I love pitching stocks to my friends, family, colleagues and the GEO community. It’s that one habit I just can’t break.

There are lots of reasons you might choose to join a stock research platform like Geoinvesting. However, when it comes down to it, in the end, you are probably looking for interesting ideas on stocks that you might want to add to your portfolio or perform research on.

So, that’s why in this installment of the Monthly GeoWire, we are reiterating a new addition to our website – The Pitch Lobby, a concept we recently sent you some information about on September 9, 2023.

We don’t want to focus on short term returns, but it’s nice to see that the stocks included in the Pitch Lobby are performing nicely. Within less than 2 months, the average return was over 9% at the time of our email, while the NASDAQ and Russell 2000 small-cap indexes were down 2.4% and 4.1%, respectively. The peak average return was 16.92%.

This dedicated page serves as a central repository and summaries for our recent and future stock pitches, encompassing a range of ideas we think are timely. Most of the pitches on this page are from the GeoTeam about stocks in our research pipeline or in our Model Portfolios, but once in while we will include compelling ideas sourced from diverse channels, including contributions from our investor network.

The primary objective of this page is to provide you with a snapshot of the diverse set of companies we cover.

Make sure to visit the page a few times a month to stay current with our timely ideas.

pitch lobby profiles – July 14, 2023 to August 26, 2023

Recession Resistant Microcap At The Heart Of Large Power Grid Efficiency Initiative, New Recurring Revenue Streams In Sight

- Asset Class: Equity

- Price & Revenue: Price under $1.00; Revenue under $15 million.

- Expected Return: 100%

- Industry: Wireless Remote Monitoring

- Catalyst: Two new growth initiatives (additional recurring revenue); Insider buying; Investor awareness of growth initiatives; Building a moat; Competitive pressure abatement.

The stock pitch discusses a recession-resistant microcap company that plays a vital role in enhancing power grid efficiency within the United States infrastructure. The company’s services allow businesses to monitor operations and address issues with reduced staff. The company is taking two new growth initiatives – One that focuses on optimizing gas company operations through mission-critical services, where the company has a unique advantage, and the second involves a partnership to strategically manage electricity usage for utilities. These initiatives are expected to contribute to revenue starting in 2024.

Beyond the initiatives, the company has also seen the lessening of competitive pressures that previously hindered its growth. The CEO’s stock purchases at lower prices add to the company’s appeal. The company’s strategies position it as an innovative player disrupting traditional energy practices and expanding its market reach with new recurring revenue streams.

An AI Stock No One’s Heard Of

- Asset Class: Equity

- Price & Revenue: under $15; Greater than $100M

- Expected Return: 40.3

- Industry: AI / Information Technology & Software Data Analytics

- Catalyst: Revenue and earnings per share (EPS) growth; Favorable industry trends; Strong patent position

With the growing impact of AI in business, this company leverages AI for digital identity and fraud prevention solutions. The company’s unique approach involves an AI-infused cloud software platform that utilizes AI and machine learning to enhance the authentication of identity documents using camera-equipped devices. This approach sets the company apart in its industry.

Backing the pitch is a seasoned research contributor’s prediction of a potential 52.4% increase in the stock’s value. The company’s strong financial track record includes consistent revenue growth from $9 million to $140 million since 2001. A further anticipated 15% growth over the next three years is projected, accompanied by a streak of nine consecutive quarters of expected earnings growth.

Moreover, the company capitalizes on favorable industry trends related to identity theft, with its solutions widely adopted by thousands of institutions.

Will New Addition To Run To One Model Portfolio “Quench” Our Thirst For Supersized Returns?

- Asset Class: Equity

- Price: Under $1

- Expected Return: Potential 5x return purely based on competitors’ Price To Sales ratios

- Industry: Beverage

- Catalyst: Strong CEO Background; New Product Launch; Accelerated Revenue Growth; Investors will associate the stock with stocks of other highflying beverage companies

A non-alcoholic beverage manufacturer recently added to our “Run To One” Model Portfolio, which focuses on stocks under $1 per share that exhibit growth potential. The CEO’s industry expertise, increasing annual revenues, and the launch of a drink line targeting a sizable market segment contribute to the company’s appeal. The company’s improved capital structure, profitability at a small revenue base, and commitment to shareholder value through stock buybacks add to its attractiveness.

