Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

If you’ve ever worked in an office environment (yeah, remember those days?), one of your co-workers might have gone around from cubicle to cubicle looking for people to contribute $5 for an overwhelmingly miniscule chance at winning an exceedingly large Mega Millions lottery jackpot. Tomorrow’s drawing is for $1.9 billion, a Guinness Book Record for the world’s largest ever.

It’s probable that in the back of everyone’s mind, whether they admitted it or not, they thought that every extra dollar that was put into the office lottery pot was one extra splinter of dilution poking at the potential windfall. I even remember wondering what the heck the organizer was doing when he or she, literally 100% of the time, let a few stragglers into the melee to dilute me even more. Quite peeving actually.

What we effectively represented were shareholders in a temporary enterprise that had no problem issuing more tickets with zero incremental benefits.

Losing was always a fleeting 1 second snapshot of disappointment. In reality, we all knew that 100 extra or so tickets didn’t really increase the chance of winning – it just lowered your chance of being able to retire, buy your own island and forget life for a while. So, good luck if you partake in tomorrow’s mammoth drawing.

Public companies do the same thing with their shares all the time. And we think it’s often dumb, because a good amount of the time the reasons they do it don’t translate into elevating shareholder value.

There are exceptions, but our standards are high, so those exceptions better not disappoint.

On most occasions, our microcap company standard of 50 million or less shares outstanding is and will always be unwavering. Now, you’re probably saying, ”it’s not the number of outstanding shares that matters, it’s the value per share of certain statistics like earnings per share and valuation ratios like price to earnings and price of sales multiples that matters when determining if a stock is undervalued.”

While this may be technically true, think about it this way – A company that has a lot of outstanding shares may be giving you a clue that multiple offerings came about because the company was unable to use the money it’s been raising to grow cash flow, potentially raising red flags on the effectiveness of management.

If you’re new to #microcaps, please understand that the sooner you decide to avoid stocks with high outstanding shares & mgmt. who give out shares like candy, your odds of success will materially improve. Shares outstanding are the window to the soul of a microcap mgmt. team. pic.twitter.com/YEqTWiS46r

— Maj Soueidan (@majgeoinvesting) November 1, 2022

From our experience, our outstanding share requirement is even more applicable to penny stocks selling under a dollar.

We of course don’t want to scare you away from every stock that strays from our share count norm, as it is only 1 of 7 quantitative criteria that count towards our ultimate determination of what constitutes a potential Tier One Quality microcap stock on a quantitative basis.

In a recent tweet thread about growth at a reasonable price (GARP), Ij touched upon the pool of stocks on which we have to do some deeper dive research based on the preliminary output of a stock screen that we are working on, and we were pleased with the results.

We know we are moving in the right direction when over 230 stocks meet all 7 criteria, and around 1000 meet 6 of them. The other 3 criteria are qualitative in nature, and require more of a human or manual touch to drill down to whether they are satisfied.

11/25 Based on a Screener I’m building with @JanSvenda to identify Tier 1 Quality stocks, 232 U.S. OTC microcaps meet 7 out of 7 quantitative criteria & 1K meet 6. To learn more about #InfoArb screens I’m building please go here: https://t.co/ZADcOQb6un @MicroCapHound pic.twitter.com/9XSRvwodev

— Maj Soueidan (@majgeoinvesting) October 20, 2022

While we feel that share count is one of the more important factors in this screen, there are exceptions when a little leeway can be given:

- There is an immediately accretive acquisition lined up such that EPS will get a noticeable boost.

- The company has the ability to grow revenue and earnings per share fast enough to offset the dilution from a standard equity raise that generates new capital.

- If a new management has taken over at the helm, they cannot be held responsible for inheriting the dilution mishaps of past management that resulted in a large share count. Often you’ll see these new teams execute a reverse split to wipe the slate clean.

Again, we don’t take the failure of a company to adhere to an insufficient share count lightly, so the other 9 line items have to make a very compelling case for the stock to remain in our pipeline.

