Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

When a stock of yours is doing well, one of the hardest things you will face is deciding if you should make a decision to take short-term profits, especially if you strongly believe the stock has much more potential in the long run. But it gets even worse. Sometimes we make decisions to hold onto stocks longer than their expiration dates because of the “what if it goes up” thoughts that creep into our minds

You want to hold it, but on the same token, you are not being fair to yourself when your discipline promotes a making-money strategy.

Now, I could have just as well started this post…one of the hardest decisions you’ll have to contemplate as an investor is to let a stock with great potential sit in your portfolio for a very long time. You have faith, after your hours of due diligence, that it will give you great annualized returns in 5, 10 or 20 years, but what if it doesn’t happen on your timeline? Would the capital that would have been made available with a more swing-style trade be better deployed in another investment? And should you even preoccupy yourself with these thoughts?

So, therein lies the investor’s conundrum. When do you sell? Markets are inherently volatile, and short-term fluctuations that will test your patience are inevitable. Last week we showed you the amount of 30% or more dips (5 times) Monster Beverage Corporation (NASDAQ:MNST) experienced on its way to becoming the best performing stock of the century .

And I haven’t touched on the other ways I could have begun the post (ei. When you are losing money)…it really is all related to discipline and circumstance.

I like the long-term investing approach. But if you really know GEO, we are not averse to a hybrid strategy since there is a time and place for short term investing horizons and swing trading.

In fact, there was a time, earlier in my career, where my average stock holding period was six and nine months. I was really just trying to find a stock in the meat of a growth cycle and then not hold it past that point. I call these shorter term moves “FundiTrading” because I still like to base them on understanding the fundamentals of a company.

Why Long Term?

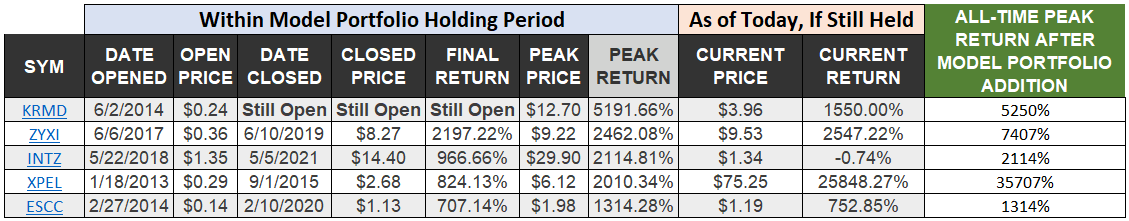

A good deal of our research is done with a longer time frame in mind. We are literally looking for the next multibagger, and we don’t mind waiting for the returns. Some might view this as being overly myopic. However, waiting on time is often required to make 5, 10 or 20 times your money in a stock. For example, from over the 200 multi-baggers we picked since 2007, let’s take a look at Koru Medical Systems, Inc. (NASDAQ:KRMD) and Xpel, Inc. (NASDAQ:XPEL). It took 5.9 years for KRMD to reach its multi-bag high, and XPEL, 8.5 years.

We would not have reaped the large returns in stocks like XPEL, KRMD, Zynex, Inc. (NASDAQ:ZYXI), Intrusion Inc. (NASDAQ:INTZ), and Evans & Sutherland Computer Cor (OOTC:ESCC) had we removed them too early from model portfolios we created.

Model Portfolio Stock Performance During Holding Period

Returns like these more than likely will make up for the losers in your portfolio. Of course, the closed returns vs. some of the astounding peak returns achieved while certain stocks resided in the model portfolio and the returns well after we removed them from the model portfolio illustrates why investing is hard. On the same token, INTZ is well below the price it was when we removed the stock from the Model Portfolio and all the stocks are well off their all-time peaks. Again, investing is really hard!

Vectorvest, in an article titled, “What is the Average Swing Trading Success Rate?”, weighed in on the most likely outcome that traders experience:

“We’ve seen estimations that as many as 90% of swing traders fail to make money in the stock market – meaning they either break even or lose money. That suggests that the average swing trading success rate is somewhere around 10% – meaning 10% of swing traders actually bring in profit over the course of a year. Now – we don’t say this to discourage you. Keep in mind that the vast majority of traders treat it more like gambling. They don’t actually use software to help them make emotionless decisions, they don’t follow sound strategies or principles, and they don’t have the right mindset.”

