Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

By Maj Soueidan, Co-founder GeoInvesting

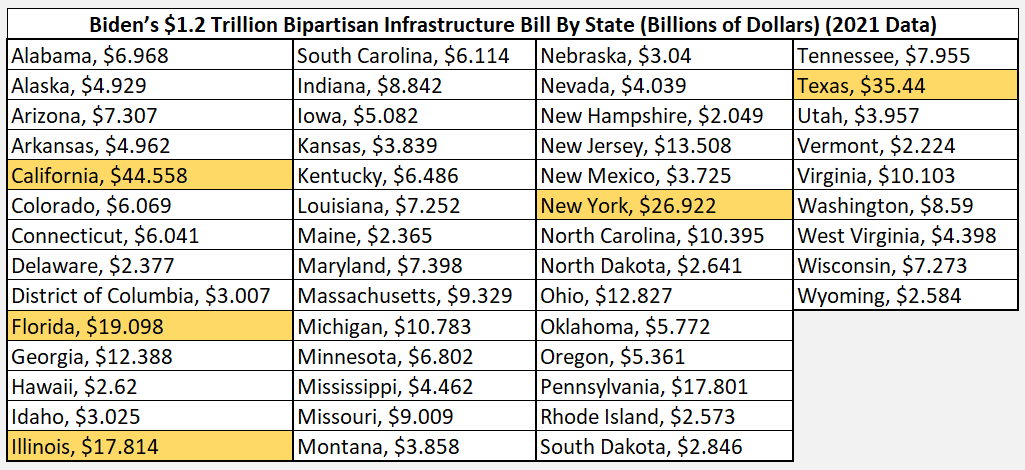

A few weeks ago I was dusting off the shelves of some of our research files at GeoInvesting, when I came across a quote I saved from an article discussing the $1.2 trillion Bipartisan Infrastructure Bill that went into law on November 15, 2021. The planned spending is quite extensive:

“California ($44.558 billion), Texas ($35.440 billion), New York ($26.922 billion), Florida ($19.098 billion) and Illinois ($17.814 billion) will get the biggest allocations.”

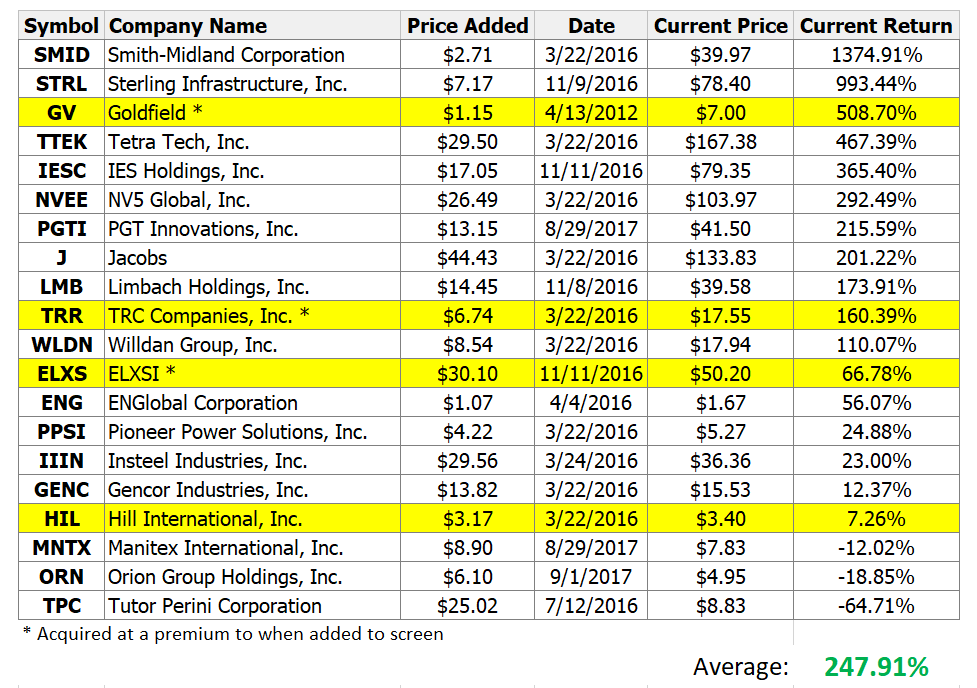

It served to remind me of one of our screens we created but eventually removed from GeoInvesting – The Infrastructure Screen.

We actually launched the screen in 2012 with only one stock and then began populating it heavily in 2016 until it contained 20 stocks by the end of 2017.

The most disappointing realization that came with going back in time, and supported by the table above, was how well the screen had performed to date, as well as from when we unpublished the screen after many stocks continued to outperform.

So far, 11 multibaggers reside on the list, a 55% multibagger hit rate. All but 3 are in positive territory, or 85% of the group.

