https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING LAST MONTH

August 2022, Volume 2, Issue 7

MONTHLY HIGHLIGHT

We are beginning a new video series in our Monthly GeoWire that will be highlighting educational videos from investors, not only from our platform but from other sites, as well as past published interviews and clip rewinds, personal memoirs, podcasts and live conferences.

We believe that with the huge shift that has occurred in the market in 2022, that now is a great time to learn from investor peers.

Our first clip is from an interview that Maj hosted with Tobias Carlisle of the Acquirer’s Multiple. He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law. He is best known as the author of the #1 new release in Amazon’s Business and Finance sector, The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market.

In this clip Maj and Tobias talk about analyzing the market and forecasting the future, not being cocky, and using only money you don’t need in the next five years for your investments.

STUDS VS. DUDS

This month we will be taking a more comprehensive look into some Studs from GeoInvesting, we will be analyzing 3 companies that have already seen significant upside since our initial coverage. However, that doesn’t mean that we believe that all of these stocks have reached their full growth potentials.

So, let’s jump right in.

Stud – Richardson Electronics, Ltd. (NASDAQ:RELL)

The first company we will showcase as a Stud is Richardson Electronics, Ltd. (NASDAQ:RELL), a company that engages in the power and microwave technologies.

RELL was originally added to our FundiTrading Model Portfolio on October 14, 2021 at $12.09 per share to our. While that has been the only stock to occupy space in that portfolio, it is intended to include stocks that we feel will enjoy near term upside movement based on expectations that they will report strong sales and EPS for several consecutive quarters. These selections are usually not based on deep-dive due diligence on our part, but bring momentum ideas to the table more quickly.

We believed RELL had some short term catalysts between conference call information arbitrage, recent earnings release momentum and the announcement of some new contracts. Accordingly, we believed earnings would get a boost in the upcoming quarters.

However, in the case of RELL, we began thinking of the company as a higher conviction selection based on our interaction with the CEO at the 2021 LD Micro Cap Conference and the company’s strong Q2 2022 numbers.

Even though the stock attained a new high of $17.50, up 45% since the inclusion in our model portfolio and is now trading at ~$16.40, we think shares should actually be valued between $18 and $20 based on trailing numbers, as well as our earnings expectations over the next few quarters. We do see a path to $30 over the year or so due to management’s portrayal of strong visibility and year over year growth for several years to come.

Stud – Cloud Communications Stock Inflection, Inflection Point Identified

The second company we are highlighting is a cloud communications stock that we have followed for several years, but have not talked about much. We believe it currently has several multibagger traits, and foresee an inflection point in the near future.

A few years ago, an activist became involved and worked to force the fraudulent management team out, as well as assist with fixing the company’s capital structure (by reducing shares & reducing debt) and work to provide a more complete product suite offering.

Currently, the company helps build other company communication infrastructures while utilizing 3rd party hardware and software. Recently, it began embarking on an aggressive acquisition strategy to capture market share and give customers a more complete solution, identifying a rather large and timely upcoming inflection point.

This will help increase wallet share for the company. Wallet share is a term used to help identify the amount that a customer spends on a yearly basis. This is especially pertinent in the case of this set-up since the company we are pitching to you has many dormant customers that are not actively engaged due to lack of supplied services.

Stud – Tech Microcap Stock Trends Up, But We Think More Is To Come

Our final stud for this month’s issue of The GeoWire is another company that is actively trying to grow its customers’ wallet share, and we just added it to our Run to One Model Portfolio!

They recently began upgrading their technology platform to grow revenue within their current customer base.

Even though we have seen the stock trend up nicely from its 2022 low, up 258%, we are excited to see the company reach this new inflection point after a brief hiatus where they fine tuned their tech platform. We believe the next leg of growth is just about to start, and we hope you will join us for the ride.

—

DUD – Gt Biopharma, Inc. (NASDAQ:GTBP)

Our dud this month is Gt Biopharma, Inc. (NASDAQ:GTBP) ($2.81, $90 million market cap). After a wild ride in shares from $6 to $19 and back to $8 during its tenure on our Select Long Model Portfolio, we closed our long position and took a minute to evaluate where and what we could have done better.

Our experience with this stock represents a case study on why you shouldn’t invest in areas that are outside of your core competency, or at least understand the associated risks. This is especially true when you’re dealing with very risky industries that have lots of unpredictable variables. Sometimes it is hard to not get caught up in the hype of the newest, shiny trends. If you’re not careful, it could wind up costing you some serious dough.

