Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

In light of the riskier market environment we are in, I have been writing to you about our new Recession Proof and Recession Resistant Model Portfolios. A great related next step is to dive deeper into the tunnel and focus on the topic of Chapter 11 Bankruptcy and how to profit by focusing on two buckets:

- Companies that survive a bankruptcy process.

- Companies whose businesses will actually benefit as bankruptcies increase…

By the way, I am not sure if you know this, but Monster Beverage Corporation (NASDAQ:MNST) once filed for bankruptcy before it ended up becoming the best performing stock of the century.

Over my thirty plus years of investment experience, buying stocks that have emerged from bankruptcy has been a highly rewarding strategy. In fact, the first investment I made in a stock was a company (Storage Technology) that exited Chapter 11, where I ended up making a quick 60%. I also bought some telecom Chapter 11 exits that entered bankruptcy after the Dot Com crash. They ended up as huge multibaggers or being acquired for a nice premium.

Chapter 11 is a type of bankruptcy filing that allows a struggling business to continue operating while it reorganizes its debts and assets. This is different from a Chapter 7 bankruptcy, which involves the liquidation of a company’s assets to pay off creditors.

During the Chapter 11 process, the company communicates with the courts and creditors to develop a viable operating plan that will ensure the survival of the company, while satisfying its obligations. A ‘Q’ is placed at the end of the stock’s symbol during this exercise.

Typically, all of the existing common stock is canceled and new stock is issued to creditors in lieu of the money owed to them, and potentially to investors via private placements upon exiting Chapter 11, often resulting in a tight float.

The chance for investment success in these situations can depend on the post bankruptcy liquidity of the company, as well as a revised business plan and the terms of the restructuring arrangement as it relates to money the company still owes to debt holders, vendors, and suppliers. Many times, the restructured firm is eventually acquired.

This week, we highlight a video by investor June Collier (@JuneCollier) that gives some perspectives on what happens to shareholders when a company files for bankruptcy. He explains a typical scenario of what happens to a company’s stock as it files for bankruptcy, and if there is any hope for shareholders.

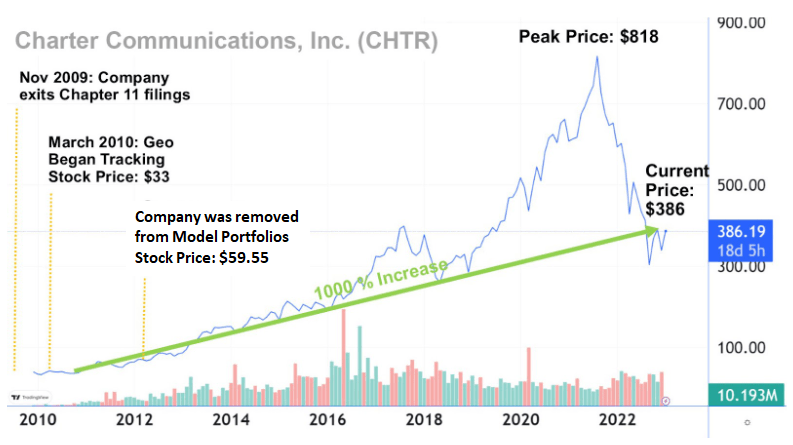

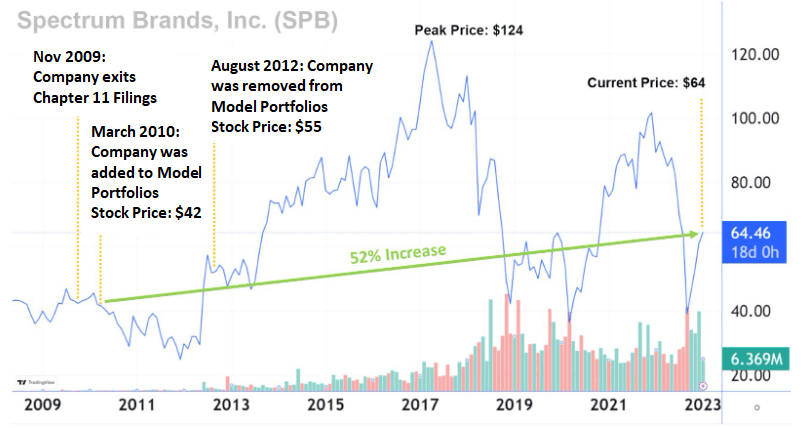

I’ll leave you with two case study charts highlighting two well-known companies that were once on GeoInvesting’s Model Portfolios after they exited Chapter 11 – Charter Communications, Inc. (NASDAQ:CHTR) and Spectrum Brands Holdings, Inc. (NYSE:SPB):

It’s important to point out that, at their peaks, better performances were left on the table with these portfolio holdings after they were removed from our model portfolios. It’s a bit eye-opening to view the above charts and see what rewards just a few more years would have reaped.

So yeah, investing is hard (also illustrated by the Canterbury Park Holding Corpora (NASDAQ:CPHC) (chart below), and it’s not always a win. As a matter of fact, as you can see, had SPB been a longer term hold, there’s a chance we could have exited the position for a loss as late as 2022 – a far cry from the 195% peak return a theoretical 2017 exit would have given you!

Canterbury Park Holding Corpora (NASDAQ:CPHC) (Casino) Chart illustrates why investing is hard. The stock had 4 peak to large drawdown moves this year, even though shares are trading near 52-week highs, up 75% for the year. Now, imagine trying to hold a stock for a 5 or 10 bagger multi-year move. Easier said than done. pic.twitter.com/GYc7IGiLr3

— Maj Soueidan (@majgeoinvesting) December 19, 2022

Hi, part of this post is for paying subscribers

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

GeoInvesting Weekly Premium Email and Call To Action Updates (Jan 9 – Jan 13)

Weekly Wrap Up Summary…

Email Highlights

- Tsr, Inc. (NASDAQ:TSRI) – Strong Q2 2023 results

- Heritage Global Inc. (NASDAQ:HGBL) – reaches new milestone as strong demand for their business continues

- Creditriskmonitor.com Inc (OOTC:CRMZ) – Added to Recession Resistant Model Portfolio; Brief Reasons For Tracking (RFT) note explaining why

- Lftd Partners Inc (OOTC:LIFD) – New partnership expands vape and gummy businesses

Notable Updates

- Altigen Communications Inc (OOTC:ATGN) – Updates CoreInteract for Microsoft Teams

Premium Emails Sent During the Week

Premium Emails Sent During the Week

01/10/2023

Summary TSRI reports strong Q2 2023 results Reminer – HHS Fireside Chat Invite Reminder – January 2023 Live Member Forum Invite – Tsr, Inc. (NASDAQ:TSRI) ($7.17; $15.3M Market Cap) a provider of information technology consulting and recruiting services, announced Q2 2023 results: Sales of $26.0 million vs $23.8..see more.

–

01/11/2023

HGBL Continues To See Strong Demand For Its Liquidation Services

Stocks : HGBL

Heritage Global Inc. (NASDAQ:HGBL) ($2.56; $94.5M market cap), a company that, through its subsidiaries, engages in the asset liquidation business announced has reached a milestone of $100 million in funded financial portfolio acquisitions. “Reaching the $100 million mark is an exciting milestone for us and demonstrates our ability to leverage the opportunities we’re seeing as the current economic environment continues to drive significant increases in charge-off volume….see more.

–

01/12/2023

Why CRMZ Was Just Added to Recession Resistant Model Portfolio

Stocks : CRMZ

Summary CRMZ – Added to Recession Resistant Model Portfolio; Brief Reasons For Tracking (RFT) note explaining why – We are adding CreditRiskMonitor.com, Inc. (CRMZ) ($2.85; $30.5M market cap) to our Recession Resistant Model Portfolio. The company provides interactive business-to-business software-as-a-service subscription products for corporate credit and procurement professionals worldwide. We have yet to determine if the stock…see more.

–

LIFD Partnership To Expand Vape and Gummy Offerings

Stocks : LIFD

Lftd Partners Inc (OTC:LIFD) ($2.80; $39.4M Market Cap), a company that manufactures and sells psychedelic products under its Silly Shruum brand, and hemp-derived cannabidiol products under its Urb Finest Flowers brand, entered into a five year agreement to serve as the exclusive worldwide manufacturer and distributor of disposable vape products and gummy products for Cali Sweets, LLC, North Hollywood, California, under the brand names Koko Puffz and Koko Gummiez. Details of the agreement, among other things,…see more.

–

More Notable Updates

More Notable Updates

Stocks Partially discussed or not highlighted during the week

Altigen Communications (OOTC:ATGN), a SaaS/Cloud communications management/call center solutions provider announced major updates to CoreInteract for Microsoft Teams.

“This release marks the next phase in the evolution of the CoreInteract suite to enable organizations to leverage Microsoft Teams as their enterprise customer engagement platform. Early feedback from our customers and partners has been positive, and we are looking forward to marketing CoreInteract more broadly to the market in the months to come.

Looking to the future, we have an extensive and growing product roadmap which will drive continued innovation and bring exciting new digital customer engagement capabilities to CoreInteract. Our roadmap includes the introduction of new, natively-integrated SMS, Email and Web Chat functionality within Microsoft Teams. Based on customer demand, we also plan to add more extensive contact center capabilities for both agents and supervisors. All of these enhancements are designed to enable organizations to further automate their customer-facing workgroups and departmental contact centers with the modern, cost-effective CoreInteract platform.”

—

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.