By Maj Soueidan, GeoInvesting Co-founder

By Maj Soueidan, GeoInvesting Co-founder

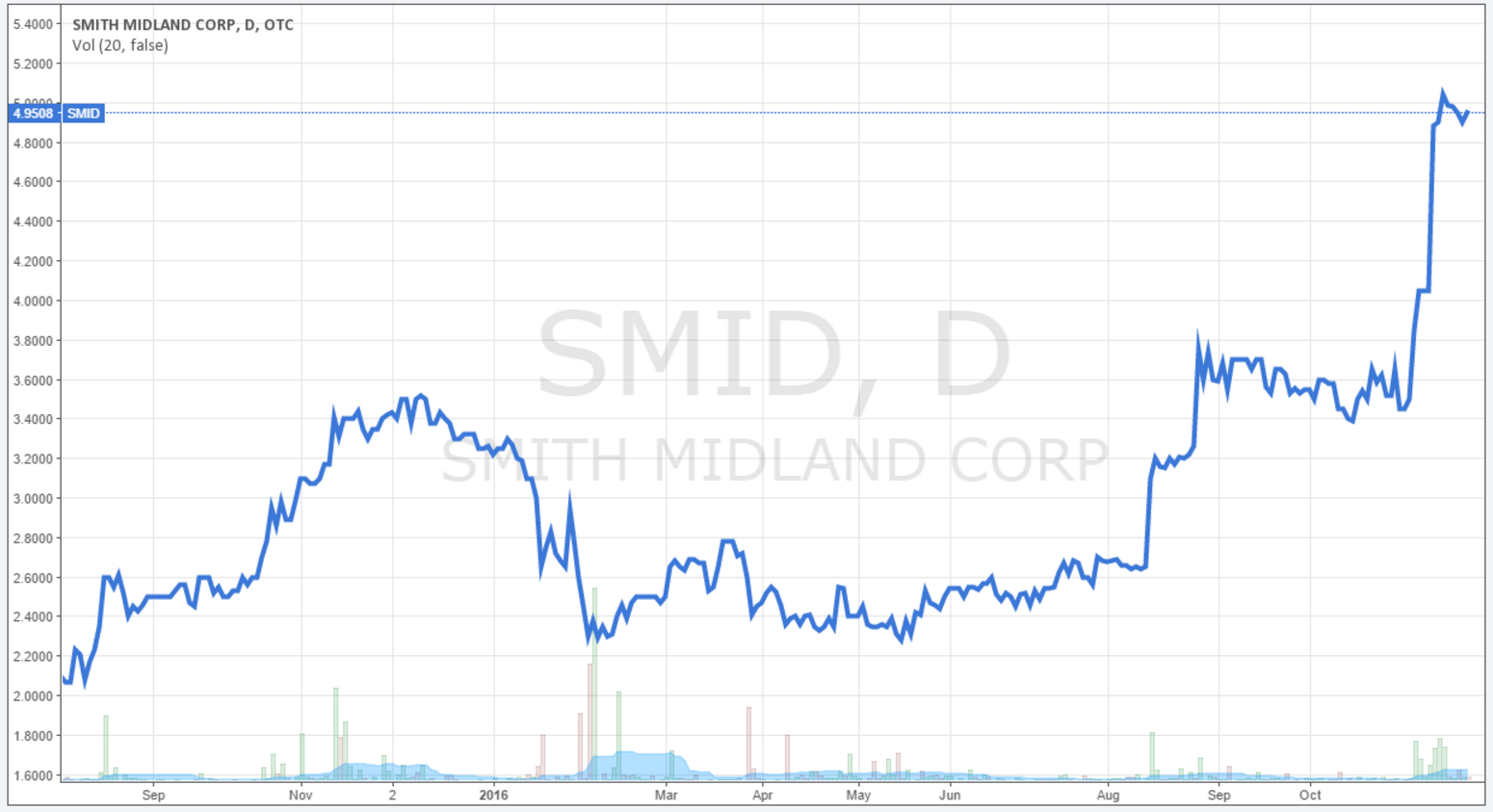

At times, it can be frustrating to be a microcap investor. Over the past several years, the level of anticipation for a revival in the microcap space has been nothing short of palpable. Much of this frustration lies in the difficult decisions to tie up capital in investments that you believe have huge potential, but come with the baggage of patience. In this light, our history with precast concrete company Smith-Midland Corp (OOTC:SMID) is no exception.

Plainly, we messed up. In August of 2015 we began tracking SMID when the stock was trading near $2.50, stating that there were signs that the company could embark on a new period of growth. After taking a position at a price of $2.95, we subsequently valued the stock at $7.00 to $7.50 as part of a fuller commentary that culminated in our belief that SMID could benefit from continued momentum and, more importantly, an increase in infrastructure spending.

House Passes Highway Bill, I Visit Smith-Midland

Sure enough, the House passed the Highway Bill on November 4, 2015 when SMID traded at $3.40. However, over the next several months, SMID’s price began to trail off along with the market collapse in January 2016, eventually hitting a low of $1.77 on February 5, 2016. I wanted a little a confirmation that adding SMID to our portfolio was the right decision, so I even conducted an on-site visit at the company’s headquarters in Virginia on February 25, 2016. The visit left me feeling good about the company’s long-term growth prospects.

Unfortunately, the company hit a speed bump for a couple of quarters. SMID failed to deliver on its bottom line even though its top line grew by an amount commensurate with what we would expect out of a budding microcap. So were faced with a dilemma. Do we hang on to a stock where management has overdelivered in the past or have faith that the Government’s new commitment to spending money to fix roads and bridges would soon benefit SMID’s business?

That was about the time when we failed to practice what we often preach. Even though we still believed that the passage of the Highway Bill could lead to meaningful price appreciation for SMID, on May 19, 2016 we sold our position at near the same price at which we began tracking the company, and below our investment entry point. The premise for making this decision was our lack of confidence that the company could continue to deliver consistent quarter over quarter profitability based on recent reports. However, we mentioned that investors willing to look at SMID as a longer-term investment would probably be rewarded.

Hindsight

Especially when it comes to investing, “hindsight” is never really a word that you’d like to enter your dialogue with your peers, let alone with an audience of premium members that look to you for convictive idea flow. You have only to look at SMID’s chart to know that this word is haunting us in spades.

The stock is up 100% from our sell point, and what is now being coined as the “Trump Rally” has ignited stocks that fit into a bucket of infrastructure, cyber security, defense and natural resources, to name a few.

The infrastructure angle has surely given SMID a boost. Below is the full chronology of our research, including the February site visit, that we conveyed to our premium members, from its inception. Congratulations to those patient investors that used our research and rewarded themselves with the longer-term success arising out of SMID’s performance.

Chronology of Smith-Midland Research

Monday, August 17, 2015

Taking closer look at SMITH-MIDLAND CORP COM USD0.01 (OOTC:SMID)

We have been tracking SMID ($2.35) for the last several years. Financial results from time to time have given us false hope that the company had recovered from the great recession of 2008. However, it appears that commentary from the Q2 2015 release indicates that the company may now be able to embark on a new period of growth. We may establish a trading position as we delve deeper into the story and draw up valuation scenarios. Quotes from the Q2 release:

“The company’s most important news today is for the month of July, 2015 (the first month of the third quarter), the company’s net income was almost comparable to the total earnings of the second quarter. Management believes that the third quarter of 2015 will show a significant increase over that of the second quarter of the year.

The Company continues to receive orders on a weekly basis, most of which will be put into production during 2015 with the remaining orders to be produced in 2016. At this point, we have enough orders to be profitable until the end of June 2016.

We have begun to make great strides in our journey to become a fully lean company which is making us a much more efficient and effective company for our customers, our associates and our shareholders. As always, the goal of management, our associates and our board of directors is to increase the value of the Company each and every day.”

Monday, October 26, 2015

Taking A Pre-Earnings Position In SMID ($2.95)

Several factors have led us to take a pre earnings position in SMID. SMID invents, develops, manufactures, markets, leases, licenses, sells, and installs an array of precast concrete products for use primarily in the construction, highway, utilities, and farming industries in the United States. In our August 17, 2015 email we stated we have been tracking SMID for several years but that commentary from its Q2 2015 release indicated that company may now be able to embark on a new period of growth. More details to come.

Monday, November 2, 2015

Several factors have led us to take a pre earnings position in SMID. SMID invents, develops, manufactures, markets, leases, licenses, sells, and installs an array of precast concrete products for use primarily in the construction, highway, utilities, and farming industries in the United States. In our August 17, 2015 email we stated we have been tracking SMID for several years but that commentary from its Q2 2015 release indicated that company may now be able to embark on a new period of growth. Our reasons for optimism include:

- Comments from the Q2 2015 release indicate Q3 has been shaping up strongly.

- Comments in the Q2 Form 10-Q , that disclosed the company expects the profit generated in Q3 to exceed the loss recorded for the six months ended June 30, 2015, and put the company in a positive position for the nine months ended September 30. Further, Q4 is expected to produce another positive quarter of earnings as a result of the company’s current backlog, making 2015 a significant turnaround over 2014. Management believes that the positive quarterly earnings momentum of 2015 will continue into 2016.

- Comments from the Q2 2015 press release follow:

“The company’s most important news today is for the month of July, 2015 (the first month of the third quarter), the company’s net income was almost comparable to the total earnings of the second quarter. Management believes that the third quarter of 2015 will show a significant increase over that of the second quarter of the year.

The Company continues to receive orders on a weekly basis, most of which will be put into production during 2015 with the remaining orders to be produced in 2016. At this point, we have enough orders to be profitable until the end of June 2016.

We have begun to make great strides in our journey to become a fully lean company which is making us a much more efficient and effective company for our customers, our associates and our shareholders. As always, the goal of management, our associates and our board of directors is to increase the value of the Company each and every day.”

- The 3 industries SMID serves should benefit as the economy improves. The company sells its products to the construction, utilities and farming industries.

- New product offering gaining steam. The company’s J-J Hooks Saftey Barrier product has been gaining traction as several state Department of Transportation have approved the product for highway use. Comments from several state departments suggest the products ease of use and assembly give it a competitive advantage over competing products.

- The House Transportation and Infrastructure Committee on Thursday approved a bipartisan bill to spend up to $325 billion on transportation projects over the next six years.

- We feel comfortable that the next several quarters will have favorable sales and EPS comparison compared to the prior year periods.

- We feel the company is minimally on track to report a 12 month rolling EPS of $0.30. Apply a P/E multiple of 15 on our forward EPS assumption of $0.30 would equate to a price target of $4.50. Upside potential exist as our assumptions do not take into account any price increases.

Caveat:

- Management has a recent history of gaining traction with its new growth initiatives in the past. (However, greater visibility and an improving economy should mitigate this caveat)

- Economy takes turn for the worse.

- Government budget issues at the Federal, State and Local level.

- Operations can be negatively impacted in the colder months. (unusually cold weather could lead to construction delays)

Tuesday, November 3, 2015

Coded SMID ($3.10) As A GeoBargain

In our August 17, 2015 e-mail, when the stock was trading at $2.35 we stated that commentary from the Q2 2015 release indicated that the company may now be able to embark on a new period of growth. On October 26, 2015 we disclosed that we were taking a pre-earnings bet on SMITH-MIDLAND CORP COM USD0.01 (OOTC:SMID). Yesterday, we coded SMITH-MIDLAND CORP COM USD0.01 (OOTC:SMID) as a GeoBargain and published our reasons for optimism. See our full research note here.

Friday, November 13, 2015

Once again, the GeoTeam has uncovered an information arbitrage opportunity (bullish Form 10-Q commentary not included in the press release) in Smith-Midland Corporation (SMID). SMID invents, develops, manufactures, markets, leases, licenses, sells, and installs an array of precast concrete products for use primarily in the construction, highway, utilities, and farming industries in the United States.

On 10/26/15 we alerted premium members that we were taking a pre-earnings position in SMID, when the stock was trading at $2.95. We had been tracking the company for several years and Q2 2015 commentary piqued our interest when management indicated the company was ready to embark on a new period of growth.

On November 2, 2015, we published our research note detailing our reasons for optimism. We followed up on November 3, 2015, by coding SMID as our newest GeoBargain.

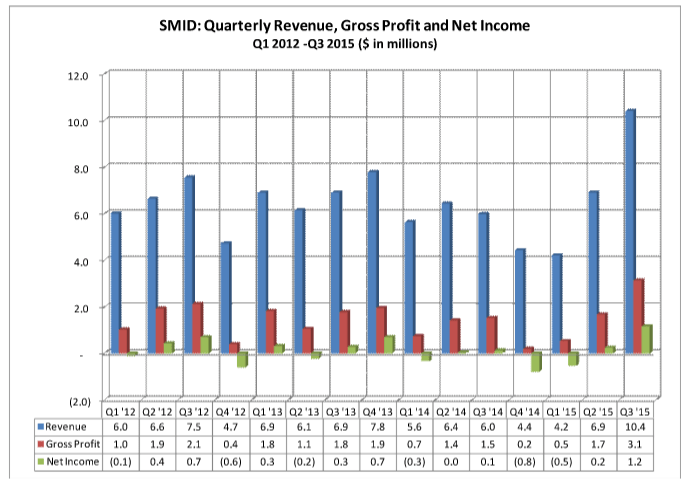

On November 12, 2015, an hour before the close, SMID reported blow-out Q3 2015 results that exceeded even our expectations.

