It’s time for investors who still hang on to the premise that SAIC filings absolutely have no relation to SEC reported numbers in the analysis of FIE ChinaHybrids to wake up. Of course, the most ideal situation is to compare SAT filings with SEC filings. However, the relevance of facts leading to evidence that a linear relationship should exist between fillings (SAIC=SAT=SEC) is ever increasing. Don’t take it from me or my PRC attorney Bob’s findings… Take it right from the horse’s mouth.

In a follow up to a press release issued on December 14, 2010, Gulf Resources (NASDAQ:GFRE) filed an 8K providing a convincing and detailed response to fraud allegations contained in an “anonymous report.” However, some revealing granular details omitted from the press release outlined in the filing have gone unnoticed:

Exhibit 99.2 of the 8K clearly includes a statement implying that for the Foreign Invested Enterprise such as GFRE, the SAIC and SAT filings should theoretically have a strong linear relationship between one another, meaning that after accounting adjustments they should be in line with the SEC filings.

GFRE’s (FIE) subsidiaries, Shouguang Yuxin Chemical Industry Co., Ltd. and Shouguang Haoyuan Chemical Industry Co., Ltd. are tax payer enterprises operated in an ordinary manner within our bureau’s jurisdiction. The recent rumor disseminated online regarding this company’s US$7.36 million revenue and US$110,000 net profit for 2009 has serious discrepancies with the data that this enterprise actually declared with our bureau for tax payment purposes. The actual operating data is the data archived at the State Administration of Industry and Commerce after the annual JOINT examination of the State Administration of Industry AND Commerce and the State Administration of Taxation.

Yangkou Taxation Sub-bureau, Shouguang Municipal Bureau of State Administration of Taxation

We can make two observations from the information contained in this filing. First, the SAT’s statement did not necessarily comment that GFRE’s PRC filings were in line with SEC filings. It just discredits the anonymous report’s revenue findings, which by the way differ from the information I have obtained regarding GFRE SAT filings. I must say that I am disappointed. Can you believe this? What an opportunity GFRE had and they flubbed it. The company just had to have tax authorities issue a statement claiming that the numbers were close to SEC filings.

Second and more importantly, the joint inspection statement not only rings true with my attorney’s statement on August 25, 2010…

For the foreign invested companies, including Sino-foreign joint venture enterprises and wholly foreign owned enterprises, the annual financial report submitted to the AIC is required to be audited by an independent CPA firm. The same report will also be filed to the taxation bureau and several other government authorizations, such as State Administration for Foreign Exchange, for the issues of foreign exchange administration and others. If a company has a negative income in the audited financial report, the company does not pay income tax and the company may claim the rights to make up for losses in the next several financial years.

…but it also identifies with Ben Wey’s cavalier statement in a recent article retrieved from his web site.

State Administration of Taxation (“SAT”) is the only Chinese government agency that has the legal authority to collect corporate taxes and receives annual financial reports of a business. SAT has tens of thousands of local branch offices across China. Corporate tax reporting in China is a local event, filed by a business within the jurisdiction of an SAT office where the business is physically located. Once a business makes its tax filings, the local SAT office issues a “Certificate of Tax Completion” to the business which provides evidence that its tax filings are complete and accepted, and that the business has satisfied all of its tax and financial reporting obligations. Then a copy of such filings is provided to the SAIC office which can certify that the business is in good corporate standing. That is the very extent of the SAIC’s involvement in Chinese tax filings.

Wait, there is more… I stumbled upon an passage in Liandi Clean Tech (OTCCB:LNDT) June 2010 10K that builds the case even further:

Annual Inspection: (Page 14).

In accordance with relevant PRC laws, all types of enterprises incorporated under the PRC laws are required to conduct annual inspections with the State Administration for Industry and Commerce of PRC or its local branches. In addition, foreign-invested enterprises are also subject to annual inspections conducted by PRC government authorities. In order to reduce enterprises’ burden of submitting inspection documentation to different government authorities, the Measures on Implementing Joint Annual Inspection issued by the PRC Ministry of Commerce together with other six ministries in 1998 stipulated that foreign-invested enterprises shall participate in a joint annual inspection jointly conducted by all relevant PRC government authorities. Beijing Jianxin, as a foreign-invested enterprise, has participated and passed all such annual inspections since its establishment on May 6, 2008.

If you are still not convinced, realize that SAIC and SAT filings for every FIE company we have obtained are linear. New Energy Systems (AMEX:NEWN) and China Education Alliance (NYSE:CEU) are just two examples where matching SAIC and SAT filings that we have obtained do not match SEC documents. Interestingly, the first tier one IPO Chinese, Trina Solar Adr (NYSE:TSL), we pulled filings on matched across the board (it took several attempts for us to find an RTO that matched). We have also spoken to executives of several Chinese companies who have commented that the SAIC and SAT relationship is valid: “The same annual report is sent to the SAIC and SAT.” Oh by the way…we have also heard that regulation may soon require that SAIC filings be part of required disclosures. Really, we think regulatory bodies needs to go a step further and require that companies ensure that SAT matches SEC and/or offer direct proof that auditors have obtained SAT/SAIC documents independently.

Is it possible that SAIC filings, especially for FIEs, are more useful than originally thought in the analysis of our beloved ChinaHybrids? If you believe that companies omit the truths for a reason, then yes. If you believe that the joint inspection between SAIC and SAT agencies is relevant as opposed to just a casual event, then comparing SAIC filings to SEC is a vital step, maybe the first step, in the due diligence process. Now, we are not naive. We do think that even FIE’s will eventually craft ways to ensure that SAIC filings match SEC while still evading the SAT, especially in locales where bureaucratic mayhem and inefficiencies exist. Thus, ultimately the retrieval of SAT information will become more crucial. That is why it is vital we pull as many SAIC filings as we can right now!!

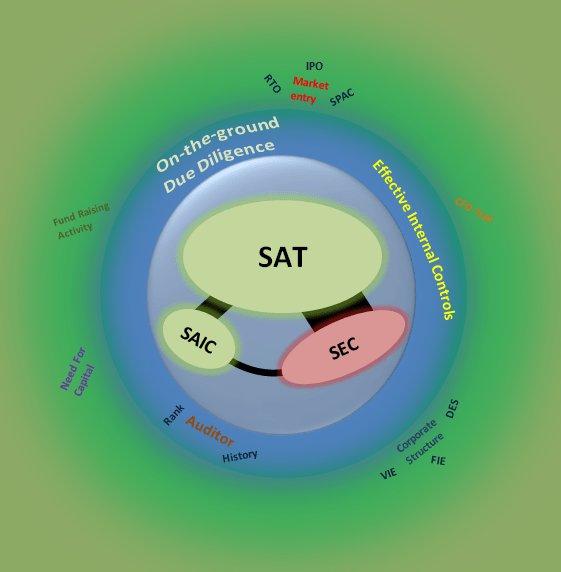

Let’s pretend for a moment that you believe SAIC documents are important. I have begun to devise a process investors can apply to segregate between business fraud, tax avoidance and legitimate operations.

Recall this statement from my August 25, 2010 article:

There are two types of taxes relevant to this discussion. The value added tax (VAT) is levied as a percentage of revenue. (In the service industry there is a business tax; there is no VAT. The Business Tax is similar to VAT and the PRC government is transferring Business Tax into VAT) China has a sophisticated mechanism for collecting the VAT that involves a process of tracking invoiced transactions among all parties involved in a particular sale chain. Thus, the payment of this tax is difficult to circumvent. However, companies can underreport the top line through what is called white receipts, or transactions without invoices. On the other hand, underreporting income to lessen the burden of income tax appears possible. This arises from an inefficient income tax oversight process. Taxes are paid to the State Administration of Taxation (SAT).

The key take away from this information is that VAT is applied to revenues and more difficult to circumvent compared to income tax, especially when multiple vendors are present in a sales chain. Going a step further, a company that desires to employ tax avoidance schemes will do so by overstating expenses as opposed to drastically fudging revenues. Thus, the revenue line in SAIC filings for FIE might be an accurate representation of the true size of a company and difficult to manipulate. A company would be foolish to overstate its revenues and commit to more taxes than it should pay. Likewise, understating revenues leaves it open to the risk of severe penalty. Understanding that GAAP revenue reporting standards and the possibility that a level of “culturally accepted” VAT avoidance schemes will slip through the cracks, I have offered the following process that investors can apply regarding SAIC FIE analysis when SAT information is not available:

Step 1 – Use SAIC documents to determine if companies (who pay VAT) are worth exploring

- Validation Criterion One- Confirm revenues. If revenues match within 25%, we can at least take comfort that the company is not a “shell” and has a fighting chance to evade the business fraud card. Those companies where revenue mismatches are greater than 25% pose risks to the investor that include:

- VAT avoidance schemes that may not be culturally acceptable, subjecting the company to substantial penalties or negative adjustments to balance sheets by auditors, such as the case with Qingdao Footwear Inc (OTCCB:QING).

- A situation where a company has blatantly lied about revenues in SEC documents

- Validation Criterion Two (taking an additional look at companies where revenues are in an acceptable range of SEC filings) – Further analysis to confirm that taxes paid and net income match. Confirmation that tax paid/net income matches strengthens (not guarantees) the case that a company is being truthful about its margins and not stealing money from shareholders via tax avoidance schemes. However, an extra hurdle is created if net income does not match even when taxes paid match. Are expenses outlined in SAIC documents being manipulated through an “acceptable tax avoidance scheme” or is the expense structure a true representation of the health of a company where margins were inflated in SEC filings?If taxes paid does not match (higher in SEC), leading to a mismatch in net income (higher in SEC), we could have a real company that is manipulating tax obligations via culturally accepted over expense reporting schemes and/or lying about its margins. In both of these instances, the higher pre-tax income will be required in SEC filings to justify the higher forged tax expense and/or margins. This will then lead to higher net income in SEC filings compared to SAIC filings. In actuality, if margins in SEC docs are legit, the tax expense on the SEC document is often likely the amount the company should have paid.The obvious challenge here is discerning between acceptable levels of tax fraud vs. margin manipulation. We need to determine if the company is real, committing tax fraud, fudging its margins or is a mix of variables? We are getting pretty good at identifying trends in SAIC/SAT vs SEC filings to draw conclusions. Again, I am willing to accept a 25% underreporting statistic for net income and or income tax obligations. Fuqi Intl (NASDAQ:FUQI) is a good example of a real company where revenues matched, but net income did not due to margin manipulation. Also, as we learned from Tongxin Intl Ltd Com (OOTC:TXIC), 100% matches do not guarantee success. These examples reinforce why on the ground DD is becoming more vital.

- Validation Criterion Three- Confirm that cash balances, assets and liabilities match. (I will have more on this step at a latter time).

At this point you should have a good idea of what you were dealing with, which will determine how important step two will become.

Step Two- Perform on the ground due diligence.

Ask any legitimate investment professional who lives in China and they will say don’t even consider buying Chinese companies without extensive on the ground DD. (this has been an eye opening experience, leading me to question many of the companies I had once adored, but also find new firms that appear legit).

Step Three – Supplemental criteria to support SAIC/SAT filings

- Determine auditor rank and turnover. Also consider if the auditor can be inspected by the PCAOB. Investors should wait for the new audit to be completed before making your final investment decision, especially, when upgrades to auditors are announced,

- Make sure internal controls are in check.

- Track miscellaneous items such as executive/director turnover/quality, going public method, reneging on implications insinuating that a capital raise is not in the cards, number of capital raises since going public compared to cash balances, and characteristics of capital raises (see red flag list for more color).

If you choose to invest in companies that are riding a thin line on matching issues during the step 1 process, then on-the-ground due diligence is takes on greater importance, but know that you have still opened yourself to some type of misrepresentation risk. If you do not have access to on the ground DD then choose companies that have the least discrepancies in step one or follow the GeoTeam as we probe companies.

Remember that there is no SAIC/SAT joint inspection for VIE company structures. Thus, for lower tier VIE we recommend that investors proceed with caution unless they have access to SAT information. Hopefully auditors will begin to pull SAT filings independently of the company. Investors should also consider taking a look at Chinese companies that came public through an IPO with respected underwriters or were fallen angels like China Techfaith Wireless Adr (NASDAQ:CNTF). In the current environment, we recommend that investors with no access to SAIC/SAT filings should think twice about investing in ChinaHybrid unless on the ground DD has been performed and/or until auditors get their act together. On-the-ground investigations are priceless when considering VIE or FIE. Until further notice, we will invest in few ChinaHybrid companies where we have not obtained SAIC/SAT filings or carried out some level of on-the-ground investigation. We recommend that investors do the same. Depending on how the CCME case (which currently appears bleak) ends up, simply looking at auditors to make an investment decision could ultimately hold less weight. I am actually concerned that top auditors may shy away from the China RTO space.

I have taken a unique and possibly controversial approach to ChinaHybrid analysis. We need to arrive at a point where we can make investment decisions without having to consider the long list of due diligence items that do not have to be obtained for U.S. company analysis. It should be as easy as trusting SEC documents, but we are just not at this point yet. Comparing SAIC/SAT to SEC filings is the next logical step, higher on the food chain than most other due diligence items.

Circle of Trust

It can not rule out all serious cases of fraud, but at least we have a starting point to begin our investigation of companies we know are real and worth researching. Mismatching filings do affect ChinaHybrid multiples by giving market players fuel to begin or round out a hit piece. Stop asking yourself why and just accept that SAIC/SAT analysis is vital if you want to be involved in the ChinaHybrid space. It is time to protect your portfolio. We have become more comfortable adding a short strategy to our analysis that combines SAIC analysis with on the ground investigations.

Successful investing requires a process of narrowing a list of potential companies to a manageable level. It does not matter that some of the companies left behind may go up without you. It only matters that the process you abide by leads to consistent returns while limiting blow ups. What I have just outlined may not be the only way to make money in the space, but it may be an option that will increase investment success. If you still want to live in a state of denial regarding the relevance of SAIC/SAT analysis, fast forward to a point in the 1987 movie Wall Street where Bud Fox asks Gordon Gecko why he needs to wreck his father’s company….Gordon’s answer: “Because it’s wreckable alright!”.

Simple but true!!!!!!!!!