https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING LAST MONTH

July 2022, Volume 2, Issue 6

Multibagger Case Study

Usa Truck, Inc. (NASDAQ:USAK)

Before we begin digging into the long term success story that Usa Truck, Inc. (NASDAQ:USAK) was, we’d like to address a few things. First, USAK was pitched to us by Egor Romanyuk, a very respected fellow investor several years after it went dormant from our coverage universe in 2015, as depicted in the first set of key action dates below. The first go around was as successful as the second, and our early research was validated by the final 2022 outcome.

The reason for this preface is that Egor is about to pitch another stock in the same industry, exclusively for our premium base, and it’s a pitch that we are very eager to hear given his success with stocks in the same industry.

With USAK’s acquisition depicted in key action date set #2 below, this makes 2 takeovers of the 3 stocks he has pitched to us so far, with USAK joining CAI International (acquired at a price of $56/share and pitched at price of $23).

For his Yellow Corporation (NASDAQ:YELL) idea (see his pitch here), the stock was trading at ~$3.50 and has had a roller coaster ride with the rest of the market, reaching a high of $15.24 in December 2021 only to retrace back to its current levels.

All told, those who listened to Egor could have racked up cumulative returns of 711% by investing in all 3 of his transportation stock picks pitched to Geoinvesting, stemming from his early expertise gained while working with his father in the transportation industry.

It’s hard not to be excited about this, and we think being around for the pitch would be a great opportunity to see why we love Egor’s intensity and passion for investing in transportation stocks so much.

Be around for the unveiling of the pick.

MONTHLY HIGHLIGHT

This coming Sunday we are highlighting one of our favorite investors, Peter Lynch, in our GeoWire Weekly Wrap-up, which is available to our Premium Members on Sunday evening and then to our GeoSubscribers on Monday via this link.

We wanted to preface the release of our Sunday Wrap Up with the link to the original video as well as an original write-up, by Maj Soueidan, our Co-Founder, to give you some background insight.

“Stock Shop with Peter Lynch – A Gem of a Video Discovery on Lynch’s Stock Picking Process” is one of our very favorite videos Lynch produced, and is a small snippet from a stock picking lesson multimedia CD plan called “Stock Shop,” released in 1998. Portions of the lesson, highlighting various segments from Stock Shop, can be found on YouTube.

We believe we are entering a new market environment that will see growth + value strategies making a big comeback to how investors pick stocks. Growth At A Reasonable Price, or GARP, is the practice of looking for stocks that have a reasonable valuation based on P/E ratio, and that are growing year over year on sales and earnings.

In this Sunday’s Weekly Wrap Up, we plan on giving a lesson on how to use the Peter Lynch formula combined with our own GeoPowerRanking System (GPR) and GARP, to help you set short term targets.

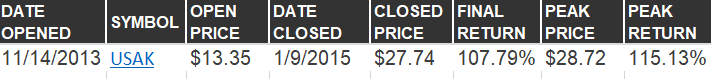

Key USAK action dates – Set 1

- 10/27/2013 – GeoInvesting Begins Initial Research

- 11/15/2013 – Added to GeoInvesting Longs/GeoBargain Portfolio at $14.15

- 01/12/2015 – Removed From GeoInvesting Longs Portfolio at $27.88 A 107.79% increase

Key USAK action dates – Set 2

- 08/08/2021 – USAK Brought Back On Our Radar By Geo Contributor Egor Romanyuk at $13.85

- 02/2/2022 – Egor Romanyuk Closes His Position At $29.09 A 110% Increase

- 06/24/2022 – USAK Is Acquired By Schenker, Inc. $31.72/sh.

USA Trucking’s Long Road To Acquisition

Usa Truck, Inc. (NASDAQ:USAK), is a truckload carrier in the United States, Mexico, and Canada. The company operates through two segments, Trucking and USAT Logistics.

We first brought USAK to our Premium Members in 2013, after we pieced together multiple pieces of Information Arbitrage and realized that USA Trucking might have been a prime candidate for an eventual acquisition. In case you are not familiar with the term Information arbitrage, or InfArb as we like to call it, it exists when:

“a disconnect between stock prices and available public information on a company is noticeable and monetarily worth pursuing. Sometimes, the mispricing of micro-caps can be substantial. This strategy has “paid dividends” for many investors. Part of the reason the “InfoArb” opportunity exists is that investors often incorrectly label ALL microcap stocks as pump & dump schemes promoting companies with no revenues and profits.”

InfoArb Clue One: Offer Already Rejected

Knight-Swift Transportation Hol (NYSE:KNX) published a presentation that we interpreted as a trashing of USAK. We viewed this as a classic ploy to keep the stock down so that Knight could try to acquire the company at a lower price. We believed Knight would have to raise its offer significantly to have a chance of acquiring USAK.

InfoArb Clue Two: 13D/G Filing Analysis – Activist Investor Gets Involved

In September 2013, a 13G filing and two November Form 4 filings showed that Stone House Capital Management acquired 1,343,830 shares of USAK, representing a 13.0% ownership interest. Interestingly, Stone House’s Form 4 showed that it purchased shares on November 14, 2013 at a price of $13.56.

On November 7, 2013, Baker Street Capital also filed a 13D where it disclosed that it owned 1,400,000 shares, or 13.3%. Specifically, Baker purchased its shares in two blocks:

- 751,277 at $13.00 on October 8, 2013.

- 648,723 at $12.85 on November 6, 2013.

Combined, Baker Street and Stone House thereafter owned 2,705,000 shares, or around 26% of USAK. Essentially, Knight would have needed Baker Street’s blessing to acquire USAK.

The fact that Baker Street and Stone House purchased shares near USAK’s 52-week high, and at much higher prices than Knight’s bid, led us to believe Baker Street also felt that Knight’s bid was too low.

InfoArb Clue Three: Understanding the 13D vs. 13G

Baker Street made sure to file a 13D, as opposed to a 13G, regarding its ownership stake in USAK. Thus, we think Baker Street would lead a charge to maximize value for USAK shareholders. A 13G is filed when an investor intends to be a passive owner in a company. However, a 13D is filed when an investor wants to leave the door open for taking an active role in defining the direction of the company, including the possibility of exerting control.

InfoArb Clue Four: Who is Baker Street?

Baker Street is:

“…a value-focused investment firm founded in 2009 by Vadim Perelman and based in Los Angeles.”

Baker had a knack for making large bets in special situation plays, and winning big. In fact, one of its past investments was in AutoInfo (old symbol AUTO), a company similar to USAK that also participated in the trucking industry. In November 2011, Baker disclosed that it bought a 9.1% position in AUTO at a price of $0.55. On March 1, 2013 the company was acquired by Comvest Partners for a $1.05, or 90% premium over cost.

InfoArb Clue Five: USAK Turnaround in Full Throttle

USAK hired its new CEO John Simone on February 18, 2013. He had 30 years of operational and management experience in the transportation industry and had worked for companies such as UPS, Ryder, and Greatwide Logistics.

InfoArb Clue Six: Knight Needs USAK

A USAK investor presentation (Slide 20) filed in October 2013 highlighted that Knight might want to acquire USA Truck, which it viewed as a hostile situation:

- Knight’s growth had stagnated.

- Needed to reinvigorate Knight’s stock price during a slow-growth period.

- Acquire USAK drivers to solve the driver shortage problem.

- Buy USAK market and route strengths east of Great Plains.

- Knight recognized USAK’s progress before the market fully reflected the true value.

InfoArb Clue Seven: Now That Activist Investors Are Involved, There Is Little Chance That Knight Will Get the Votes To Steal USAK At $9.00

In the words of USAK management from the October 2013 Investor Presentation:

- Knight opportunistically timed its proposal to capture significant shareholder value creation that rightly belongs to USA Truck’s stockholders.

- Offer fails to reflect rapid progress being made under the new and expanded management team.

- Offer does not reflect strong prospects for earnings growth.

- USA Truck’s board remains open to all strategic options that reflect the full intrinsic value of the company, including further discussions with Knight.

In the end, USAK was clearly worth more in a turnaround situation than Knight was giving it credit for. We believed a potential suitor could pay much more than where USAK was currently trading at and still have it be monetarily accretive.

On January 12, 2015 we announced that we sold our long position in USAK and uncoded it as a GeoBargain at $27.88, which was within our takeover price target range, t of $25 to $40 that was based on earnings power and EV/sales scenarios

USAK shares had risen strongly as investors speculated that lower oil prices would benefit the company’s results. At the time, we had exposure to several other oil related plays and wanted to lock in profits.

Egor Romanyuk And His Trucking Trifecta

Egor’s experience and knowledge in the trucking industry has been leading him on a path to find what he feels to be some of the better transportation-focused companies. He has brought GeoInvesting’s Premium Subscribers 3 different contributor picks since 2019, boasting an average peak return of 237.12%.

In his first conversation with Maj in April 2021, Egor explained why he invests heavily in transportation companies, capitalizing on a true “buy what you know” philosophy preached by our favorite investors, Peter Lynch.

When Maj caught up with Egor on August 6, 2021, he primed his pitch with a few small reasons why USAK was in his crosshairs:

- “So USA Truck – The reason why I like it. It’s super illiquid. When there’s good news, it moves up. I did a lot of research on it and like it for all the fundamental reasons.

- The trucking industry is very hot right now. I’m sure you’ve seen pictures of all the container ships that are stuck at LA ports, trying to get in.

- The trade deficit for the U.S., I think it’s at record levels. So there’s a lot of stuff being imported into the country.

- The retail sentiment is high right now. So there’s a lot of freight to be moved around. And trucking companies or a lot of trucking companies are capitalizing on that.”

USAK was officially added to our Research Contributors Model Portfolio on September 27, 2021 at $15.78.

Part of what we loved about Egor’s pitch was that he conveyed what he thought the fair value of USAK to be:

“So there’s all this freight that needs to be moved at all these high prices, but there’s nobody to drive them. Right. So even there, they got hurt. And even then they came out with a record quarter. I think once like Darren Hawkins of YELL said on the transcript -, as soon as all these American workers get off the bench and get back into work, then I think it’s just gonna blow up and it’s gonna blow up the most in the industrial sector.”

“I mean, trucking is just, it’s gonna go huge, it’s gonna affect the rates, it’s probably going to bring them down, because there’s so much more supply of trucks, when you have all these drivers. But, you know, the way prices work in the world regarding whatever it is, they rarely have a tendency to go down. Once you get the prices up, you’re very likely to just keep them there where they are”

“So that’s the short pitch. I think it’s very undervalued. I think at simple multiples in the industry, we’re looking at probably a $250 million market cap fair price. So we’re talking about double the price of the stock now. So I think it’s fair, that it will be 30 bucks a share, and it’s going to get there. The float is actually quite small. The float is, I think, only 2 million shares.”

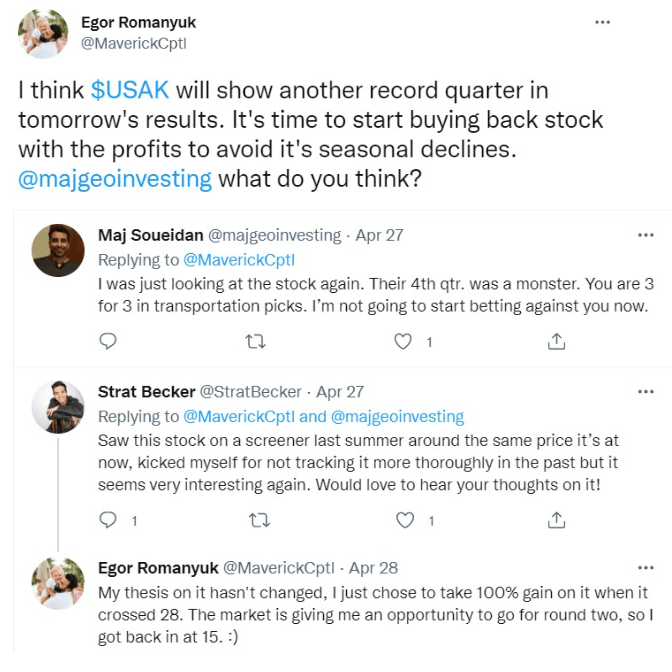

On February 27, 2022 Egor officially announced that he had closed his position in Usa Truck, Inc., after the stock’s price climbed to a peak price of $29.09 during his coverage period, or an increase of 110%.

We would like to note that on April 27, 2002, Egor announced via Twitter that he was re-opening his long position in USAK.

On June 24, 2022 USAKs journey to acquisition finally came to a close. Usa Truck, Inc. (NASDAQ:USAK) was acquired at $31.72/sh, a huge premium of 126% over prior day’s closing price of $14.02. A big congratulations is due to our members who held on from the beginning of our coverage.

As Maj says, we won’t be betting against Egor or his batting average, which is a baseball perfect score of 1,000%, and the reason why we love our GeoInvesting Contributors.

Stay tuned for his next pitch coming soon.

Favorite Idea – Pitch Of the Month

Favorite Idea – Pitch Of the Month

Our company of the month is a leading provider of innovative solutions to recurring problems to keep the air in the environment clean. We had the pleasure of interviewing both their CEO and CFO in a Live Fireside Chat this past month and we were happy to learn more about the company and hear their insights into its growth strategy.

The company reported blowout Q1 2022 results with sales nearly tripling to ~$85 million vs. the prior year, with an EPS ballooning to around $0.60 vs. a loss. We believe we could be looking at a real home-run here, even in the short-run.

We are banking that the recent increase in revenue from regulatory developments will be long lasting. At a P/E of around 5x, the stock seems cheap and we feel could possibly be an acquisition target.

We think there’s a great possibility that the company can convince the market that there is some permanence in positive growth trends beyond two or three years.. This could lead to the P/E re-rating to 10x or even 15x, potentially resulting in a nice increase in the stock price.

