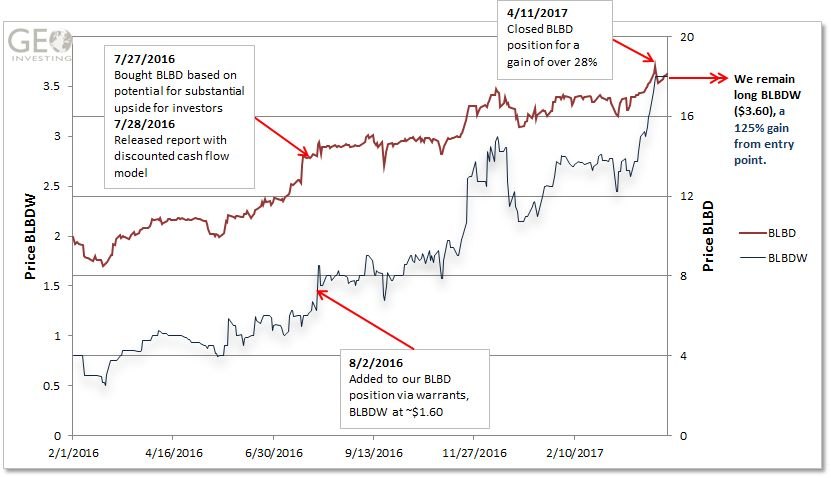

In July of 2016, several media outlets, as well as a top activist publication, contacted us. They wanted to know more about the role we were taking to prevent American Securities (“PE Firm”), a private equity firm from “stealing” public company Blue Bird Corporation (NASDAQ:BLBD) from minority shareholders by making a low-ball offer that would value the company considerably lower than its worth. In other words, American Securities, who at the time already owned 57% of BLBD, wanted to take the iconic transportation company private. In the midst of our plight, we noticed that there was substantial upside potential in the company’s warrants. In an article to our members, we outlined why we believed the PE Firm was committed to the acquisition. On the surface, the story was bit complicated to understand, a reason why we thought the stock’s price was only slowly reacting to recent developments. Once we connected all the dots, the story was quite simple. Now, less than a year after GeoInvesting began coverage on and disclosed our long position in BLBD at $14 per share, we have closed our long position, but remain long the company’s warrants and are currently up 125% in our position. Below you will find our chronological coverage of Blue Bird from the beginning.

In July of 2016, several media outlets, as well as a top activist publication, contacted us. They wanted to know more about the role we were taking to prevent American Securities (“PE Firm”), a private equity firm from “stealing” public company Blue Bird Corporation (NASDAQ:BLBD) from minority shareholders by making a low-ball offer that would value the company considerably lower than its worth. In other words, American Securities, who at the time already owned 57% of BLBD, wanted to take the iconic transportation company private. In the midst of our plight, we noticed that there was substantial upside potential in the company’s warrants. In an article to our members, we outlined why we believed the PE Firm was committed to the acquisition. On the surface, the story was bit complicated to understand, a reason why we thought the stock’s price was only slowly reacting to recent developments. Once we connected all the dots, the story was quite simple. Now, less than a year after GeoInvesting began coverage on and disclosed our long position in BLBD at $14 per share, we have closed our long position, but remain long the company’s warrants and are currently up 125% in our position. Below you will find our chronological coverage of Blue Bird from the beginning.

We are currently tracking another warrant that we feel has potential that is similar to or greater than those of BLBD. Find out which one now.

Wednesday, July 27, 2016

Taking small long position in BLBD ($13.98)

BLBD qualifies as special situation we perceive as a potential shareholder abuse case, but with substantial upside for shareholders

- Cerberus Capital Management affiliated funds sold the operating assets now named Blue Bird Corporation to the public through a reverse merger with a shell company called Hennessy Capital Acquisition Corp in February 2015. The intention is to have Blue Bird taken private not even one-and-a-half years later at a favorable valuation for the acquirer, another private equity firm called American Securities

- Private equity firm American Securities Corporation, recently announced the completion of the acquisition of 57% of the outstanding shares of Blue Bird Corporation from Cerberus

- On July 20th American Securities sent a non-binding letter of intent, to acquire the rest of the outstanding shares not currently owned by American Securities Corporation

- The letter implied a take-over price in the range of $12.80 to $13.10 per share; the stock currently trades above $13.90 per share

- A conservative Discounted Cash Flow (DCF) model yields a stock price of $16.04, which is ~25% over the low end of the proposed bid

- Valuation multiples support the DCF conclusion

- Analyst estimates show strong growth in sales and EPS. If we used a P/E of 15x on 2017 estimates we get an even higher valuation of $20.10 (analyst EPS estimate of $1.34 x forward PE of 15x). Note that our DCF used very conservative assumptions, even below company guidance in some areas.

