A long time member of GeoInvesting, TheGladiator (twitter: @TheGladiatorHC), who himself is a champion of microcaps, posed some questions to Maj Soueidan, Geo’s President and Co-founder. Because the questions were sent to him via email, it gave Maj a chance to deeply reflect on his beginnings as he’s often done before and get specific on some key strategies he uses when investing in microcaps.

The Gladiator Interview With GeoInvesting Co-founder Maj Soueidan

1. What got you into the markets in the first place?

My dad basically launched my full time investing journey which has run about three decades now. He lived the American dream, arriving in the United States from Lebanon in 1969. He found a long career in pharmaceutical sales and eventually started his own business in the home building accessory industry. My dad was an extremely hard worker and somewhat of a perfectionist, which influenced the intensity I’d eventually put into researching stocks.

I can’t remember exactly when, but at some point, when I was kid, I started observing my dad’s obsession with the stock market. He actually set up an office in our basement just for stock research, the “stock cave.” It’s funny, when I look back at those times I can begin to see my roots as a microcap investor.

My dad would increasingly emerge from the stock cave excited to tell me about a company I never heard of that he came across after doing some morning research on company earnings reports. Until those moments, I didn’t fully appreciate that the stock market is more than just the Dow Jones Industrial Average and S&P 500. I eventually began spending time with my dad watching the Nightly Business Report on PBS, hosted by the late Paul Kangas. The program offered a daily market recap and interviews with CEOs and analysts. I remember eagerly waiting for Kangas to discuss smaller companies, but no bueno.

One thing that stuck in my mind was watching my dad remain calm during market turmoil, such as the 1987 crash, one year before I would graduate from high school. As I was running around being nervous with no money invested, my dad was extremely calm figuring out what stocks to purchase as the market was falling. I’m sure experiences like this have helped me cope with market volatility.

When I was in 11th grade I actually participated in a mock investment contest put together in my economics class. Upon the encouragement of my teacher, I proceeded to lose all my money by investing in a bankrupt disk drive storage company. My teacher taught me a key lesson when he quipped: “Remember to always do your own research.”

Now, I’m a huge Peter Lynch fan, but I remember practicing his “buy what you know” investing theme even before reading his book, “One Up On Wall Street”.

When I was 16, I got a job working at a local greeting card company. I wanted to do some homework on the industry after my dad excitedly emerged from the stock cave one day talking about a noname public company in the industry that had great earnings. I demanded to talk to the owner of the local company to get started working in the finance department, which landed me exactly where I belonged: the warehouse, loading and unloading bags of greeting cards onto trucks and wooden pallets. But I’m glad I got the experience. I saw firsthand what a poorly run company with low employee morale and management looked like. Needless to say, I learned years later that the company didn’t make it.

Interestingly, I recalled my experience from that time when I started researching a microcap stock in 2012 at around $0.30, Greystone Logistics (OOTC:GLGI), a manufacturer of plastic pallets which are more expensive than wood pallets, but last a lot longer. I remember thinking to myself when I was working at the card company how shitty and worn out some of these wooden pallets looked, which made my job harder. I eventually bought the stock which just eclipsed $1.00. I also had a job at a golf course so I could be around some people who had some money and maybe learn a few things about investing. But I’m so bad at golf that this plan was dead on arrival.

It wasn’t until my dad gave me Lynch’s book, One Up On Wall Street, during my first year in college that I ditched my “I don’t know what I want to do career path” in favor of choosing finance which ultimately led me to pursue my full time investing career.

While in college, I started participating in a stock contest organized by U.S.A Today called the stock market investment challenge. It was an awesome experience. You actually would call mock brokers to place your trades. That got me deep into research mode. Soon after, I made my first investment in a stock, making 60%. It was the same stock I lost all my paper money in during my 11th grade contest. The company had emerged from bankruptcy.

I wasn’t getting what I wanted out of my college courses, where teachers were preaching the efficient market hypothesis and that it was almost impossible to beat the market. I remember my portfolio manager teacher telling me that I would never make it in the business. So, I spent my time at the library reading the Value Line and doing some side work at Dean Witter Reynolds, where I was cold calling leads for a broker who happened to be the best friend of one of my cousins. I would use Dean Witter’s office on the weekends to do research on stocks by reading S&P tear sheets. It was a fantastic learning experience. I started to understand how important public, yet ignored, information can give you an edge.

After college, I started renting an office with a friend of mine. The perimeter of the office was surrounded by annual reports, about knee high, that I had requested to be sent to me. That was right out of Lynch’s playbook. I was digging into those reports to read though CEO letters to shareholders which you really couldn’t get anywhere else. I was trying to find information in these letters that was not present in press releases and was actually where I found one of my first microcap multi-baggers.

So, I was learning lots of lessons early on, such as:

- Do your own homework

- A whole world of high quality smaller capitalized companies do exist in the stock market

- I can gain an edge investing in under followed microcaps

- I can gain an edge investing in special situations

- I can gain an edge by being a first mover

- Information arbitrage, when found, can be a powerful tool

This might be a little longer answer than you are looking for, but I love reminiscing about my investing journey. I always remember something that I forgot happened.

2. Can you give us a summary of your trading strategy?

As far as my research process, early on I was really drawn to combining price momentum with strong company fundamentals. Basically I would manually track stocks hitting 52 week highs, trading under $30, where shares outstanding were under 20 million. I had used the Barons and The Wall Street Journal to create those lists. So, my research bucket consisted of lots of microcaps and nanocaps. Remember, there are about 20,000 stocks that trade in North America. So I knew right away that I needed to reduce that universe to a manageable level. Looking at microcaps reduced that number down to 10,000. Concentrating only on the U.S. and tracking new highs continued to shrink the list to a manageable level. I would then place stocks in various buckets such as ignore, high priority and revisit later. In the beginning of my career I leaned on Lynch’s stock picking criteria to help me fill these buckets…

- Trailing P/E<25

- Forward P/E<15

- Debt Ratio <35%

- EPS Growth >15% to <30%

- PEG Ratio (PE/EPS 3-5 Growth Rate) <1.2

- Market Cap < $5 billion

… along with reading press releases and interviewing management.

I had more a short term focus, trying to find high quality companies entering into four to eight quarter growth inflection points. The strategy worked really really well, delivering annual returns for my portfolio of 100% for years. It wasn’t until much later that I began to place greater focus on becoming a longer-term investor.

I really found this process to be useful because it created a very definable process I could follow, which is important for a beginner investor looking for ways to cut into a stock selection universe of 20,000. To this day, I would be hard pressed to find a more powerful strategy than combining momentum and strict fundamentals if you’re looking for shorter term wins. I eventually hired a programmer in 2007 to build me a program to track new highs in real time, along with other data points. I still use that program today to power my momo research.

Now, even though I was predominantly a momentum investor in my early years, I still wanted to get into stocks before momentum set in. So part of my research centered around reading the Investor’s Business Daily or Value Line to search for stocks that were not quite hitting top momo and earnings scores, but were fundamentally moving in the right direction, where I thought the momentum crowd would eventually step in. These days, I accomplish this task by simply reading earnings reports and taking note of troubled companies that are beginning to show signs of hope. Once in a while I will run stock screens to look for struggling companies to see if I can find any potential turnaround stories.

My full on microcap strategy aha moment came when my dad made money on a security software/products company. It went up 5x in a short period of time. But I could not find the symbol in my research bucket list. When I asked my dad about it he said the company trades on the pink sheets (aka over the counter or OTC) and that the Wall Street Journal has a special section for those companies, where I could also track new highs.

It took me some time to find OTC winners because there’s a lot of junk trading on the OTC and it wasn’t as easy to find information on those companies back then. But the research was well worth it. I invested in so many OTC microcap multi-baggers, many of which were eventually acquired at hefty premiums. Many of these companies used to be on the NASDAQ, NYSE or the AMEX and were once loved companies, maybe emerging from Chapter 11 bankruptcy on the OTC. I’m telling you, the emerging from Chapter 11 trade is money. For example Charter Communications, Inc. (NASDAQ:CHTR) emerged from Chapter 11 in November 2009 and has risen from around $30.00 to where it now trades at $600! Oh by the way, I sold it for about $60.00. Pure genius 🙁

One thing I am really drawn to is digging for information and beating the crowd to it. And the microcaps universe is where you can do it. At Geoinvesting, we really preach the concept of information arbitrage:

An information arbitrage exists when a disconnect between stock prices and available public information on a company is noticeable, and monetarily worth pursuing.

You can find these information disconnects by looking in places where investors tend to shy away from due to time constraints or just lack of motivation to dig past press releases such as:

- Complete review of 10Ks and 10Qs. For example, the management discussion & analysis and business overview sections can include tidbits of information not contained in press releases.

- Tracking insider buying and selling trends detailed in form 4 SEC filings

- Tracking SEC 13D filings to see if shareholder activists are entering the picture

- Comparing earnings conference call transcripts to related press releases

For the last 10 years, my core strategy has been to build large multi-year positions in “Tier One” quality microcaps and nanocaps. Some key characteristics of what I consider to be Tier One microcap include:

- Strong management

- Management focused on business, not stock price movement

- Revenue

- At or near profitability

- High probability turnaround stories

- Insider ownership

- Manageable debt burden

- Ability to grow without excessive equity raises

- Shares outstanding are not excessive

I invest in extremely illiquid stocks, the less liquid, the better.

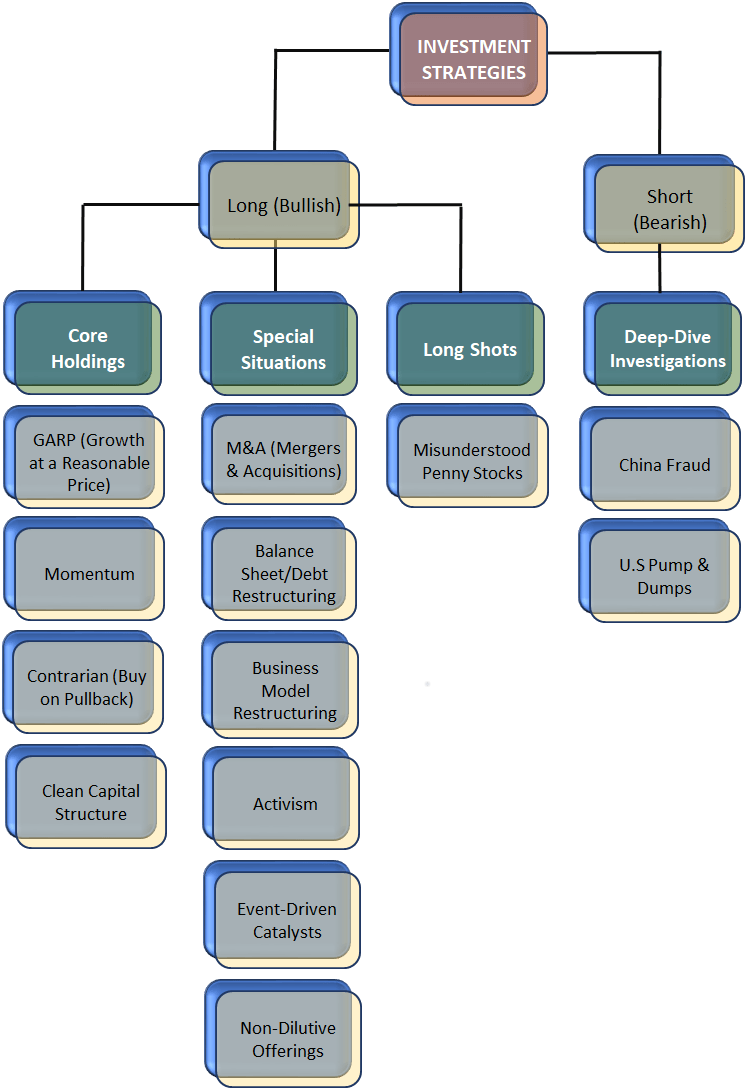

Around my core strategy, I take a few long shot bets and short-term bets based on

- Special situations

- Momentum + value

- Lesser tier companies that have some positive catalysts occurring

I’ll occasionally put on a short selling position. I’m not much of a day trader, but will trade here and there if I feel some fundamental factors are driving that decision.

When I invest for the long-term, I’m very interested in understanding the qualitative aspects of a story and management’s ability to face challenges. Over time, this has allowed me to buy stocks that look overvalued right now that will look very undervalued in a few years based on current prices.

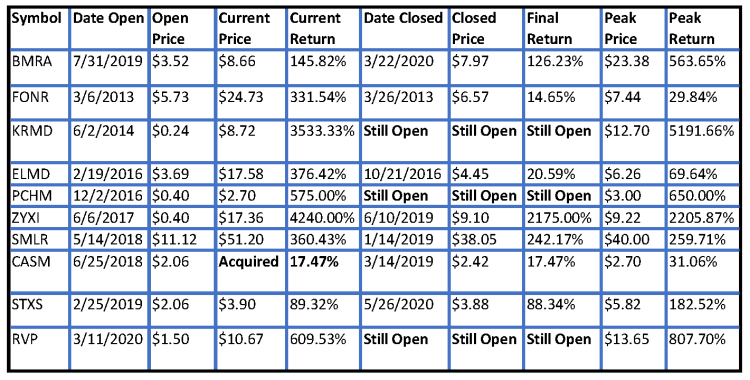

I’m a really big fan of investing in companies that are in the early innings of transitioning to recurring revenue models, including medtech. I’ve invested in 10 medtech companies since 2013, some of which have risen well above my exit price.

Note: Data as of As of 8/7/2020

Although I still love the combination of momentum and growth inflection point investing, I have added considerably to my strategy buckets. Here is a summary of my research buckets:

3. If there was one thing you know now that you wish you knew when you first started what would it be?

As a full time investor, I wish I would have been quicker to have taken steps to have been better emotionally prepared for crashes and corrections that caused draw-downs in my portfolio. That would have entailed doing 3 things a little better:

- Think long term

- Be careful using leverage too liberally

- Managing overall finances

I wish I would have approached stock picking from a longer term perspective earlier than I did. As I mentioned earlier, the crux of my investment strategy for several years was to invest in undervalued Tier One microcap companies reaching business inflection points where growth would break out for several quarters, and then riding the momentum as other investors piled in. The strategy worked great for many years. But it really didn’t put me in a mindset to evaluate a company for the long term in such a way that if the strategy stopped working, I’d be stuck in some of the stocks, unsure if I’ve invested in the right management team or business model.

If you anticipate holding a stock long term you just begin to look at the company differently, not really caring about short term. And because of your deeper due diligence and higher conviction you might have in the company, you will be in a better position to emotionally handle pullbacks in the market. The 2008 recession is a great example of what I am talking about. After the recession, the Tier One microcap universe went out of style, causing my strategy not to work as consistently. So, I was forced to adapt to think longer term. And I am a much better investor because of that.

The good news is that I feel like we are in a very special place right now, with regards to the Tier One microcap space, where I believe I have a long term strategy that’s going to work, combined with a very good chance of making good money in the short term using momentum + inflection point investing. The perfect storm!

Making sure you manage your portfolio and your life in a way to allow you to emotionally handle pullbacks can go a long way in putting you in the right emotional state to make good investment decisions when faced with some really challenging times.

There’s nothing worse than when tax time comes in April and you haven’t reserved any money aside to pay taxes and your portfolio’s falling, and then you end up selling stocks that you don’t want to sell as they are crashing, just to pay your taxes. A similar scenario occurs when you’re heavily in margin and you need to sell stocks at the bottom of a crash to meet margin calls or pay bills, as opposed to having a slush fund ready to pounce on fear and panic. If you’re not careful you can end up entering rinse and repeat cycles of making money and losing money and never moving forward. How aggressively or conservatively you manage your personal finances can also play a role on how nimble you can be in the market. As a full time investor it’s really important to view investing as if you are running a business.

I think a good rule to use when your portfolio is rising would be to reserve 30% of profits for taxes, 25% in a dry powder account, 10% in a living expense account and reinvest 35% into new or current stocks or maybe even some real estate. I can’t say that I have used these rules to perfection, but I have definitely gotten better at applying them over time. Some of these actions I took had me better emotionally prepared for the COVID-19 correction.

The one good thing that I did do early that saved my ass is purchasing a good amount or real estate with my profits as opposed to reinvesting it all in stocks.

4.Tell us about your biggest winner

That would probably be Repro Med Systems, Inc. (NASDAQ:KRMD). It’s at least the one that I’m most proud of. The company provides a drug delivery infusion pump platform. KRMD has a special place in my heart because it was one of the first stocks I bought with a very long term focus in mind and was borne out of one of my non core buckets, before eventually becoming a large core holding. I have held the stock for 13 years, first purchasing the stock around 10 cents in 2007. Shares reached a high of $12.84 earlier this year.

To be honest, I used to hate penny stocks. I couldn’t stop losing money on them because I was approaching them with a get rich quick mentality, leaving me chasing sexy stories with no real substance. KRMD was the first penny stock that I bought from a longer-term perspective.

This little penny stock was playing in a great industry, had a recurring revenue stream and a management team that really understood the market and prioritized patient care. KRMD has had a leading market position in its niche home infusion target market (Subcutaneous Immune Globulin (SCIG) for several years. It has a best in class solution that delivers medication subcutaneously (under the skin), as opposed to intravenously (in the vein) and without the need for electric power. This is a perfect solution to meet the burgeoning growth in demand for home healthcare. KRMD’s competitive position began to get a boost in 2007, when it received a favorable FDA decision regarding medicare reimbursement:

“The Freedom60 Syringe Infusion Pump is the only allowable pump to be billed with the Subcutaneous Immune Globulin (SCIG). All other pumps or modifiers will result in a denial.”

This allowed legacy management to perform a decent job increasing the usage of the company’s solution for limited medical conditions it was already serving. However, a new management team and board that began entering the picture in 2018 accelerated the adoption into current target markets and have been gaining FDA approval to expand the usage of KRMD’s solution to infuse more drugs. These actions have put KRMD in a position to possibly eventually expand outside its $500 million target market to one that is worth several billions of dollars.

KRMD opened the door to a whole new world of penny stock multi-baggers and interest in investing in medical device companies. (Refer to question 2 above)

KRMD was also part of a Geoinvesting model portfolio I’ve been managing with my team since 2013 called Run to One (R21) that to date includes 29 stocks. The portfolio is comprised of higher quality companies that are trading well under $1, and that we believe will eclipse $1 over the long run. As of 8/7/2020, the average return of these stocks is currently 350%, with a peak average return of 667%. 15 of those stocks eclipsed $1.00 per share at one point in their tenure on the portfolio. There are a few new ones that were recently added to the portfolio.

5. Tell us about your biggest loser and how did you mentally recover from that?

Mentally recovering from a big loss has not been a big issue for me. I have the attitude that as long as I have money to play with I’ll be ok. The math dictates that even if you lose 100 percent of your money in a stock that you own, the money you can make by going long is infinite, when you look at your investments through a perspective of owning an entire portfolio of stocks. That is why I believe that a reasonably diversified portfolio of extremely undervalued stocks, maybe 5 to 12, is ideal for most investors as opposed to betting the farm on a couple of stocks. Furthermore, taking a loss can be a relief as opposed to holding a stock you know you should get rid of.

So to be honest, I have handled taking a loss on a bad decision really well and have been lucky that for the most part, my big losses have been more than offset with gains in other portfolio positions. Knock on wood!!! Also, there is probably more stress in hanging on to a stock that you know you should sell.

With all this being said, It’s been more challenging to cope with situations where my entire portfolio gets decimated due to situations like dot bomb, 2008 and COVID-19. If you are a full time investor, it’s really important that you have positioned yourself as best you can to mentally prepare to take advantage of crashes, as I discussed earlier. I find that stepping away from the T.V. and not looking at my account also helps. You need to trick your mind!

But I want to still answer your question about a big loss. There was this SaaS company, Determine Inc. (old symbol DTRM) (formerly Selectica, Inc.) that got me good. I got excited because I had started gaining interest in investing in recurring revenue software business models. This particular company was in the midst of a turnaround and had some well-known investors actively supporting the turnaround. The stock quickly rose 100% to around $7.00 and then gradually descended through numerous stock offerings as the turn around failed to gain momentum. However, I stuck with it as the larger investors continued to fund the company. I became emotional with the stock. Had I dug deeper into these investors I would have learned that they were not as great as I thought in that they structured their deals in a way intended to benefit them at the expense of shareholders.

My biggest mistake was that I misread the company culture. When I look back at my experience it appeared that the model was broken. The company had gone through multiple CEOs that had little success turning the company around.

I got excited when they promoted a tenured marketing employee from within who knew the company really well and was with the business when it had excelled at a point in the past. Under his leadership the company still struggled and did numerous equity offerings. I Should have bailed earlier than I did. They eventually filed for bankruptcy.

A lesson I learned was not to give too many passes on equity offerings when there have been no operational improvements, especially amid numerous management changes.

6. What are the usual warning signals that a spec stock has gone bad and it’s time to leave?

This list can go on and on, but here are a few red flags I look for:

- Management turnover, especially CFOs and especially CEOs during turnarounds. If multiple CEOs can’t execute a turnaround it could be a sign that a company is fundamentally broken at its core and can’t be fixed.

- Excessive equity offerings with no progress in the business.

- Equity offerings when it has been clearly communicated that the company would not have to raise capital

- History of botched acquisitions

- Management teams don’t understand capital structure and the importance of maintaining a clean capital structure. During an on-site visit, I once had a CEO ask me how to calculate earnings per share and to explain why dilution was bad.

- History of making poor acquisitions

7. Why microcaps? Of all the different kinds of companies to invest in, why microcaps?

The simple answers of why I like microcaps are two fold:

1. Stats

The stats just prove that there’s so much alpha to gain by investing in smaller capitalized stocks vs. larger capitalized stocks and the smaller that you go the bigger that alpha becomes.

For example, the smallest subset of microcap stocks have been shown to outperform larger stocks by 14.75% (1927 to 2016).

2. Competitive landscape

Less competition for ideas might be the biggest reason I like investing in microcap stocks.

Large cap investors face incredible competition – hedge funds, sell-side analysts, high-frequency traders – all vying for the same small amount of alpha.

Just like in any aspect of life, less competition gives you a first mover advantage. Imagine a playing field where some of the brightest people cannot compete with you due to company restrictions! That’s what the microcap universe offers you. That is because most Wall Street institutions cannot invest in microcaps, or just refuse to invest in them.

Furthermore, the financial media spread negative stereotypes about investing in microcap stocks that are simply false, scaring investors away. Finally, the 2008 stock market crash permanently removed many individual microcap investors from the equation. This means that so much incredibly valuable publicly available information that no one looks for is waiting to be found. I and my team spend our time searching for this information with the aim to buy stocks early, knowing that one day other investors will eventually find them too.