The CEO’s reputable track record and an established distribution network enhance the company’s prospects. Key reasons for favoring the stock include its presence in 10,000 locations, the recent launch of a beverage product targeting a larger market, and the first mover advantage in an underserved high-growth industry segment. The company’s profitability at a small revenue base further supports its potential.

At the time of our write up the stock was trading at a P/S ratio of 2x compared to its competitors’ 10x, and it has around $1 million in net operating losses to offset future taxes.

While acknowledging the potential for significant rise in the stock’s value, considering momentum in its new beverage product, a few caveats include the stock’s lack of liquidity, the unproven nature of the new product line, and the need for distribution expansion.

Microcap Fund Manager Reveals His Top Pick

- Asset Class: Equity

- Price: Under $25

- Expected Return: 50%

- Industry: Staffing Solutions

- Catalyst: Strong order backlog; Management repurchase of shares

A microcap fund manager with a strong track record and 7 years of experience revealed his top pick, which aligns with my prior research endeavors. The stock, previously covered by my team on GeoInvesting, had a significant rise in 2022 followed by a pullback due to market conditions. The company operates in the staffing solutions sector for commercial and government segments in North America.

Key points from the bullish pitch include:

- Management’s successful share repurchases (20% since 2020).

- Strategic expansion into stable sectors like clean energy and healthcare.

- Robust fundamentals and cash flow, supported by a solid order backlog.

- Anticipated earnings growth in the coming period.

- A potential 50% stock price increase based on a conservative P/E valuation of 15x.

Riding High On A 166% Move In AEHR Year To Date, GeoInvesting Subscriber Gives Us His Next Pick

- Asset Class: Equity

- Price & Revenue: Under $1

- Industry: Remote Software Solutions

- Catalysts: Sparse competition; Artificial Intelligence; Locked in contract revenue – All to contribute to various facets of growth.

A GeoInvesting subscriber, known for his successful pick of Aehr Test Systems (NASDAQ:AEHR) with a 166% gain year-to-date, has presented a new exclusive idea. The company focuses on providing remote software solutions to the energy industry, aiding in timely infrastructure maintenance to prevent costly disasters and downtime. This stock is seen as a candidate for the RunToOne Model Portfolio (R21) due to its nearing inflection point and potential 300% undervaluation.

Key points shared with GeoInvesting subscribers include:

- The stock’s low visibility due to undiscovered bullish catalysts.

- The company has a unique and irreplaceable service, creating a competitive advantage.

- Predictable revenue growth through expanding contract values.

- The software employs AI capabilities from a rich dataset spanning years.

- Anticipated 50% yearly growth for several years.

- Despite being priced under $1.00, the stock is expected to exceed $1.00 within the year.

______________________________________________________________________

GeoInvesting Progress and Stat Summarizations

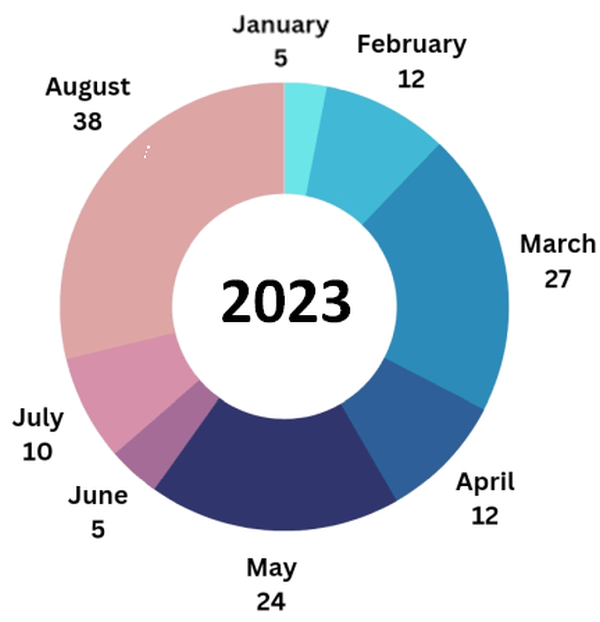

Last month we told you that we were expecting the bulk of Q2 earnings in August, and we actually ended up processing 38 quarterly earnings reports! By comparison, only 10 of our covered companies published earnings in the prior month.

As each quarter passes by, we get to see which companies are adapting to the new market environment. We are excited to start processing Q2 2023 earnings reports, using a new smart press release product I created. Stay tuned for more details on this here.

2023 Quarterly Earnings Reports Processed, YTD

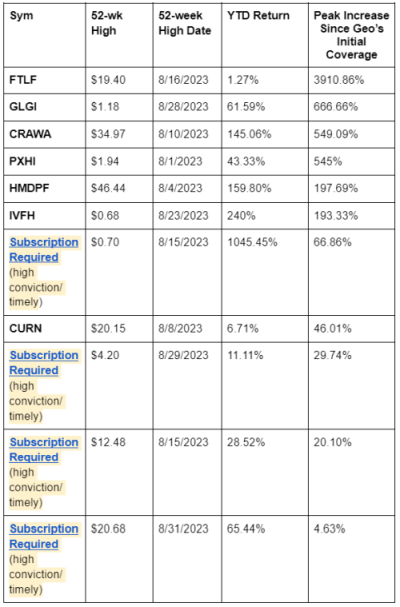

11 companies from GeoInvesting’s Model Portfolios reached new 52-week highs in August 2023

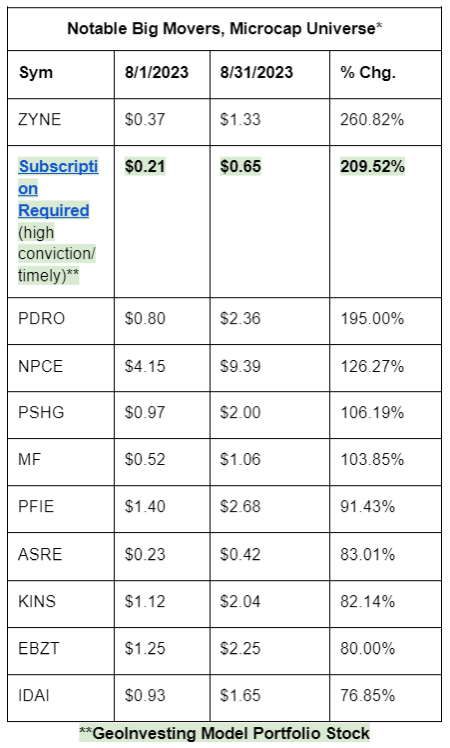

10 top performers across the microcap Stock universe, August 2023

*Notes

– Shares Outstanding: less than 50m

– CURRENT price: $0.25 to $100

– 30 day ave vol: 5,000 to 100m

– Exchanges: NASDAQ, OTC, CA

– Market cap: $5m to $300m

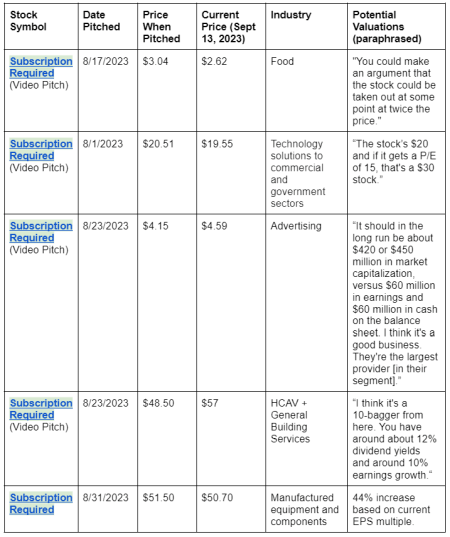

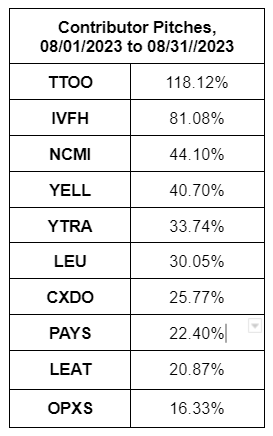

5 New Contributor Pitches in August 2023

Top 10 Research Contributor Returns, August 2023

—

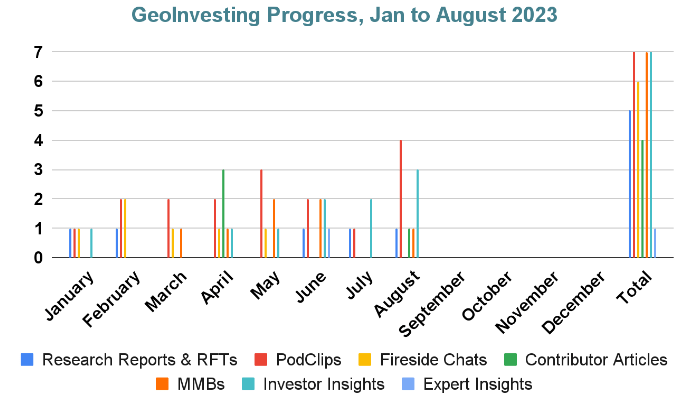

So far in 2023, apart from daily emails and weekly GeoWire Content, we have published a combined 40 pieces of Premium content across the following segments:

5 Research Reports & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

17 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

6 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

7 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

7 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

1 Skull Session Expert Insights (NEW) – Recorded and live podcasts that feature conversations with industry experts.

4 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

4 August 2023 GeoWire Weekly Issues – Premium Subscriber Insights and Pitches

Fund Manager On His Combined GARP And Short Selling Strategy (Pitch Included) [GeoWire Weekly 95]

August 6, 2023

We are excited to present a compelling video stock pitch by a contributor on a company we believe stands out as one of the superior entities in the staffing industry. Notably, they strategically…

Investors Ignoring Two New Acorn Energy Remote Monitoring Growth Initiatives; CEO Jan Loeb Elaborates [Weekly GeoWire No 97] [Video]

August 20, 2023

This past week, I engaged in a Skull Session Management Briefing with Jan Loeb, the CEO and President of Acorn Energy Inc (OOTC:ACFN), covering the company’s second-quarter results, growth…

Full Time Investor Tim Heitman Trades Investment Stories And Strategies With Maj Soueidan [Weekly GeoWire No 98] [Video]

August 27, 2023

Last week, had a Skull Session/Investor Insights session with Tim Heitman, an investor of over 40 years who transitioned from investing in larger companies to focusing on micro and nano caps. His…

Thanks for joining thousands of other investors who follow GeoInvesting

Your current have access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the second Tuesday of every month, covering case studies, stats and fireside chats.

- Our Saturday emails, sent weekly, focusing on stock pitches from the microcap universe.

With a Premium Subscription, you’ll also receive full access to our entire research service platform which includes but is not limited to….

- Access to our entire catalog of microcap stock coverage, spanning 14 years.

- Timely alerts on new Bullish Stock Ideas and Related Updates on our entire Tier One Quality Microcap coverage universe.

- Clear opinions on our convictions, valuations and changes in our conviction.

- All ideas supported by Research Reports and in-depth Due Diligence.

- Access to our Model Portfolio of high conviction ideas.

- Portfolio Protection Research and related Red Flag Alerts.

- Participation in all Live Interviews, Fireside Chats and Q&As with microcap company executives.

- Participation in our Monthly Open Forums to discuss Geo’s microcap coverage. Hosted by Co-Founder Maj Soueidan.

- “GeoWire” monthly and weekly newsletter which includes our Weekly Wrap-Up, curated for our Premium Subscribers, highlighting our research coverage and stock idea generation that took place during the week.

- Access to all premium audio and video podcasts featuring our stock pitches and educational content.

- Stock ideas from handpicked Research Contributors who have proven to beat the market.

Why GeoInvesting

We believe we’re in a period where tier one quality microcaps are being aggressively sought out by investors, many of which we have already found and continue to find. These are the types of companies that Co-founder Maj Soueidan built his success on in his 3-decade investing career. In case you are wondering what our tier 1 criteria are for microcap performers, here they are:

- Long operating history

- Strong management

- Management focused on business, not stock price movement

- Generating revenue

- At or near profitability

- High probability turnaround stories

- Insider ownership

- Manageable debt burden

- Ability to grow without excessive equity raises

- Shares outstanding are not excessive