Profiles/Bios from Recent Investor Interviews

We are excited to share that we’ll be enhancing our Video Shelf to more comprehensively display our wide array of videos and clips that fall within the realm of what we’ve been striving to achieve over the last few years – meeting and speaking with peers to compare notes on investing strategies, pitches and stories; screening the web for learning material from some of the most widely acclaimed investing legends like Peter Lynch and Warren Buffett; interviewing experienced management via invite-only events hosted live for our Membership base,

We are well on our way to establishing a great library of video content to draw upon a full spectrum of valuable insights with over 300 management and investor interviews and clips.

You’ll probably hear the moniker ‘Skull Sessions’ a bit more in the coming months, since that is how we’d really like to be known – as a team of investors who, as Miriam Webster defines it, communicate through:

“…meetings for consultation, discussion, or the interchange of ideas or information. called also skull practice.”

Ironically enough, football teams use the term for pre-game strategic huddles to draw out their game plans for an upcoming match. Theirs ends in a physical bout, while in contrast, our wits are put to the test to bring you insights from the best investors, industry experts, and management teams.

We thank you for your support as we aim to make our Video Shelf the most valuable resource of investor insight videos. One thing you’ll notice right off the bat is the amount of manual effort and preparation we put into our Skull Session Investor Insight Interviews.

With respect to our investor chats, we’ve published our video conversations with some great investors and microcap experts like:

- Paul Andreola of Small Cap Discoveries

- Dan Schum, Nanocap Specialist

- Tobias Carlisle, Founder of the Acquirer’s Multiple

- Noah Goldberg, Quant Investor and Blockchain Expert

- Quim Abril, CEO of Draco Global and Highly Ranked Hedge Fund Manager

- Sam Namiri, Ridgewood Investments Portfolio Manager

- Scott Weis, CEO of Semco Capital

- Ryan Telford, Quant Investor

- Sean Westropp, CEO of Deep Sail Capital

- Tim Heitman, Private Investor

- Mak Gomes, CEO Pipeline Data, LLC

- Vittorio Bertolini,co-founder of Coinfolio Capital

- Tyler Dupont, founder of Augury Research

- Bryan McCann, Private Investor

- Paul T., Special Situation Investor and Financial Analyst

- Brandon Beylo, Investor / Founder of Macro Ops

- Egor Romanyuk, Private Investor & Transportation Industry Expert

- Rich Howe, Founder of Stock Spinoff Investing

- Arham Khan, Mecca Partners Hedge Fund

- Peter Halesworth of Heng Ren Investments and Author of Conquering COVID: Sinovac, An Unlikely Hero

- Scott Shuda, Founder and Managing Director at Breakout Investors

I love talking about stocks and learning about the investment process of different investors, especially those in the microcap world that I haven’t interacted with yet.

I feel like I am actually lucky that GeoInvesting (‘GEO’) has built a reputation that allows me to reach out to investors to speak with them about their investing processes and favorite stocks so I can share them with other investors through archived replays of the talk and related clips at GEO..

Along with continuing to provide/deliver first class research from the GeoTeam, GEO is ramping up its mission to identify and collaborate with the most exceptional microcap investors. Our goals pertaining to our investor network include:

- Providing our audience with unparalleled microcap research.

- Sharing more insights and stock picks from our investor network.

- Learning about investment processes from successful investors.

Our efforts to expand and enhance our investor network are ongoing, and you can expect much more exciting related content in the near future.

With all this in mind, today I am sharing the bios of 7 investors whose insights and pitches were gleaned through Skull Sessions I hosted on Geoinvesting in 2023.

Each of these investors brings a distinctive investing specialization or focus to the table, making their contributions even more valuable. Along with the bios, I am including links to the full sessions, some of which include favorite pitches, as well as a bonus clip.

—

Scott Weis, CEO of Semco Capital

Scott Weis is the CEO of Semco Capital, an RIA focused on public companies undergoing significant business transformation either through restructuring, selling under-performing divisions, or acquisition. Scott is a full time investor with a particular expertise in turnarounds.

Bonus Clip – Scott Weis, President & CEO of Semco Capital on his Investment Strategy

Full Video

–

Sean Westropp, CEO of Deep Sail Capital

Sean Westropp is the CEO of Deep Sail Capital, a long/short hedge fund with a focus on microcap stocks based in Chicago. Sean employs a framework he calls the four pillars of an exceptional investment. These are, (1) having a good business model, (2) having outstanding management, (3) substantial long term growth prospects, (4) having reasonable valuation.

Bonus Clip – Sean Westropp Explains His Investment Process

Full Video

—

Ryan Telford, Quant Investor

Ryan Telford is a mechanical engineer with a decade of experience in investing, primarily in the mining industry where he works as a consultant. Initially drawn to quantitative investing and following strict rules, he later realized that investing is more nuanced, influenced by his readings of Warren Buffett, Joel Greenblatt, and Jim O’Shaughnessy.

Bonus Clip: Ryan Telford’s Book Recommendations

Full Video

–

Tim Heitman, Full Time Investor

Tim Heitman is a full time investor with a focus on special situations. He has been a full time investor for 4 years and is a contributor on various digital platforms including Seeking Alpha. He values equal weighting of one’s portfolio.

Bonus Clip: Tim Heitman Talks About His Experience With Turnaround Stocks (Vimeo Link)

Full Video

–

Sam Namiri, Ridgewood Investments Portfolio Manager

Sam Namiri is an investment adviser and portfolio manager at Ridgewood Investments, focusing on small and microcap stocks.

Sam’s investing strategy involves thoroughly analyzing the quality of the business, factoring things like earnings, recurring revenue, customer retention, and growth runway.

Bonus Clip: Sam Namiri Discusses “War Stories” and the Insurance Market (Vimeo Link)

Full Video

–

Mark Gomes, Retired Investor

Mark Gomes has a background in the technology research industry, having worked at International Data Corporation and referencing the Gartner Group as a prominent player in the field.

He emphasizes the importance of understanding industry dynamics, a skill he acquired during his career. Mark later ventured into entrepreneurship with his own business, Pipeline Data, and retired around 2009.

Nowadays, he actively participates in chat groups, offers mentoring, and maintains a blog at Mark Gomes Stocks (markgomesstocks.wordpress.com), where he freely shares his knowledge and insights to assist others in their financial endeavors.

Bonus Clip: Mark Gomes Shares His Investing Beginnings & Pathway to Early Retirement

Full Video

_________________________________________

GeoInvesting Progress and Stat Summarizations

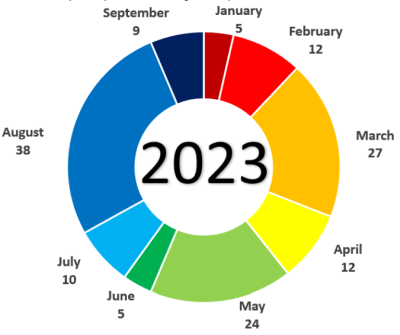

Last month we told you that we were expecting the bulk of Q2 earnings in August, and we actually ended up processing 9 quarterly earnings reports in September! By comparison, a healthy 38 of our covered companies published earnings in the prior month of August, as expected.

As each quarter passes by, we get to see which companies are adapting to the new market environment. We are excited to start processing Q2 2023 earnings reports, using a new smart press release product I created. Stay tuned for more details on this here.

2023 Quarterly Earnings Reports Processed, YTD

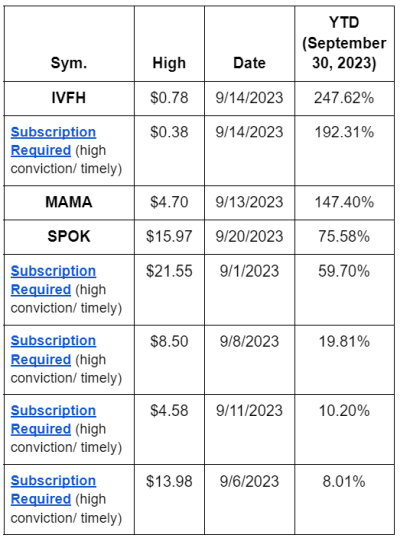

8 companies from GeoInvesting’s Model Portfolios reached new 52-week highs in September 2023

To get our entire Tier One quality stocks list, let us know you are interested.

To get our entire Tier One quality stocks list, let us know you are interested.

—

*Please also note that year to date, we’ve published 157 video clips parsed from the Investor Insights, Fireside Chats, Management Briefing and Expert Insights.

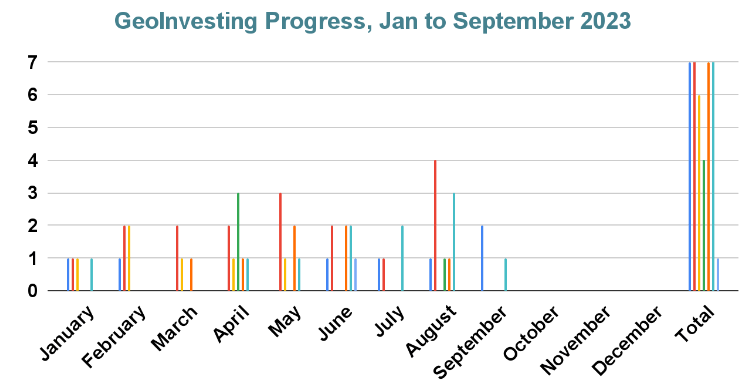

So far in 2023, apart from daily emails and weekly GeoWire Content, we have published a combined 209 pieces of Premium content (including video clips) across the following segments:

Written

6 Research Reports & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

4 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

17 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

1 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

6 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

7 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

11 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

157 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

–

Here’s what you may have missed this month

Morning Emails in September 2023

- A 1,000% Reason To Be Curious If Activist Does For LFVN What He Helped Do For FTLF; TRT Hopes To Benefit From New EV Contract (9/26/2023)

- KonaTel, Inc. – New In-depth Special Report Detailing Catalysts Required For Growth (9/20/2023)

- Call To Action Updates For SGRP, AMMX, and MAMA; MITK Continues To Get Current With Filings (9/15/2023)

- MAMA and CODA Earnings Coverage (9/13/2023)

- VIRC and ADFJF (DRX.TO) Earnings Summaries (9/11/2023)

- MOJO Announces First 2 Months’ Results of Q3 2023 (9/8/2023)

- It Seems ACFN Is Telegraphing Good News (9/7/2023)

- Final Notice of Sept. 2023 Forum Invite; MITK, DAKT Strong Fiscal 2023 Q1; SEED Finally Issues Release on Debt to Equity Conversion (9/6/2023)

- CPHRF to Cancel Shares; TTLTF Order From US Armed Forces Agency (9/5/2023)

Weekly GeoWire Emails in September 2023

- Adding 4 Stocks To Buy On Pullback Model Portfolio #11 [GeoWire Weekly No. 102] (9/24/2023)

- Portfolio Manager Sam Namiri Perspectives On 4 Stocks He Is Following [GeoWire Weekly No. 101] (9/17/2023)

- As We Dial In On A Newer Open Forum Format, Weekly Milestone Reached [GeoWire Weekly No. 100] (9/10/2023)

Stock Pitches in September 2023

- Buy On Pullback Portfolio #11 About To Be Launched With 4 Stocks, 80.58% Return Expected (9/23/2023)

- Shifting Paradigm Bodes Well For These Higher Quality Stocks (9/30/2023)

Case Studies in September 2023

- Iec Electronics Corp. (IEC) Case Study – A CEO’s Simple Formula For Success Produces ‘Nothing But Net’ (9/16/2023)

Skull Sessions in September 2023 (Firesides, MMBs, Investor Interviews)

Earnings Reports in September 2023

- VIRC and ADFJF (DRX.TO) Earnings Summaries (9/11/2023)

- New High Conviction Beverage Stock Announces Record First 2 Months’ Results for Q3 2023 (9/8/2023)

Click Here For More On GeoInvesting

Thanks for joining thousands of other investors who follow GeoInvesting

Your current have access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the second Tuesday of every month, covering case studies, stats and fireside chats.

- Our Saturday emails, sent weekly, focusing on stock pitches from the microcap universe.

With a Premium Subscription, you’ll also receive full access to our entire research service platform which includes but is not limited to….

- Access to our entire catalog of microcap stock coverage, spanning 14 years.

- Timely alerts on new Bullish Stock Ideas and Related Updates on our entire Tier One Quality Microcap coverage universe.

- Clear opinions on our convictions, valuations and changes in our conviction.

- All ideas supported by Research Reports and in-depth Due Diligence.

- Access to our Model Portfolio of high conviction ideas.

- Portfolio Protection Research and related Red Flag Alerts.

- Participation in all Live Interviews, Fireside Chats and Q&As with microcap company executives.

- Participation in our Monthly Open Forums to discuss Geo’s microcap coverage. Hosted by Co-Founder Maj Soueidan.

- “GeoWire” monthly and weekly newsletter which includes our Weekly Wrap-Up, curated for our Premium Subscribers, highlighting our research coverage and stock idea generation that took place during the week.

- Access to all premium audio and video podcasts featuring our stock pitches and educational content.

- Stock ideas from handpicked Research Contributors who have proven to beat the market.

Why GeoInvesting

We believe we’re in a period where tier one quality microcaps are being aggressively sought out by investors, many of which we have already found and continue to find. These are the types of companies that Co-founder Maj Soueidan built his success on in his 3-decade investing career. In case you are wondering what our tier 1 criteria are for microcap performers, here they are:

- Long operating history

- Strong management

- Management focused on business, not stock price movement

- Generating revenue

- At or near profitability

- High probability turnaround stories

- Insider ownership

- Manageable debt burden

- Ability to grow without excessive equity raises

- Shares outstanding are not excessive