Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

The news of William O’Neil’s passing on May 28, 2023 stirred memories of my early ventures into the world of momentum (aka Momo) investing. O’Neil was an American investor, entrepreneur, and author of several books, most notably “How to Make Money in Stocks” and “24 Essential Lessons for Investment Success“. He was the founder of Investor’s Business Daily (IBD) in 1984 and the creator of the CANSLIM investment strategy. (more on that later)

When thinking about his significant contributions to the field of stock market analysis and investment strategies, I found myself in a nostalgic headspace back to the days when I obsessively began tracking stocks attaining new 52-week highs, armed with nothing more than a pen, paper, and the Wall Street Journal/Baron’s.

The act of recording these upward surges in a handy three-ring binder became my personalized version of CliffsNotes, something that I’ve been more frequently trying to reproduce, just without the writing utensils. This turned out to be an invaluable resource that guided me through my early years in investing.

William O’Neil’s lasting fingerprints can be seen everywhere as he has built an army of momentum investors, with 100,000 digital subscribers (90% of revenue) to the IBD. Numerous websites, such as Barchart.com, along with trading techniques and value investing strategies incorporate the concept of momentum. In May 2021, News Corporation (NASDAQ:NWSA) acquired IBD for $275 million.

I am grateful for the impact he has had on my own investing journey and the inspiration he has provided to countless others seeking success in the financial markets.

The Basics Of William O’Neil Momo Strategy

If using momentum is part of your investment strategy, then there is a good chance that you’ve heard of William O’Neil. He left a mark on the world of finance with the creation of the CANSLIM investing strategy and is best known as the founder of Investor’s Business Daily (IBD).

O’Neil’s approach to stock selection merges stock fundamentals with technical analysis, emphasizing the importance of identifying stocks with robust earnings growth, and solid financials. The core of O’Neil’s ranking system boiled down to two numbers:

IBD SmartSelect Composite Rating:

- The SmartSelect Composite Rating evaluates stocks based on various fundamental and technical factors, including earnings growth, sales growth, profit margins, return on equity, and other key metrics. The rating ranges from 1 to 99, with higher numbers indicating stronger overall performance and fundamental strength. The composite is basically an overall ranking that takes into consideration more targeted rankings, as explained below. (Source: IBD)

IBD Relative Strength Rating:

- The Relative Strength (RS) Rating, something most of us are familiar with, measures a stock’s price performance relative to other stocks in the market. It looks at a stock’s price trends, volatility, and ability to outperform the broader market. The RS Rating ranges from 1 to 99, with higher numbers indicating better relative price strength compared to other stocks. (Source: IBD)

IBD Earnings Rating:

- The earnings ranking is proprietary Earnings Per Share Rating that allows you to quickly identify stocks with the strongest profit growth. The EPS Rating takes into account the growth and stability of a company’s earnings over the past three years, with extra weighting put on the most recent two quarters. (Source: IBD)

Institutional Ownership Rating:

- In addition to the stock rankings based on fundamental and technical analysis, IBD also provides an Institutional Ownership ranking. This ranking evaluates the level of institutional buying or selling activity in a particular stock.

It provides insights into whether institutional investors are accumulating or reducing their holdings in a given company.

IBD’s Institutional Ownership ranking is expressed on a scale of A to E, with A indicating high levels of institutional buying and E indicating significant selling.

His influential book, How to Make Money in Stocks, remains a cornerstone for aspiring investors, providing invaluable insights into successful trading. O’Neil’s innovative strategies and educational contributions have solidified his position as a pioneer in the investment world.

More on William O’Neil’s CANSLIM Method

When I eventually learned more about William O’Neil’s approach to investing, it made total sense. His CANSLIM Method combined technical indicators, such as momentum, with fundamental analysis to create a robust investment strategy as a starting point for investors that connect with a momentum strategy.

CANSLIM represents a set of criteria for selecting stocks with the potential for significant growth. Each letter in CANSLIM stands for a specific factor to consider when evaluating investment opportunities.

“C” – Current quarterly earnings per share, which should show substantial growth.

“A” – Annual earnings growth, indicating a history of consistent profitability.

“N” – New products, services, or management initiatives that can drive future growth.

“S” – Supply and demand, assessing the trading volume and price movement of a stock.

“L” – Leaders or leading companies within their industries.

“I” – Institutional sponsorship, indicating if professional investors are interested in a particular stock.

“M” – Market direction, which assesses the overall trend and health of the market.

By combining these factors, O’Neil’s CANSLIM method offers a comprehensive and systematic approach to identifying potential high-performing stocks.

My Early Approach To Momentum Investing

O’Neil’s passing had me reflect on my early days as an investor because I started my investing journey as a momentum investor.

Before I became aware of him, I was tracking new highs and new lows, hoping to uncover a winning strategy with little effort. Yes, I was being lazy!

Yet, it quickly became evident that blindly buying stocks at either extreme without any further analysis yielded unsatisfactory results, yet pretty similar subpar returns.

