GeoWire Monthly, Vol. 3, Issue No. 11, December 2023

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 3, Issue No. 11, December 2023

Lately, we’ve had a lot of good reasons to put a spotlight on our belief that broad investor appetite for quality microcap stocks is back in full force. Several of our recent communications conveyed that these types of stocks continue to gain momentum and are beating all of the major stocks indexes by a large margin.

We think this theme is so important that, as part of this Monthly GeoWire, we are bringing to attention our late December updates.

The crux of the update was inspired by Dominique Mielle’s book, Damsel in Distressed: My Life in the Golden Age of Hedge Funds, which put us in a frame of mind to use her concepts to convey that we are full speed ahead and plan to ride a multi-year quality microcap wave.

An excerpt (versioned for this month’s copy) from an article published to GeoInvesting on December 25, 2023, Capitalizing On Inefficiencies: A Reflection On ‘Damsel In Distressed’ By Dominique Mielle, encapsulates why I am the most bullish on our microcap investing strategy since the onslaught of the 2008 Recession created a prolonged period of microcap bearishness.

“…

While large cap only investors and microcap haters have to contend with increasing competition in strategies that are finding success, microcap stock pickers have the luxury of searching for opportunities in a pool of around 10,000 stocks in North America (~50% of total stocks), while arguably, the competition has been declining or at least staying level.

It’s a dream set-up, especially if your strategy is value investing, or whatever you want to call buying undervalued stocks producing revenue and earnings, a style of investing that was not broadly in vogue for the past 15 years (also applies to high probability turnarounds).

But mark my words, it’s quietly coming back.

And it’s going to be back for several years and lead to massive expansions in valuation multiples.The 24% and 27% rallies we just witnessed in the small and microcap indexes, respectively, over the last 2 months is child’s play. The best is yet to come for these types of stocks.

Get used to seeing the big mover lists being occupied by more and more legit companies as opposed to MEME and pump and dump stocks.

…”

I’m proud to say that since the founding of GeoInvesting in 2007, our team has brought our premium subscribers over 200 multibaggers.

While 2022 made the investing landscape more challenging, the last two years have been a great time to reset strategy and get ready for the next bull market which will be led by quality microcap stocks, as well as high-probability microcap restructurings.

I’m betting my 30+ investing career on it. Our strategy to be hyper focused on quality is paying off, as evidenced by the performance of the 14 stocks we added to GeoInvesting’s Model Portfolios in 2023, with 6 of them achieving 40% returns or more, and only 4 in minimally negative territory (-0.67%, -4.09%, 5.25%, and -12.01%.)

So there you have it. Before we got into last month’s coverage and stats, I needed to once again get this off my chest and use my proverbial bullhorn, in case you didn’t hear me the first 4 times.

