important to reference codes that are included in the filings.

The Secret Codes

The codes are outlined here on page 6 so that you can determine if a purchase was or was not related to a derivative security reported on various transaction filings such as Form 4 and Form 5. The direct purchase non-derivate codes you should be most interested in are “P” for buy and “S” for sale. Essentially, all other codes are mainly related to derivative instruments or other transactions that are not the result of meaningful “skin in the game” transactions.

As you can see, Peter Kellogg executed his purchase of ESCC shares indirectly through open market transactions as evidenced by the code “P” in column 3 next to the corresponding transaction (as opposed as “D” for disposed). Leave it to the SEC to use similar letters for different codes.

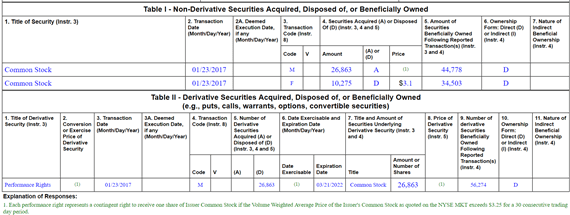

Take another example of a stock we are long, GSE Systems Inc. Common Stock (AMEX:GVP).

A constant flow of non-derivative direct market purchases by insiders confirmed by Form 4 analysis was a big reason we placed a bullish bet on microcap GVP at around $1.40 (even though shares appeared expensive at face value). Similar purchases have continued at prices over $3.00. You can see our initial coverage on GVP here.

GVP Insiders were also awarded performance based stock warrants that can be exercised in different tranches when shares reach certain predetermined levels. Some of these levels have been reached, which prompted insiders to exercise some of their warrants. Notice that even though the transaction is included in the Non-Derivative Table, the codes “M” and “F” show that it was the result of a conversion of derivative security (performance rights). A peek at the Derivative Table supports this fact. These performance rights have a zero cost basis.

Here is a list of all the Form 4 codes:

General Transaction Codes

P – Open market or private purchase of non-derivative or derivative security

S – Open market or private sale of non-derivative or derivative security

V – Transaction voluntarily reported earlier than required

Rule 16b-3 Transaction Codes

A – Grant, award or other acquisition pursuant to Rule 16b-3(d)

D – Disposition to the issuer of issuer equity securities pursuant to Rule 16b-3(e)

F – Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3

I – Discretionary transaction in accordance with Rule 16b-3(f) resulting in acquisition or disposition of issuer securities x

M – Exercise or conversion of derivative security exempted pursuant to Rule 16b-3

Derivative Securities Codes (Except for transactions exempted pursuant to Rule 16b-3)

C – Conversion of derivative security

E – Expiration of short derivative position

H – Expiration (or cancellation) of long derivative position with value received

O – Exercise of out-of-the-money derivative security

X – Exercise of in-the-money or at-the-money derivative security

Other Section 16(b) Exempt Transaction and Small Acquisition Codes (except for Rule 16b-3 codes above)

G – Bona fide gift

L – Small acquisition under Rule 16a-6

W – Acquisition or disposition by will or the laws of descent and distribution

Z – Deposit into or withdrawal from voting trust Other Transaction Codes

J – Other acquisition or disposition (describe transaction)

K – Transaction in equity swap or instrument with similar characteristics

U – Disposition pursuant to a tender of shares in a change of control transaction

I hope this summary helped you if you were unsure of how to properly use Form 4 filings in your research process. Other MEBO purchase forms also exist (Source: Investopedia):

- Form 3 – This document must be filed with the SEC no later than 10 days after an insider becomes affiliated with a company, and it must be filed for each company in which a person is an insider, regardless of whether the insider has an equity position in the company at that time.

- Form 5 – Insider transactions involving small amounts of money and certain transactions such as gifts of shares received from another party are sometimes exempt from the usual Form 4 reporting requirements; therefore, a Form 5 submission is required from an insider who has at least one transaction which was not reported during the year. Form 5 submissions are due to the SEC no later than 45 days after the company’s fiscal year ends, or within six months after an insider ends his or her affiliation with the company.

- Form 144 – A form that must be filed with theSEC when an executive officer, director, or affiliate of a company places an order to sell that company’s stock. Also known as Rule 144.

- 13D – The Schedule 13D is a form that must be filed with theSEC under Rule 13D. The form is required when a person or group acquires more than 5% of any class of a company’s shares (and wishes to reserves the right to exert control). This information must be disclosed within 10 days of the transaction. Rule 13D requires the owner to also disclose any other person who has voting power or the power to sell the security.

- 13G – To be able to file 13G instead of 13D, the party must own between 5 and 20% in the company. It must also be clearly understood that the party acquiring the stake in the company is only a passiveinvestor and does not intend to exert control. If these criteria are not met, and if the size in the stake exceeds 20%, a 13D must be filed.

In a follow up article, I will go over end-of-year insider transaction arbitrage and highlight examples where you could have used Form 4 research to find microcap stocks in which insiders were telegraphing expectations of higher prices or confidence that sharp drops in share prices were buying opportunities. Tracking insider purchases correctly is a great tool anyone can use to increase conviction when making short-term or long-term bets alongside management. Notice that I mainly talked about insider buys — why? Peter Lynch said it best:

“Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.”

Mike

Would you consider code M bullish?

Maj Soueidan

Thanks for the question, Mike.

We would generally not consider a purchase that has a code M to be bullish, since the stock is related to the exercise of a derivative security. However, there are some instances where an insider exercises an option below the exercise price. That could be considered to be somewhat bullish, where the insider is telegraphing some type of confidence. We have seen this happen in the past. Furthermore, The M scenario could be considered moderately bullish if the insider has a habit of converting options and not selling the stock that was received.

To be clear, we would not necessarily treat a code M as bearish. Options are part of the game and the benefit of being an insider.

Edmund

This is a great post. I have one question. What if insiders have been transferring shares to trusts that benefit their children and/or spouses? Following these transfers, would the insiders have to disclose subsequent sales from these trusts?

Maj Soueidan

Hi Edmund,

Yes, since they would still be considered to have a “beneficial” or indirect relationship standing.

Imran Salahuddin

Great post. Very informational. The basic message seem to be to look for “P”s. Thanks.

Maj Soueidan

Hello Imran,

Yes, you got it. At least when we are looking at things from a bullish view point. Everything else is just clutter. Of course, we want to pay attention to other things like if management is selling stock aggressively despite bullish commentary they’re making in their press releases. However, remember what Peter Lynch said: insiders sell their stock for a variety of reasons, but they for only one reason, they think the stock is gonna go up. So, athough insider selling can be interesting to watch, the buy indicator is much better in my experience.