Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and reply with any feedback.

This post was first published on GeoInvesting Pro Portal. You can access it here, where additional premium content was included along with the complimentary Commentary below.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

By Maj Soueidan, Co-founder, GeoInvesting

A few weeks ago, I wrote an article, “Hall Of Fame Pitcher Nolan Ryan Would Be A Great Microcap Investor,” after being inspired by the Netflix, Inc. (NASDAQ:NFLX) special, “Facing Nolan.”

Well, that’s not the only Netflix special that caught my attention that I related to investing. Last year, I got into watching Empire type series on Netflix with a woman I was dating, Vivi. She was well versed in this subject and prodded me to watch “Roman Empire.” During season 1, episode 1, the series began highlighting Marcus Aurelius, the 16th Roman Emperor and a philosopher who ruled from 161 to 180 AD. He’s been described as the last great Roman Emperor.

Vivi and I ended up getting into a deep discussion on some of his philosophies. Well, Vivi actually schooled me!

It doesn’t take too long into an investing journey when you realize that the stock market can be a rollercoaster of emotions. Even though my conversations with Vivi took place months ago, I recently started thinking about Marcus Aurelius again and all of a sudden realized that some of his teachings perfectly correlate with becoming a better investor, especially pertaining to microcaps.

More specifically, it’s worth exploring how Marcus Aurelius’ principles of Stoicism can be applied to investing, helping us maintain perspective, emotional resilience, and sound decision-making.

Marcus Aurelius and Stoicism

Before we jump in, let’s talk stoicism. Aurelius is known for his philosophical writings and teachings, particularly his collection of personal reflections and thoughts known as “Meditations.” Marcus Aurelius was a practitioner of Stoicism, a school of philosophy that emphasizes personal virtue, rationality, and self-control as the path to true happiness.

Stoicism teaches that people should focus only on what they can control in life, like their thoughts, actions, and attitudes, while accepting the things they can’t control, like external events and the actions of others. It emphasizes the importance of living in accordance with nature and reason, striving for wisdom, courage, justice, and self-discipline— all of which can be applied to your behavior and managing your emotions while investing in the stock market. Below we’re breaking down the top four stoic teachings that may help give you an edge in the stock market.

Tips for Aurelian Investing

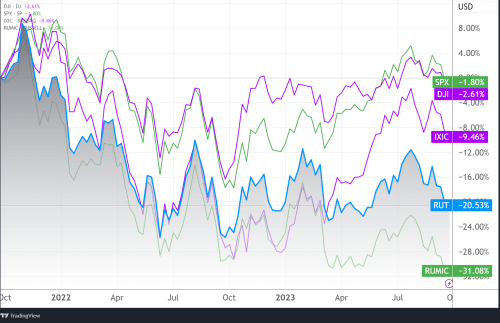

Investing can cause emotions to often run high. For example, the last 2 years’ volatility supports this case:

But, it’s been an extra challenging market for smaller cap investors. As you can see, investing in small cap stocks has been brutal, as measured by the Russell, 2000 Index (RUT), and even worse, the Russell Microcap Index (RUMIC) versus other major indexes. Since October of 2021, while the major indexes are just about struggling to break even, the RUT and RUMIC have languished to a level way below the dryline, at negative 20.5% and negative 31.1%, respectively.

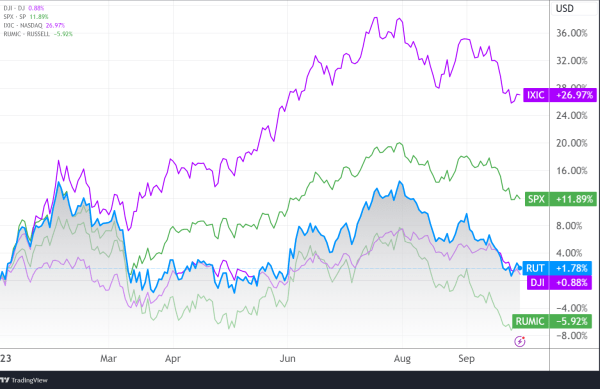

In 2023 year-to-date, the RUT is up just about 1.78%, the RUMIC is down 5.92% vs. the NASDAQ, which is up 27% for the year, while the DJI and S&P 500 (SPX) are up 0.88% and 11.9%.

Even if you’re picking some great stocks that are going up, the volatility in some of these stocks has been crazy. It’s not uncommon to have a stock go up 100% over a few months and then lose 50% for no reason rather quickly, regardless a valuation.

The principles of Stoicism might be able to help you stay anchored. By delving into what we’ll call “Aurelian Investing,” I’ll explore how Stoicism can guide us in managing behavior and emotions. I’ll break down a few tips for applying these teachings into your investment mindset.

To be clear, I’m not writing this article from the perspective of being a day trader relying more on charts and technicals. It’s tailored more towards those who make decisions based on fundamental investing principles. That being the case, I’m sure that even traders can apply some of Marcus Aurelius’ principles, making sure they stick to their plan and disciplines, as opposed to getting caught up in emotions.

1. Focus on What You Can Control

One of the fundamental tenets of Stoicism is the idea of focusing only on what is within your control. In the stock market, there are a ton of factors beyond our control – including market sentiment, macroeconomic trends, and company-specific events, to name a few. Marcus Aurelius would advise investors to concentrate on their own actions and decisions, rather than obsessing over external factors that you can’t control.

Applying Stoicism to an uncertain world of microcaps, arming yourself with knowledge would make you better prepared to make informed decisions and navigate the unpredictable world of microcaps with conviction.

I’m a big believer that a great research process that helps build conviction in the stocks that you are buying, as well as understanding what stocks you should no longer be owning can go a long way in shaping your success as an investor.

With microcaps, thorough due diligence takes on a whole new level of importance. Imagine you’re a Stoic investor looking into a new microcap stock. You’d want to channel your inner Marcus Aurelius by emphasizing the need to meticulously research these companies. That means digging into their financial reports, scrutinizing the competency of their management teams, and understanding their potential within their niche markets.

It also means understanding how to know what risk factors may compel you to avoid investing in a stock or the chances that a risk factor might be resolved, resulting in a potential upward revision of valuation multiples.

However, you also have to understand what type of investor you are to help define your appetite for risk and whether you’ll be more of a long-term investor, or a short term investor. You also might want to consider if you have more of a mindset to be a diversified or concentrated investor.

Taking these steps could improve your chances at maintaining control over your strategy, even when the market is unpredictable.

2. Embrace Volatility

Stock prices can soar and plummet in a matter of minutes, and that’s not something we can control. Marcus Aurelius would encourage investors to embrace this volatility as a natural part of the market’s ebb and flow. In his Meditations, he wrote:

“The universe is change; our life is what our thoughts make it.”

Instead of panicking during market downturns, Stoic investors would view them as opportunities to exercise their resilience and adaptability. They understand that market fluctuations are beyond their control and that the key to success lies in how they respond to them.

Marcus Aurelius’ Stoic philosophy encourages a long-term outlook, even in the volatile realm of microcap stocks. Stoicism encourages people to use a “view from above” mentality, which stoics use to take their first person perspective into a third person perspective.

Ponder this scenario: a microcap stock you’ve invested in experiences a sudden price drop. A Stoic investor would practice the view from above, reminding themselves to avoid getting swept up in the drama and remember that this setback will likely not matter in time. Instead, they’d maintain a patient, long-term perspective, understanding that short-term price fluctuations are like ripples in a pond.

Speaking of capitalizing on fear in the markets, it’s serendipitous that we launched our 11th Buy On Pullback Model Portfolio (BOP) this past week. As we stressed:

“Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.”

3. Practice Rational Decision-Making

Stoicism places a huge emphasis on being rational, and using sharp reasoning skills to decide your actions. In the stock market, emotional decision-making can lead to costly mistakes. Trust me, I’ve made a few myself, selling stocks during a panic moment, because I was watching CNBC or staring at my computer screen. By the way, I no longer do either of these anymore.

Marcus Aurelius believed in the power of rationality to overcome impulsive reactions.

When investing, it helps to take a step back and assess a situation objectively to avoid making hasty decisions based on fear or greed. This means walking away from your trade station and checking in with your research before you make a panic sell or FOMO (fear of missing out) decision. Remember, the stock market rewards patience and discipline time and time again. That’s why having a great research process with conviction will help prevent some impulsive actions.

Referring to the article I wrote in 2018, “So You Want To Be A Full-time Investor Here’s 10 Tips,” following tip number 10…

“Manage Your Life Efficiently, Manage Your Margin”

… will help you make more rational decisions.

4. Cultivate Gratitude and Contentment

Stoicism encourages people to find contentment in the present moment and be grateful for what they have. Applied to investing, that just means appreciating the gains you’ve made rather than constantly craving more. Marcus Aurelius would caution against the insatiable desire for wealth and the tendency to measure success solely by financial gains.

By practicing gratitude and contentment, you can avoid the trap of constantly chasing returns and making impulsive, high-risk investments, especially when you see others making money in meme or fad stocks or bragging about their secret methods to making millions on social media.

I will end this discussion with two more really important thoughts.

Stay Braced Against Losses: Resilience to losses in microcap investing embodies the Stoic philosophy of embracing life’s challenges as opportunities for personal growth and development. Why? Because you are going to have to learn to live with taking losses. Stoic investors who encounter losses in their microcap portfolios wouldn’t view it as a defeat or live in regret, but as a stepping stones in their journeys towards financial wisdom.

These investors maintain their composure and refuse to let setbacks undermine their overall financial well-being. Instead, they learn from their mistakes and possibly adapt their strategies. This Stoic approach not only builds emotional resilience but also fosters a mindset of continuous improvement in the ever-changing landscape of microcap investing.

One thing I’ve learned is that thinking about taking a loss is more limiting to progress than just selling something and moving on.

Don’t Get Cocky: Overconfidence is a pitfall that Stoic philosophy warns against. Investors who becomes excessively self-assured in their knack for selecting lucrative microcap stocks puts them in a position to eventually be disappointed. A Stoic perspective acts as a reality check, reminding them of the intrinsic unpredictability within the market, and the recognition that we don’t always know everything.

By acknowledging your own limitations and embracing a rational, humble approach, you can position yourself as a better-equipped navigator of the markets. This mindset cultivates a healthy respect for the uncertainties of the market, encouraging meticulous research, risk awareness, and a readiness to adapt to changing circumstances—attributes that can help mitigate the consequences of overconfidence and enhance the chances of making well-informed investment decisions.

Being humble will also make you a much more pleasant person to be around and encourage other investors to share their stock picks with you.

Related material from the Education Hub and more:

- Manage Emotion and Behavior in Investing

- Lauren Templeton: “Investing The Templeton Way” [Transcript]

- Behavioral Finance Is Central To Value Investing

- Not All News Is Bad News

- Stock Investing, Work Ethic & Dad All Rolled Into One

- Long-term or Short-term Investing? How About Both?

- Invest For the Long Term, Assess Risk and Manage Your Life [VIDEO]

- Short Term Vs. Long Term Investing [Twitter Thread]

This post was first published on GeoInvesting Pro Portal. You can access it here, where additional premium content was included along with the complimentary Commentary above.

Tweets and Reposts From Maj’s Feed

Book Review Continued. Peter Cundill on obsessing over market timing. Not saying that understanding economic & stock market cycles is useless, but it’s amazing how so many incredibly smart people spend hours trying to predict the economy/stock market and lose money. If they would… https://t.co/fOSZBUMUNa pic.twitter.com/LJYs2kAgdL

— Maj Soueidan (@majgeoinvesting) September 25, 2023

.@stockspinoffss .. just saw this spinoff release on Cosmos Health Inc. (NASDAQ:COSM). I’m not sure if it’s worth watching, but thought to pass it along to you.https://t.co/OuVRTUcRFJ

— Maj Soueidan (@majgeoinvesting) September 27, 2023

🟩YTD 2023: +24.56% vs S&P +12%

Added two new positions this quarter.

One is Bioventus Inc. (NASDAQ:BVS).AX and the other one is undisclosed.

Had a few drags on my performance in the last two years. The main drags coming from the decision not to sell.

Most know that I own a media company.… https://t.co/TEGiX5Emww pic.twitter.com/VphZY3aOfH

— Not a CFA (@Investmentideen) September 29, 2023

Love coming across scenarios where analyst estimates substantially ignore company growth initiatives & targets. Creates awesome InfoArb set-ups when research legitimizes the targets. Digging into one. Stay tuned🤞. @GeoInvesting @MicroCapHound @JanSvenda @katerams4 @sanj_amarnani

— Maj Soueidan (@majgeoinvesting) October 1, 2023