This was all taking place fresh after reading Peter Lynch’s first book, One Up On Wall Street, which led me more down a fundamental path to investing, as well as using the Value Line publication to help me with my research.

You might not know this, but The Value Line introduced a “momentumish” concept in 1931, before O’Neill started writing about it in1950. Like IBD, Value Line had two rankings at the time I was using it:

Timeliness™ Rank:

- Value Line’s Timeliness™ Rank indicates the expected relative price performance of a stock over the next six to 12 months compared to the approximately 1,700 other stocks in their coverage universe. It ranges from 1 (Highest) to 5 (Lowest). A lower rank suggests the stock may underperform the market, while a higher rank implies potential outperformance. (Source: Value Line)

Safety™ Rank:

- The Safety™ Rank assesses the total risk of a stock relative to other stocks in the Value Line universe. It considers factors such as financial strength, stock price stability, and earnings predictability. The Safety™ Rank ranges from 1 (Highest) to 5 (Lowest), with a lower rank indicating higher risk and a higher rank indicating lower risk. (Source: Value Line)

Technical Rank

- The Timeliness Rank™ is designed to predict stock price movements over a three to six month time period. In each case, stocks are ranked from 1 to 5, with 1 being the highest ranking. Further, it is based on price movement factors, and should be considered in conjunction with the Timeliness rank. (Source: Value Line)

So, I basically decided that I would want to scan for timely stocks trading under $30 via new 52-week high lists as my initial screen to bring stocks into my research funnel, supported by fundamentals to continue to dwindle down the list.

After extensive trial and error, I discovered that combining momentum with fundamentals could be a powerful tool, and I became hooked.

A big challenge I faced at the beginning of my investment journey was how to sift through a vast pool of 20,000 stocks in North America and narrow it down to a manageable selection. So, I began to apply momentum investing by focusing exclusively on microcaps, reducing the universe to 10,000 stocks. However, at that time, my universe was much smaller since I only bought stocks in the U.S.

I would further reduce my universe by eliminating industries that held less interest for me, such as financials, biotechs, oil & gas, and natural resources.

After I used these first steps to develop my total addressable microcap universe, I would move down a path of fundamental research, with reinforcements from press releases, SEC filings and management interviews to create my potential buy list. (more on these buckets another time).

Today, these steps are still a very important part of my research process.

I agree Paul. Combing Momentum + Fundamentals is such a powerful strategy. It’s all I used for the first 20 years of my investing journey and still dominates my daily research process.

— Maj Soueidan (@majgeoinvesting) May 30, 2023

Integrating O’Neil’s Strategy With My Own

Inspired by O’Neil’s methodology, I eventually devised the GeoPowerRanking a fundamental metric I developed to identify stocks entering the meat of an accelerated growth cycle, combining it with my momentum investing approach. This combination has proven to be a powerful tool throughout my investing journey.

Furthermore, very early on, I would attempt to find stocks not highly ranked using IBD and Value Line that I predicted would eventually rank high. That is what is great about investing in microcaps. We can buy stocks well ahead of the crowd and institutions.

