Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

There’s going to be certain times when you need to think twice before believing bullish commentary from management teams. You need to understand that that bullish commentary can change on a dime. I learned this lesson when considering investing in some technology stocks right before and during the dotcom bust. At that time, as risk was escalating, many technology company management teams I interviewed commented that they saw no problem with their industry. They assured me that they’d be able to navigate an economic slowdown. Well, that couldn’t have been further from the truth as many of these companies pivoted on their bullish stance just weeks after these interviews.

If it’s one thing we’ve learned during this latest bout of economic uncertainty that has taken over the country, it’s that the term “crap shoot” was coined for a reason. By whom? Who knows? But it can most definitely be applied to what’s evolved right in front of our eyes. It’s uncertainty and certainty whipped into one nice package for you to unwrap.

Those who speak in certainties have a heavier load to carry, because with great promise comes great responsibility. If we promised on Twitter that our entire portfolio would achieve a 100% gain this year, it’s a guarantee that every eye in the investing world would be waiting for their chance to call BS by December 31 to join in on a ratioed Twitter attack mocking our chicanery that might have even Elon Musk join the fray to call us out on using his platform to spread fake news.

If we said it was probable, the same thing might occur. If we said it was “achievable” given a unique set of circumstances in the face of a year that’s challenged the best of the best, it’d be a whole different story.

So, where are we going with this? To the term “grain of salt”, another phrase of which the origin escapes me, but is most applicable to our current situation. Because, in the world of stocks, if you’ve taken some executive’s comments with anything other than a grain of salt, you might find yourself in a predicament. In other words, 2022, and during the pandemic for that matter, it’s been quite the crap shoot with respect to company guidance from some management teams, be it in the microcap or megacap worlds.

Great company guidance is sometimes the elixir for the investor hungry for a chance to heed a management team’s bullish commentary, taking it straight to his or her portfolio. For some, it might be that last extra push, the cherry on top of a journal of research supporting the investment.

Here’s where it gets a little muddy, though. It’s safe to assume that most executives believe everything they say. But at some point, management could be just as in the dark as investors and it is our job to figure out if we can believe management commentary in light of some of the facts.

Take staffing, for example. When we wrote about the staffing trio of Rcm Technologies, Inc. (NASDAQ:RCMT), Mastech Digital, Inc (NYSE:MHH) and Tsr, Inc. (NASDAQ:TSRI) on April 11, 2022, we addressed the bullish trends that arose as a Covid-induced side effect of the lack of talent available across multiple industries.

All three companies were rather bullish on their industry outlooks, even though talk of layoffs started brewing as the Fed began taking a tough stance on inflation through an aggressive promise to increase interest rates until inflation comes under control.

Obviously, a concern of ours was that staffing companies could be impacted by the Fed’s decision. On the other side of the coin, could they be insulated from the risk of increased layoffs in a tight labor market?

We put a larger focus on RCMT since we found extensive, relevant earnings conference call commentary from the company’s Executive Chairman, Brad Vizi, who cited sourcing, securing and retaining talent as the keys to success in an environment where those three facets were/are becoming increasingly scarce. He specifically focused on the growing RPO market that can be applied to various verticals.

RPO stands for “recruitment process outsourcing. It is a business model whereby a company outsources the management of the recruitment function (in whole or part) to a third-party specialist to drive cost, quality, efficiency, service, and scalability benefits.” (Src: Hudson RPO)

“The wide-scale adoption of the RPO model represents a $5.5 billion plus market opportunity and is quickly gaining steam within a fast-changing labor market where demand for talent is outstripping supply. This model is a win-win for RCM and our partners as it represents a more holistic solution for the client and has enabled us to establish longer-duration contracts with blue chip customers across health care, pharma and life sciences.”

He continued to explain the model’s application to the education industry and how it represented a transformational approach, through RPO, to aid in delayed cognitive development, anxiety, social stress, mental health, behavior, and scholastics. He also talked about how their emphasis on remote nurse staffing was a new growth channel that was gaining traction.

Well, it worked, and to be fair it was more than a pitch. The company put together a couple quarters of incredibly strong quarterly financial results.

The stock rose from around $13.17 at the time of our article to a peak of about $28.00, before retreating to current levels near $15 per share. While it is still outperforming its peers, we always have to be pragmatic about our expectations, since we are well aware that there are caveats to every story, and staffing is not immune, as evidenced by the most recently reported quarters across a few other companies. But a little further down we’ll talk about why RCMT might be an outlier, for now.

Otherwise, this past quarter is an example of the slight 180’s management of staffing companies took when it came to tempered forward-looking statements that were in contrast to very bullish outlooks conveyed during the last several quarters, coming out of the pandemic.

Let’s take a look at Hudson Global, Inc. (NASDAQ:HSON), Mastech Digital, Inc (NYSE:MHH) and Caldwell Partners International (OOTC:CWLPF) (CWL.TO), staffing companies who all included some form of caution in their calendar Q3 press releases and conference calls, which to us represent miscalculations induced by in-the-moment trends that would assumedly accelerate. If you are interested in investing in such companies, we’ve put together a few CliffsNotes (adapted from this Tweet) that drive this point home.

2022 Third Quarter CliffsNotes on Staffing Industry: Management Commentary in Press Releases and Conference Calls

MHH Q3 2022 results (missed estimates, weak commentary):

- Sales of $63.1 million vs $59.5 million in the prior year

- Non-GAAP EPS of $0.33 vs $0.38 in the prior year

Press Release: Demand for the Company’s IT Staffing Services segment showed some weakness in assignment starts compared to the previous quarter. Additionally, project ends remained elevated during the quarter, which resulted in a decline of 30-consultants on billing.