And 4 have been acquired at premiums to when we added them to the screen.

Smith-midland Corporation (NASDAQ:SMID) tops the list at a return of 1374.92%, a company on which I coincidentally conducted an on-site visit at their headquarters in March 2016.

By the way, I can’t stress enough that you’d be greatly served to use our research beyond our calls to action or model portfolios. We see our idea generation and bullish theme analysis as extremely integral parts of our entire due diligence process we have been using since 2007.

The performance of stocks that we didn’t even include in our model portfolios is a great example of why I stress this point.

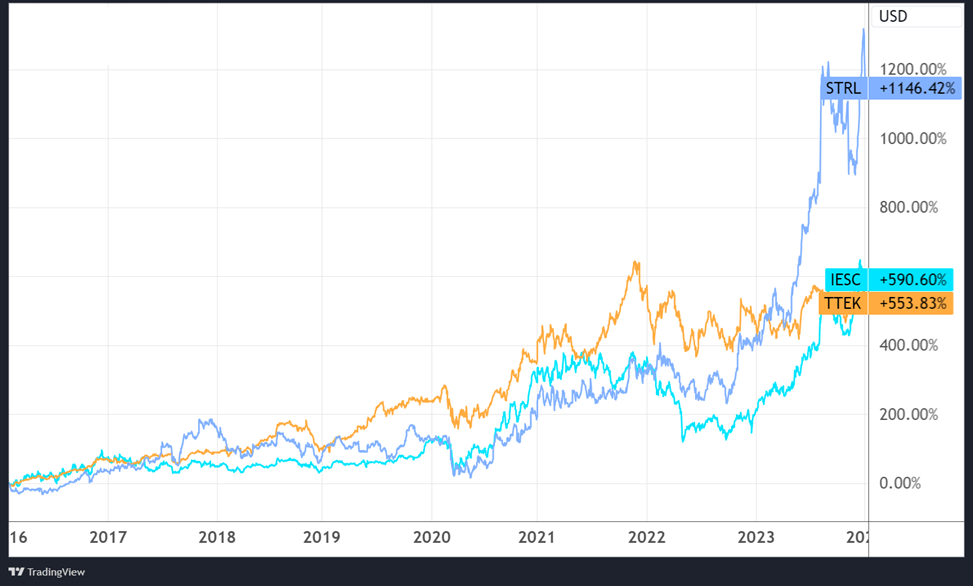

For example, returns of non-portfolio stocks Sterling Infrastructure, Inc. (NASDAQ:STRL), Tetra Tech, Inc. (NASDAQ:TTEK) and Ies Holdings, Inc. (NASDAQ:IESC), some best performers on the Infrastructure Screen, show amazing increases since January 1, 2016:

To be fair, even though we didn’t buy and hold a lot of the names on the list, we did make some money off the screen from names that made it to our Model Portfolios.

Over time, 8 stocks made it to our Model Portfolios via 11 separate disclosures, together racking up a current aggregate return of 2333.4%, or an average return of 326% per instance.

But it still hurts to see stocks like Smith-midland Corporation (NASDAQ:SMID) end up on the new high list everyday and Nv5 Global, Inc. (NASDAQ:NVEE) eclipse $100. We removed NVEE at $22.38 and $29.25 via two separate forays with the stock in our main Model Portfolio, capturing returns of 59.85% and 49.92%, respectively, instead of the multibagger returns it went on to enjoy…that’s what makes investing hard.

As for SMID, it’s selling at a ridiculous valuation (P/E of 375) in an industry that typically does not carry high valuation multiples. There is also no way I would have held the stock through volatile EPS and lackluster sales growth, a large institution exiting all of its stock and a financial restatement! Well, I didn’t 😂.

However, a big key to becoming a successful investor and maturing over time is to look forward, leaving your regrets behind, as part of history. In order to rewrite history, you need to keep moving.

Now, as we’re approaching a point in time when we think the Infrastructure Bill is about to start accelerating a deployment of funds, it’s a great time to revisit the screen.

We are most interested in seeing if there are any stocks on the screen that underperformed, and might be ready to rise as beneficiaries of the bill. If considering the stocks that have, as of January 12, 2023, gone up less than 25%, that list would include:

- Pioneer Power Solutions, Inc. (NASDAQ:PPSI)

- Insteel Industries, Inc. (NYSE:IIIN)

- Gencor Industries, Inc. (NYSE:GENC)

- Hill International, Inc. (NYSE:HIL)

- Manitex International, Inc. (NASDAQ:MNTX)

- Orion Group Holdings, Inc. (NYSE:ORN)

- Tutor Perini Corporation (NYSE:TPC)

We’re also interested in possibly adding some new stocks to the screen.

We are extremely confident that we’re going to be able to find a couple more multibaggers from our infrastructure screen homework.

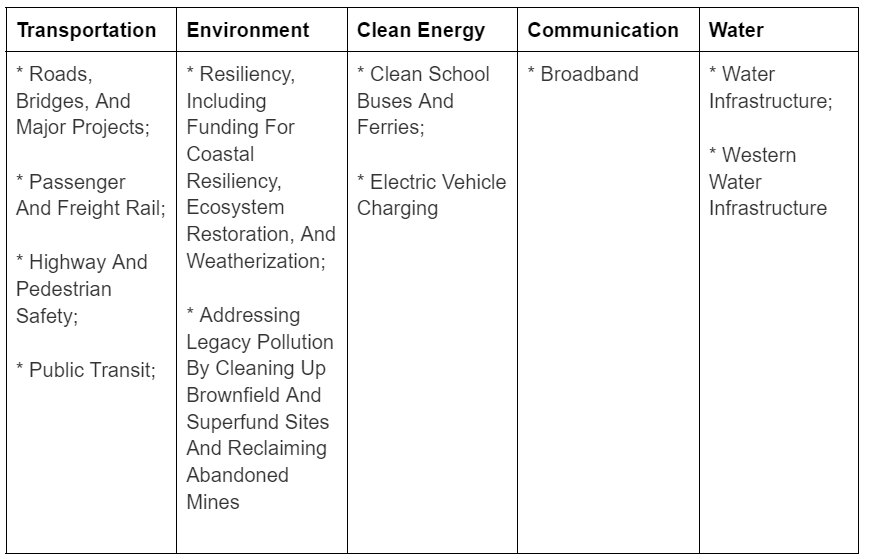

One thing we will be doing is digging deep into the actual bill to see if we can find some companies that match the themes of the bill.

For example, the information below shows where some of the money is going to be allocated:

- $110 billion in bridge and road repairs

- $105 billion in public transit and passenger and freight rail systems

- $73 billion to upgrade power infrastructure

- $65 billion to ensure that access to high-speed internet

- $55 billion in clean drinking water systems

- $50 billion in weatherization projects to protect against climate change

- $42 billion in repairing, maintaining and modernizing nationwide airports, ports and waterways

(Data provided by smart smartasset.com)

Category Breakdown

Government’s Allocation By State

* States in yellow indicate the 5 largest allocations

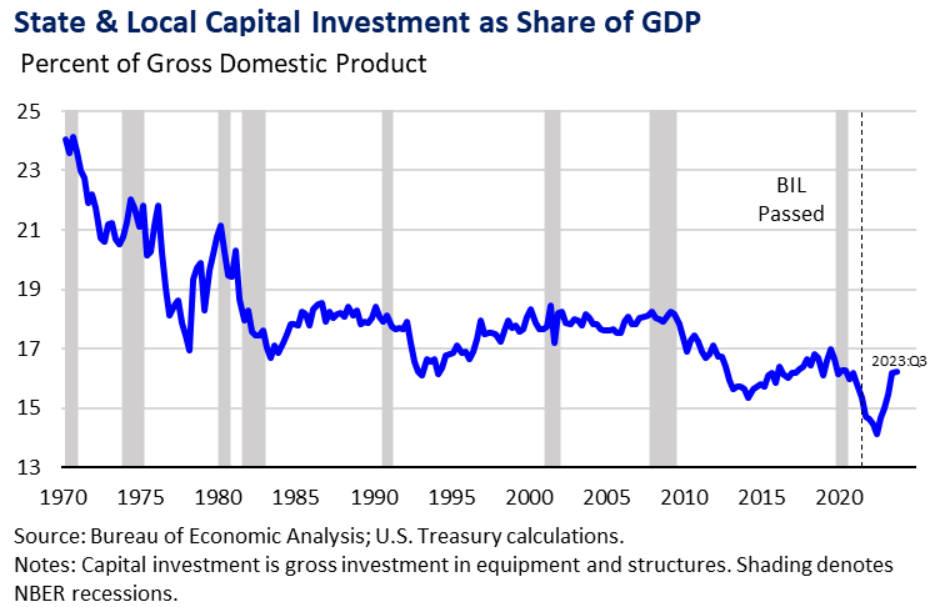

By the way, state and local municipality infrastructure spending are starting to trend up after a multi-year decline, according to the U.S. Treasury.

The infrastructure theme goes well beyond a government funding play. There are just certain industries that have to upgrade their infrastructure, with or without government funding.

Stay tuned for more information on the time and date of a Skull Session Fireside Chat we are scheduling with the CEO of an infrastructure company that we will be adding to the screen.

—

If you are a premium subscriber and not currently logged in, you can log in here to view The Associated Premium content. Once Logged in, Just click on The link for The Latest Issue Listed At top of your Home Page.

If you are not a premium subscriber, please JOIN HERE.

—