<<< back to Legendary Investors

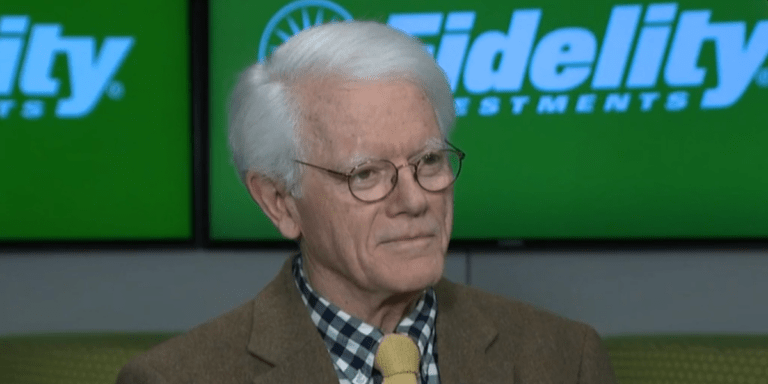

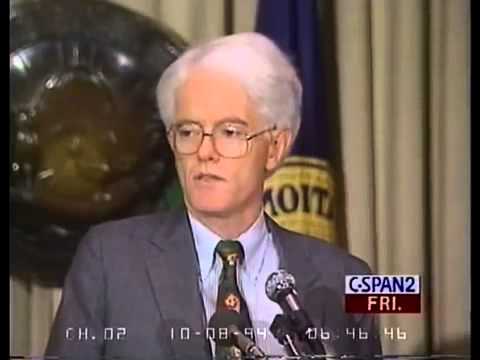

Peter Lynch (born January 19, 1944) is an American investor, mutual fund manager, and philanthropist. As the manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return, consistently more than doubling the S&P 500 stock market index and making it the best-performing mutual fund in the world. During his 13 year tenure, assets under management increased from $18 million to $14 billion..(Source: Wikipedia)

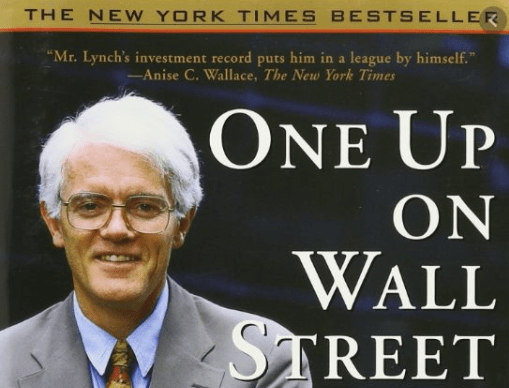

Books By Peter Lynch

The Ugly Advantage is about the future of attention in an age of distraction. Peter Lynch shares his experience as a Fortune 500 executive, award-winning entrepreneur, and TED Speaker. His 20 years of leading talent transformation brings to life a wealth of powerful lessons that will save you time and money as you build and grow your business.

In Learn to Earn, Peter Lynch Lynch and co-author John Rothchild explain in a style accessible to anyone who is high-school age or older how to read a stock table in the daily newspaper, how to understand a company annual report, and why everyone should pay attention to the stock market. They explain not only how to invest, but also how to think like an investor.

In easy-to-follow terminology, Peter Lynch covers how to find companies to invest in, how to value companies, and when to get out of companies invested in - the main theme running through the book is that an amateur investor can and will out perform professionals if they avoid the noise from wall street and focus on companies they understand.

Legendary money manager Peter Lynch explains his own strategies for investing and offers advice for how to pick stocks and mutual funds to assemble a successful investment portfolio.Develop a Winning Investment Strategy—with Expert Advice from “The Nation’s #1 Money Manager.”