Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

By Maj Soueidan, Co-founder GeoInvesting

Every year, on some level in our research or education, we remind you that companies have a somewhat wide latitude on how they are permitted to make adjustments to generally accepted accounting principles (GAAP) earnings per share (EPS) to report non-GAAP or “adjusted” earnings per share (EPS).

In an article we wrote in August 2016, “To GAAP or Non-GAAP, That is the Question,” we dove into this topic to highlight conservative and aggressive ways companies can make adjustments to GAAP EPS.

In the end, when analyzing EPS, we should strive to calculate a number that is most representative of a company’s everyday operations and its run-rate earnings power. This is accomplished by eliminating impacts to earnings per share that are one time in nature or generally non-recurring, as well as making adjustments to some non-cash gains/charges.

In January 2023, we actually talked more specifically about these scenarios and how you can apply GAAP vs. non-GAAP analysis to execute successful short term trades.

For example, one way we like to apply these principles on a personal level is to make a little money in short-term trades. This can be done through potentially buying stock in companies that were overly conservative in calculating their adjusted EPS, or shorting companies that were overly aggressive when highlighting adjusted EPS.

However, a second strategy you can use to make short term profits around your long-term strategy is by identifying companies who are providing only GAAP EPS, when they should also be providing adjusted EPS.

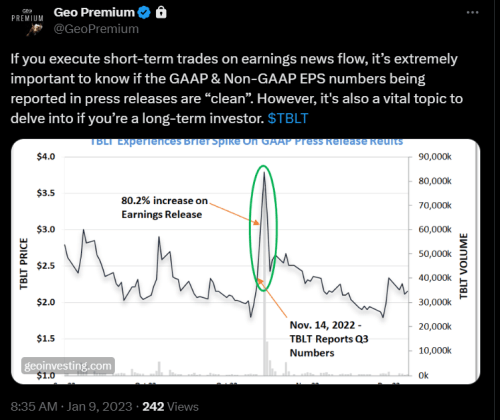

This was actually the subject matter of the January article, when we highlighted Toughbuilt Industries, Inc. (NASDAQ:TBLT) and its 80% pump and round trip dump, as investors figured out that the company’s reporting of only GAAP EPS overrepresented its true earnings power.

And while it’s not technically “required” for companies to report GAAP numbers that eliminate huge non-recurring positive net income adjustments, to us, this amounts to the equivalence of financial disclosure malpractice.

It’s a bit insulting that some companies may think they can catch experienced investment professionals off guard, and it’s unfortunate that the everyday, less sophisticated investor may not be savvy enough to look beyond what the company is presenting.

Using a current example, if you weren’t paying attention to the fact that Csp Inc.’s (NASDAQ:CSPI) press release headline, highlighting stellar GAAP EPS for its full fiscal year, you may have been fooled into thinking that it represented the true earnings power of the company. But I saw it differently.

Why reading press releases is useful & why GAAP EPS doesn’t always trump non-GAAP:Csp Inc. (NASDAQ:CSPI) Headline full year headline EPS reported as $1.09. However, adjusted EPS after taking out other income would be about $0.40 (not taxed) & a loss for quarter. https://t.co/yLFuwrT8wY pic.twitter.com/EooIpGWFqj

— Maj Soueidan (@majgeoinvesting) December 12, 2023

The reality of CSPI’s case was that although the company eventually discussed the large 1-time gain in a sentence down the body of the press release, the company did not supply an adjusted EPS number anywhere in that same publication.

Making the assumption that it might take investors a bit of time to understand that they’d have to calculate a Non-GAAP number, I used this information arbitrage edge to take a small short position at around $21 in pre-market trading. It had closed the previous day at $22.63.

Ultimately, I covered my short position at around $18. Shares closed at $17.90 after hitting an intraday low of $16.43.

There are two lessons here. First, in the microcap space, there are less eyes, and therefore less of a chance that Information Arbitrage (InfoArb) will be readily noticeable by other investors, giving you the opportunity to pounce. Second, thoroughly reading press releases should be an integral part of the investment process for any serious long term investor or day trader.

And while we don’t normally tangle with the short game to a large extent anymore, or publish regular short ideas, you can still refer to this trade as a case study if short selling is part of your overall investment strategy.

By the way, we are not saying CSPI is uninvestable. In fact, due to the recent launch of a new software offering, we are actually tracking the company from a bullish point of view. At Friday’s close of $16.70 on Friday, we are now attempting to understand if this pullback could provide a longer term buying opportunity. Here is our latest note that we published about what’s going on at CSPI.

—

If you are a premium subscriber and not currently logged in, you can log in here to view The Assoicated Premium content. Once Logged in, Just click on The link for The Latest Issue Listed At top of your Home Page.

If you are not a premium subscriber, please JOIN HERE.

—