GeoWire Monthly, Vol. 4, Issue No. 1, January 2024

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 1, January 2024

The Intersection of Stock Investment Ideas Between Us and Peers

While perusing Twitter, I came across a Twitter post by Clark Square Capital (@ClarkSquareCap) highlighting a list of stocks from the River Oaks Capital H2 2023 Report that included a table of companies that were labeled as either an ‘Excessive Discount’ or ‘Wonderful Business’. We recommend that you read the entire update to get a feel on their take on stock idea discovery.

By the way, we want to extend a big thank you to Clark Square for posting it.

Aside from being a beautifully simple way to initially introduce the list of portfolio companies using one descriptor, we couldn’t help but notice that 2 of the companies on the list intersected with our coverage – nutritional supplements company Fitlife Brands, Inc. (NASDAQ:FTLF) (Wonderful Business) and PharmChek® Sweat Patch drug detection manufacturer Pharmchem Inc (OTC:PCHM) (Excessive Discount),

Enjoyed the River Oaks Capital H2 2023 Letter:

h/t @Whit_Huguley https://t.co/DP3n5jscjJ pic.twitter.com/clRbWAgFgS

— Clark Square Capital (@ClarkSquareCap) February 6, 2024

Here’s an excerpt on FTLF from page 19 of their letter:

“Fitlife Brands (FTLF) develops and markets nutritional supplements – protein powders, pre-workout, amino acids, weight loss products, fish oils etc. – under 13 different brand names. It is our seventh largest position in the fund and now has a market cap of $90m.

Through CEO Dayton Judd’s innovative capital allocation decisions since taking over in 2018, he has turned a near bankrupt company that sells commodity branded products into a wonderful business.

Each step of Dayton’s remarkable turnaround from 2018 to H1 2023 was highlighted [on pages 7 and 8] in the last letter.”

River Oaks is an Investment Fund run by Whit Huguley (@Whit_Huguley), CFA, who describes the fund’s focus in the following manner:

“We invest in a select number – 8 to 15 – of publicly listed companies primarily in the United States. Our focus is discovering mispriced companies in underfollowed markets by doing extensive in-depth research and visiting each management team. The average market cap of the companies we own is ~$200m.”

While some might argue that investing in a larger bucket of stocks is an equally good or even better way to capture a larger opportunity to nab multibaggers, we do have to admit that the strategy they use is similar to that of our 4 to 7 stock Buy on Pullback Model Portfolios that can be argued contain “discounts on wonderful companies”. Our Buy On Pullback Strategy Webinar of ours offers some more insights into our strategy.

And of course, their market cap preference is right up our alley.

Besides, connecting with some of River Oak’s stocks in their H2 2023 letter, we also connected with the tenets they lean on to start to qualify potential investments.

- Sells a wonderful product that will generate substantial cash for years to come.

- Treats their customers, employees, and community admirably.

- Is run by honest and able people that also have ownership in the business.

- Does not take excessive risk.

- Has a long-term plan for the business.

- Is selling ownership at a significant discount to fair value.

Sounds pretty good to us. We also lean on 2 lists that expand on both the qualitative and quantitative, our Tier One Quality and Multibagger checklists.

We obviously agree with their assessment on FTLF and PCHM that have been Model Portfolio holdings of ours since 2018 and 2016, respectively. And the returns speak for themselves.

So, once in a little while, it’s nice to get some validation on the stocks that we choose to put in our Model Portfolios from well-respected firms such as River Oaks that dabble in the same universe as ours.

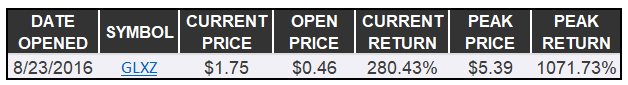

As a side note, we also wanted to point out that gaming company Galaxy Gaming Inc (OTC:GLXZ) is part of the list, so that calls for a shout out to a contributor of ours that identified the stock as an undervalued asset back in 2016, and currently with the exceptional returns below!

Now, it looks like our next task is to look under the hood of the remaining companies on their list. Maybe there’s another diamond in there, so definitely keep track of our own assessments on them should we find a few compelling enough to dig deeper.

If you want to see our evolution of research on FTLF or PCHM, and the initial GeoInvesting contributor pitch behind GLXZ, let us know and we’ll be happy to share it with you for free.

200 Multibaggers And Counting

GeoWire Weeklies, Jan. 2024

December 2023 Newsletter, In Case You Missed It

GeoInvesting Progress and Stat Summarizations, January 2024

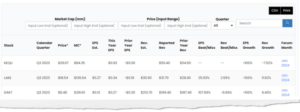

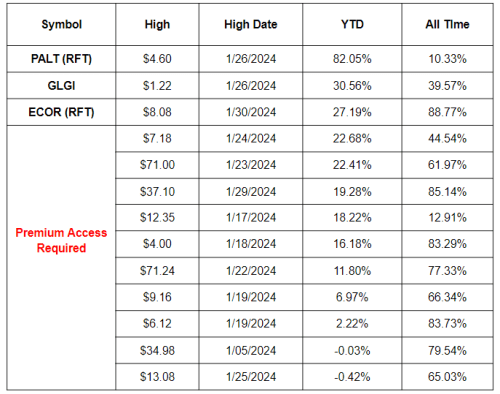

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

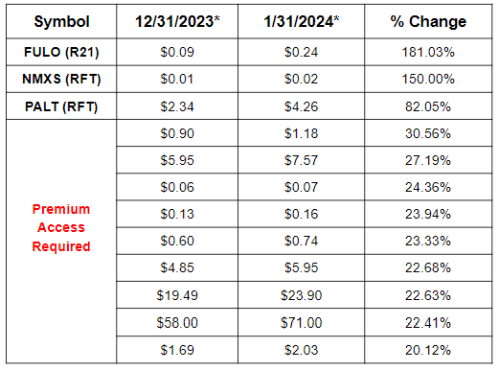

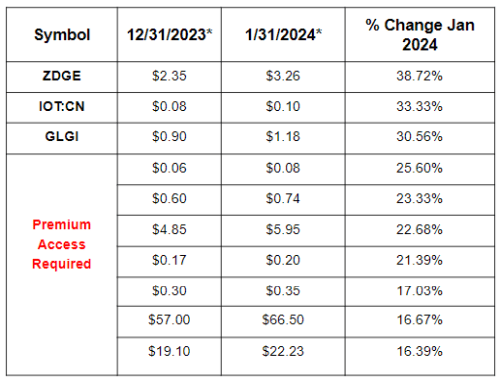

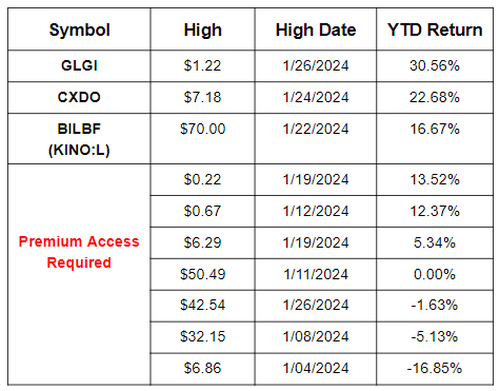

Stocks Rising >20% Across All GeoInvesting Model Portfolios/Screens

Top 10 Best Performers for the Month of Jan 2024 From GeoInvesting Contributor Picks

New 52-wk Highs From GeoInvesting Contributor Stock Picks

- Yellow indicates multibagger potential

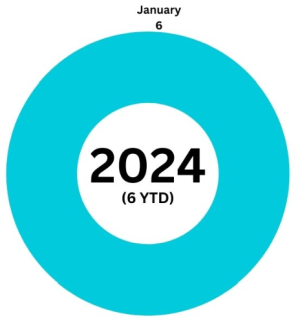

Earnings Processed, January 2023

During January 2023, we processing 6 Quarterly Earnings Reports, bringing our full year total to 6 so far.

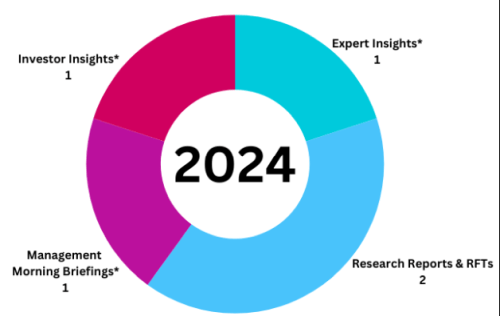

Research Progress, January 2023

*Please also note that year to date, we’ve published 14 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 19 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder in 2023, we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

Premium Emails You May Have Missed in January 2024

- Open Forum Reminder; MOJO Strong Year Over Year Growth Continues; SOFO Sells Main Business Segment – 01/04/2024

- CRAWA Makes Bolt-On Acquisition; TPCS Provides Insight on Votaw Acquisition – 01/08/2024

- TAYD Reports Q2 EPS Increases 24% On Flat Sales, Record Backlog and $9 Million Share Repurchase – 01/10/2024

- Portfolio Protection Research Synopsis – Swvl Holdings (SWVL) – A GAAP vs. Non-GAAP Assessment – 01/11/2024

- FLXS Blowout Preliminary Results; HGBL Buys Pharma Assets – 01/12/2024

- CXDO Skull Session Invite; TATT Wins Another Contract – 01/16/2024

- BLBD Record EV Bus Contract; GLGI Strong Q2; ETCC Reaches Profitability; HYDI Shareholder Letter Piques Interest – 01/17/2024

- EDUC Now NASDAQ Compliant, Q3 Conference Call Developments Worth Tracking – 01/18/2024

- SWVL Portfolio Protection Update; Adding 14 Stocks to Research Pipeline – 01/22/2024

- RWWI Earnings Coverage; AATC Deserves a Closer Look – 01/26/2024

- Telescope Innovations (OTC:TELIF) (TELI.CN) Record Q1 2024 Results Has Us Digging Deeper – 01/30/2024

- Very Encouraging KTEL News Related to a New Business Agreement – 01/31/2024

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- New stock ideas backed by in-depth research

- Stock pitches from our Premium subscriber investor network.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails..

- 15 Years of archived research on over 1500 companies and counting.

- Access to our Live and Archived CEO Interviews.

- Weekly Newsletter and Monthly Live/Archived Forum, just in case you missed our updates and alerts.

- Education on investment process and case studies.

Pitches You May Have Missed

Appendix

Content Distribution Key

Written

2 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

0 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

0 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

0 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

0 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

1 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

1 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

1 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

263 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.