In fact, an active trading strategy can lead to a more complex and exhausting mental state of mind since investors can live and die by the hesitancy to sell a winner and the failure to cut losses on a non-core holding. This is what is called loss aversion, and it is a portfolio killer. It’s when you tend to hold a losing stock longer and incur a bigger loss.

One of my favorite stats that supports long-term investing is summarized in this passage from a breakdown of a Lauren Templeton presentation where she discusses how emotions play into how investors make decisions.

“So, Peter Lynch, when he was annualizing 29%, conducted a study and he wanted to know what the average investor in Magellan had earned. And what he found was that the average investor had earned 5% and many had actually lost money. He was annualizing 29%.

So again, investors are constantly doing the wrong thing. When a manager runs up, they give him money, when the manager draws down, they take it away…

Of course, bad portfolio management can hurt long-term investing. For example, a highly concentrated portfolio can get decimated if one or two positions plunge. However, the biggest mistake some long-term investors make is not trimming profits on a stock that has gone up or not selling the entire position if the bullish thesis or valuation no longer warrants holding the stock. The key point: A long-term strategy does not mean set it and forget it.

With all this being said, short term investing strategies have their place.

Why Short-term?

Short term investors will explain that they don’t have to go through losing decades worth of gains in one or two years like some long-term investors may have experienced multiple times over the years. This rinse and repeat cycle is mentally taxing.

Furthermore, good traders and fundamental investors that employ short-term strategies successfully can experience great success compounding “base hits” and doubles. For example, earning 20% on your investment 4 times results in a more than doubling of your initial capital, assuming you reinvest the proceeds of the previous sale!

| Initial Investment | Increase | Final Value |

| $10,000 | 20% | $12,000 |

| $12,000 | 20% | $14,400 |

| $14,400 | 20% | $17,280 |

| $17,280 | 20% | $20,736 |

Furthermore, what the “Model Portfolio Stock Performance During Holding Period” table (several paragraphs above) does not tell you is how we may have hybridized those picks, deciding to trade around the price fluctuation of the core positions while maintaining a steadfast view that long term stock appreciation would occur despite the volatility that comes with microcaps.

Some of these interim decisions were conveyed through our premium alerts and research, and via 10 buy on pullback” (BOP) model portfolios. (By the way, we are seriously considering bringing the BOP portfolios back). Our first 10 BOPs showed an average return of 43.42% by the time they were fully closed, and an average peak return of 79.61%. The average time each portfolio was open was 11.6 months.

These examples show why a combo approach is interesting. It’s also not right to assume that short term investing cannot be based on fundamentals. It’s not just about technical analysis and day trading based on the charts. Most of the things I do, whether it’s short or long term, is based on the fundamentals. Although, we do use a few technical short term strategies that we employ such as watching for set-ups when a big seller in a stock finally gives up and unloads his/her position in a big block(s) trade below market price. After the block is sold, the price often temporarily fills the gap and then some. We are watching HGBL closely, since we know a large investor is in the process of selling.

A favorite fundamental based short-term strategy of ours that is easy for you to deploy is one in which information arbitrage (InfoArb) is present and can be immediately capitalized on when investors eventually take notice of information you have found and analyzed. This opportunity only occurs in the microcap universe.

Below are examples of Acquisition Arbitrage, a subset of InfoArb where clues enable us to call the possibility of a company being bought out at premiums to the current price.

| Company* | Date InfoArb Identified | Price At InfoArb Identification | Acquisition Date | Acquisition Price | ROI |

| Merrimac Industries (Old symbol MRM) | 6/30/2009 | $7.70 | 12/24/2009 | $16.00 | 107% |

| Responsys (Old symbol MKTG) | 4/10/2013 | $6.42 | 1/2/2014 | $27.00 | 320% |

| Frozen Food Express Industries (Old symbol FFEX) | 6/6/2013 | $1.72 | 7/15/2013 | $2.10 | 22.1% |

| Golden Enterprises (Old symbol GLDC) | 6/20/2016 | 6.71 | 7/19/2016 | $12.00 | 78.8% |

| Smart Employee Benefits (Old symbols SEBFF, SEB.V) | 8/5/2022 | $0.07 | 1/4/2023 | $0.22 USD | 214% |

- *MRM – Change in executive employment agreement signals company will be acquired.

- *MKTG – Poison pill in SEC filings put in place to make sure a takeover would maximize shareholder value. Acquisition activity in the industry was accelerating.

- *FFEX – 13D filings show that another trucking company bought shares in the company.

- *GLDC – Information hidden in SEC filing regarding how insiders held their stock in a trust pointed to a high possibility that the Company was for sale.

- *SEB – Comment on Q2 2022 conference call pointed to a strong possibility that the company was in negotiations to sell the company.

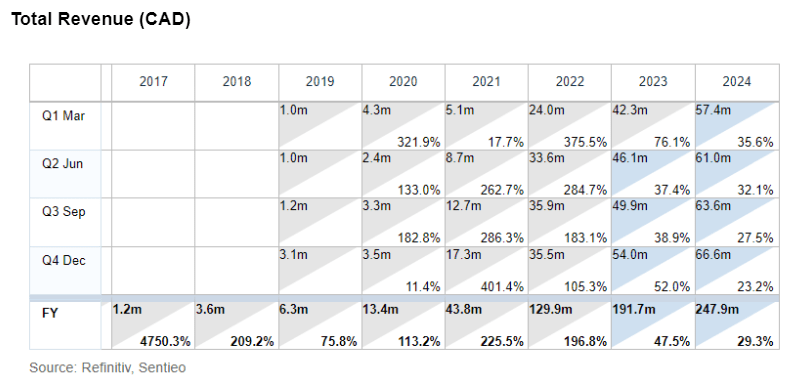

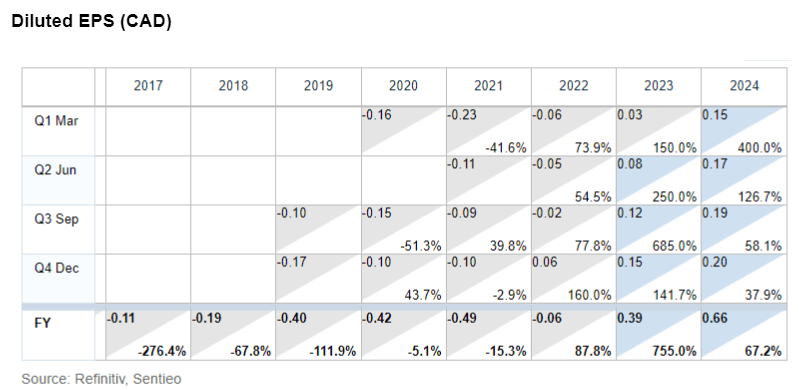

Using momentum (technical analysis indicator) by tacking stocks attaining new 52-week highs combined with our GeoPowerRanking (GPR) strategy (fundamentals) is an extremely powerful short term tool. The GPR measures the number of consecutive quarters that a company is expected to grow revenue and EPS growth.

This combo strategy captures momentum and growth inflections at the right time. The essence of the strategy is to buy an undervalued stock that is starting to get noticed and about to enter a new period of growth and sell it before the GPR worsens. It’s also useful when you want to trade around your long-term core holdings by taking on trading positions during strong GPR periods.

I love buying out of money call option trades on stocks entering a nice GPR period, hoping for a huge move in the options as the related stock moves as the company reports several strong earnings reports.

Spok Holdings, Inc. (NASDAQ:SPOK) is a great example of when, on January 3, 2023 (the day it was added to Geo’s Top 5 Favorites Model Portfolio), I said

“If you’re into options, they are available, and very playable without a high premium.”

They were trading at 15 to 20 cents, then went to $2 before their April expiration date.

Below an example of a strong revenue/EPS GPR set-up, that my team at MS Microcaps found and is tracking. Notice that the stock has strong sales and earnings per share estimates for 7 quarters, or a GPR of 7.

The company is a “global financial technology company powering digital banking and instant payment solutions for today’s gig workforce. It partners with leading platforms and marketplaces, such as Uber, Lyft and DoorDash.”

As far as shorting stocks go, I am starting to see a short-term trend, where stocks that get annihilated on bad earnings reports continue to go down over the next several days and weeks.

Fundamental investors with a hybrid approach realize that by adopting a patient and disciplined mindset “compounds” over time…but, also that short-term investing has its place.

Of course, whatever approach you take, you will still need to stick with your disciplines and monitor your initial thesis for buying a stock (or shorting it). Stories change, and sometimes you have to make the tough sell (cover) decisions when things change. Monitoring your basket of investments should be like breathing – constant. In the microcap space, if you set it and forget it, you might be making a big mistake that can set you back with regard to long and short term strategies.

part of this post is for paying subscribers

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks