Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

It’s true. There are a lot of investors and hedge fund managers in the realm of microcap investing that have breathlessly echoed what we have been saying about the advantages of investing in the space for some time. We’ve also been saying that the selloff in many microcap stocks is overdone and it’s time to really pay attention to where the growth and value are.

Investment ideas don’t have to be screaming in your face at close range. Sometimes it is nuanced, which is why we are so keyed in on deeper research, be it by virtue of idea generation or education, and connecting with the content of peer analysis and discoveries outside the walls of GeoInvesting.

So, for the third week in a row, and on the heels of last week’s highlight video reel of our conversation with Vittorio Bertolini, we are focusing on another professional who publishes third party content – Seeking Alpha Contributor, The Institute for Innovative Development (IID), who endeavors to be:

“…an educational and business development catalyst for growth-oriented financial advisors and progressive financial services executives who are determined to grow their firms in a business environment of accelerating business and cultural change.”

As you might expect and as conveyed by its business model, IID’s columns are intended to be learning fodder for professionals interested in the perspectives of those in networking and business activities to find commonalities across a spectrum of next-generation investment instruments.

The Institute’s June 8, publication,, 2022 Microcap Universe: Overview And Opportunities, authored by Bill Hortz, Founder and Dean, serves as such through the Q&A with executives and portfolio managers at activist fund 180 Degree Capital Corp. (NASDAQ:TURN), Kevin Rendino (CEO) and Daniel Wolfe (President).

180 Degree Capital Corp. distributes its investments in small and microcap public companies across a wide array of industries, actively engaging with management teams to improve the performance and operational efficiencies of the companies in its fund.

TURN’s purpose sits well with us, since we actively look for and include turnarounds in our model portfolios frequently. In fact we just added 2 turnaround stocks to our model portfolios – a 100-year old marketing services company with whom we had a Fireside Chat with on January 11, 2023, and a high conviction idea, , a provider of healthcare communication solutions, with whom we’ve scheduled a Fireside Chat for March 1, 2023.

As of September 30, 2022, 44.6% of TURN’s invested capital was distributed across Fertilizers & Agricultural Chemicals, Interactive Media & Services, and Technology Hardware, Storage & Peripherals. See their entire Q3 2023 list here.

Again, to be clear, IID’s column was more of an educational piece and we are not endorsing an investment in TURN. We wanted to make that apparent from the get-go. We just really liked what we read since it was a basic exercise in picking the brains of fund managers who focus on unlocking value in microcap and small cap companies through turnaround-focused activism.

First, to put into context the most recent mindset of TURN’s Kevin Rendino, he released a very comprehensive, eloquently framed, and sometimes cynical Q3 shareholder letter in which he said his “quiet part” out loud regarding the smaller capitalized, and assumedly turn-around, equity market:

“Here is something I have rarely said in all my days of managing money. Instead of tiptoeing around “Mr. and Ms. Market” so as not to hurt its feelings and always saying the right thing like, “You need to respect the market and assume it is right,” I choose a different path. I have seen such utter nonsense in the indiscriminate selling of so many names, regardless of news or valuation, that I do not believe the market is right. I believe the market is not right in ascribing a going out of business valuation..”

The idea of microcap turnarounds is quite familiar to us and in this article we intend to further interpret TURN’s commentary on that subject and the microcap space in general, as many of our views intersect.

There are obviously a number of reasons why a company can be distressed and needs to turn its business around. Poor financial performance, operational inefficiencies, a weak balance sheet, a lack of market penetration, and stagnant growth are some common offenders that businesses need to overcome to spark growth and eventual success. It takes good management, and in some cases new management, to recognize the solutions and act.

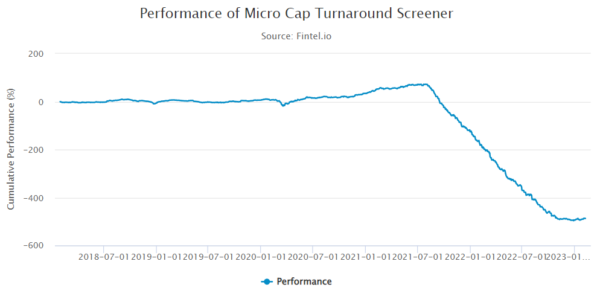

But as the last year or so has shown us, there hasn’t been much to celebrate in turnaround prospects. The following chart from Fintel shows the cumulative performance of a 61-microcap stock turn-around model portfolio. The value was relatively stable to trending upward and above sea level leading up to mid-2021, and then the bottom dropped out of it, resulting in a dramatic aggregate 500% deficit by 2023.

As we have a bit of experience dealing with turnarounds as a “special situation” strategy we’ve used in the past to find potential Model Portfolio holdings, we are very familiar with what can go right or wrong, as I touched upon with Jan Svenda in an Avoiding the Crowd Podcast episode titled, Perfecting Turnarounds in the Microcap Universe.

It’s a very speculative strategy, so you have to carefully examine all the moving parts to pin down the conditions that stymy progress:

“…it all comes down to management. Really, in the end, we do realize management is driving the story. I do see a lot of the issues in why turnarounds fail sometimes, or why they stagnate. A lot of it is in the marketing and sales process – Having the wrong approach to it; hiring the wrong people; being aggressive at the wrong time. I’ve learned that seems to be a common theme across some of them. It doesn’t mean they fail, it means that if you have a good CEO. They realize that and they fix it…”

Personnel was actually the culprit that ultimately got me in my failed December 2012 investment in contract cycle management SaaS company Determine Inc. (old symbol DTRM) (formerly Selectica, Inc.) As I discussed with an investing influencer, The Gladiator in August of 2020, poor choices by what I first gleaned to be competent management ultimately led to a burn in my portfolio. Through a steady stream of dilutive capital raising deals and what I should have realized was a historical pattern of a revolving door of CEO’s, the holding flopped. Another mistake I made was getting way too excited about the success some of its competitors were having and the multiples they were commanding during takeover activity. It prompted me to hastily put DTRM in the same class as these comps. I learned from it, and then moved on, logging the mistake as a lesson learned in proper due diligence.

More recently, there was also Muscle Pharm Corp (OOTC:MSLPQ), a nutritional products and supplements company that seemed like a promising growth story when it turned profitable during 2021, prompting us to interview the company to learn more about management’s plan to sustain its momentum. We expected a major inflection point not too far into the future, and the stock even tripled after we began our coverage, making us believe that our thesis was vindicated by the strong move. As bad luck would have it, as worldwide inflation and supply chain issues worsened in the wake of Covid-19, MSLP got caught up in the fray of higher raw material prices, which impacted the business to an extent beyond the company’s bandwidth to fix. Having been unable to dig out of the hole, they recently filed for Chapter 11 bankruptcy.

On the other side of the spectrum and in contrast to my experience with Determine, Inc. and MSLP, if a well-intentioned and/or competent management team see fit, either internally or with the help of activists or advisors, to right the ship, and it’s a company that checks off some of the qualities it takes to become a Tier One Quality Microcap company, the stage could be set for a nice comeback. Some examples of turnarounds that ended up being huge multibaggers for those that were able to hold them were:

- Nutrisystem, Inc. (Acquired by Tivity Health, Inc.)

- Medifast Inc (NYSE:MED), 6545% (Identified by GeoInvesting)

- Bluelinx Holdings Inc. (NYSE:BXC), 1100% (Identified by GeoInvesting)

- Charter Communications, Inc. (NASDAQ:CHTR), 2385% (Identified by GeoInvesting)

180 Degree Capital addressed why the companies they work with are so overlooked. Microcaps deal with a myriad of factors that are largely unique to the world of smallcaps and microcaps. Potential turn-arounds may also face additional challenges as the companies might not have all the tools in place to succeed, despite having great products/services and an encouraging TAM.

TURN clearly sees the advantage of investing in microcaps because many of the factors, at face value, don’t detract from the attractiveness of the actual businesses, but more so add to the perception that the stocks are uninvestable. The latter, and I think they’d agree with us, opens the door for outfits like us to find the overlooked gems first.

As Rendino from TURN put it:

“The number of investor eyeballs digging into the businesses, financial statements, and other important aspects of these microcap companies are significantly less than companies with larger market capitalizations. But do not think that every smaller cap company has reporting or delisting issues. They do not. We have found real companies, with real cash flows managed by fine executive teams. In fact, many executives are tired of working at bigger, bureaucratic companies and seek the more entrepreneurial and fast-paced environment offered at small public companies.”

Sound familiar?

His co-portfolio manager, Wolfe, continued:

“…nearly 75% of companies in the micro-cap space are followed by less than three analysts. Our experience suggests that a vast majority of these names are not covered by a single analyst. Analysts and institutional investors are simply unable to spend the requisite time to familiarize themselves with these opportunities due to position size limitations, liquidity restrictions, and overall capacity constraints. This dynamic creates a compelling opportunity for those investing in the micro-cap universe to be on the forefront of discovering overlooked, orphaned investment opportunities and to benefit from the forthcoming value/size appreciation that can follow if these companies can execute on their business.”

So, this is why investing in microcap turnarounds can be exceedingly successful – it combines the enormous growth potential of uncovered and unknown microcaps with the prospect of them successfully overcoming some of the peripheral challenges that come with being a turn-around.

Microcaps often have limited institutional investment. Without the support of institutional investors, they have a harder time accessing capital, which is crucial for their growth and survival.

They may have limited options for financing and have to rely on high-risk, high-reward sources of funding, such as issuing new shares, debt financing, or crowdfunding.

Additionally, the lack of institutional investment can make it harder for these companies to attract and retain top talent, as well as to expand their operations and develop new products.

However, as we said, if there is a subpar management team with limited experience at the helm, it’s likely that poor practices have led to inefficient capital allocation which in turn leads to poor financial performance, ultimately having a negative impact on growth.

Moreover, weak corporate governance can mean that the directors are unable to make informed decisions to respond to the needs of their shareholders and gain the trust of institutions. In the end, a fragmented ownership structure with many small shareholders who may not have the influence to drive the company forward results in orphaned, illiquid investments.

TURN actually endeavors to help the companies they are interested in address these challenges by providing their microcaps with the necessary resources and expertise to affect positive change.

A turnaround can experience significant improvement in its financial performance and operating efficiency. The process typically involves a change in strategy, management, or operations, and is designed to restore the company to profitability and growth.

Some goals of a turnaround are to address issues such as poor financial metrics, a bad capital structure, inadequate investor outreach and messaging, unqualified management, insufficient equity to grow, unproven strategies, investor trust, limited market presence, lack of M&A to induce growth, no analyst coverage, and overall listing challenges.

In Rendinos’s dialogue about TURN’s role to affect improvements in some of these areas, he states

“While each of these situations are unique, all present an opportunity to use activism constructively to unlock significant value creation for shareholders in these micro-cap companies. Simply put, we believe using a constructive activism approach can enhance investment results and drive suitable outcomes for the companies we invest in. We believe pairing micro-cap investing with activism has enabled us to differentiate from other micro-cap investors.”

His statement serves as an example of a different approach to microcap investing that we find compelling, being that we are keenly aware of some of the shortcomings of even some of the stocks that we invest in.

Of course, not all of them are the quintessential definitions of turn-arounds, but all could probably stand to shore up an aspect or 2 of their businesses. It would go a long way. In fact, a lot of micros end up being turnarounds, purely given the growth and catalyst angles.

In wrapping up, TURN’s portfolio managers realize that the microcap space is a breeding ground for potentially outsized gains. We obviously think so too. We really encourage you to read IID’s article featuring TURN’s viewpoints, as well as Rendino’s shareholder letter. Bill Hortz does a great job of extracting some basic and quite informative pieces of knowledge from 2 very obviously seasoned and passionate investors.

We’ll leave you with a quote from Wolfe and Rendino that answers Horze’s question about this inflation-heavy market we’ve entered:

“Interestingly, using history as a guide, we see the current sell-off as an opportunity as it relates to the small/microcap market generally. In fact, the small cap market, which includes micro-cap companies, is the only major asset class to outpace inflation during every decade since the 1930’s. Further, going back to 1926, the small cap market is the only major market that has on average been able to outperform inflation even when inflation moves above 5%.”

“…smaller companies often produce outsized growth in a growing economy than rising rates imply, and they are often able to pass on price increases to customers in an inflationary environment.”

…we believe the current fear-driven sell off is providing significant opportunities in the small-cap market, particularly for a microcap investor.”

Amen to that.

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.