I no longer avoid investing in Canada based companies. When you screen for stocks to buy, you might have a desired set of criteria on a quantitative, qualitative and geographical basis.

If you...

As far back as I can remember, I put an outsized focus on special situation stock investing because I knew that in some instances, the rewards I could reap from certain outlier circumstances would be...

When you think of individuals such Carl Icahn, Ronald O. Perelman and Nelson Peltz, you might think of their knack for business acumen, successful fund management and even philanthropy. However, there...

It’s true. There are a lot of investors and hedge fund managers in the realm of microcap investing that have breathlessly echoed what we have been saying about the advantages of investing in the space...

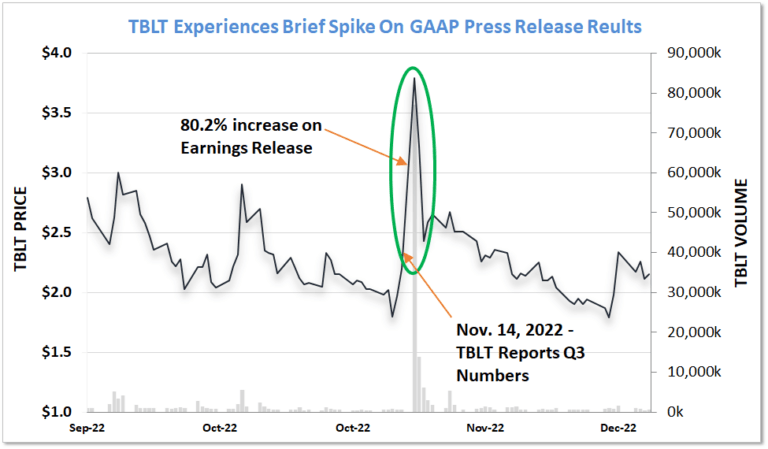

In 2016 we addressed the dichotomous approach to understanding the differences between generally accepted accounting principles (GAAP) and non-GAAP earnings. There are ways they should be scrutinized...

The sales, earnings and thus share prices of cyclical stocks (cyclicals) tend to fluctuate with the overall economy and are associated with industries that are heavily affected by the economic cycle...

There’s going to be certain times when you need to think twice before believing bullish commentary from management teams. You need to understand that that bullish commentary can change on a dime. I...

We’d like to visit another story that could just as well have been part of our last weekly segment to prove that some management teams just get it right. We wanted to offer it up as another example of...

- 1

- 2