Over the last ten years we have worked hard to earn the trust of investors with our stock research service. “Find the truth, report the truth, invest in the truth” has been the motto that defines our culture at GeoInvesting.

Our approach is supported by four key pillars:

- Provide quality research.

- Build trust.

- Use a cross disciplinary approach to research.

- Always strive for excellence

Since Geo’s inception a library of over 1000 proprietary research pieces has been compiled on our platform, many of which were the culmination of hours of due diligence. What’s always enabled us to offer a unique perspective that not everyone can offer is the diversity of the backgrounds of our research crew – seasoned writers, lawyers, analysts and researchers that compliment and push one another to be better every day. Through our willingness to talk about red flags when we find them, the transparency of our disclosures and the fact that we are not blind bulls, we have built trust.

The above has enabled us to achieve exemplary returns, including over 50 multi-baggers and 40 stocks acquired for profitable premiums. But obviously, nobody is perfect…if we claimed we were, you would not believe us. That is why we also highlight and learn from our mistakes.

Change Has Made Us Better

When we started GeoInvesting a decade ago, the world was a little different.

The iPhone had just launched. There were no other real smart phones, and no App Store. The App Store in the first half of 2017 crushed Apple’s ENTIRE 2007 revenue ($4.9B versus $3.5B). Thousands of companies have come into existence simply because of the App Store existing. Names like Snapchat, Zynga and GLUU have all been beneficiaries of this entirely new niche of software development.

Google had recently bought YouTube for $1.65B. Revenue for this unit of Alphabet now is expected to reach ~$10.2B this year. Last year, the top 10 channels on YouTube earned over $70 million in revenue and there are dozens earning over a million a year now.

The Cubs hadn’t won the World Series since before radio broadcasts, let alone TV.

Geo has also evolved over time. We launched in 2007 to bring our microcap style research to other investors. We were 100% bulls at the time. Yet, you may only know Geo’s reputation for our short game, exposing more than $15 billion in fraudulent China based stocks, as evidenced in the upcoming movie “The China Hustle“. The funny thing is that we aren’t really even short sellers, per se.

We started GeoInvesting to bring quality, bullish microcap opportunities to investors and help build awareness of the advantages of investing in microcaps. That is still the case today. Around these themes, we use our extensive experience to help educate GeoInvesting members. In fact, our co-founder Maj Soueidan has been a full-time Investor for nearly three decades. What is great about our microcap research process is that investors can learn to become better stock pickers across all market cap spectrums using the techniques we generally reserve for microcaps.

We still don’t think enough investors give microcaps a fair shot, mainly due to the constant drubbing they receive by the financial mainstream media like. Jim Cramer, for instance, has no problem talking about how great Montage Technology (NASDAQ:MONT) and Wal-mart (NYSE:WMT) are, but fails to point out that these companies were once microcaps. This just means more opportunity for investors willing to “bend the rules”.

Stock Research Products

Interacting with our members and listening to what they want helps us define and improve our stock research products. That is why we have introduced “Calls to Action” on individual picks and various portfolios.

We have had great success with our premium portfolios and the “Calls to Action” that we disclose to Geo members. The premium portfolios are stock research products that help organize our research for members to gain focus as to which companies they want to explore and with what tactics: they can be concentrated, diversified and/or speculative investing strategies with varying time horizons.

Concentrated Strategies for the Short Term to Midterm Investor

- Mock Buy on Pullback for Contrarian Investors. We are constantly on the search for company stock prices that react negatively or have muted reactions to good news. These type of overreactions (or under reactions) are often the result of market gyrations or the inability of investors to digest the full scope of a particular event. At the start of 2016, we decided to create our “Buy on Pullback” mock portfolios to take advantage of these mispricing scenarios.

Concentrated Strategies for the Long-Term Investor

- Mulitbagger Portfolio“Our Multi-Bagger Mock Portfolio is for investors willing to hold through volatility caused by market gyrations or operational hiccups. These are companies we think have the right management teams and share structures in place that could see their stocks increase several times over the next 3 to 5+ years”.

For the Speculative Investor

- Our Mock “Run to One” portfolio is geared for speculative investors who are looking for penny stocks that still meet our quality standards. Too often, microcaps are associated with pump and dump penny stocks. But, the price of a stock does not define its marketcap (MC = Price*Shares Outstanding). Nor does the price of a stock define its quality. It is true that most of our actionable alerts and premium portfolios contain stocks that trade over $1. However, we will not shy away from delivering picks under $1 if we think they have “room to run”. The “Run to One” portfolio identifies fundamentally strong securities trading cheaply for various reasons…stocks we believe have a good chance to cross the $1 per share threshold.

- Takeovers. This portfolio is comprised of select stocks we feel are takeover candidates due to strategic review processes or hidden clues in filings or press releases. Over 40 of our highlighted stocks have been acquired.

Case Studies

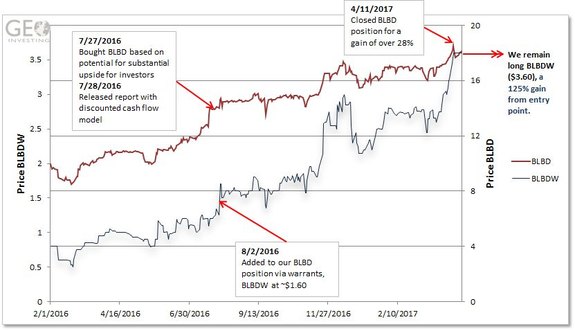

We always strive to keep learning. So, in addition to receiving actionable ideas, our library of educational articles is a great source to lean on. In addition, our case studies can be used to sharpen or find new investment strategies. They are growing in number, so learning how we use these strategies can go a long way to enhance your own investment acumen. Here is one example:

Why Invest in a Geo Membership?

The answer is simple: to gain an edge. The GeoTeam is obsessed with stock research and thrives upon uncovering opportunity where no one else is looking.

At our core, GeoInvesting remains what it always has been: An Information Arbitrage (InfoArb) organization specializing in microcap stocks. InfoArb is a term we coined a few years ago to define instances when publicly available information is either undiscovered or underfollowed by the market at large. In cases where this InfoArb tells us that the valuation of a company is mispriced due to a variety of factors, there is a likely “Call to Action” (CTA) that will eventually be issued. One of the things we love about investing in microcaps is the information arbitrage opportunities they present.

While we do use screeners at times, nothing can replace good old fashioned hard work, like reading 10-K’s and 10-Q’s, listening to conference calls, and talking to management – all in addition to other due diligence we perform. Our primary goal is to find mispriced securities and misunderstood stories. Like Peter Lynch, we turn over tons of rocks, and like Benjamin Graham we have no problem getting involved when appropriate.

Thank You for the Opportunity

If you are to join us as a subscriber, you would get to pick the brains of our team, learn how we think and what we are exploring, and gain an edge in the market. Imagine for a minute what our insights could do for your overall portfolio returns and ask yourself if it’s worth it — hundreds of subscribers have already asked themselves the same question.

Thank you, and welcome!

Maj Soueidan and the GeoTeam