GeoWire Monthly, Vol. 4, Issue No. 2, February 2024

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 2, February 2024

Latest Pitch You May Have Missed

See More Pitches here

Premium Emails You May Have Missed in February 2024

Investor Insights Highlight – Thomas Birnie

GeoInvesting research contributor Thomas Birnie’s perspective on investing is characterized by a transition towards a more consistent, long-term strategy irrespective of market conditions. His investment philosophy centers around identifying high-quality businesses trading at what he perceives as good or undervalued prices, with a particular focus on the small and microcap sectors, where he sees significant opportunity.

Birnie’s approach is inspired by principles of quality investing, as advocated by Warren Buffett and Charlie Munger, which emphasize investing in businesses with a track record of growing their earnings.

To quote a few instances in the recent roundtable discussion (referenced below in this Monthly Issue) we had with him and a few other investors:

“I want to invest with companies that kind of bootstrap themselves and they are self-funding, profitable businesses in general.”

“I used to look at valuation first, when I was screening companies. Now I’m first trying to find very high quality businesses with a moat, and trying to find and pick them up at cheap prices and technical levels.“

“There’s just been tremendous opportunity in the small cap space to load up on very high quality businesses. And some of them I just have not found yet. I’m just still trying to get my feet wet on how to effectively find these businesses – the right valuations…”

Meet Thomas Birnie

Thomas can be found on Twitter at @Proveninvesting You can read his 2020 thesis on Smart Employee Benefits here, a stock that ended up getting acquired for a 39.5% premium over Birnie’s publish price.

200 Multibaggers And Counting

GeoWire Weekly Recaps Jan. 2024

December 2023 Newsletter, In Case You Missed It

GeoInvesting Progress and Stat Summarizations, February 2024

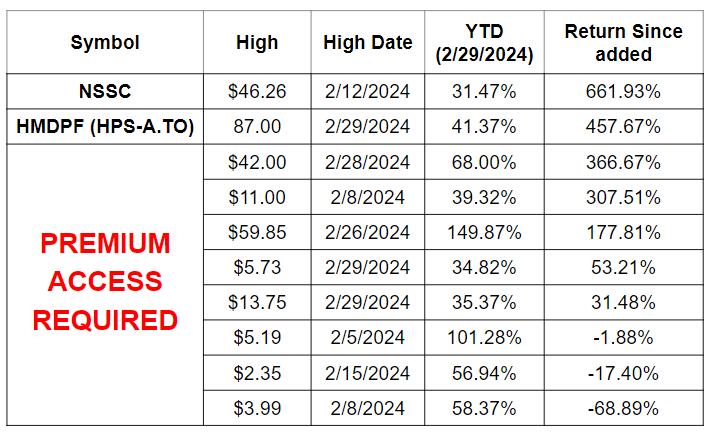

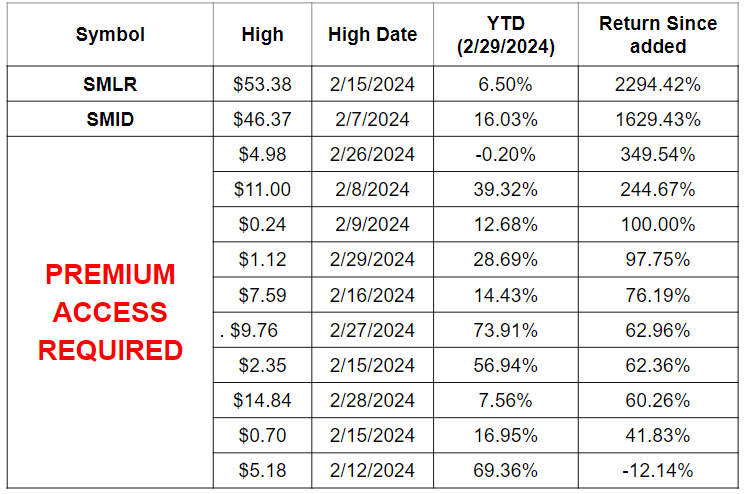

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

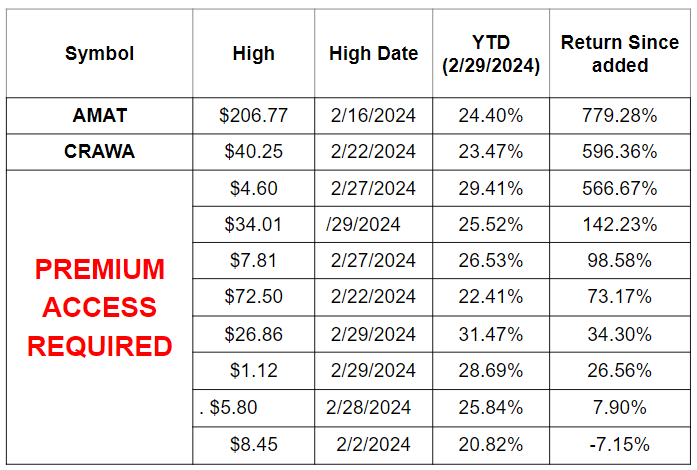

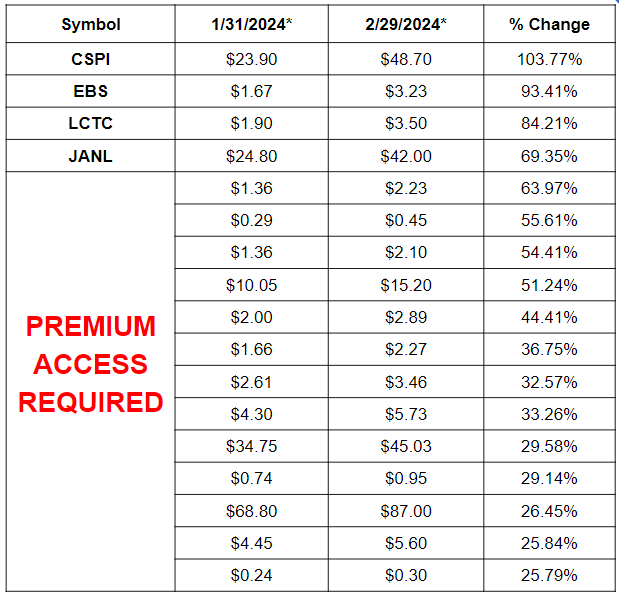

Stocks Rising >25% Across All GeoInvesting Model Portfolios/Screens

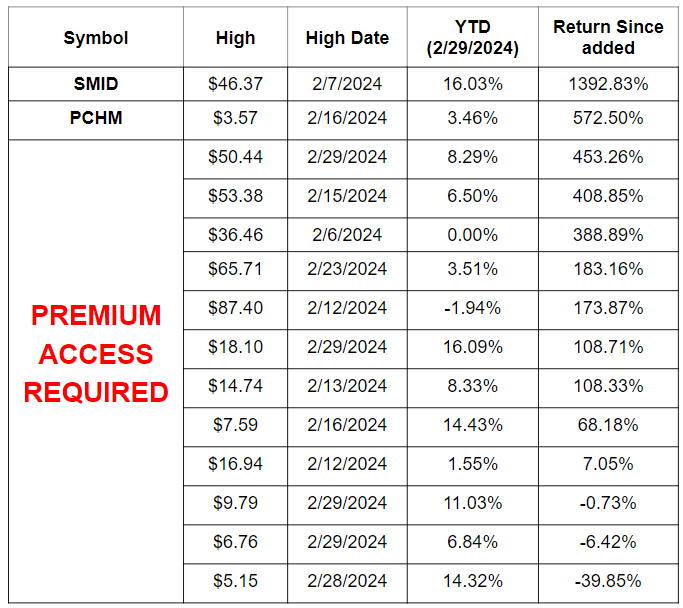

Top 10 Best Performers for the Month of Jan 2024 From GeoInvesting Contributor Picks

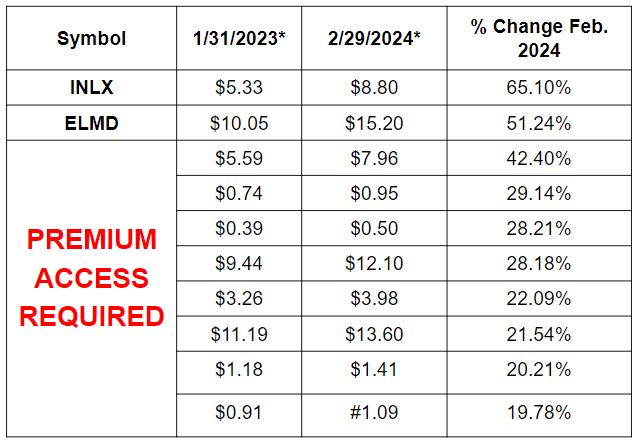

New 52-wk Highs From GeoInvesting Contributor Stock Picks

Research Progress, February 2023

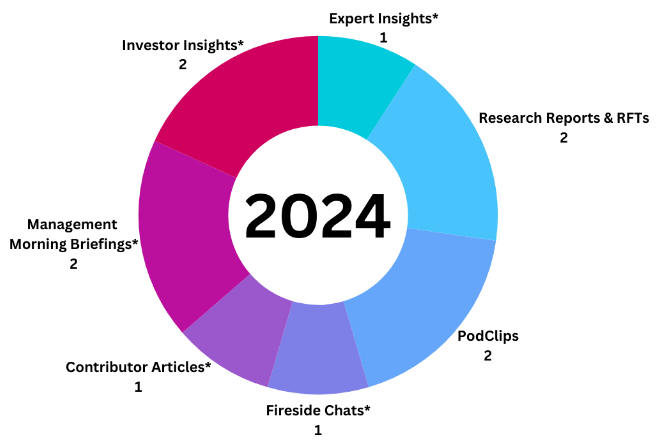

*Please also note that year to date, we’ve published 48 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 59 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

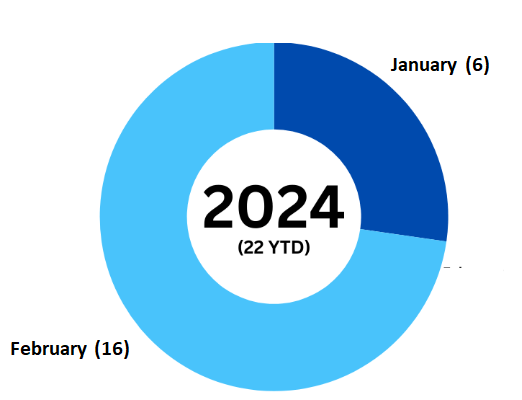

Earnings Processed, February 2023

During January 2023, we processing 22 Quarterly Earnings Reports, bringing our full year total to 22 so far.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- New stock ideas backed by in-depth research

- Stock pitches from our Premium subscriber investor network.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails..

- 15 Years of archived research on over 1500 companies and counting.

- Access to our Live and Archived CEO Interviews.

- Weekly Newsletter and Monthly Live/Archived Forum, just in case you missed our updates and alerts.

- Education on investment process and case studies.

Complimentary Thomas Birnie Case Study on XPEL, Inc. (XPEL)

Appendix

Content Distribution Key

Written

2 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

1 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

1 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

0 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

1 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

5 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

1 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

48 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.