Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Last week, we discussed 1. How investors give demerits to management teams that don’t treat their shares outstanding like gold and end up diluting shareholder interests and earnings per share over time by issuing excessive shares, and 2. How some management teams, such as Nv5 Global, Inc.’s (NASDAQ:NVEE) team, demonstrated how to judiciously issue shares without overly diluting, particularly when growing through an acquisition strategy.

We’d like to visit another story that could just as well have been part of our last weekly segment to prove that some management teams just get it right. We wanted to offer it up as another example of an almost perfect implementation of the use of capital, be it raised funds or cash on hand, to grow a company in an accretive manner through acquisitions.

It’s basically a testimony on the fiduciary responsibility of public companies to handle the funds the way a public company should, as expected by shareholders..

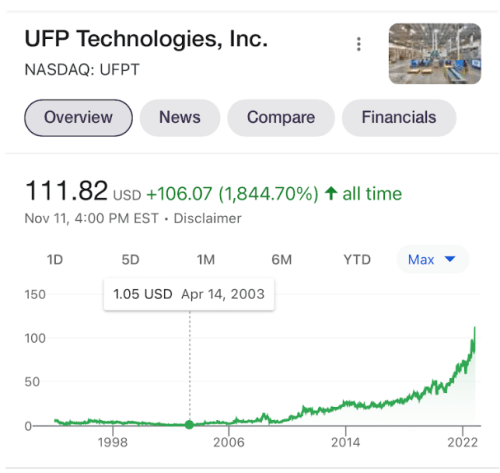

The company in focus today is UFP Technologies, Inc. (NASDAQ:UFPT). The Company is a designer and custom manufacturer of components, subassemblies, products and packaging utilizing highly specialized foams, films, and plastics primarily for the medical market.

Its diversification extends to providing highly engineered products and components to customers in the aerospace and defense, automotive, consumer, electronics, and industrial markets.

What shareholders of this once microcap company have been able to ride is its success to organically grow through accretive acquisitions early on, and it still happens to be UFPT’s current strategy as stated most recently in its 2021 10K. Since we took a look at NVEE’s similar approach to responsible growth while maintaining its stewardship to its shareholders, we’ll take a small look at UFPT, particularly through the lens of share count vs. EPS from 2003 to 2022.

More specifically, in 2003 UFPT outstanding shares were 4.68 million, compared to 7.54 million today, an increase of 61%. Sales grew 470% during that same period, to $348.2 million (including Q4 2022 estimate). From 2004, the first year net income was positive, to the end of fiscal year 2021, net income grew 31,000%, while earnings per share grew 1,129%. That is what accretive growth looks like. Actually, this is what it looks like:

Why are these numbers so important? It shows that despite the issuance of shares, the company was able to substantially grow its earnings per share at a much faster rate than the increase in newly issued shares.

The more important point is that it shows that management gets an A+ in implementing a highly accretive earnings per share acquisition strategy.

Acquisition history

| 3/17/2022 | Advant Medical Ltd. |

| 12/31/2021 | DAS Medical |

| 10/31/2021 | Contech Medical, Inc. |

| 2/2/2018 | Dielectrics, Inc. |

| 12/31/2012 | Packaging Alternatives |

| 9/3/2009 | Advanced Materials Group |

| 7/8/2009 | E.N. Murray |

| 3/12/2009 | Foamade Industries |

| 1/4/2000 | Simco Industries |

| 12/1/1998 | Pacific Foam |

| 2/4/1997 | FCE Industries |

| 1/1/1993 | Moulded Fibre Technology |

Most recently, the company had enough cash on hand to execute M&A transactions that added to its bottom line. The year 2022 will happen to be UFPT’s biggest net income generating year in its operating history, $348.2 million per analyst estimates..

“Throughout fiscal 2022, the Company plans to continue to add capacity to enhance operating efficiencies in its manufacturing plants. The Company may consider additional acquisitions of companies, technologies, or products that are complementary to its business. The Company believes that its existing resources, including its revolving credit facility, together with cash expected to be generated from operations, will be sufficient to fund its cash flow requirements, including capital asset acquisitions, through the next twelve months.”

So, the question is, has this company become so efficient that it will no longer have to issue shares to make acquisitions? It seems that is where UFPT has landed for the time being.

Of course, UFPT is an extreme case of a multibagger on steroids. It’s nice that they were able to find the right secret sauce to exercise in accretive acquisition strategy, but a key point to heed is that while we highlighted an aspect of the company that made it appealing and successful, it’s just one component to look for when vetting out the highest probability multibaggers. There will be more on that in the coming weeks and months for sure.

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.