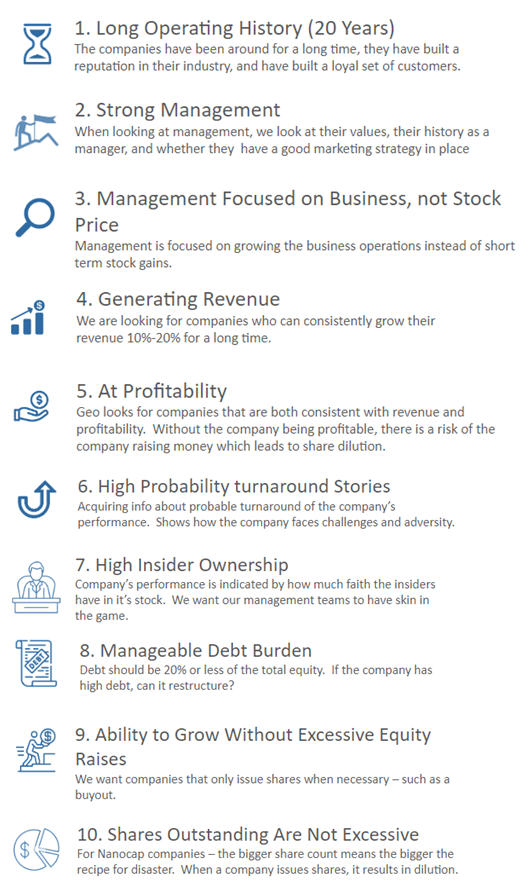

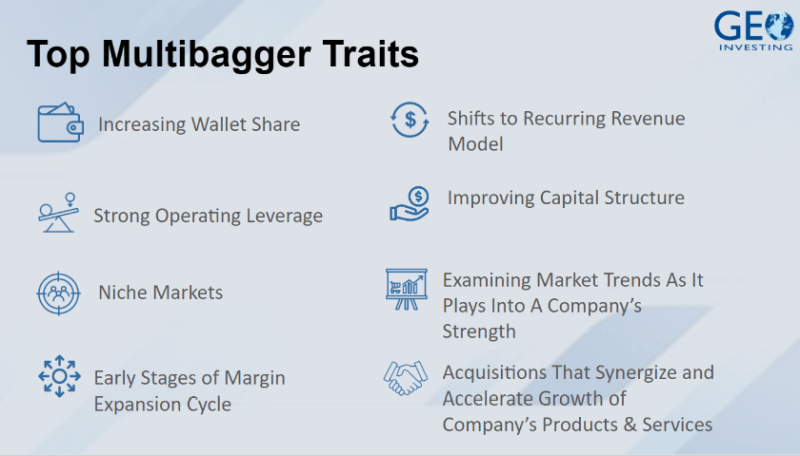

Over the years, I have continued to add elements to my strategy to increase the odds of finding quality, high probability, multibaggers by creating a Tier One Checklist and a living multibagger checklist:

By the way, there are studies that momentum investing definitely has its place in the investing world.

Eugene Fama, Narasimhan Jegadeesh, and Sheridan Titman have conducted various studies and published numerous papers on momentum investing over the years. Here are some notable publications by Fama, Jegadeesh, and Titman related to momentum:

- Eugene Fama and Kenneth French: Their influential paper “Common Risk Factors in the Returns on Stocks and Bonds” was published in 1993, where they introduced the three-factor model and discussed momentum as one of the factors.

- Narasimhan Jegadeesh and Sheridan Titman: Their groundbreaking paper “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency” was published in 1993. This paper extensively studied momentum investing and its profitability.

Here are some key statistics and findings from these papers along with other academic research that support momentum as a strategy:

- Positive Price Momentum: Studies have shown that stocks that have exhibited strong positive price momentum over a certain period (such as 3 to 12 months) tend to continue their upward trend and outperform the market in the subsequent period.

- Negative Price Momentum: Conversely, stocks that have shown negative price momentum (declining prices) tend to continue underperforming the market in the short term.

- Persistence: The momentum effect has been found to persist across different time periods and in various markets, indicating that it is not merely a random occurrence.

- Cross-Sectional Momentum: Momentum investing can be applied not only to individual stocks but also across a portfolio of stocks. Portfolios constructed based on momentum strategies have shown superior performance compared to traditional buy-and-hold strategies.

- Risk-Adjusted Returns: Momentum strategies have demonstrated the ability to generate excess returns after adjusting for risk factors, suggesting that the strategy may provide a risk-adjusted edge for investors.

- Complementary to Value Investing: Momentum investing has shown to be complementary to value investing, with both strategies providing independent sources of return. Combining momentum and value factors in a portfolio can enhance performance.

In Jim O’Shaughnessy’s book, “What Works On Wall Street,” he discusses combining momentum with other factors to enhance investment strategies. For example combining value, quality, and momentum factors can provide better risk-adjusted returns than relying on any single factor alone.

On The Cusp of GARP + Momo Excelling

It should be noted that O’Neil was not immune to head fakes. One of William O’Neil’s most notable investment failures occurred during the dot-com bubble in the late 1990s and early 2000s. O’Neil’s investment strategy primarily focused on identifying and investing in growth stocks with strong fundamentals. However, during the dot-com bubble, many technology and internet-related stocks experienced an unprecedented surge in valuations, driven by speculative investing.

O’Neil’s approach, which emphasized buying stocks with solid earnings growth and institutional support, did not align well with the speculative nature of the dot-com bubble. He famously warned about the excessive valuations and irrational exuberance in the market during that time but acknowledged that his warnings were not heeded by many investors.

During the dot-com bubble, O’Neil’s investment style faced significant challenges, as many of the growth stocks he typically invested in experienced sharp declines.

This has relevance with respect to today.

Some of my best record breaking investing years occurred after the dot com bubble burst, when value investing mattered again and I now believe we are in a similar situation.

Up until the 2022 correction and bear market, value investing was in a 15-year drought as low interest rates and quantitative easing supported speculative investing and an “earnings don’t matter” mentality.

The ensuing 2022 correction reminds me of the post dotcom set-up, which is why I believe growth at a reasonable price (GARP) + momentum style strategies that we are aggressively employing at GeoInvesting are going to handily beat the market over the next several years.

ICYMI here are some of these related thoughts:

1/25 #TheGreatHeadFake: Why we’ll look back at this market correction & conclude that it was a huge head fake. Mark my words, we’re entering a multiyear bull market for forgotten growth+value stocks. Fundamentals to take centerstage. #Thread

— Maj Soueidan (@majgeoinvesting) October 20, 2022

Have a great investing week!

Maj Soueidan, Co-founder

with Zou Soueidan, Senior Editor

part of this post is for paying subscribers

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks