Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

If it’s one thing that the last 30 years have shown me, it’s that there’s always a counterculture brewing somewhere, and that it manifests itself in many forms. Political, societal, music, and fashion norms are written in history until they are challenged and rewritten. At times, they even become the norm again as if to succumb to some kind of reincarnation helped along by generations exploring a side of life that they’ve read or heard about but never experienced. In most cases, an entirely unique chapter emerges for an undetermined period of time, leaving those set in their ways scratching their heads in wonderment as to “how this could have happened”.

Viewing investing through a countercultural lens leads to a wide array of scenarios that showcase exactly how dynamic peoples’ appetites for bucking trends can be.

Take cryptocurrencies, for example, the total market cap of which is about 1/60 that of US GDP. Now be honest – have you ever even bought bitcoin, etherium, litecoin, or any other coin for that matter? Do you know how to determine if a coin or token is designated as ECR-20, or what that even means? Do you fancy a cold wallet or hot wallet? Do you frequent coinmarketcap.com? Are cryptocurrencies your chicken or your egg? Is blockchain the future of secure banking? Do YOU even care?

How about Wallstreetbets? Yup, they are still around. This is the large Reddit forum whose unexpected and explosive entry into the investing scene created shockwaves so large as to leave many to wonder whether the investing landscape has been changed forever by a group of everyday Main Street investors. Do some who are part of the Wallstreetbets crowd know of any style of investing other than the flash-mob frenzy that sent GameStop Corporation (NYSE:GME)’s price soaring so high that it threatened the ability of some financial firms, who were short the stock, to continue as a going concern? Now, even though Wallstreetbets got their revenge on short sellers, its weapons of choice are low quality stocks and pump and dump type of set ups. As irony would have it, all these low quality stocks have been demolished. A true zero sum game!

Will these investors ever venture out of this combat (or comfort) zone and truly start to explore the one type of investing that actually works over the long term (and we predict will also start working in the short term): buying quality assets at a reasonable price? Are they being scammed by those at the top of the Wallstreetbets food chain? Do YOU even care?

The bottom line is, if you kind of don’t care and just think it’s a news story, you are certainly not part of the counterculture and most likely think that everyone who is will come to their senses eventually. If you’ve dabbled in it, you likely thought it was interesting, albeit a fad that might fade away with the passage of time, to make way for another countermovement, after which a resurgence is not out of the question, of course.

–

In my world, I’d like to think that what was once an investing norm is about to become today’s counterculture, and it’s not one that should be dismissed so readily. After having largely hibernated and not been as effective for the 15 years after the 2008 crisis, the GARP, or growth at a reasonable price, style of investing is about to become as relevant now as it was back then. There’s a generation of young investors that will not have experienced what I believe will be their “I don’t care” moment. But this is where they will be wrong and how this movement is differentiated from a fad.

I am calling it a movement because that is what it needs to be. For too long now, investors have been able to throw darts at random investments, riding a bullish, relentless wave of unbridled optimism void of supporting fundamentals and rife with nosebleed P/E’s that any financial scholar would have a hard time substantiating, no matter how the numbers were crunched. As long as revenues grew substantially, it didn’t matter if the bottom line languished.

My beginnings followed a cult of personality, Peter Lynch, whose stock picking process was comprised of a strict pattern of analyzing stocks on their current value and potential for growth. This resonated with me, and, after college, was the primary way in which I found my stock investments. I was young, and it was what I knew worked. So, like Lynch, I invested with a “what’s a business really worth and more importantly, what’s it worth paying for” frame of mind.

When the 2008 crash occurred, along with it came the crashing of the collective norms that defined what smarter investing was supposed to be. The investor appetite for growth plus value investing wasn’t really there anymore.

I never really considered the prospects of owning stocks with extreme valuations. Sure, if there was a stock I owned that wandered outside the acceptable range, I could reassess the value after the next quarter’s earnings release and determine if continued and measured growth was tenable. I based what I owned on real numbers, real ratios, real guidance that I could confirm…and not so much on pie-in-the-sky speculation, or a red sell or green buy button showcased on a nightly basis at CNBC’s studios.

It’s my contention that we MUST counter what has been many peoples’ norm for the last 15 years. It’s unavoidable in light of what we went through post-pandemic, and what we continue to experience in 2022, and most likely beyond. The fast growers (ironically, one of Peter Lynch’s 5 company investment categories) were quickly repriced, and most of the tech stocks that had previously experienced 20-fold increases in their prices came back down to earth (See May 2022 highlight, here for more context). It is my opinion that they still have room to fall as the market realizes that their growth will slow down, or that the price it’s paying for growth does not make sense. As Lynch put it, all fast growers eventually become slow growers.