A prime example of when a company rolls out a solid plan in the aftermath of share issuances occurred with Nv5 Global, Inc. (NASDAQ:NVEE). Our May 13, 2016 note on one of the company’s instances of dilution echoes our thoughts and opinions of such moves.

In the case of NVEE, now trading at ~$140, or nearly 900% over our very initial call to action on the stock at $14/share, that opinion was more than tempered by the company’s actions and stated goals (Note the price of the stock in this 2016 premium note!):

NVEE ($29.13; marked down to $27 pre market) – Shares of NVEE are marked down slightly over a $2 due to the announcement of a public offering of 1.7 million shares at a price of $26.25. Investors should note that management states it plans to use the funds for a potential acquisition of Dade Moller & Associates (private company) and other possible acquisitions. While we are never a fan of dilutive events, in NVEE’s case, with management’s proven acquisition strategy we feel confident management will use the funds for what will ultimately be another accretive acquisition(s). Last May, NVEE announced an offering of $1.4 million shares at a price of $19.50. Shares were trading at around ~$21 at that time and dipped slightly on offering news. The Company announced two accretive acquisitions over the next two months that added over $45 million in revenues. The stock quickly recovered and has been hitting new highs. We would expect a similar occurrence with this offering. Please note that NVEE is up ~40% since our February 2016 call to action, and shares are now trading at a more reasonable/fair P/E. We may look to add to our position on steep pullbacks.

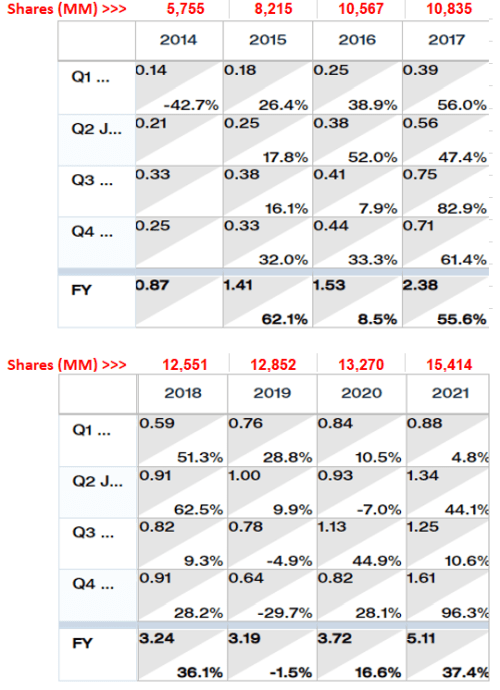

Since 2014, NVEE has issued about 10 million shares, but has found a way to grow its EPS consistently, year over year, from $0.87 in 2014 to $5.11 in 2021. Now that’s some execution. Check out the last 8 years, our coverage period on the company:

On the other hand, let’s look at Smart Employee Benefits Inc (OOTC:SEBFF) and Muscle Pharm Corp (OOTC:MSLP), two companies on our Run to One Model Portfolio that have been going through restructuring processes to grow revenue and turn a profit.

Both companies had outstanding share counts well over our minimum threshold, but we decided to make an exception because we connected with managements’ visions. However, over a year after they landed on our portfolio, both companies’ restructuring initiatives have not taken hold as expected. They’ve had to continue to issue more shares to pay the bills and execute their plans – basically, to stay afloat.

To be fair, in the case of MSLP, the company was blindsided by the effect inflation had on its gross margins just at the time it seemed like its restructuring plan was about to inflect.

Shares of the companies have dipped dramatically in the last several months of trading. This subject also brings up why we view insider ownership as such an important criteria on our list.

Our hope is that management teams that own a large stake in the companies that they’re running will make sure that they issue shares for the right reasons and will be effective stewards of the use of capital to minimize the impact of dilution on earnings per share.

–

Hi, part of this post is for paying subscribers

Already a paying member? Log in and come back to this page.

—

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.