https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING LAST MONTH

April 2022, Volume 3, Issue 4

SPECIAL HIGHLIGHT

Welcome to this issue of the Geowire Monthly!

In this edition, we get back to our video focus by covering my appearance as a guest on The Acquirers’ Multiple, a podcast hosted by Tobias Carlisle (@greenbackd). He reached out to me because I had attained the top spot at a newsletter platform that features member pitches and stock ideas. After some 2022 battle scars, I still reside in the top 7 out of a total of 87 authors.

Tobias is the author of The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market

Even though I had this conversation with Tobias in 2020, I thought it would be a great idea to bring it to light again for investors that began following our newsletter since then. It serves as a great primer to get familiar with parts of my full-time investing journey…just in case you have been contemplating upgrading your experience on Geoinvesting through a subscription to our Premium Subscription here.

We discussed my early years of investing and some of the most important things that shaped my investing journey.

During the interview, we delved into a range of topics including:

- Chapter 11 stocks. This is very relevant to today’s investment environment where we believe there will be a good flow of exciting chapter 11 exit investing opportunities. (you can read more about these topics here and here). For example, National Cinemedia Inc. (Nasdaq: NCMI) Bed Bath & Beyond (OTCMKTS: BBBYQ) and Lannett Company (OTCMKTS: LCINQ) are some large public companies that just filed for Chapter 11.

- Crypto Ponzi schemes

- Momentum investing

- The misappropriated penny stock stigma

- Tier 1 Microcap qualities.

Given my belief that we are entering a new era of investing in which traditional value investing strategies that contributed to my early investing success (and took a backseat during the last 15 years) are making a comeback, some of the things Tobias and I talked about are more relevant than ever.

Therefore, I am excited to share our conversation with you and hope it provides valuable insights and knowledge that you can apply to your own investing journey.

VIDEOS IN FOCUS

Featured Video Clip #1 – My Investing Background

We started the podcast by discussing the influence my dad had on my investment journey from a young age. When I was in 11th grade, I participated in a mock investing contest in my economics class which eventually led me to participate in multiple investment contests run by USA today.

Some of my earliest memories of the stock market involve sitting with my father and watching the Nightly Business Report on PBS. I can remember my dad emerging from the basement (his stock cave) with new stock picks he was excited to share with me.

His composed demeanor amidst significant events like the 1987 crash and the Gulf War (1990 – 1991) truly inspired me, as I witnessed his unwavering approach to investing without yielding to stress. It was through him that I became acquainted with OTC (Over-The-Counter) stocks, as he introduced me to the dedicated section in the Wall Street Journal that tracks new 52-week highs and lows in that universe. Intrigued and captivated, I embarked on a journey of purchasing OTC stocks under his invaluable guidance,

But what really got my full-time investor juices going was when my dad gave me the book “One Up on Wall Street” by Peter Lynch in 1990. It further ignited my passion for investing and put me on the path to getting ready to buy stocks with real money as opposed to just experimenting in investment contests and paper trading.

At 86, my father’s passion for investing is still evident today. He currently invests primarily in dividend stocks, but still feeds his speculative passion through investing in biotech stocks.

I plan to continue investing when I reach his age and doing the necessary research to find obscure, but potentially lucrative stock ideas.

Featured Video Clip #2 – Crypto Ponzi Scheme

Tobias and I discussed our experiences with cryptocurrency and touched upon the Bitconnect Ponzi scheme. I shared my views that investor interest in cryptocurrencies reminded me of the dotcom boom and bust era.

Many invest in crypto without understanding what they are buying. It’s been evident that there is a much greater opportunity for ponzi style frauds in the crypto space, compared to the stock market.

Bitconnect happened to be one of the most prevalent and notorious frauds that arose back in February 2016. It was a Ponzi scheme in which participants would buy Bitconnect coins with the promise to earn an unsustainably high amount of daily interest for owning them, and getting even more rewards by way of referrals.

However, investors would have to lock up their money for three months before being able to withdraw any interest or principal, all the while being encouraged to bring in more people to join the scheme. The setup was clearly a pyramid scam, but those who joined early could have earned a lot of money. As usual with all pyramid schemes, the last to enter become the greater fools.

Ultimately, Bitconnect and other similar pyramid scams eventually blew up,

Tobias recounted an experience where he witnessed someone buying BTC with a credit card on a crypto ATM at the mall, and it was right near the first peak when it was worth $20,000. He said that as the individual was purchasing it, the price kept rapidly changing to the point that he didn’t even know the price that he was paying for it.

—

Featured Video Clip #3 – China Fraud

I spoke with Tobias on how the China fraud epidemic made me reevaluate my investment strategy when it came to risk assessment. Here are the details of how it transpired:

- I began my investment career primarily focusing on U.S. microcap companies. However, around 2005, I started taking notice of a few emerging China-based companies listed in the U.S. (China Hybrids).

- These companies caught my attention due to their seemingly undervalued status, with super low price-to-earnings ratios.

- Things took a turn in 2010 when some of the companies we had analyzed were suspected of fraudulent activities by other research firms.

- To address these accusations, I enlisted the help of a lawyer who specialized in China equities law to analyze financial documents and determine the validity of the fraud claims.

- Started building an on-the-ground team in China as well as actually sending a Geoinvesting subscriber to China with 50 stocks to investigate that he was bullish on. Two weeks later, in July 2010, he said to get the hell out of the U.S. China Stocks, Suspecting that many of them were frauds.

- We suspended bullish coverage on the entire universe.

- As I attended conferences and interacted with the CEOs and CFOs of these companies, I sensed that something wasn’t right. Many would only communicate through translators, and their responses seemed indifferent, making me more suspicious.

- With the assistance of a PRC attorney, we meticulously examined their financial statements, called SAIC filings (State Administration for Industry and Commerce) that are documented in China on the provincial level and written in Mandarin. We discovered instances where the financial numbers reported in the Chinese filings differed significantly from those in the corresponding U.S. SEC filings. It was a startling revelation.

- We gained a better understanding of the legal framework in China and conducted extensive accounting and financial analysis on several companies. Eventually, we shared our troublesome findings on numerous U.S. listed China based companies through the publication of multiple reports over the years.

- Our participation in the activist movement ultimately led to the delisting of 12 fraudulent China-based companies. You can read more about these efforts in an article I published in 2016.

Our efforts were recognized in the documentary “The China Hustle” where we were featured as the main protagonists.

—

Featured Video Clip #4 – Finding Tier 1 Quality Microcap Companies

Microcap investing can be a tough arena to navigate, but there are great opportunities to be found in “Tier 1 Quality Companies“. Some of these qualities that I outlined include a 10-criteria set of requirements such as having revenue and being at or near profitability, having a favorable capital structure, and a long history of being public. I also noted that I look for companies that don’t continually tap the markets to raise dilutive capital, resulting in bloated share accounts.

However, we should be wary that the microcap realm can be more of a playground for some companies, where the focus is more on cashing in through playing the “pump-and-dump game” rather than striving to succeed through success and creating profitable operations.

Investors need to look for warning signs, such as a history of reverse splits, or frequent dilution through the issuance of shares, without showing any signs of growth or profitability.

Tobias and I discussed the issue of “fluff” in the market, where companies with little to no revenue can see their stock prices skyrocket with the right press release or announcement.

—

Featured Video Clip #5 – Momentum Investing

Investing in momentum stocks has been a popular strategy for many investors over the years. Investors Business Daily (IBD) made the strategy popular through the CANSLIM method. Paul Androlia of Small Cap Discoveries also tracks momentum to fill his research funnel.

Momentum investing involves identifying companies that are experiencing significant upward price momentum.. These stocks can be tracked by observing t52-week high lists or relative strength indicators (RSI).

But be mindful, you still need to perform research to find out why a stock is hitting a high. Is it just speculation or do fundamentally sound reasons exist to justify the move higher. We actually talked about this strategy in a Weekly GeoWire issue that discusses the importance of research and analysis in the investing process.

My shift to Include a longer term investing focus to my strategy

It’s been no secret that the last bull market was not dominated by traditional value investing tenets, especially when it came to microcaps. This made it challenging to successfully apply some of the short term momentum strategies across a broad base of value investing stocks, which I was accustomed to doing.

In response, I tweaked my strategy to also focus on the longer term, and finding hidden companies well before their stocks hit new highs. To find these hidden companies, my team and I read every nanocap & microcap press release that comes out, as long as they fit within certain criteria. If we see fit, we examine their press releases, conference call transcripts and SEC filings or OTC filings if the company does not file with the SEC, narrowing the microcap universe down to a manageable bucket of stocks.

Over time, I have learned the importance of patience and taking a longer-term approach to some of my investments. Today, I combine my momentum investing strategy with all sorts of other strategies to find stocks earlier, before they hit the new highs list.

—

Featured Video Clip #6 – Non Dilutive Offerings

Tobias and I touched on taking advantage of non-dilutive stock offerings as a strategy to make money in the short term. Not all offerings filed by companies are dilutive, creating opportunities to buy stocks that fall in reaction to stock offerings.

Some offerings occur to allow large shareholders to sell a bunch of stock at one shot, usually at a big discount to the current price of the stock. Once the seller is gone, pressure can be relieved, allowing the stock to increase, even well beyond where it was before the offering was announced.

I shared an example of a company I invested in, Bluelinx Holdings Inc. (NYSE:BXC), a leading wood-building supply company that got crushed in the recession of 2008-2009.

The company faced significant challenges and bankruptcy, prompting Cerberus Capital to take a 55.37% majority stake in the company to help rescue the company.

In 2016, I became interested in the company, having seen its stock price decline to around $5 per share from $85 in 2007. Despite some negative articles on the company, I saw potential in their plan to de-risk the company by selling assets, reducing debt, and improving operations through restructuring efforts.

—

The stock initially rose to around $10, but later fell due to an offering priced around $7 per share to allow Cerberus Capital to sell its entire position. Subsequent to the offering, management bought shares and announced a transformative acquisition, leading the stock to spike to around over $40 per share over a couple days!. We sold most of our position during the run-up and eventually exited the entire stock at $25 in March 2019.

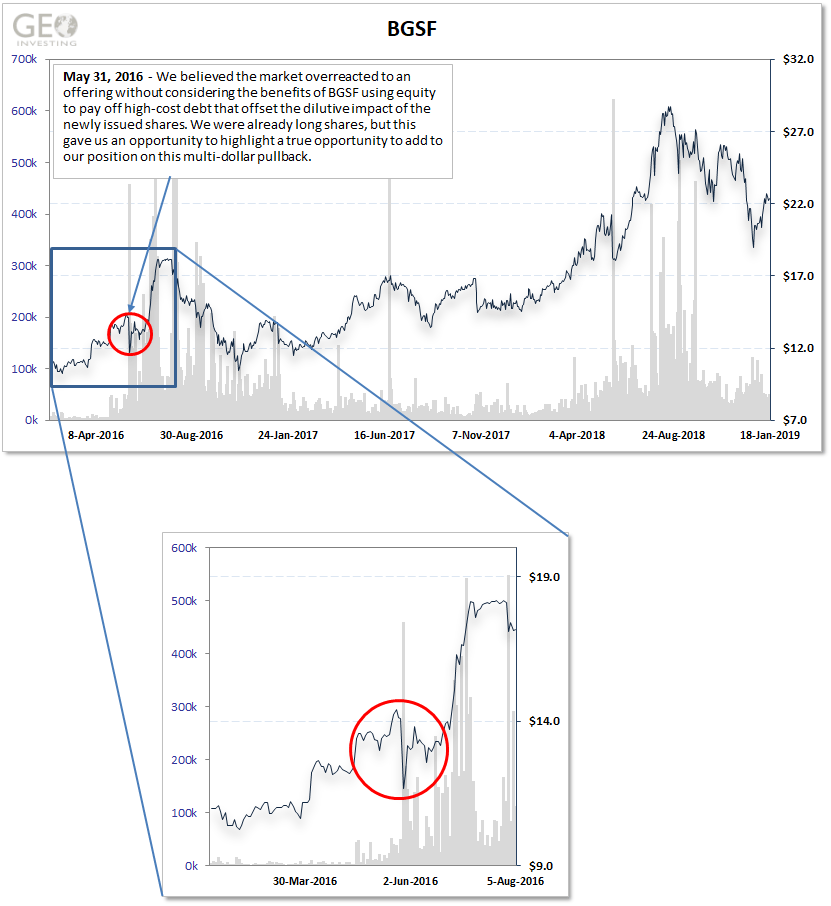

This was a scenario we discussed in an article on staffing company Bgsf, Inc. (NYSE:BGSF) when the stock traded down 17.3% to close at $13.53 on Friday May 27, 2016 after announcing a public offering of 1,075,000, resulting in newly issued shares of common stock priced at $14.00 per share. It was disclosed that the proceeds would be used to pay down debt, which we calculated would not be overly dilutive to the company due to the interest savings the company would glean from the reduction in debt. The stock quickly recovered from the drop and then some in the following weeks after the offering.

—

Featured Video Clip #7 – Stocks Coming Out of Chapter 11

Our conversation shifted towards investing in stocks coming out of Chapter 11 bankruptcy.

Tobias admitted that he has invested in bankruptcies, but lost a lot of money in the process. He explained that in his experience, oftentimes the bankrupt company gets taken over by a private equity firm that holds it for a long period of time. They are just waiting for it to drift down so they can keep buying a little more. These firms can afford the long term holding period, as the company only comprises a small portion of their assets. As Tobias cites, “like a $50 million holding for them in a multibillion-dollar book”.

However, I love investing in companies coming out of Chapter 11 bankruptcy when the restructuring involves the company surviving as a public company, as I had some good experiences with distressed telecom companies after the dot-com bubble. And let’s not forget that the best performing stock of the century, Monster Beverage Corporation (NASDAQ:MNST) was a stock that emerged from bankruptcy.

During the bankruptcy process, the company undergoes restructuring to eliminate or reduce its debts/liabilities and improve its financial position. When a company comes out of Chapter 11 bankruptcy as a public company (usually by canceling the old stock and issuing new stock), it is often a significantly different entity from what it was before. It may have shed some of its assets, eliminated some of its liabilities, and restructured its operations. As a result, its stock may be undervalued, presenting an opportunity for investors to buy it at a huge discount to fair value of what the company can earn in the future.

—

Featured Video Clip #8 – Penny Stocks

Before we concluded our interview, we went back and forth on a topic that excites me – penny stocks. Most people believe that penny stocks are fraudulent companies with poor share structures and limited sales, but you may be surprised to find that there are many great and established penny stocks that offer tremendous multi-bagger opportunities. In fact, since 2007, we identified 22 companies with growing businesses when they were penny stocks in our Run to One Model Portfolio (trading under $1.00) that went on to rise over $1.00, all of which multi-bagged.

I enjoy playing in this field because everyone is ignoring it – seasoned investors, and novice investors alike.

My strategy in this segment of the market is to find penny stocks with great capital structures, good management teams, and business models that make sense, and then hold them for a while, starting with small bets. Maybe they have a little hair on them that can be resolved one day. Take these few examples of penny stocks I originally owned at under $1.00 that yielded multibagger returns as they increased to over $1.00 that are still hanging on to nice gains after the 2022 correction:

Percent Gains of Penny Stocks in our Model Run to One Attaining & Holding Above $1

| Stock Symbol | Date Opened | Open Price | All-time Peak Price After Model Portfolio | All-time Peak Return After Inclusion in Model Portfolio | Current Price | Current Return | Industry |

| KRMD | 06/02/2014 | $0.24 | $12.70 | 5,250% | $3.81 | 1,487% | Healthcare |

| PCHM | 12/02/2016 | $0.40 | $5.80 | 1,350% | $2.84 | 610% | Healthcare / Drug abuse monitoring technology |

| PXHI | 05/28/2019 | $0.30 | $1.65 | 473.3% | $1.65 | 450% | Used Phone Platform |

| ZYXI | 06/17/2017 | $0.36 | 27.02 | 7,406% | $9.65 | 2,312% | Medical Devices |

| ESCC* | 02/27/2014 | $0.14 | $1.98 | 1,314% | $1.19* | 752% | Planetarium products/ services |

| XPEL | 01/18/2013 | $0.29 | $103.84 | 35,706% | $75.77 | 2,6027% | Protective Coatings, Automotive |

| POLXF* | 06/12/2013 | $0.50 | $2.82 | 464% | $1.87* | 274% | Chemicals |

| GV* | 03/28/2012 | $0.94 | $8.65 | 820.2% | $7* | 154% | Construction |

| SPRS | 02/02/2016 | $0.73 | $4.50 | 516.4% | $3.07 | 320% | Electronics |

| PAYS | 07/12/2017 | $0.49 | $18.67 | 3,710% | $3.33 | 732% | Payment Solutions |

* ESCC acquired by Elevate Entertainment Inc. (“Elevate”), an affiliate of Mirasol Capital, LLC at $1.19 per share.

* GV was acquired by First Reserve, a private equity firm, at $7 per share.

* POLXF executed a business combination with BioSpectra Inc. in April 2023 wherein BioSpectra will acquire all of the outstanding common and preferred shares of the company for the price of $2 per common share

—-

Closing

I hope my discussion with Tobias Carlisle provides you with valuable insights and knowledge that you can apply to your own investing journey. Remember to always do your research and investigate microcap stocks thoroughly before investing.

~Maj Soueidan, Co-founder GeoInvesting

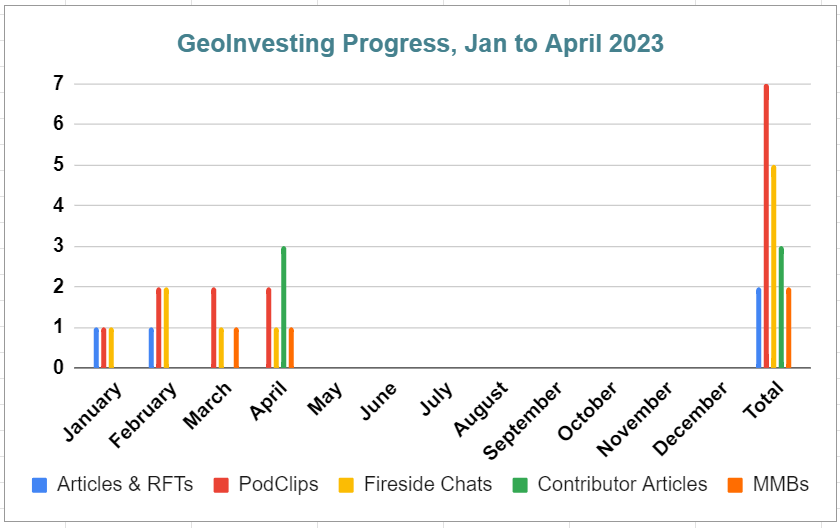

PROGRESS, YEAR TO DATE

GeoResearch Articles & RFTsPodClipsFireSide ChatsContributor Articles & PitchesManagement Morning Briefings

PREMIUM NEWSLETTER CONTENT YOU MAY HAVE MISSED THIS MONTH

Are You Failing To Do Proper Research? Here’s An Antidote [GeoWire Weekly No 82].

Investing mistakes are common. They are made every day by thousands of investors looking to make a quick buck on YouTube hearsay, a Twitter tip, a Reddit forum discussion or “TikTok guru” just out of college. This leads to poor choices, leaving them vulnerable to misinformation, biases, and market volatility. It ultimately jeopardizes their financial goals. Basically, when it comes down to it, there are many corners of the internet that prey on the inexperience of new investors, or the apathy of those who don’t see the value of proper due diligence (DD) to confirm, for themselves, if a certain stock is a legitimate investment, or just one that fits within their investment style. Failure to perform proper DD and document findings is one of the foremost failures that investors face. Unfortunately, it is not the only mistake that is often made. Others include focusing too much on short-term gains, poor portfolio risk management, lack of buy and sell discipline and emotional biases. Over the coming weeks, we’ll address some of these specifically, but today we are going to stick with the research theme since that is the one that in most cases kickstarts the whole process of finding the right stocks.

LMR-focused Company Pitched By Scott Weis of Semco Capital During April 2023 Open Forum [GeoWire Weekly No. 81]

Last week, we held our April 2023 Live Member Open Forum. It was a bit longer, but to be honest, we can’t get away from having 1 longer-running forum every quarter – justifiably so – because earnings season typically raises the intensity with which we operate and increases the volume of stories we have to process. The forum this time around was also made a bit richer because of a guest pitch by a regular research and stock idea contributor/GeoInvesting member, so we didn’t mind the added tape. We invite Geoinvesting subscribers to publish their stock pitches to help you build your research pipeline. At times, we add some of the stocks to our model portfolios. Our research contributors have produced cumulative peak returns of 36,050% over 78 pitches (22 with over 300% returns) since 2015, when we began accepting applications to submit ideas. If you are interested in submitting an idea to be published on Geoinvesting or want to help us to get through our own idea flow generation process, please contact us.

No Lack of Opportunity For This Asset Liquidation and Charge-off Loan Platform Business [GeoWire Weekly No. 80]

The past couple of weeks were active with live Fireside Chat and Management Morning Briefing style interviews with companies that we are watching closely, have written some detailed content on (think RFTs), and/or fill spots on our Model Portfolios. We will continue to strongly suggest that you attend these meetings or at least view the replays, as they offer so much more information than you would glean from earnings conference calls and related press releases and SEC filings. They are an extremely valuable and integral part of our due diligence. WIthout them, it’d be much more difficult and time consuming to profile the companies given the sometimes limited information available on public platforms. It’s a no brainer. The one we held on April 11, 2023 with a company involved in the asset liquidation and charge-off loan platform businesses, Heritage Global Inc. (OTC:HGBL), was particularly timely given the combination of our focus on bankruptcy special situations of late and the case of distressed company $NMCI that caught peoples’ attention when it rallied over 200% when it filed for bankruptcy protection that same day. When NCMI disclosed this news, it put a spotlight on how some companies can potentially emerge from bankruptcy, sometimes cleaner & stronger than ever. Clear success is not a done deal for the company, as there are still many unknowns on how clean it will come out on the other side.

Looking at Power Generation and EV Charging Through The Eyes of Pioneer Power Management [GeoWire Weekly No. 79]

When a microcap company CEO jokes that he and his executive colleagues, across the course of their careers at various ventures, have collectively sold $1 billion worth of products and services, it’s normal to want to hear the rest of what he/she has to say about the things they have up their sleeves. Such was the case with Nathan Mazurek, the CEO, President and Chairman of the Board at Pioneer Power Solutions, Inc. (NASDAQ:PPSI), when he joined us for a Fireside Chat on April 4, 2023. PPSI engages in the design, manufacture, integration, refurbishment, service and distribution of electric power systems, distributed energy resources, power generation equipment and mobile EV charging solutions for applications in the utility, industrial and commercial markets. Before we get into a few of the details of our conversation with the CEO of PPSI, we want to make it clear that even though we had a prior instance of success investing in the stock, it’s been several years since we have followed the company in great depth and are just getting acclimated with the company’s new business model. Our current opinion is that PPSI is definitely worth keeping a close eye on due to a huge acceleration in revenue growth (and revenue growth guidance for 2023 of 50%), but we need to be convinced that the company has reached a point where it can operate profitably on a consistent basis.

See All Past GeoWire Issues Here