GTBP is a clinical stage biopharmaceutical company that focuses on the development and commercialization of novel immuno-oncology products based on its proprietary technology platforms. Investors became very bullish on GTBP when it announced that it would be approaching NK (natural killer) cell therapy differently than other cancer treatment-centric biopharmas that bank on the body to increase its own production of NK cells as opposed to infusing “lab made” NK cells.

Our decision to remove GTBP from our portfolio stemmed from the company’s history of only highlighting selected data in its patient trials, and the fact that, as we’ve said before, biotechs are not our core competency.

In retrospect, we can see that there just simply was not enough valuable information available for us to study. Coupled with the lack of full transparency and our lack of knowledge in the cancer treatment field, this was a rollercoaster we should not have climbed into.

MS Microcaps Active Portfolios – Timely and Relevant

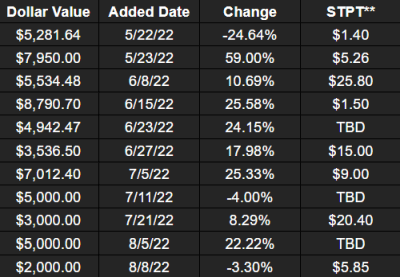

The MS Microcaps Active Portfolio, a new product brought to GeoInvesting by MS Microcaps (MSM), is already seeing substantial growth and success in its first 3 months available to only GeoInvesting members.

Since its inception, the average return of all the stocks in the portfolio is 15.70% despite the current state of the market. As you can see from the screenshot below, we have a diversified portfolio, a diverse range of prices, and in just a few short months we have proven that we can beat the market.

The platform provides:

- Actively Managed Diversified Portfolio

- A Run to $1 Million Portfolio

- Exclusive Chat Room

- Weekly Research and Raw Cliff Notes

- MicroCap Information Arbitrage Tools

MSM was originally only available to GeoInvesting members, but is now available to everyone for a limited time at the same discounted rate. For those interested in learning more about (MSM) Active Portfolio, and their Run To $1 Million Challenge, please go here.

MSM Believes that now is a great time to join, as their portfolio is growing, but still in the budding stages, and they recently initiated their first pick for their Run To $1 Million Challenge (goal of turning $10,000 to $1.0 million).

PROGRESS, YEAR TO DATE

GeoResearch ArticlesPodClipsFireSide ChatsContributor ArticlesManagement Morning Briefings

WHAT YOU MAY HAVE MISSED THIS MONTH

Weekly Wrap Up Highlights, Education and More

Use Our Live Events as Opportunity to Gain Alpha [GeoWire Weekly No. 43]

Why is it so important to join us in our live events like the Fireside Chats and Management Morning Briefings. The Fireside Chats are by invitation only, and are intended to accomplish several things like: Learning about company management and their histories, qualifications and goals; A conceptual understanding of the companies in general; Question and answer sessions that both we and our members can take a part in; Garner any new bits of information that might make for actionable moves on our part

An Antidote to the “Nifty 50” Frame of Mind [GeoWire Weekly No. 42]

In our July 7, 2022 podcast with Tobias Carlisle, the Founder of The Acquirer’s Multiple, we got a really great perspective on this subject matter that fits nicely in the narrative of large cap overvaluation vs. opportunity in smaller stocks poised for growth on the basis of their underlying fundamentals. He visited a phrase coined the “Nifty Fifty” that in two instances, decades ago, was applied to a group of stocks that were very relevant to investors who were looking to capitalize on what turned out to be disruptive, or popular high growth stocks, like $MS, General Electric Company (NYSE:GE) and Walmart Inc. (NYSE:WMT). Tobias recounted how history kind of repeated itself on these two occasions – during a boom in the 1960s to 70s, and in the wildly notorious dot com era, however it was not just relegated to those time periods. He pointed to other historical patterns when investors successfully sought only high growth stocks, but while that was the ebb, the antithesis was the subsequent flow of value that crept into the equation – the so-called mitigator, the antidote – to keep things in check for a while after growth stocks or markets corrected.

GARP as a Counterculture [GeoWire Weekly No. 41]

If it’s one thing that the last 30 years have shown me, it’s that there’s always a counterculture brewing somewhere, and that it manifests itself in many forms. Political, societal, music, and fashion norms are written in history until they are challenged and rewritten. At times, they even become the norm again as if to succumb to some kind of reincarnation helped along by generations exploring a side of life that they’ve read or heard about but never experienced. In most cases, an entirely unique chapter emerges for an undetermined period of time, leaving those set in their ways scratching their heads in wonderment as to “how this could have happened”.

See All Past GeoWire Issues Here