- The valuation method offered by American Securities is flawed and we do not expect it to hold up in a Delaware court (see link to letter above)

- Spitfire Capital Management filed a 13D, voicing their intention to fight the proposed “takeunder”

From the 13D:

“On July 20, 2016, American Securities LLC submitted a non-binding indication of interest letter to the special committee of the board of directors of the Issuer for the acquisition by ASP BB Holdings LLC (“Holdings”) of all of the outstanding fully-diluted equity of the Issuer not currently owned by Holdings and its affiliates (the “Transaction”). The Reporting Persons currently intend to oppose the Transaction”

Why we perceive it as potentially interesting:

- There are several ingredients that make for a potentially rewarding investment, the most important being that we believe American Securities is committed to taking BLBD private. American Securities is a private equity firm, their intention is to make changes on an operational level to increase the value of their holdings. American Securities already owns 57% of the shares; a position that is not easy to unwind in the public markets — it seems as if there is no reasonable way for them to step back from a takeover. Additionally, private equity funds have a limited lifespan, meaning that American Securities cannot waste too much time before taking over BLBD because it limits the time they have to make operational improvements and exit the position once the fund nears the end of its lifetime.

- We believe American Securities understands the dynamic of the situation, this is why they proposed the “low-ball” offer. We reiterate the core of the situation: the best buyer is one that is already committed to a purchase.

Tuesday, August 2, 2016

Research Update – Warrants Are In Play!

We noticed that Blue Bird Corp (NASDAQ:BLBD) warrants are publicly traded under the symbol BLBDW (~$1.60). . Please note that the warrants convert into half a share of stock at an exercise price of $5.75 per half share and that they expire in 2020. You can read about the terms of the warrants on page 22 of the 2015 10-K.

“Each warrant entitles the holder thereof to purchase one-half of one share of our Common Stock at a price of $5.75 per half share ($11.50 per whole share), subject to adjustment. Warrants may be exercised only for a whole number of shares of our Common Stock.”

Per our analysis, the current price of the warrants of around $1.60 are trading with little to zero premium. Because the warrants trade with little premium, they should at least move in lockstep with the stock (the warrants should move 50 cents for every dollar move in the stock). For this reason, we added to our BLBD position via warrants. Update Spitfire Management holds about 7.3% of BLBD. This morning, Spitfire filed a new 13D, offering its analysis of the saga concerning a non-binding letter to acquire BLBD for around $13.00 by an affiliate of American Securities (PE Firm). Spitfire’s financial analysis implies a price target ranging from $21.85 to $27.60. Other Highlights of the Report

- BLBD is an iconic and the fastest growing school bus brand

- It is the undisputed leader in alternative fuel-powered school bus sales

- There is significant upside through industry recovery and accelerating propane-powered bus sales

- The Company has an experienced and committed management team.

On The Same Page We agree with Spitfire on key aspects of their opposition of the “Affiliate’s” offer, and keep our previous stance of demanding a high market premium in a take-over offer. We would add that in a fair-value appraisal, the preferred valuation method should be a Discounted-Cash-Flow analysis as it has proven to be perceived as more credible by Delaware judges than other methods. We prepared various valuation scenarios in an article published last week detailing our bullish thesis on BLBD. Our reasonable valuation scenarios ranged from $16.04 to $20.10. Our outlier scenario put BLBD north of $40.00. More Support for Our Thesis We found additional support for our initial thesis, which is that American Securities is committed to an acquisition. American Securities is a private equity firm with $15 billion under management invested through various funds it owns and operates. These funds have limited partnership agreements between the fund(s) and the investors that put up money in a fund. The Limited Partnership agreement forms the basis of the relationship between LPs and General Partners (the people that manage the fund), and defines scope and type of investments the fund is supposed to undertake. Two critical aspect of a Limited Partnership (LP) agreement are:

- The fund will have a finite term. At the end of the term the capital is distributed to the limited partners and the private equity firm. Thus, there is pressure on the fund to consummate deals and liquidate the investments before the end of its term. Otherwise investors will be upset that they tied up their money for little to no return and the PE firm will sacrifice its reputation.

- The fund should not invest in publicly traded companies just for investment purposes and liquidate later on the open market. That is not what the LPs signed up for. That basically means that a private equity fund has to pursue go-private transactions in publicly traded stocks that it’s already invested in, aggressively.

We were able to get our hands on a few standard private equity LP agreements. We believe the funds of American Securities are highly likely to have similar stipulations. The sections below are from a Carlyle Partners private equity fund.

Thursday, August 4, 2016

Will Look To Add to BLBD Position If Shares Pullback

On July 27, 2016 we initiated a long position in Blue Bird Corporation (NASDAQ:BLBD) ($13.69) when shares were trading at $13.98. We stated BLBD qualifies as special situation we perceive as a potential shareholder abuse case, but with substantial upside for shareholders. On August 2, 2016 we issued an update with more support for our bullish case and added to our position via stock and warrants Yesterday after the close, the company issued a press release announcing the Board of Directors has formed a special committee to consider the proposal from American Securities. Quote from the press release: The special committee of independent directors will consider the proposal and, if it deems advisable, solicit and consider any alternative transactions involving the potential sale of the Company. The special committee is comprised of Daniel J. Hennessy, Gurminder S. Bedi and Alan H. Schumacher. In connection with its review of the proposal, the special committee has engaged Evercore to act as its financial advisor and has retained Sidley Austin LLP as its legal counsel. This morning, the Company reported Q3 2016 results:

- Sales of $323.1 million vs $262.6 million in the prior year and ahead of analyst estimates of $312.0 million

- Non-GAAP EPS of $0.64 vs $0.46 in the prior year and ahead of analyst estimates of $0.50.

Slight delay due to later than expected EPA approval leads to slight decrease in annual revenue guidance:

“We began production of our new gasoline-powered Vision school bus and plan to start shipping buses with this powertrain in our fiscal fourth quarter, pending final certification from the EPA. Due to later-than-expected EPA approval of our exclusive gasoline bus, we see potential for slightly lower volume in the fourth quarter. As such, we are adjusting our full year net revenue guidance downward to $930-950 million and revising Adjusted EBITDA to $70-72 million. Due to our ongoing focus on cash management, we are able to maintain Adjusted Free Cash Flow at $30-35 million.”

If shares pullback due to the slight decrease in annual revenue guidance, we will look to add to our long position.

Friday, August 5, 2016

Added To Our BLBD Long Position

In yesterday’s email, we stated we would look to add to our Blue Bird Corporation (NASDAQ:BLBD) ($14.10) position if shares pulled back due to the slight decrease in its annual revenue guidance. Shares fell ~6% in the trading session, reaching a low of $13.75. We added to our position under $14. In related news, Craig-Hallum raised its price target to $23 from $19.

Wednesday, August 17, 2016

Will Look To Add BLBD On Possible Dip

We will look to add Blue Bird Corporation (NASDAQ:BLBD) ($14.46) if shares fall under $14 due to investors misinterpretation of yesterday’s news release. After the close, BLBD announced an adjustment to its fiscal Q3 2016 results relating to a non-cash compensation expense. The adjustments do not impact the non-GAAP operating results. See our recent article on why we feel BLBD offers a compelling arbitrage opportunity.

Tuesday, August 30, 2016

BLBD Scenario Analysis

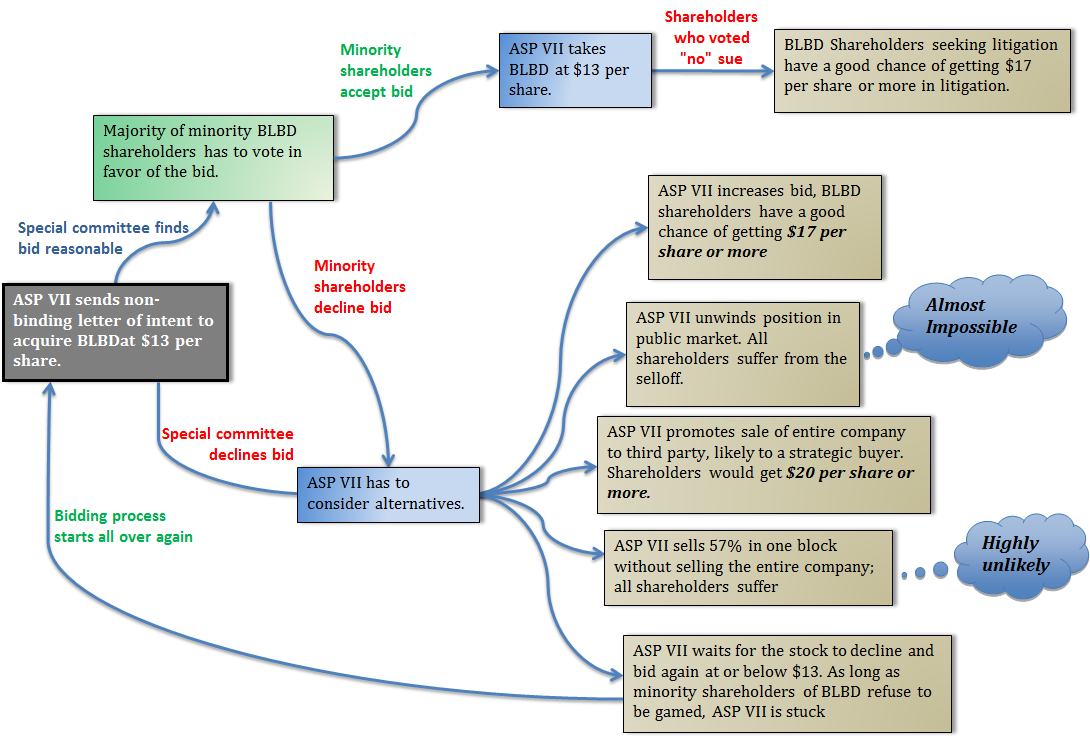

If you are not familiar with BLBD, its history and its current situation, you can read our ongoing coverage of the stock here . Introduction American Securities is a private equity firm, their intention is to make changes on an operational level to increase the value of their holdings. Their LPs do not want them to have positions in publicly listed equities for an extended period of time. American Securities already owns 57% of the shares; a position that is not easy to unwind in the public markets — it seems as if there is no reasonable way for them to step back from a takeover. One could easily argue that they are in a long squeeze of sorts. Private equity funds have a limited lifespan, meaning that American Securities cannot waste too much time before taking over BLBD because it limits the time they have to make operational improvements and exit the position once the fund nears the end of its lifetime. Additionally, private equity funds typically have stipulations that require LP approval in case the fund invests in publicly traded equity for an extended period of time — after all public market investment is not what the LPs signed up for. The specific fund of American Securities that invested in BLBD is American Securities Partners VII (ASP VII), a fund that opened in January 2015 with $5 billion committed. American Securities’ funds are somewhat different from normal private equity funds in that they have an unusual long lifetime of 25 years. Since we do not have the LP agreement of ASP VII, we cannot determine the exact timeline and requirements ASP VII has to follow in its public market investments. We believe American Securities understands the dynamic of the situation and this is why they “low balled” their offer to begin with. We reiterate the crux of the situation: the best buyer is one that is already committed to a purchase, and American Securities fits this bill easily. Special Circumstances of the Bid The bid is somewhat special in that the potential acquirer already owns a majority of the shares. This is clearly a conflict of interest situation. Under these circumstances Delaware law typically applies “Entire Fairness” principles. There are two procedural steps when a conflict of interest situation arises. First the proposed transaction has to be approved by a special committee, which is typically formed from the members board that do not have a direct affiliation with the potential acquirer. Second the transaction is typically subjected to a non-”waivable condition that the majority of the unaffiliated shareholders has to adopt the merger or tender into the offer. This is called the majority of minority condition. In the case that an offer is accepted and the private equity firm can take BLBD private, no-”voting shareholders stand a good chance of getting additional money in a litigation process. The bidding process in this situation is inherently flawed as a price-” discovery tool, and one could argue that ASP VII created the situation on purpose. After all a successful take over by a third party would require approval by ASP VII, who happens to be the bidding opponent. There are several scenarios that have to be considered going forward. The graphic below explains scenarios and the outcomes for shareholders. The Alternatives