Our IT Staffing segment, on the other hand, delivered positive financial results in the third quarter, although we did experience some decline in staffing demand as we’ve seen customers controlling their staffing spend in anticipation of potential recessionary conditions.

Conference Call: We will continue to monitor activity levels in Q4 to assess if this was an aberration or the beginning of a shift in market dynamics.

–

CWLPF (CWL.TO) fiscal Q4 2022 results (strong year, cautious commentary)

- Sales of $23.6 million vs $41.6 million in the prior year

- Basic EPS of $0.10 vs $0.039 in the prior year

Press Release: “While we celebrate our accomplishments in fiscal 2022, we are focused on the future. We have seen the business leaders at our clients become more cautious with concerns about an economic downturn or recession on the horizon. This has translated into a reduction in hiring demand, especially in the technology and retail sectors. We saw headwinds begin late summer and build through early fall – especially in our IQTalent segment, whose clients are weighted towards the technology sector. Accordingly, we have taken actions to right size the staff with business levels for the near term.”

–

HSON Q3 2022 results (disappointing quarter, weak commentary, missed estimates)

- Sales of $48.6 million vs $35.0 million in the prior year

- EPS of $0.30 vs $0.49 in the prior year

Press Release: “The third quarter’s results were impacted by a reduction in Project RPO work as well as a slowdown in hiring activity in the technology sector, which is expected to continue into 2023. Despite these headwinds, activity at most existing clients remains robust and our sales pipeline is heavily focused on the healthcare sector. We are confident in our ability to manage the business in this environment, and we remain well positioned to respond to the needs of our clients going forward.”

Conference Call: Further, I’d like to emphasize that our enterprise RPO work, which comprises approximately 75% of our business, is holding up very well. That said, we did have temporary operational challenges at 2 of these clients in the quarter, which have since begun to abate. The remaining 25% of our business, which consists of recruiter on-demand work for the technology sector and project RPO work, is where we have begun to see a general slowdown.

–

So, circling back to RCMT, this darling of ours went a slightly different route with its Q3 2022 commentary, staying away from any verbiage that might lead investors to believe that anything was less than copesetic at the company.

RCMT Q3 2022 results (excellent quarter, beat estimates)

- Sales of $58.2 million vs $45.5 million in the prior year but below analyst estimates of $61.9 million

- EPS of $0.33 vs $0.24 in the prior year and beat analyst estimates of $0.28

However, this leaves us to wonder if the company is slightly lagging behind in any future weakness due to its involvement in staffing areas increasingly under pressure by a stressed economy.

There has been a very noticeable trend in the IT sector in the last few months that underscores the need for us as researchers to determine exactly how certain initiatives at companies like RCMT will be affected: LAYOFFS:

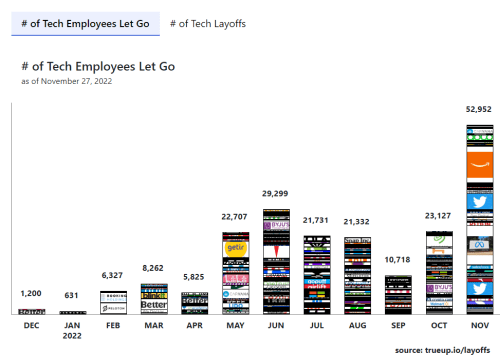

The November 2022 pre-holiday spike in layoffs across the likes of Amazon.com, Inc. (NASDAQ:AMZN), $TWTR and $META are representative of a wide swath of companies that have in aggregate let go of 202,911 employees as of 11/27/2022, so we have the whole month of December to wait for what could be an even more dismal tally.

While RCMT is strategically diversified across segments like Engineering, Specialty HealthCare, Life Sciences and Information Technology, and as explained above, its strategic foray into Scholastics verticals, we have to get a grip on how this diversification might balance out RCMT’s growth in the short term should the company get exposed to the unavoidable dynamics of a recession, and as the United States recovers. In other words, exactly how insulated is RCMT?

We have to also consider a few other things. Analysts are expecting a slowdown in RCMT’s growth rate, putting a ding in RCMT’s GeoPowerRanking (GPR) criterion that helps us qualify companies as candidates to experience strong near-term stock momentum. GPR represents the number of consecutive quarters that a company is estimated to grow EPS more than 20 to 30 percent.

You might say that the company has been beating estimates handily. So, maybe the analysts have it wrong. However, the margin by which the company is beating estimates is considerably narrowing, meaning that they might be modeling the company’s growth more accurately moving forward, in which case we’d be able to trust the estimates a little more.

More importantly, the company provided us with some useful information it its Q3 2022 conference call, where management talked about sales general and administrative expenses possibly increasing in order for the company to meet long-term EBITDA targets. We need to ask ourselves if analysts have baked a higher expense assumption into their estimates.

“We’re not interested in being a $30 million EBITDA company for very long. We’re — Bradley and I here want to get this to $100 million in EBITDA. and we’re not going to do that without increasing SG&A. Simply, we have to increase SG&A to make more EBITDA and to drive the stock price. Now we have to do it wisely, but we absolutely have to invest in SG&A to grow the company. And I think if we look at this company historically, that’s an area where we’ve made some mistakes, where we’ve been hesitant to make investments. And part of our performance in the past is investing in SG&A.”

In the end, should we really believe the RCMT is going to be any different than the rest of its peers, outperforming them quarter over quarter, or is the party about to come to a halt?

The company’s Q4 2022 might tell the tale, and we’ll know a few months from now.

But the real question we need to ask ourselves, is do we even want to deal with the current uncertainties in the staffing industry?

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.