GeoWire Weeklies, Dec. 2023

November Newsletter, In Case You Missed It

GeoInvesting Progress and Stat Summarizations, December 2023

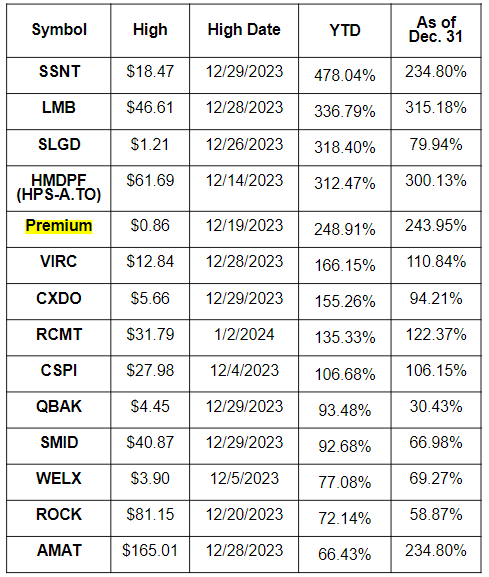

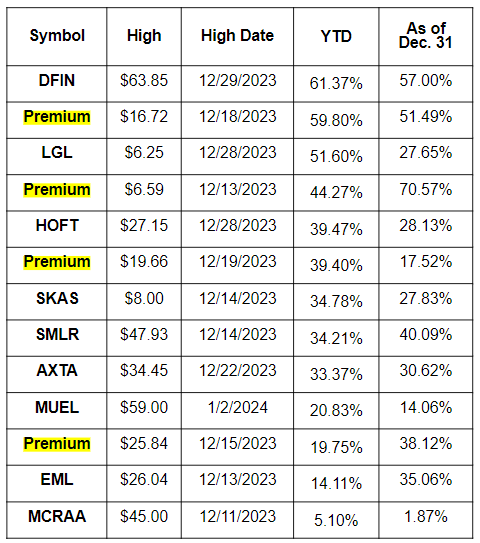

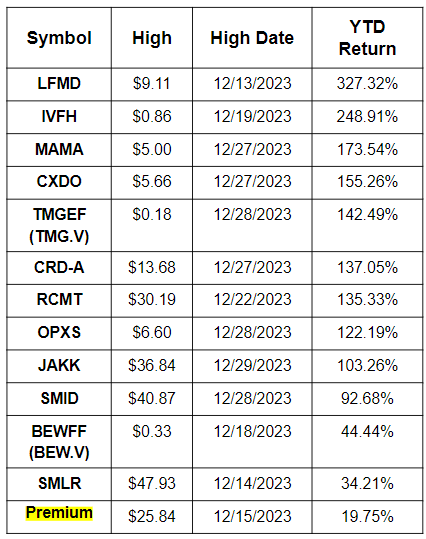

Yellow indicates multibagger potential

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

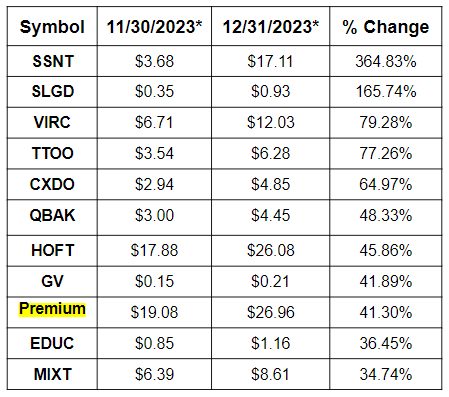

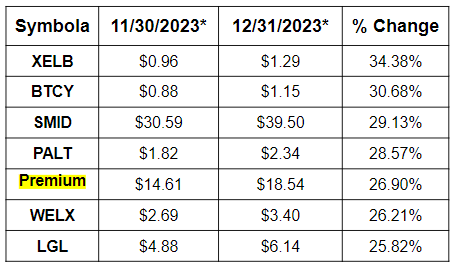

Stocks Rising >25% Across All GeoInvesting Model Portfolios/Screens

Stocks Rising >25% Across All GeoInvesting Model Portfolios/Screens

- Yellow indicates multibagger potential

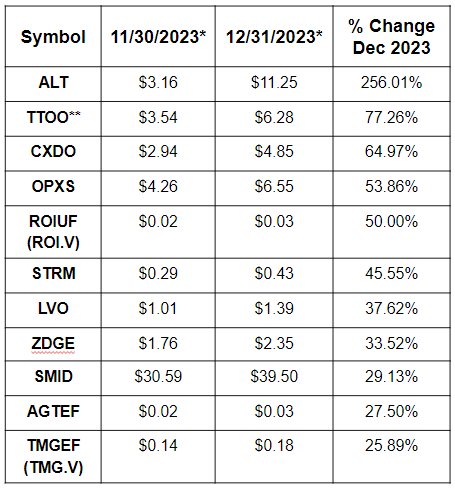

Top 10 Best Performers for the Month of December 2023 From GeoInvesting Contributor Stock Picks

New 52-wk Highs From GeoInvesting Contributor Stock Picks

- Yellow indicates multibagger potential

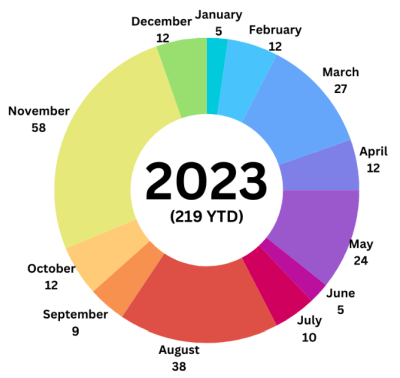

Earnings Processed, January To December 2023

During December 2023, we finished out the year processing 12 Quarterly Earnings Reports, bringing our full year total to 219.

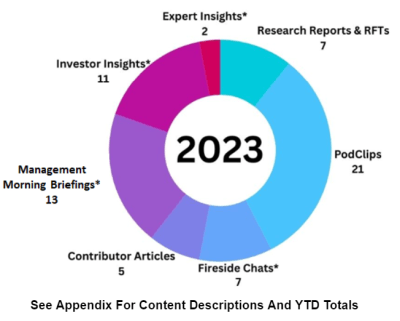

Research Progress, January To December 2023

*Please also note that year to date, we’ve published 263 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2023, apart from daily emails and weekly GeoWire Content, we have published a combined 329 pieces of Premium content (including video clips) across the segments detailed in the appendix.

Premium Emails You May Have Missed in December 2023

LAKE Makes Accretive Acquisition; CRAWA Increased Dividend Amount and Permits Share Buyback – 12/01/2023

Strong Earning Reports From LAKE, KEQU, HOFT and ADFJF (DRX.TO) – 12/07/2023

MITK Preliminary 2023 Results and Guidance In Line With Analyst Estimates – 12/08/2023

Open Forum Invite; TPCS Financial Details of Acquisition Target; LFVN Upcoming Fireside Chat – 12/11/2023

BLBD Reports Strong Q4 2023 Results; ADFJF (DRX.TO) Strong New Order Update – 12/12/2023

Additional LAKE Skull Session Clips – 12/14/2023

ATGN More Of The Same; CRAWA Share Repurchase Announcement; Deeper Dive Into GENC – 12/15/2023

December 2023 Forum Replay And Presentation Download Now Available – 12/18/2023

TATT Call To Action and Cliff Note; KTEL To Accelerate Growth With Non-Dilutive Financing – 12/22/2023

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- New stock ideas backed by in-depth research

- Stock pitches from our Premium subscriber investor network.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails..

- 15 Years of archived research on over 1500 companies and counting.

- Access to our Live and Archived CEO Interviews.

- Weekly Newsletter and Monthly Live/Archived Forum, just in case you missed our updates and alerts.

- Education on investment process and case studies.

Pitches You May Have Missed in 2023

Appendix

Content Distribution Key

Written

6 Research Reports & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

21 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

3 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

7 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

13 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

11 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

263 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.