Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Last week, we said that we’d be addressing some of the most common shortcomings that plague investors, and provided a cursory overview of one aspect of the investment process that is often overlooked – deep research. We’ll continue with the “investor oversights and failures” theme as we move through May and June, investigating additional facets that are pain points that must be addressed to become successful.

As we continue to ruminate over the next topic, the short term versus long term investing dilemma, we thought that a good prelude to that would be to take a look at some investment scenarios that fit in with that discussion. We’ve covered the topic before, but there is much more to expound upon on the subject that might help us reach some conclusions on the best approach investors should take, or maybe even a blended approach

Personally, in the first part of my full time investing career, much of my focus was in trying to find great companies in the meat of their growth cycles, holding them through that growth cycle and then selling them when the cycles were coming to an end. It was a great formula that worked fantastically for me.

Eventually, after a 2008 recession, that strategy wasn’t working as well in the microcap space. So I pivoted to investing on a more long term basis. Part of that decision was also based upon looking at some of the stocks I had sold in the past, like Monster Beverage Corporation (NASDAQ:MNST), along with a host of other names, that went on to capture sustained multibagger returns.

As you may have heard, MNST is the best performing stock of the century. So before we get into a full discussion of the long term versus short term dilemma, we thought it’d be fun to take a look at some different investment scenarios with this poster child of massive returns, and maybe begin to craft a teachable moment, for us and anyone else that wants to listen, on strategies that revolve around certain disciplines (ei. short term, long term).

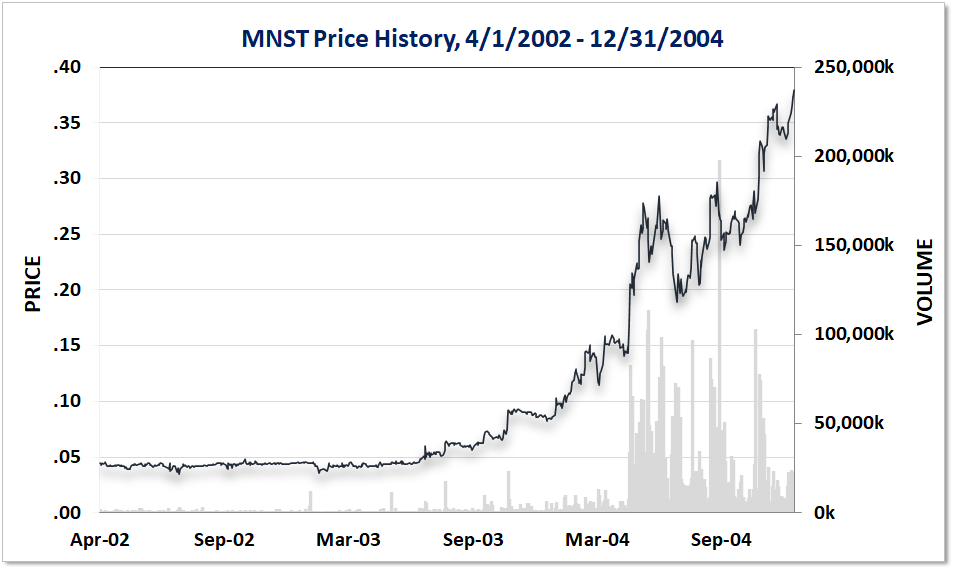

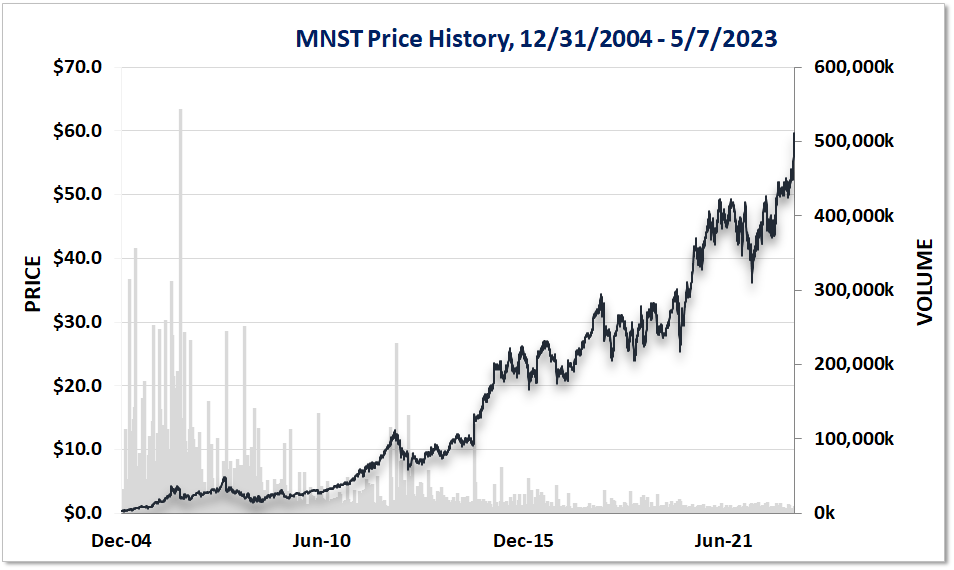

So, here’s what we found. First, when you’ve got a chart like that of MNST, it’s a little easier to digest with 2 charts because the increase in the stock from April 2002 to today, 139,736%, is so large.

Across the timeframes of the MNST charts above, there were 5 drawdowns of ~30% or more. When looking at the massive increase in stock price, as a rational investor it would be hard to argue that trying to time the troughs and peaks is an ideal approach to reap as many trading rewards as possible.

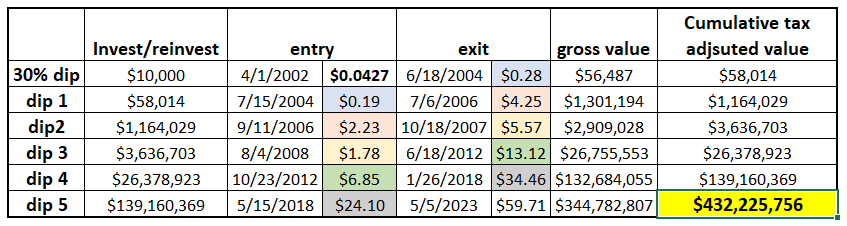

However, let’s just entertain the notion that an investor attained perfect harmony with movement of the stock over the years and timed the trades perfectly. You probably know where we are going with this – a somewhat not so believable plot twist where the luckiest investor alive took in $128,867,041 (assuming an initial $10,000 investment and 15% set aside for taxes on each exit). By some miracle, he or she had the wherewithal to reinvest all the proceeds from the previous trade after waiting for the inevitable trough.

Figure 1

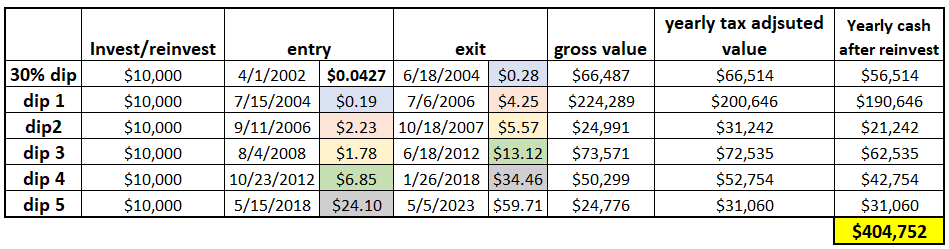

Let’s look at a trader who is not so bold as to risk everything and take more measured bets at the troughs.

Figure 2

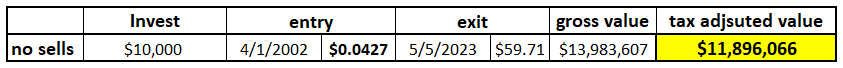

Finally, there’s the set and forget investor, who some might say is lucky in their own right. He or she bought $10,000 worth of MNST and didn’t realize that the stock was still in his/her portfolio. Fast forward, and he/she is the proud owner of $11,886,066 21 years later, as of May 5, 2023.

Figure 3

Key Takeaways

So what does this really show us?

Well, for starters you would have had to find a great stock, and MNST was certainly a great stock. If you were spot on in your research, you would have picked a stock that consistently grew its revenue from $92 million to $6.3 billion, and EPS from basically about $0 to $1.12, from 2002 to present.

Some other major takeaways should be noted.