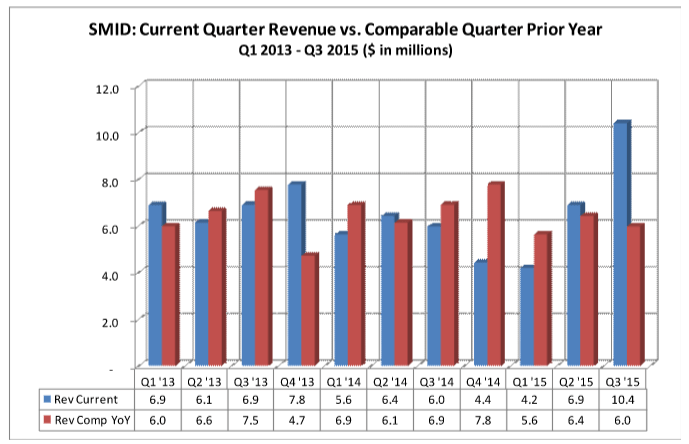

- Total revenue of $10.4 million for three months ended September 30, 2015 was $4.4 million or 74.1% more than revenue generated in Q3 2014.

- Net income of $1,152,056 for Q3 2015, compared to net income of $112,490 for the same period in 2014, a 1,000%+ increase.

- Basic and diluted earnings per share were $0.24 and $0.23, respectively, for Q3 2015 vs. $0.02 basic and diluted earnings per share for Q3 2014.

Management’s commentary in the press release follows:

Rodney Smith, Chairman and CEO, stated, “The management and associates at the Company are extremely proud to be able to present the financial results for the third quarter of 2015, one of the best quarters on record for Smith-Midland. All of the associates of the Company have been instrumental in making this quarter so successful.

“Smith-Midland is five years into our lean journey and under President Ashley Smith’s leadership, we have made significant improvements such as highly improved production planning, many improvements in employee efficiency and significant product quality improvement, and the journey continues.

“One of our top priorities for the remainder of 2015 and also in 2016 is continuous New Product Development through our Smith-Midland Research and Development team. Arguably one of the best research and development teams in the Precast Industry, we are currently developing several new products which include Non Bolted Highway Parapet, Slenderwall III and a Highway Crash Cushion using SoftSound. Innovative product development has always been the key to the future for Smith-Midland from a sales and profitability standpoint and to maintain our competitive edge for the Company and our international family of Easi-Set licensees.”

In addition, the company provided bullish commentary in the Form 10Q MD&A that was not included in the press release . Following are excerpts from the MD&A regarding SMID’s revenue segments. We encourage you to read the entire filing here :

Soundwall sales – $871,711 — “Management expects that soundwall revenue should remain relatively strong during the remainder of the year and into 2016.”

Archetectural Panel sales – $412,176 — “While the construction economy has been trending up for the past 12 months, the volume of architectural projects continues to be less than that of other wall panel projects and also while not as competitive as last year, are still the most competitive bids.”

Slenderwall sales – $1,005,492 — “The two new Slenderwall projects that started in the second quarter of 2015 resulted in increased revenue for the nine months ended September 30, 2015, when compared to the same period in 2014. Slenderwall sales should remain strong throughout 2015 and into the 2016.”

Barrier sales — $617,101- “During the three and nine month periods ended September 30, 2015, we have received several medium size barrier orders which have not shipped as of yet, however, these orders are expected to ship in the fourth quarter of 2015 which should significantly increase barrier sales in the fourth quarter of 2015 over the fourth quarter of 2014.”

Easi-Set® and Easi-Span® Building Sales — $692,169 – “ Management believes that the Company may see a slight increase in building sales during the fourth quarter of 2015 over the fourth quarter of the prior year based on its current building backlog , but customer installation demands will control when final installation will be made.”

Miscellaneous Sales — $320,784 – “Management believes that miscellaneous sales will increase slightly during the fourth quarter of 2015 over the fourth quarter of the prior year.”

Royalty Income — $425,831 – “Management believes that royalties will continue to increase moderately over the remainder of 2015 as a result of the continuing improvement in the construction industry.”

Barrier Rentals — $3,137,761 – “The increase resulted primarily from two large rental contracts awarded the Company for two short-term barrier rental projects in Washington DC and Philadelphia, PA for the month of September 30, 2015. These projects were related to the Papal visit, and this type of special event may not be repeated in the near future or in the year 2016. The Company will endeavor to find this type of project in the future, but projects like this one are particularly few and far between. While the increase in revenue for barrier due to the special project was significant, regular barrier rentals excluding the special projects revenue were up significantly for both the three and nine months ended September 30, 2015 when compared to the same periods in 2014. The increase was due to the continued increase in the construction industry and particularly in highway infrastructure spending.”