In these slow growers, Lynch looked for steady earnings growth, rising dividends (when applicable), and room to keep growing. He maintained that you want slow growers to go on forever. You have to respect that – a mature view in which you have the power of time and compounding on your side, should you not stray from that discipline. And that looking for a quick buck will most likely bite you in the ass.

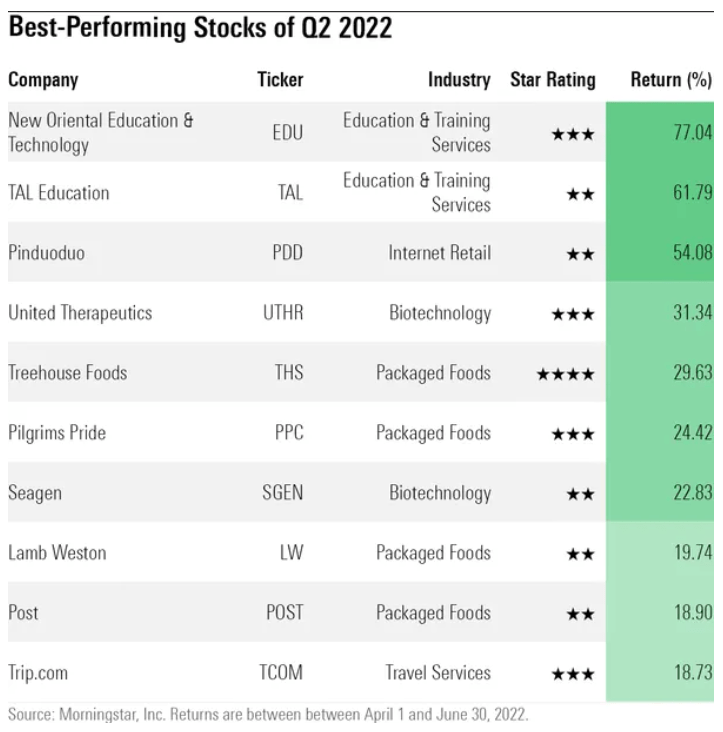

It’s hard to make an argument against the growth plus value approach in GeoInvesting’s universe of microcap stocks. As a matter of fact, prior to 2008, it was common for me to have 3 to 4 stocks rival the top 10 quarterly performers of any market capitalization. You can even take Morningstar’s Large Cap standouts for this past Q2 2022, for example:

However, one stat is missing from this top 10 list. If you are a GeoInvesting member, you know that several of our microcap stocks would fit right into this list on the basis of their Q2 performance.

Five of our top Q2 performers posted 94.2%, 60%, 55.2%, 53.1% and 50%, enough to offer you a buffer against what’s been a rough go for the past several months of 2022.

Wall Street wouldn’t and won’t cover these stocks for the mere fact that they are microcaps. You see, as savvy and smart as Wall Street makes itself out to be, you can turn their ignorant opinion that all microcaps are low quality companies into your biggest advantage.

If Wall Street naysayers looked under the hood a bit, they would realize that revenue and net income are quite tangible, and should not be overshadowed by a market cap number that simply represents share count multiplied by price.

It was actually one of my goals every quarter to make sure I could pick some stocks that could outperform that list, stocks that represented the growth plus value approach, sporting formidable GeoPowerRankings and experiencing growth inflection. And it’s a goal I achieved for many quarters before value investing became more challenging after 2008.

As risk-hungry investors begin to realize that they cannot get consistent, crazy returns from throwing darts and investing in the indexes, unproven biotechs and promoted pump and dumps, they’re going to have to join the new counterculture of old that spawned my investing journey

Said in another way, the market is going to start punishing stocks that can’t report earnings and cash flow, and rewarding GARP microcap stocks that we know how to find.

The Ponzi scheme is over. Companies that can’t mature on the basis of BOTH growth and value are not going to be able to raise debt or cheap equity and get a good return on capital as rates go up. Over time, those stocks are going to come down, and it’s already happening. The money is going to find a way back to smart hands for years to come. And this fits perfectly in the wheelhouse of what GeoInvesting does best: finding the best quality microcap stocks that offer the best blend of the growth plus value proposition.

Hi, part of this post is for paying subscribers

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.