Friday, September 2, 2016

Research Update

BLBD ($14.52; marked up to $14.80 pre market) On July 27, 2016 we issued an alert that we were buying shares BLBD. The stock was trading around $13.95 at this time. We believed and continue to believe that a private equity company’s bid to acquire the school bus manufacturer for around $13.00 is way too low. We followed up our initial alert with various valuation scenarios in an article published on July 28, 2016 detailing our bullish thesis on BLBD. Our valuation scenarios ranged from $16.04 to $20.10. Our outlier scenario put BLBD north of $40.00. On August 20, 2016, Geo Co-Founder Maj Soueidan spoke with Barron’s detailing why Geo believed the private equity bid for BLBD was too low. See the full Barron’s write uphere. Yesterday (9/1/2016) after the close, BLBD announced that its special committee rejected the offer from American Securities, stating:

“After careful review, and based in part on the advice and analysis of its financial advisor, the Special Committee determined that American Securities’ proposed valuation is inadequate and undervalues the Company. The Special Committee, with the assistance of its financial advisor, is prepared to enter into discussions with American Securities to determine if the proposed valuation can be increased to adequately reflect the full value of the Company. The Special Committee is willing to consider any amended proposal from American Securities and any proposals that any third parties might put forward.”

Investors should note, in the latest 13D/A filed by Spitfire Capital (activist investor) on August 2, 2016, Spitfire’s financial analysis implies a price target ranging from $21.85 to $27.60.

Wednesday, September 21, 2016

**Special Situation Update

Shares of Blue Bird Corporation (NASDAQ:BLBD) fell 8% during yesterday’s trading session on the heels of a 13D/A filed by American Securities (AMIC). On September 19, 2016, after the close, American Securities, the private equity with intentions to take BLBD private, formallywithdrew the non-binding indication of interest letter submitted to the Special Committee on July 20, 2016 for the acquisition of BLBD. The original letter indicated a transaction price of around $13.00 per share. After receiving the non-binding letter of interest, BLBD’s board formed a special committee to evaluate the proposal. On September 1, 2016 the special committeeannounced that it found American Securities’ proposal inadequate. The possibility that American Securities was not going to increase its bid was one of the scenarios GeoInvesting Analyst Siegfried Eggert laid out on August 30, 2016. We think American Securities does not want to show its cards and will maybe come back with a revised offer at a later time. The PE firm’s governing documents may stipulate when AMIC has to wind down its fund. An extended timeframe may result in a more favorable position (lower market price) to bid for the company, for example if market conditions turn negative or if financial markets crash. We want to reiterate our basic stance: with a 50%+ position in the stock, it will be very difficult for American Securities to liquidate its position in the open market without sending shares under their cost basis. The most viable options for them to get out of the stock are to sell the entire block to a third party or to take the company private and then issue the shares to the public again later. We believe that American Securities will eventually force a liquidation event. Remember, PE firms are not in the business to make meager returns. Thus, they need to make their investments at extremely low valuations. We find it absurd that AMIC is stating that it feels $13.00 is a fair bid for BLBD when it’s safe to assume that they would plan to sell the stock at much higher prices if they were successful in acquiring the company.

Monday, September 26, 2016

Research Update

BLBD ($14.60) announced that it commenced the shipment of all new gasoline-powered type-C buses. The company plans to sell over 400 prior to its fiscal year ending in September. As announced in the third quarter earnings call, BLBD plans to deliver 300 fewer buses in fiscal 2016 because of a delay in engine certification. The announcement of the shipment does not come as a great surprise, but is additional proof that BLBD is making progress in natural gas-powered buses.

“Both Blue Bird and our customers are very excited about our all-new, gasoline-powered Type C school bus,” said Phil Horlock, president and CEO of Blue Bird Corporation. “This bus has the lowest acquisition price compared with other fuel types, while requiring simpler maintenance and providing outstanding cold weather performance. The proven and modern 320 HP 6.8 liter V10 engine delivers outstanding performance and is another great example of our goal to provide innovative, affordable and differentiated products that customers want and value.”

Shares of BLBD have recovered all the losses from the September 19, 2016 13D/A filing which showed American Securities formally withdrew its non-binding offer of $13 per share. See our full update from that day here.

Wednesday, November 16, 2016

BLBD to Present at Craig-Hallum Select Conference

BLBD ($14.95) is presenting at the Craig-Hallum Select Conference in New York today. The company confirmed and narrowed its guidance range for fiscal 2016 (in millions):

- Revenue: $931-935 (midpoint $933)

- EBITDA: $70-72 (midpoint ($71)

- Free Cash Flow: $32-34 (midpoint $33)

As of Q3, the guidance was:

- Revenue: $930-950

- EBITDA: $70-72

- Free Cash Flow: $30-35

We assume the reduction in the high end of revenue guidance is due to the delay in the launch of its new Type C gasoline-powered buses which it discussed in it Q3 conference call. The full presentation can be viewed here.

Tuesday, December 13, 2016

Research Update – BLBD Q4 2016 Earnings

BLBD ($17.05) reported Q4 2016 results:

- Sales of $286.4 million vs $307.6 in the prior year and below analyst estimates of $293.0 million

- Non-GAAP EPS of $0.49 vs $0.68 in the prior year and ahead of analyst estimates of $0.43

- Achieved full year guidance for Revenue, adjusted EBITDA, and adjusted FCF

2017 Guidance:

- Expects 2017 revenue to be $980 million to $1 billion; analyst estimates are for $1.01 billion

- Expects 2017 EBITDA to be $72 to $76 million; analyst estimates call for $80.2

The company was able to refinance its $160 million term loan:

“On December 12, 2016, the Company successfully refinanced its $160 million term loan and $75 million revolving line of credit. The new credit facility, led by Bank of Montreal as Administrative Agent and an Issuing Bank, reduces the Company’s effective interest rate paid by approximately 4 pts.”

BLBD indicates that the annual savings from the refinancing are approximately $4m, which translates to $0.13 boost to fully diluted EPS. Comments from management:

“Overall, we had a great year at Blue Bird. We successfully launched four, all-new powertrains while delivering solid growth in top-line revenue and Adjusted EBITDA,” said Phil Horlock, President and Chief Executive Officer of Blue Bird Corporation. “Our propane-powered bus offering continues to be the undisputed leader in alternative fuels with sales up 33% over the prior year. We shipped 406 new gasoline-powered Vision school buses in September, following an unexpected delay in CARB certification for the product. Overcoming this obstacle was a testament to our strong relationship with The Ford Motor Company and Roush CleanTech. With the broadest product range and engine choice in the industry, we are well-positioned for growth next year. Consequently, we are forecasting continued growth in fiscal 2017 with full year net revenue guidance of $980 million -1.0 billion, Adjusted EBITDA of $72-76 million and Adjusted Free Cash Flow of $38-42 million.”

Being that guidance and growth is weak for 2017, we are viewing this as a special situation play on the possible takeover angle. The adjusted EV/EBITDA for 2016 is 9.5 and 8.6 for 2017. We plan to continue offer BLBD management further guidance on how to maximize shareholder value.

Friday, February 10, 2017

Research Update – BLBD Q1 2017 Earnings

BLBD ($16.65) reported Q1 2017 results:

- Sales of $136.7 million vs $131.3 million in the prior year and ahead of analyst estimates of $131.6

- Non-Gaap net loss of $0.13 vs a loss of $0.12 in the prior year and missed analyst estimates of a loss of $0.09

- BLBD reaffirmed its 2017 guidance of $980 million – $1,010 million sales, Adjusted EBITDA of $72 – $76 million and Adjusted Free Cash Flow of $38 – 42 million.

CEO Phil Horlock stated on the Conference Call:

“And finally, all industry data, or registrations of net new orders received together with higher core activity that we are seeing supports our position that new school bus industry should grow by between 3% to 4% this year and reach around 33,534,000 buses this year. All-in-all a solid first quarter Blue Bird and in line with our expectations.”

We initiated our position in BLBD in July 2016 as a special situation play (not a growth play) when the stock was trading ~$14.00 based on what we perceived as a potential shareholder abuse case, but with substantial upside for shareholders. You can see our full coverage on BLBD here. Notably, the company did not comment on the status of the relationship with majority owner American Securities.

Tuesday, April 11, 2017

Locked in nice gains in BLBD common shares, remain long warrants.

Shares of BLBD hit a new 52 week high of $18.35 in yesterday’s trading session. We have closed out our long-held position of BLBD common stock. We initiated our position in July 2016 as a special situation play (not a growth play) when the stock was trading ~$14.00, based on what we perceived as a potential shareholder abuse case, but with substantial upside. You can see our full coverage on BLBD here. We remain long the stock via its warrants, trading as symbol BLBDW.