Shipping and Installation — $1,223,599 – “With the shipping revenue generated by the current projects shipping and the new ones beginning to ship in November, shipping and installation revenue should increase in the fourth quarter of 2015 from the fourth quarter of the prior year. For the full year 2015, the Company will continue to be behind 2014 revenues based on the installation and shipping activities discussed above.”

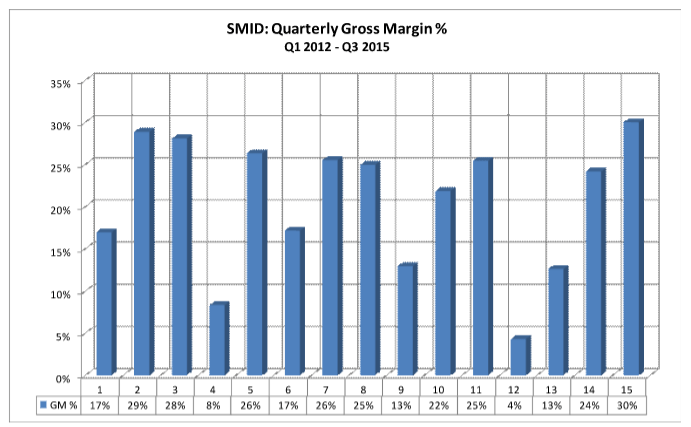

The following quarterly charts give perspective on how far SMID has come since Q1 2012 and an indication of how much momentum the business currently has. Revenues, gross profits and net income are all strongly headed in the right direction. Also, quarterly revenue comps vs. the same period in the prior year are strong. Barring an unusually severe winter we expect SMID’s business momentum to continue well into 2016.

Valuation

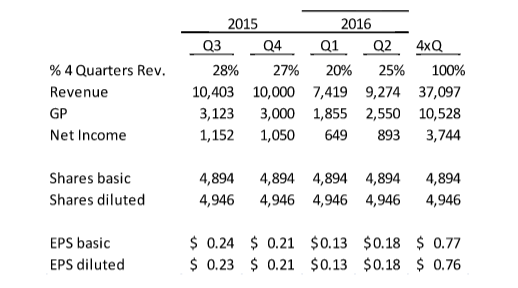

We believe SMID should be valued between $7.00 and $7.50 per share based on two valuation approaches:

- Projected operating results for four quarters with Q3 2015 as the base and estimating the next three quarters using historic quarterly revenue distribution % for the last four years. Q1 is the weakest quarter seasonally due to winter weather.

Applying a 10x multiple to estimated diluted EPS of $.76 implies a $7.60 value.

- Competitor USCR has a Price/Sales ratio of .95. Applying that ratio to our four quarter revenue estimate of $37.1 million yields a $7.13 value.

Next Steps

We hope to interview management in the near future to determine how much of the recent momentum will carry through to future quarters. Given SMID’s recent performance and the seemingly inevitable increase in infrastructure spending on highways and bridges in the U.S., we are confident that Q3 2015 was not a one-off event. We anticipate SMID’s recent momentum will continue in the near term.

Friday, December 4, 2015

SMID Declares Special Dividend; House Passes Transportation Bill

SMITH-MIDLAND CORP COM USD0.01 (OOTC:SMID)’s ($3.40) Board of Directors declared a special dividend of $0.04 per share to be paid on December 30, 2015 to shareholders of record as of December 18, 2015. In other positive news for SMID, The House on Thursday passed a $305 billion measure to fund highways and mass-transit projects for the next five years. The passage of this bill should take a huge bit of uncertainty off companies’ growth prospects that play in the construction space. We will be searching for other companies that could benefit from this development.

On 10/26/15 we alerted members that we were taking a pre-earnings position in SMID, when the stock was trading at $2.95. On November 2, 2015, we published our research note detailing reasons for optimism. We followed up on November 3, 2015, by coding SMID as our newest GeoBargain.

Wednesday, March 16, 2016

Recently, Geo co-founder Maj Soueidan visited SMID ($2.55) for a first-person look at company facilities and to speak with management regarding the company’s workflow and competitive advantages. Maj was given a tour of the grounds and was able to see the various products (slender walls, vaults, etc.) in stock and ready for delivery. In the end, the visit was very informative and confirmed what we had already understood to be a solid business.

Summary

- Site visit to Smith-Midland yields valuable insight into plant operations.

- SMID management informs Geo’s President on plant workflow.

- Key take away – Management is confident that the company’s competitive advantages can help it outperform peers.

See the details of the visit here.

Tuesday, March 29, 2016

SMID ($2.72) reported Q4 2015 results:

- Q4 sales of $7.7 million vs $4.4 million in the prior year period

- Q4 EPS of $0.05 vs a loss of $0.12 in the prior year

Quotes from management:

“It is personally gratifying to me that we were able to deliver on our projected increased profitability and that the Great Recession is largely over for Smith-Midland…

…As always, we continue to look ahead to the future of the Company and what to expect for 2016 and beyond. As most of you are aware, a $305 billion, five year highway bill was passed by Congress and signed by the President giving some added stability to highway work. For Smith-Midland and our nationwide network of Easi-Set Worldwide licensees this allows us the opportunity to quote on an increasing list of highway projects. We currently have seven soundwall projects in production or waiting to start production in the near future. These projects as well as our other projects in progress should keep us profitable for the remainder of 2016.”

| Product | % Of Sales | Projection |

| Soundwall | 10.9% | Increase vs 2015 |

| Architectural Panel | 7.8% | Decrease slightly vs 2015 |

| Slenderwall | 10.2% | Unknown |

| Misc wall | 8.2% | Flat to 2015 |

| Barrier Sales | 9.2% | Unknown |

| Beach Prisms | >1% | Unknown |

| Easi-Set and Easi-Span | 9.8% | Increase vs 2015 |

| Utility and Farm | 9.1% | Slightly above 2015 |

| Misc product | 1.7% | Unknown |

| Royalties | 5.8% | Increase vs 2015 |

| Barrier Rentals | 13.3% | Decrease vs 2015 |

| Shipping and Install | 12.3% | Increase vs 2015 |

In summarizing the table we see that going through 2016, about business that represents

- 50% of the company’s business is expected to improve,

- 20% is expected to decrease

- 21% is unknown

While we expected sequentially down results from the Company’s historically strongest Q3 quarter, we were hoping for slightly stronger Q4 results. As we have talked about in our past coverage of SMID, the company has a history of delivering inconsistent quarterly financial results. This is the one factor that has held back investors from taking shares to higher valuation multiples. It’s a good news that the company believes it will remain profitable for 2016, but investors will likely want more clarity on revenue growth before placing their bets. We plan to contact management.

Monday, May 9, 2016

GeoBargain SMID ($2.35) is probably one of our biggest disappointments. We announced we were taking a closer look at SMID on August 17, 2015 when the stock was trading at $2.35. We stated we were taking a pre-earnings position on October 26, 2015 when the stock was trading at $2.95. The stock got as high as $3.59 on blowout Q3 results. Management commentary in the Q3 press release and quarterly filing indicated the Company had good visibility into Q3 trends, expecting them to continue for a few quarters. Q4 results came in significantly less than Q3 and below our expectations.

Furthermore, in the 10-k filing, management commentary regarding its product outlook was not nearly as bullish as is was for Q3. Frankly, we are having a hard time reading SMID management. We don’t plan to hold an aggressive position into upcoming Q1 2016 results. We are hoping the Company’s book value per share of $2.34 will offer some support if financial results disappoint. There is no doubt that SMID is participating in a favorable industry environment, especially with the passage of the highway bill in late 2015. We would like to have more confidence that management can capitalize on this opportunity. We will give SMID one more shot in the upcoming quarter before we remove from the GeoBargain list.

Thursday, May 12, 2016

SMID ($2.35) – As we stated in our email on May 9, 2016, SMID has been one of our biggest disappointments. We have decided to close out our long position ahead of upcoming Q1 2016 results. We announced we were taking a closer look at SMID on August 17, 2015 when the stock was trading at $2.35. We took a pre-earnings position on October 26, 2015 when the stock was trading at $2.95. The stock got as high as $3.59 on blowout Q3 results.

SMID ($2.39) – Reported Q1 2016 results:

- Sales of $8.0 million vs $4.2 million in the prior year

- Loss per share of $0.02 vs $0.11 in the prior year

Quotes from management:

“The Company powered through the tough winter months with a minor loss. As expected, shipping and installation has picked up through the spring time and we expect the second quarter financial results to improve.

The new State and National highway construction bills that have been passed recently have resulted in a significant amount of sales orders, helping to generate our $20 million backlog for the next 12 months.”

While the topline for the quarter was strong, we are somewhat surprised the Company was not able to generate a profit on that level of revenue, as it did in Q4 on lower sales. We will look to reach out to management once again to discuss the quarterly results.

Wednesday, May 18, 2016

One of the biggest frustrations investors have with SMID is believing that management has turned a corner to put the company on path of consistent profitable growth. Q1 2016 financial results illustrate this point. While the top-line for the quarter was up a strong 92%, we were somewhat surprised the Company was not able to generate a profit on that level of revenue, as it did in Q4 on lower sales.

This quarter, SMID reported EPS loss of $0.02 on sales of $8.0 million, compared to a profit of $0.05 on sales of $7.7 million in the fourth quarter of 2015.

Another area of concern we have is management’s grip on business conditions it normally outlines in its 10-Q and 10-K filings:

- The Q3 2015 management discussion & analysis was decidedly bullish accompanied with what appeared to be some pretty good visibility out to June 2016.

- The Q4 2015 management discussion & analysis introduced some less robust commentary

Now after reading through SMID’s Q1 2016 filing 10-Q it seems management has a decidedly bullish outlook for 2016, at least from a top line perspective. We have less clarity on how margins will play out. One thing is clear to us, investors in SMID will need to exercise patience and deal with volatility in sales and earnings along a path to growth.

Here is the segment by segment breakdown for Q1 2016. As you can see below, management expects nearly every segment to increase slightly to meaningfully in 2016.

Wall Panel Sales – Wall sales are generally large contracts issued by general contractors for production and delivery of a specific wall panel for a specific construction project. Changes in the mix of wall sales depend on what contracts are being bid and what projects are in production during the period. Overall wall panel sales increased significantly during the three months ended March 31, 2016, compared to the same period in 2015. The following describes the changes by product type:

Soundwall sales increased by 725% for the three month period ended March 31, 2016 when compared to the same period in 2015. In addition to soundwall contracts that were obtained prior to a pick up in regional economic activity, with the passage of the federal highway bill, state highway departments are beginning to have more highway funds available for state projects which has increased the need for soundwall projects in Virginia. In addition, because of the availability of more projects, price for soundwall have increased modestly. Management expects that soundwall revenue should remain relatively strong during the remainder of the year.

Architectural panel sales decreased significantly during the three month period ended March 31, 2016, compared to the same period in 2015. The decrease resulted from having substantially completed one large project in 2015 with only minor amounts left to complete in the first quarter of 2016. The Company has two small architectural projects in its current backlog to be completed in 2016. While the construction economy has been trending up for the past 12 months, the volume of architectural projects continues to be less than that of other wall panel projects but not as competitive as 2015.

Slenderwall panel sales decreased by 88% during the three month period ended March 31, 2016 when compared to the same period in 2015. The decrease resulted from the completion of two Slenderwall projects during 2015. The Company has a $2 million Slenderwall project that begins production in May of 2016 and has been awarded a $3.2 million Slenderwall project that will start production later in 2016. In addition, the Company has bid several other Slenderwall projects and expects to be awarded one or more prior to the end of the year. Slenderwall sales should increase during 2016 and into 2017.

Miscellaneous wall panels significantly increased for the three month period ended March 31, 2016 when compared to the same period in 2015. The Company began a miscellaneous project in the fourth quarter of 2015 that will run through 2016 in the amount of $2.5 million. We expect sales to continue to be strong for the remainder of 2016 for miscellaneous wall panels. The market seems to be strong in this area as we have bid on several other projects that, if awarded, would begin later in the year.

Barrier Sales – Barrier sales increased significantly during the period ended March 31, 2016 compared to the same period in 2015. As discussed above in the soundwall panel sales, the passage of the federal highway bill created numerous highway projects in Virginia requiring soundwall panels, barrier sales and barrier rentals discussed below. The Company has commenced production under the $3.5 million barrier contract for the facility in Columbia, South Carolina and a large contract in its Midland, Virginia facility. Several more sales/barrier rental contracts are being reviewed now for bid, indicating that barrier sales and rentals should be strong for the remainder of 2016.

Easi-Set® and Easi-Span® Building Sales – Building and restroom sales increased 52% for the three months ended March 31, 2016, compared to the same period in 2015. The increase in sales was mainly due to the increase in restroom sales for state parks and other outside venues for the period. Management believes the Company will continue to see a slight increase in building and restroom sales for the remainder of 2016 as requests for bids has increased over the past six months.

Utility and Farm Product Sales – Utility and farm products sales decreased slightly over the three months ended March 31, 2016, compared to the same period in 2015. The Company received a large order for manholes on a local highway project for which delivery began in the fourth quarter of 2015 and has continued production during 2016. The project is running behind schedule and the contractor has slowed its production requirements, however, management believes it will pick back up this summer. Utility products are tied closely with infrastructure spending by federal, state and local governments and with the passage of the federal highway bill, sales and bids on these products seem to be slowly improving.

Miscellaneous Product Sales – Miscellaneous products are products produced and sold that do not meet the criteria defined for other revenue categories. Miscellaneous product sales decreased significantly for the three months ended March 31, 2016, compared to the same period in 2015. With the increase in soundwall projects, management has not focused on this product line as some of these projects tend to be difficult to manage. Management believes that miscellaneous sales may increase slightly during the remainder of the year.

Royalty Income – Royalty revenue was relatively flat for the three months ended March 31, 2016 compared to the same period in 2015. Barrier royalties were up for the three months ended March 31, 2016 compared to the same period in 2015, however the increase in barrier royalties was offset by the decline in building royalties for the same periods. All of the other royalties were at much lower levels than the barrier and building royalties and had little impact on the totals. Management believes that royalties will continue to increase moderately over the remainder of 2016 as a result of the continuing improvement in the construction industry.

Barrier Rentals – Barrier rentals increased significantly for the three month period ended March 31, 2016 compared to the same period in 2015. The increase in barrier rentals was due in part to the highway bill passed by Congress in 2015 discussed in the soundwall and barriers sales sections above. While sales increased significantly, the sales price itself also showed a slight increase. Management is aware of several special projects coming up during 2016 and is endeavoring to obtain these projects which also sell at increased margins.

Thursday, May 19, 2016

Even though SMID is trading at book value, we are removing SMID as a GeoBargain due to our lack of confidence that management can produce consistent profitability even as revenues continue to increase. We will continue to actively track the story as the passage of the recent highway bill could still lead to a significant increase in demand for the Company’s products.

We encourage you to the read the segment by segment breakdown for Q1 2016. Management expects nearly every segment to increase slightly to meaningfully in 2016. See the full breakdown here.

Wednesday, August 31, 2016

SMID ($3.74) – Ex-GeoBargain SMID reached a new 52 week high on August 26, 2016 of $3.76. We coded SMID a GeoBargain on November 2, 2015 when the stock was trading at ~$3.10. On May 19, 2016 we stated, despite shares trading near book value ($2.40), that we were removing SMID from the GeoBargain list due to our lack of confidence that management can produce consistent profitability.

We noted that demand could still see significant increase due the passage of the $305 billion highway bill and that management did expect each segment to increase slightly to meaningfully in 2016 based on commentary from the 10-Q.

Patient investors were rewarded, even though we moved on to other opportunities.

Tuesday, September 13, 2016

SMID ($3.70) – Ex-GeoBargain SMID announced it was selected to supply its soundwall product for the Virginia Department of Transportation (VDOT). The overall VDOT project is $31 million and we are analyzing SMID’s potential portion of the contract. From our initial rudimentary analysis, we think the value of this contract could be at least $1.5M in revenue. It’s worth noting that SMID has stated on several occasions that the price environment for its products has improved. Our analysis used the value of past contracts and may be conservative due to the better pricing environment.

SMID reached a new 52 week high of $3.80 on September 7, 2016. We coded SMID a GeoBargain on November 2, 2015 when the stock was trading at ~$3.10. On May 19, 2016 we stated, despite shares trading near book value ($2.40), that we were removing SMID from the GeoBargain list due to our lack of confidence that management could produce consistent profitability.

We noted that demand could still see significant increase due the passage of the $305 billion highway bill and that management did expect each segment to increase “slightly to meaningfully” in 2016 based on commentary from the 10-Q.

Patient investors in SMID were rewarded, even as we moved on to other opportunities.

Tuesday, November 15, 2016

SMID ($4.05) announced Q3 2016 results:

- Sales of $12.4 million vs $10.4 million in the prior year

- EPS of $0.34 vs $0.23 in the prior year

Quotes from management:

“We expect all of our companies, Smith-Midland VA, Smith-Carolina, NC, Smith-Columbia, SC, Concrete Safety Systems and Easi-Set Worldwide to continue in a profitable manner. The Smith-Columbia precast plant has two significant barrier contracts and one moderate lagging panel contract. We have bid on several soundwall projects and management believes we have a fair chance of obtaining these contracts. We believe that 2016 will be an outstanding year for Smith-Midland.”

Congrats to patient investors. Unfortunately we bailed on the stock due to uncertainty on management’s ability to consistently grow the company. As we stated when we removed SMID from the GeoBargain list.