Over the last couple of years, I have been making an effort to watch video presentations by educators and investors I respect. Most recently I have been focusing on investing emotion.

I then like to transcribe them, so I can highlight interesting points to revisit later. Like Charlie Munger put it while giving his USC Law commencement speech:

“Without Warren Buffett being a learning machine, a continuous learning machine, the record would have been absolutely impossible. The same is true at lower walks of life. I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines, they go to bed every night a little wiser than when they got up and boy does that help particularly when you have a long run ahead of you.”

A common theme that resonates through many of these speeches is how human behavior and investing emotion can negatively influence the way we invest. It got me thinking, so I recently ran a poll on my Twitter Page asking about how vital it was to being a good investor:

It’s nice to see I am not alone in believing that emotion/behavior is important! It’s a “top 3” obstacle I have faced over the course of my investing career, along with greed and the “what if” syndrome.

[layerslider id=”38″]

Tuning out the media is easy and can be done quickly – just turn the T.V. off or close the CNBC page you may be obsessing over on your phone. As for a stock selection process, over time you will be able to develop one that’s personalized to your investing style and needs, but it’s your emotion that can keep you from pressing the “off” button on the T.V. and executing on your stock selection process that you know works. Ultimately, we are awake and lay down with our thoughts every day.

Lauren Templeton Weighs In

One video I came across drove the behavior point home. The speech, “Investing the Templeton Way,” was hosted by Talks at Google published on March 6, 2017, and presented by Lauren Templeton, president of Lauren Templeton Capital Management, LLC. Her great uncle, was the late billionaire investment guru Sir John Templeton.

This is a fantastic presentation that I recommend every investor should put on their video shelf. You can see the full transcript here.

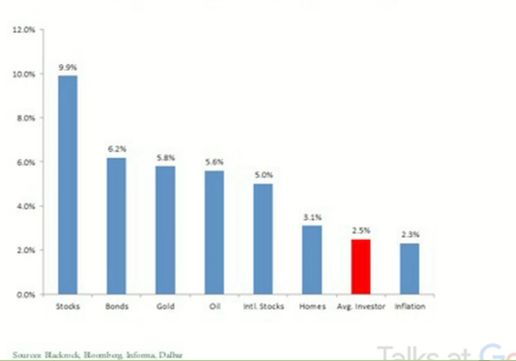

At about the 12-minute mark, Lauren starts talking about behavior and investing. She brings up a slide that highlights the returns of the “average investor” compared to various asset classes between 1995 and 2014.

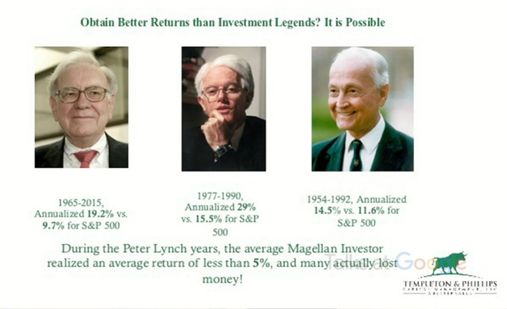

The average investors logged in a whopping 2.5% return! My initial thought after seeing this was that it just validates a belief that many microcap investors hold: a major reason some individual investors just can’t beat the market is because they are probably competing in areas of the financial markets where they don’t have an edge. Templeton continues with the following slide, highlighting the returns of Warren Buffett, Peter Lynch and Sir. John Templeton over various time spans:

Notice the passage at the bottom of the slide. Peter Lynch studied the average performance of investors in the Magellan fund for the 13 years when he was the portfolio manager. He found that they averaged just 5% annually compared to the 29% annual performance of Magellan. As much as we talk about how professional fund managers can’t beat the market, individual investors look to be far worse.

