We all want to be happy, so why are we so drawn to negative and bad news and why does it stir something up inside of us? Is it because bad news is an obstacle to our happiness, and we need to be aware of potential threats to our happiness? Could it be because so many of us like to debate and there’s no better subject material to debate than sensational bad news?

Instead, just blame the brain. When the status quo is threatened, our brains naturally respond:

“Your brain is simply built with a greater sensitivity to unpleasant news. The bias is so automatic that it can be detected at the earliest stage of the brain’s information processing.

The brain, Cacioppo demonstrated, reacts more strongly to stimuli it deems negative. There is a greater surge in electrical activity. Thus, our attitudes are more heavily influenced by downbeat news than good news.” @HaraMarano

“Biologically speaking, when we feel threatened, we usually resort to one of 3 reflex-like reactions in order to protect ourselves from more hurt: fight, flight, and freeze. Depending on the situation, our brains try to determine the most likely outcome of a conflict and assess if there is enough time to escape, sufficient strength to fight/win, or if “playing dead” is the best strategy in order to survive.” @NewStartTherapy

“These responses are not rationally chosen. Rather, they are triggered by external stimuli which cause your brain to fire almost instantly. Many of us have had experiences in the past where such a response was necessary for physical or emotional survival, and the brain has been shaped in ways to optimize these self-defense responses. The trouble is, while our reactions were probably shaped by a legitimate threat in the past, it may now be exaggerated in terms of the threat we now perceive from our partner when discussing an uncomfortable subject.”

Tom Stafford (@tomstafford on Twitter) wrote about this subject in 2014 for the BBC in a brief article, “Psychology: Why Bad News Dominates All The Headlines”. Stafford summarizes a study conducted by two researchers, Marc Trussler and Stuart Soroka, who concluded that “negative bias” is real:

“The researchers present their experiment as solid evidence of a so called “negativity bias”, psychologists’ term for our collective hunger to hear, and remember bad news. It isn’t just schadenfreude, the theory goes, but that we’ve evolved to react quickly to potential threats. Bad news could be a signal that we need to change what we’re doing to avoid danger. As you’d expect from this theory, there’s some evidence that people respond quicker to negative words. In lab experiments, flash the word “cancer”, “bomb” or “war” up at someone and they can hit a button in response quicker than if that word is “baby”, “smile” or “fun” (despite these pleasant words being slightly more common). We are also able to recognize negative words faster than positive words, and even tell that a word is going to be unpleasant before we can tell exactly what the word is going to be.”

Keep Your emotions In Check

There is no doubt that the media knows that misery, controversy or, better yet, both, sell. They know we are naturally wired to respond and debate to news of this nature. Engagement is what they want. When watching your local news channel, you need to wait until the last couple of minutes before they report the “feel good” news. The media knows that things that threaten your happiness or attainment of a wealth will capture your attention.

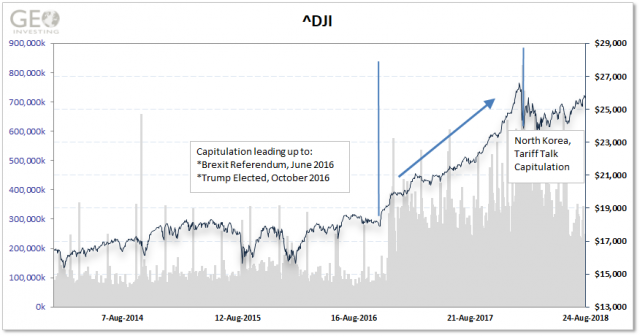

Unfortunately, when it comes to investing, we sometimes tend to make irrational decisions due to our natural impulse to “survive”. Ironically, many times when we react this way, we do more harm than good. If you sold your stocks on what some may have labeled bad news, like the Brexit referendum or Trump winning the election, you likely know exactly what I mean. And don’t forget North Korea and recent tariff talks/trade wars.

When you sell, you go into protection mode, sometimes unable or unwilling to buy back in. However, the reality of the situation is that even in the worst of scenarios, whether perceived or real, companies can quickly adjust.

Life Goes On

The media is now telling us that tariffs could lead to a doomsday scenario. The truth is that the proposed Trump tariffs will hurt some companies, but it will also help some and have little effect on others. Your goal as an investor is to do your best to assess how companies are adjusting to changes in the playing field as a result. Don’t let these externalities lead you to give up on investing.

Instead of turning to the media for answers, I like to track insider purchases during times when the market is putting downward pressure on shares of microcap stocks, where investors perceive greater risk to exist when compared to larger capitalized stocks. You can read about how to track insider transactions here.

Reading conference call transcripts to get a feel of how changes in the macro environment will impact companies is also extremely effective. The Sentieo platform has helped on this front, which loads transcripts quicker than any other affordable service that I have used in the past.

What you will likely observe after listening/reading to management on conference calls is that, just like in the past, they respond quickly and it’s not the end of world for most of them. For example, many companies that have direct links to the steel industry are seeing a short-term pop in sales and earnings as they work through older inventory purchased when steel prices were lower, selling it at higher average selling prices. You can see more about the near-term catalysts (increase in steel prices, recovery in energy sector, new product line) that are positively effecting companies like FRD here.

Longer term, as inventories begin to reflect higher costs, healthy demand and the ability to pass along higher raw material costs to customers will determine growth outlooks. A June article by Simon Constable published in Barron’s, Tariffs Won’t Dent Steelmakers, weighs in to conclude that U.S. steel companies will be just fine:

“Many of the world’s biggest metal producers already have operations in the U.S. and can shift production there to avoid the tariffs.”

And another article by Teresa Riva just published in Barron’s, Steel and Iron Stocks May Have Bottomed, references Credit Suisse’s analyst Curt Woodworth:

“Global and China steel-production data remain very bullish and while global scrap prices have seen sharp falls from the crisis in Turkey, we expect scrap prices to bounce back towards the end of 2018,” the analyst writes. “The sharp sell-off in equities and exchange traded metals in our view is overdone relative to solid physical demand.”

Overall, a good amount of management teams that could be negatively impacted by tariffs are having little trouble passing along increased costs to customers, according to their respective conference calls.

Additionally, many companies that buy components from China are finding other sources of supply that will only lead to a quarter or two of operational disruption.

Fast forward to now: the media is painting Turkey as the next doomsday event. Don’t let your brain be fooled! Instead, feed your brain by performing your research to find information arbitrage and clues that will help you find the right unjustly punished stocks.

Learn how we do it at GeoInvesting by starting here.