Timing

Timing your entries into and out of stocks requires a special talent of not only timing the market, but most likely also understanding the ebb and flow of a company’s growth cycle. However, if perfected, you would have made a ton more money on selling the MNST tops and reinvesting your entire after tax proceeds at bottoms vs. holding your $10,000 initial investment over the data set period. However, the difference in profits of $420,329,690 leaves room for much imperfection. It also leaves room for you to lock in superior gains, even if you choose not to re-invest all your after tax proceeds. Still, if you were timing MNST, you would have needed to reinvest some of your proceeds, as Figure 2 shows that re-investing a constant $10,000 at each bottom would have yielded the worst results.

One scenario we did not test was taking a long term approach and dollar cost averaging more funds into the stock, maybe on a monthly basis.

Three ways you can attempt to time your entries and exits into stocks include:

- Trying to invest in a stock at the meat of the company’s growth cycle by predicting when it will show superior earnings per share growth for several consecutive quarters. We call this the GeoPowerRanking (GPR). I strictly used this approach, and I mean strictly, along with a Growth At A Reasonable (GARP) standard, for the first 20 years of my full-time investing career in the microcap space. The strategy worked like a charm and is coming back into vogue, after years of hibernation. Geoinvesting premium subscriber and Hedge Fund Manager, Quim Abril, uses key performance indicators (KPIs) to understand when a company’s fundamentals may improve or deteriorate.

- Using information arbitrage to take advantage of the inefficient discovery of information in ignored markets, like microcap stocks.

- On a more down to earth and relatable level, as a consumer, you can employ a strategy out of Peter Lynch’s playbook and try to understand when brands may or may not be hot if you’re a shopper throughout the product’s lifecycle. Maybe you can track the introduction of new products, when they go stale, then the introduction of new products again.

Setting and Forget?

Lots of people, including myself, talk about the power of long-term investing and some of the related advantages. However, as great as it may conceptually sound to “set it and forget it”, it’s easy to get complacent by using the long-term card to justify holding a stock you should sell when emotions won’t let you. Furthermore, many stocks that multibag go on to multi-bust. 2022 Showed us all how real this is. Of note, in the case of MNST you would have to stomach five 30% drawdowns.

Cheap or Not?

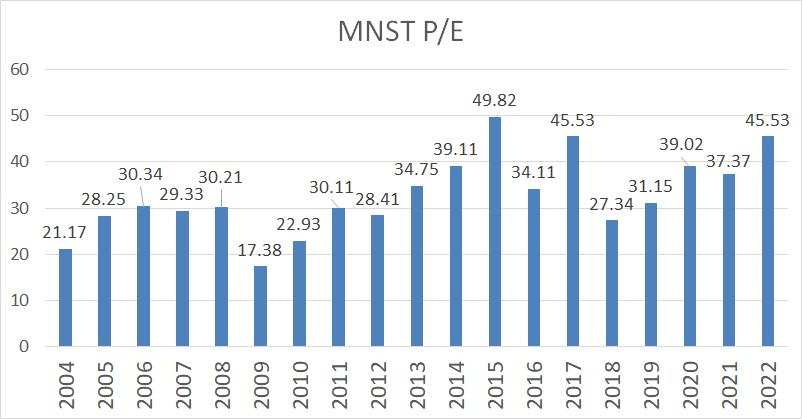

Value investors are always trying to find a “fifty-cent dollar”, but what MNST shows you is that sometimes a great company will never be cheap by Graham or Buffett standards, something we can see looking at MNST’s price to earnings ratio (P/E). Over the illustrated data set timeframe you might have assumed that the P/E was pretty unreasonable or high to substantiate an investment.

Undoubtedly, MNST is a special case, where the company has grown revenue and earnings since 2002.

However, the case study is still worth looking at and is inspiring from a short term or long term perspective. One thing is for sure, finding great companies to invest in opens up a realm of possibilities.

Investing is hard. There are no clear cut answers…you’ve got to be right on so many levels.

What I’ve learned over time is that I like to have a well balanced portfolio, a long-term approach to some stocks, and some short term strategies around that. It can be accomplished by using short term strategies (like buying stocks in a strong GPR growth cycle that are undervalued, and selling them when that growth period might be coming to a permanent or temporary end), or using information arbitrage to execute swing trading or short term trading opportunities, like we recently did with TZOO. After a little volatility, it is now up 40.33% since late December 2022.

In the coming weeks we will continue to dive into this topic a little more, which will include some more stats and data, using Geoinvesting’s 16 year history of finding multibaggers.

~ Maj Soueidan

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks