Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

When a microcap company CEO jokes that he and his executive colleagues, across the course of their careers at various ventures, have collectively sold $1 billion worth of products and services, it’s normal to want to hear the rest of what he/she has to say about the things they have up their sleeves.

Such was the case with Nathan Mazurek, the CEO, President and Chairman of the Board at Pioneer Power Solutions, Inc. (NASDAQ:PPSI), when he joined us for a Fireside Chat on April 4, 2023. PPSI engages in the design, manufacture, integration, refurbishment, service and distribution of electric power systems, distributed energy resources, power generation equipment and mobile EV charging solutions for applications in the utility, industrial and commercial markets.

Before we get into a few of the details of our conversation with the CEO of PPSI, we want to make it clear that even though we had a prior instance of success investing in the stock, it’s been several years since we have followed the company in great depth and are just getting acclimated with the company’s new business model. Our current opinion is that PPSI is definitely worth keeping a close eye on due to a huge acceleration in revenue growth (and revenue growth guidance for 2023 of 50%), but we need to be convinced that the company has reached a point where it can operate profitably on a consistent basis.

For example, the company reported EPS of 10 cents in its 2022 fourth quarter report release on March 30, 2023, but analyst EPS estimates for all of 2023 call for 4 cents (but goes to 45 cents in 2024).

So, from an investment point of view, is PPSI a 2023 event or 2024 event? Part of where EPS will land in 2023 will depend on how aggressively the company can grow its higher margin revenue streams (Mobile EV charging recurring revenue maintenance stream).

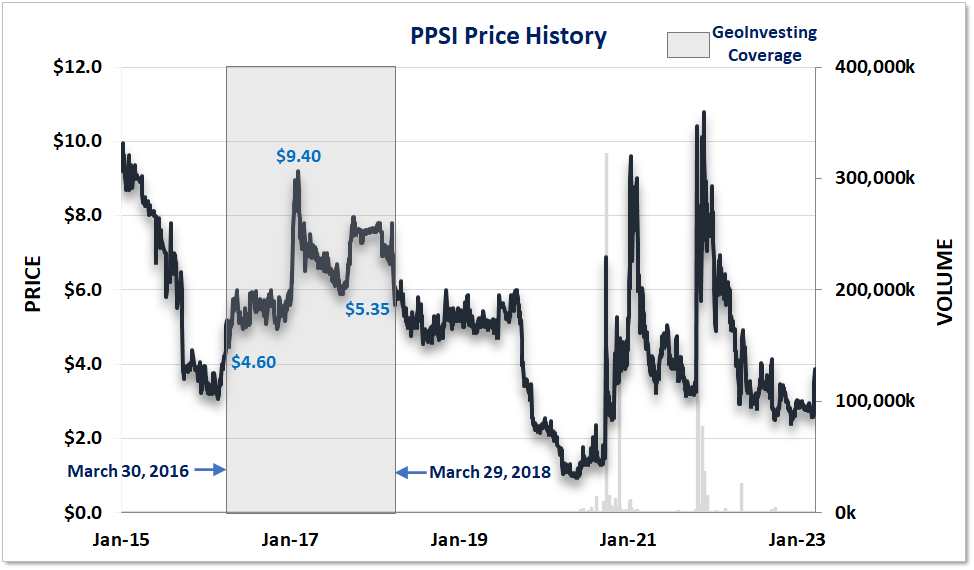

Ironically, when we began coverage in 2016, the stock was trading in a range similar to where it is trading today after a volatile 7 years.

A Stormy Trend

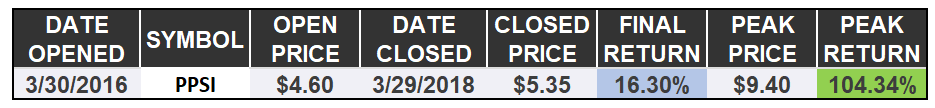

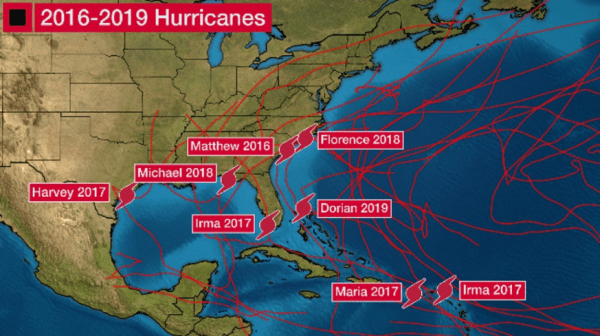

The 2016 hurricane season was unusually active and the first above-average hurricane season since 2012, producing 15 named storms, 7 hurricanes 4 of which were considered major.

Some investors might have been a little peeved at us as we used this scenario as a launching pad to run a few screens for companies that offered backup power equipment and other infrastructure resources. However, vast damage to the electrical grid introduced the possibility of the deployment of materials and equipment that would aid in recovery efforts.

While we had already added PPSI into our Model Portfolio prior to the hurricanes, it just happened to be one stock that stood to experience increased order flow from those states that faced months of recovery.

The year 2016 bled into disastrous 2017, 2018 and 2019 hurricane seasons for the Gulf of Mexico, reaping havoc across much of the south and extending into the interior of the United states, resulting in a staggering $346 billion in damage, with Texas, Louisiana, Alabama, Florida and the Carolinas catching the brunt of it. Recognize a few historic storm names?

Our First Round Coverage (March 2016)

Having said all this, Pioneer Power Solutions is not truly a story about hurricanes or trendy topics. It was really a lot more boring than that. The onset of those storms was just serendipitous being that we had already begun our coverage. And although the stock price might have gotten a little shove from nature, we originally highlighted PPSI as a stock to track due to a recent acquisition strategy, restructuring plans, strong 2016 guidance and increasing infrastructure spend in the U.S.

It wasn’t the only stock that was in our crosshairs in light of the government focus on a failing U.S. infrastructure. If you were following us at the time, you might remember our bullish stance on precast concrete products company Smith-midland Corporation (NASDAQ:SMID), on which we actually did a little on-site reconnaissance in 2016, and subsequently decided to publish a chronological carbon copy of what you would have had privy to at our pro portal as the stock quietly crept up in price from $2.95, our coverage-initiation price in October 2015, to ~$5.00 near the end of November 2017 (after we removed it from our Model Portfolio), and ultimately reaching a post-removal price of $47.99 in late 2021, or a peak return of 1,526%. Ouch.

Speaking of ouch, then there was infrastructure play Nv5 Global, Inc. (NASDAQ:NVEE), another company that found its way into our screen at around the same time frame as SMID. It provides professional and technical engineering, as well as consulting solutions, to public and private sector clients in the infrastructure, energy, construction, real estate and environmental markets. When the stock was trading at $14 in December 2015, we took a bet on a seasoned management team that we thought could take the company to the next level by leveraging the industry’s dynamics at the time. There was a heavy demand for their services and it was the company’s intent to rapidly grow revenues by almost 3x, which spelled an aggressive acquisition strategy. Our target for the company’s price was $21, which it easily met. We exited near our near term fair value at $22.38 (+59.85%), and then the stock was off to the races, reaching $154 per share in November 2022, or a 1,000% increase, without us.

In PPSI’s case, we saw a pure play on the combo of some timely trends and the potential for the company to reach an elevated level of profitability. It was also a company that liked to offer revenue guidance on a regular basis, which made it a little easier for us to measure management’s performance .

Ultimately however, even though PPSI did experience higher profits in 2016 and 2017, along with a 104% peak stock price increase during its tenure in our Model Portfolio, that revenue growth was inconsistent, leading the story to fall out of favor with investors. The main driver of revenues, the company’s transformer business (around $70 million in revenue), was facing increased competition, reduced margins and had no clear cut competitive advantage. So, in early 2018, the company decided to sell off the transformer segment for $65.5 million.

This divestiture left them with their traditional switchgear business and the engine generator service business, each doing around $10 million per year. It also left investors to wonder what would happen next. And nothing did happen except an exercise in treading water for the next several years with the 2 businesses that were losing money, as management considered what PPSI’s next chapter would look like…sign in to read more...

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.