Mutual funds exist to take out some of the emotion from investing, as well as the pressure from stock picking. How was Lynch’s conclusion possible? The microcap vs. large cap debate is less relevant, since the study was performed on a mutual fund that easily outperformed the market. Lauren explains it’s all about behavior; that retail investors buy stocks when they are going up (FOMO) and sell them when they are going down (fear).

But we already knew this, so why does it matter?

Getting To Know Your Brain

Understanding the “why” can sometimes motivate you to act on solutions to problems you may have been ignoring: it puts things in perspective. For example, I am an avid tennis player. Learning that the power packed in a shot is not just about how hard you swing your racket (all arm), but more about the energy you bring to the ball through the entire body, is vital information to possess. If you told me to stop swinging so hard with no other input, as opposed to telling me why using my entire body would generate the most efficient power, I may just revert to old habits. You will be surprised at how understanding or visualizing the “why” can help you excel in certain areas.

Templeton delves into this train of thought by discussing the dueling brain: the prefrontal cortex vs. Amygdala:

“So, the way the brain works is it’s typically taking this information and processing it in a region known as the prefrontal cortex. The prefrontal cortex is involved in decision making and complex cognitive behaviors, self-control, but it’s very analytic and it’s a very slow part of your brain.

“So, we think of the brain you can think of the brain as sort of taking an information through a fire hydrant and the prefrontal cortex is like a slow leaky faucet dripping out.

Now, when your eyes and ears sense danger or if you turn on CNBC and the markets crashing and they have always got this fabulous music playing in the background that really heighten your anxiety. The problem is that your brain bypasses the prefrontal cortex and sends information to an area called the Amygdala and Amygdala controls your fight or flight response. Amygdala is a much faster process. Processes information much faster and to do so it relies on something called Mental shortcuts or behavioral finance experts call this Heuristics. And its these mental shortcuts that oftentimes get investors into a lot of trouble when they are investing.

So, I think reading about behavioral finance is really fascinating and there are a lot of books out there and I would encourage you to pick one up and read about it because once you are aware of these mental biases you actually become a better investor. You know why you are reacting on that way to really scary information.”

The lesson to be taken from this is not to activate your amygdala by exposing yourself to certain triggers like CNBC or watching the stock market on a tick by tick basis.

We Are Humans and Always Will Be: Don’t Beat Yourself Up

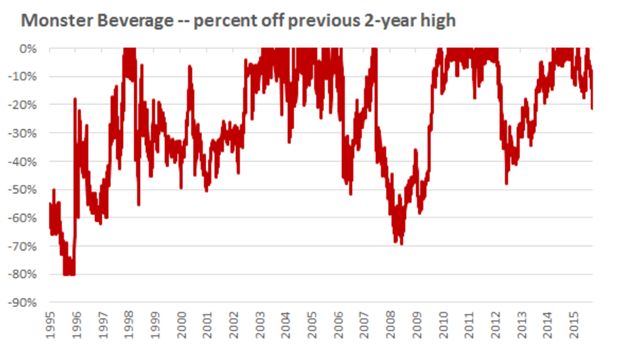

Emotions plague us all, but I have to admit that the Lynch stat did take me by surprise. It took me back to an article written by Morgan Housel which I often reference, The Agony of High Returns. He discusses the emotional roller coaster you would have had to endure to capture the multi-bagger returns Montage Technology Group Limite (NASDAQ:MONT) delivered as “the best performing stock between 1995 to 2015. It increased 105,000%, turning $10,000 into more than $10 million.” I had buried the memory of my brief interaction with MONT (which I owned at one point) around the year 2000, so this recap hit me right in my gut.

A severe amount of emotional maturity would have had to been required to stay the course. The good news is that when a stock “multibags”, you have plenty of opportunity to capture some of the gain. More importantly, many multi-baggers turn into mega-busts. What is important is that you try to base your buy and sell decisions on sound analysis. Selling a position based on emotion, compared to having an investment process, are two entirely different concepts. Focus on dealing with emotion and perfecting your process. Go here for five tips I follow to conquer my emotions.