—

MS Microcaps Active Portfolio Special

Just one last time, we’d like to say that we are pleased and excited to share the launch of a new product brought to GEO by MS Microcaps (MSM).

This new platform will focus on building a single actively managed portfolio of high quality timely stocks. Given the opportunities that the correction in the stock market is providing us with, we think MSM is launching this product at an ideal time. It will entail the execution of a disciplined approach to lock in interim gains when they are achieved. MSM believes this will give you clarity on a more frequent basis to help you protect profits and manage risk.

The platform will provide:

- Actively Managed Diversified Portfolio

- A Run to $1 Million Portfolio

- Exclusive Chat Room

- Weekly Research and Raw Cliff Notes

- MicroCap Information Arbitrage Tools

For those interested in learning more about (MSM) Active Portfolio, and their Run To $1 Million Challenge, visit MS Microcaps’ site here.

MSM Believes that now is a great time to join, as their portfolio is growing, but still in the budding stages, and they recently initiated their first pick for their Run To $1 Million Challenge (turning $10,000 to $1.0 million).

PROGRESS, YEAR TO DATE

GeoResearch ArticlesPodClipsFireSide ChatsContributor ArticlesManagement Morning Briefings

WHAT YOU MAY HAVE MISSED THIS MONTH

Video Replays Available: Forum, HDSN, SPCO, Tobias Carlisle [GeoWire Weekly No. 40]

It was due time for a conversation between The Acquirer’s Multiple founder Tobias Carlisle and our own Maj Soueidan as they navigated the various current affairs and subjects of the small and microcap world and outlook for value investing strategies. The first time they met was on Tobias’ own show, and we only thought it appropriate to reciprocate by hosting him this time. Several of the subjects were very familiar to us, especially those that included how the last decade of investing in microcaps has been a bit tricky. So, naturally, the conversation parlayed into the various strategies and mindsets needed to be a successful investor.

KonaTel CEO Sean McEwen and President & COO Charles Griffin Break Down Recent Loan and Service Distribution [GeoWire Weekly No. 39]

On June 24, 2022, when we spoke with Sean McEwen, the CEO of Konatel Inc (OOTC:KTEL), we went into the conversation hoping that he would go into sufficient detail on the progression of the company’s business, especially in light of the $3 million dollar loan they just closed to fund the purchase of phones it distributes to low income households who sign up for the company’s government subsidized telecom services. Sean talks about how the company analyzed the cost benefit of taking out a loan at 15% interest versus issuing dilutive capital and the speed at which the loan could be repaid as it drives a significant expansion of its recurring revenue customer base.

Three Management Interview Video Replays Now Available [GeoWire Weekly No. 38]

We know it’s been a tough market environment, and we’d like to thank you for sticking around while we wipe the grime of the first half of 2022 off our chins. Out of 2021 came 8 multibaggers, some eclipsing 200% in gains. However, as you know, holding onto those games in 2022 has been challenging. The current environment underscores a few themes: *Nothing lasts forever, *When times change, it’s necessary to potentially change or massage strategies to accommodate the new environment, *Money can be made in any market condition, *Portfolio management is needed to lock in gains and add shared to quality stocks around volatility. So, as bad as it’s been for some of the legacy stocks that have been in GeoInvesting’s coverage universe since 2007, we have quietly tweaked our strategy for the new 2022 value investing theme to identify qualifying stocks in our universe, as well as new stocks to highlight.

Five Underfollowed Stocks That Will Get Stronger During A Recession [GeoWire Weekly No. 37]

Searching for companies that will either solve or alleviate pressure points are great places to hunt for winning stocks in this type of environment. You can explore another interesting angle by seeking out companies that can help other companies save money. By receiving help, they can compete more efficiently by reducing costs to deliver their products and services. And after taking a deep dive into GeoInvesting’s stock coverage universe spanning 15 years, We have found 5 stocks operating in diverse industries that fit the bill. But what’s even better about these five stocks is that they should do well whether we enter a recession or not. They’re great companies with sound business plans designed to create an immense amount of shareholder value for their investors.

Are All Bets Off If This Casino Multi-plex Stock Hits The Royal Flush? [GeoWire Weekly No. 36]

While we won’t go into the various reasons why these casinos failed, we can say that we believe we’ve found a small anomaly of a company that is at least ripe for analysis. It’s in a profitable microcap company which engages in horse racing, card casino, food and beverage, and real estate development. It is domiciled in Shakopee, Minnesota and was founded in 1994. Our goal here is to figure out if we can justify looking at a casino stock, especially if we are going into hard economic times. On the surface, we like the way a potential bullish thesis could play out based on the company’s clean balance sheet and untapped revenue potential of its casino.

See All Past GeoWire Issues Here