Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

Note: This is a brief synopsis of our bullish thesis on LAKE, first made available to GeoInvesting premium members.

Lakeland Industries, Inc. (LAKE) specializes in the sale of industrial protective clothing and accessories, serving both the industrial and public protective clothing markets. Products include:

- Firefighting and Heat Protective Apparel.

- High-End Chemical Protective Suits.

- Limited Use/Disposable Protective Clothing.

- Durable Woven Garments.

- High Visibility Clothing.

- Gloves and Sleeves.

We are predicting that the stock will rise over 300%.

The company generates over $100 million in revenue, is very profitable, and has a large cash position of $26 million. This means that management won’t have to do equity raises and dilute shareholders to execute its new growth plan.

The stock is selling at a price to earnings multiple of only 12.6 times one year forward earnings of $1.20 (which we predict is very conservative), despite achieving strong earnings per share growth over the last three quarters.

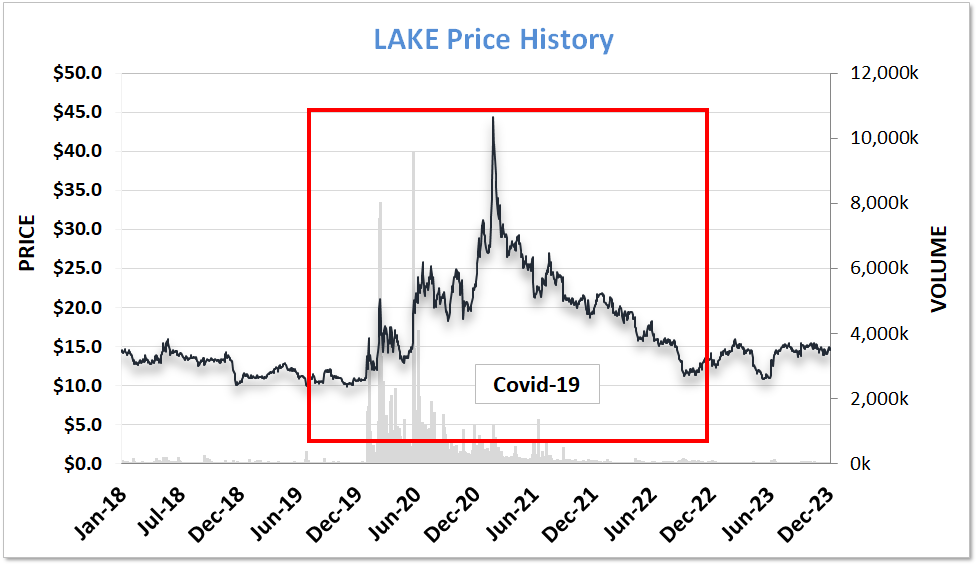

As one would expect, LAKE experienced a surge in its stock price ($10.00 to $40.00s) during the COVID-19 pandemic, driven by increased demand for its products.

However, as investors eventually understood that pandemic-related sales would be temporary, the stock price fully retreated.

LAKE’s volatile financial history and past ties to pandemic-type events has investors hating the stock. That’s why we love the story even more.

Now, with a new management team, the company is starting to focus less on its legacy, cyclical business and is getting into more predictable, less competitive high growth markets.

A key reason we are currently extremely bullish on LAKE is due to information disconnects we found among analyst sales and earnings per share estimates. It’s actually quite unbelievable that analysts are behind the “information” curve.

Analysts, in constructing sales and earnings per share estimates published on retail sites like Yahoo Finance, as well as on institutional grade platforms like Sentieo, Bloomberg, and Reuters, have totally ignored the company’s growth trajectory clearly outlined by management.

Our calculations result in financial estimates well above those of analysts, which we predict could result in the stock exceeding $60 per share vs. its current price of $15.28, translating into a return of ~300%. However, we believe there is considerable upside to EPS, and thus our price target, depending on the amount of operating leverage the company can experience as revenues increase.

We were lucky to catch PPE apparel company Lakeland Industries, Inc. (NASDAQ:LAKE) CFO, Roger Shannon, on extremely short notice for a very early morning Management Briefing Skull Session on Thursday, December 7. We threw the invite out to Shannon because…

—

This is a brief synopsis of our bullish thesis on LAKE, first made available to GeoInvesting premium members.

If you are a premium subscriber and not currently logged in, you can log in here to view Important Clips From Our Interview with LAKE management. Once Logged in, Just click on The link for The Latest Issue Listed At top of your Home Page.

If you are not a premium subscriber, please JOIN HERE.

—