https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING LAST MONTH

November 2022, Volume 2, Issue 10

SPECIAL HIGHLIGHT

Our monthly newsletter series continues with our new, alternative format of highlighting insightful video clips and discussions that give you a glimpse into personalities that have paved the way for many investors to approach various investing strategies to find what best suits your preferences based on your own goals.

From education and strategies to case studies, below we have lined up three personalities today to help you further understand a particular theme we have been highlighting which we believe is particularly relevant in today’s market environment – GARP (Growth At A Reasonable Price), It’s a topic we have heavily focused on throughout 2022 and in the past have described it as follows:

The concept of GARP essentially revolves around the search for companies that show consistent growth, whose stocks are not priced at pie-in-the-sky valuations (no room for disappointment) or at extremely low valuations (since this may incorporate hidden risks).

You don’t have to be a growth or a value investor. You can be a growth AND value investor by looking for companies with good growth prospects that are undervalued or reasonably valued. It’s really that simple.

Like some of our microcap investor peers, we use GARP as a key factor in identifying potential long term multibaggers.

Also, in case you missed it, we will continue to borrow some excerpts from a recent tweet thread in which Maj sharply focuses on the theme that fundamentals matter and why the forgotten concept of GARP will take center stage after a 15 year hibernation:

The three videos we have highlighted for this month, showcase our belief that we are entering a golden age for the GARP Investor.

And understanding that it’s just harder for multi-billion dollar companies to grow, we like to invest in a particular subset of high quality smaller companies – a group of undervalued stocks that are posting healthy growth rates that we predict will lead the next bull market.

Focusing on earning and valuations has always been our standard practice, as it helps us to identify THE BEST quality stock picks for our Premium Members. But, now we are even more super focused on this goal.

VIDEOS IN FOCUS

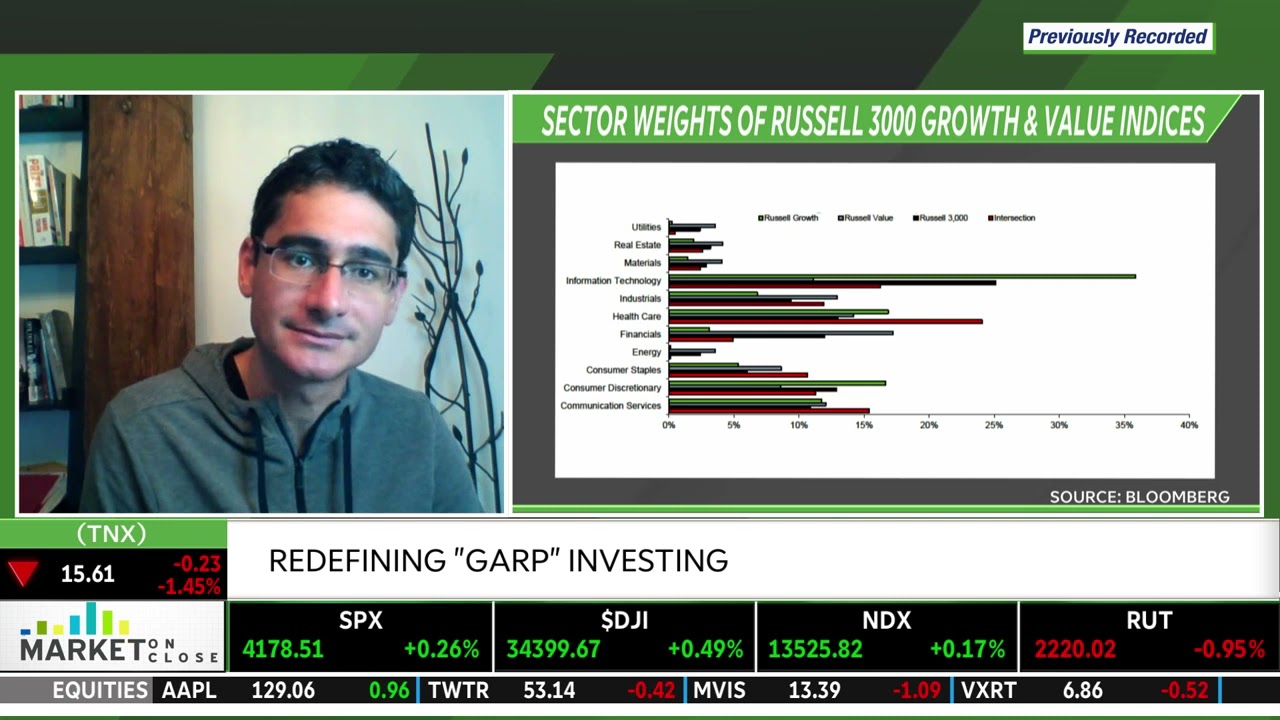

Featured Video #1 – Redefining GARP Investing

Vincent Deluard is the global macro strategist for StoneX, where he authors weekly research reports on global macro trends, flows, European capital markets and quantitative topics. Vincent advises large pension funds and other institutional investors on asset allocation and risk management. StoneX is a financial services organization that operates in six areas: commercial hedging, global payments,

Takeaways:

- Vincent Deluard, Global Macro Strategist of the Stonex Group, illustrates GARP by showcasing several companies that are both growth and value stocks.

- Deluard presents data that shows which industries have the highest number of companies with intersections on growth and value.

- Healthcare, IT, and Communication Services are among the top industries

Featured Video #2 – Peter Lynch and GARP Investing with Robert Reynolds

Robert Reynolds is a content creator on The Popular Investor 40K-subscribe YouTube channel that focuses on stock market education. He also is a stock, crypto, and real estate investor who in 2020 had an incredible ~40% return on his Etoro portfolio.

Takeaways:

- Investor Robert Reynolds discusses Peter Lynch’s investing strategy, particularly on price-to-earnings computations. He states the importance of evaluating companies based on their current earnings and cash flow, instead of future projected revenues. In addition, he discusses the importance of purchasing at a discount relative to a stock’s current and historical value.

- Other factors include:

- Debt to equity ratio – the value of each share based on the stock’s equity vs it’s debt

- Cash per share – how much cash are they producing, which coincides with the valuation you would pay for the company

Featured Video #3 – Value, GARP, and Growth Investors

Chris Haroun has gained over 60k followers on his Youtube channel and sold more than 1.5 million educational courses in every country. His courses have been profiled in Business Insider, NBC, Forbes & CNN; he’s the author of the #1 best-selling online business course.

He authored “101 Crucial Lessons They Don’t Teach You in Business School,” which Business Insider wrote is “the most popular book of 2016.” Forbes called it “1 of 6 books that all entrepreneurs must read right now.”

Takeaways:

- Chris Haroun explains the difference between a Value investor, a Growth Investor, and a GARP Investor.

- The Value Investor buys stocks that are usually very cheap in terms of price-to-earnings. They buy companies that aren’t growing that fast.

- Growth investors, on the other hand, invest in companies that are growing quickly, although at a more expensive rate.

- In between both ends of the spectrum is the GARP Investor, which is essentially investing at the sweet spot between growth and value.

- Haroun illustrates a pattern wherein a growth stock keeps growing until it gets too big and it cannot grow anymore.

- Eventually the growth slows, which causes the stock to slowly transition into the value spectrum.

RESEARCH AND IDEA PIPELINE

xxx

PROGRESS, YEAR TO DATE

GeoResearch Articles & RFTsPodClipsFireSide ChatsContributor ArticlesManagement Morning Briefingshttps://geoinvesting.com/wp-content/uploads/2022/11/GeoInvesting-Research-Progress-YTD-Nove-2022.png

WHAT YOU MAY HAVE MISSED THIS MONTH

When Others Hate Your Microcap Stock with Big Cap Appeal [GeoWire Weekly No. 56]

My analyst team at MSM thinks it may have found what will be a classic successful ‘Big Cap Microcap’ (BigCapMicro) case study in a company that provides healthcare communication solutions internationally, delivering clinical information to care teams to enhance patient outcomes (clinical communication technology to hospitals). The company has two divisions, wireless (traditional paging) and related software services to manage the flow, delivery and analysis of communication. Some of its services include subscriptions to one-way or two-way messaging, voicemail services, call center services, equipment loss or maintenance protection, and selling devices to resellers who lease or resell them to their subscribers.

Indicting CNBC [GeoWire Weekly No. 55]

CNBC, in true brand-name mainstream media format, makes it perfectly clear that it will take the negative over the positive…it just makes for better provocative investor banter and retweet fodder. It’s not the only outlet that does this, but we’re going to use them as the example of their complicit omission of any positive comments that might come out of a source that screams fire on a regular basis…say those of, for example, JPMorgan Chase & Co. (NYSE:JPM) CEO Jamie Dimon. Like him or not, Dimon is a provocateur in his own right. And CNBC likes that. We’d venture to say that the cabal of mainstream outlets breathlessly run with replays and snippets of his interviews and conference call commentary because it will invariably fit the expected narrative

Reading The Tea Leaves To Get Ahead Of The Fed [GeoWire Weekly No. 54]

Knowing that some of the inflation indicators that investors fixate on are lagging indicators, we want to beat the market to the punch. Accordingly, we have to be prepared by continuing to look for Tier One Quality microcap companies or maybe even ugly companies that might turn into quality selections, and in particular dissect Q3 press releases, earnings conference call transcripts and SEC filings that might unveil clues of softening inflation that could lead to the Federal easing interest rate hike goals. Who knows, moves by the Fed might happen sooner than later, surprising the market. We’ll be monitoring supply chain commentary as well as commodity price action, mainly in the food area and other hot pockets in the inflation number cited above.

Does Recent LGL Spinoff MPTI Offer a Decent Value Proposition?; Grilling GRIL’s CEO [GeoWire Weekly No. 53]

Another highlight of this past week was our comprehensive Fireside discussion with an executive at Muscle Maker, Inc. (NASDAQ:GRIL), a company that delivers high-quality healthy food options to consumers through traditional and non-traditional locations. Joining us was the company’s CEO and Secretary, Michael Roper, who has been in the food franchising business for 22 years. He “started off in restaurants in the year 2000 as a Quiznos franchisee out of the Chicago area.” Michael referenced his story as having been a “mailroom to the boardroom” saga that at the time culminated with him being the Chief Operating Officer of Quiznos worldwide.

Parsing Out Maj’s SGRP Pitch From the MicroCap Leadership Summit 2022 [GeoWire Weekly No. 52]

On September 15, 2022, our Co-founder presented at the MicroCap Leadership Summit, an annual event hosted by MicroCapClub, a platform for experienced microcap investors to share and discuss ideas on stocks trading at valuations of less than $500 million. He was asked to pitch a company to the Summit’s audience, so he came through with the reasons why Spar Group, Inc. (NASDAQ:SGRP) deserved to be a company worthy of a close look. The company provides merchandising and brand marketing services worldwide He prefaced his pitch on SGRP with a little about Geo and himself, and what you may know by now to be GeoInvesting’s focus on the qualities we believe that Tier 1 Quality microcap companies should have:

See All Past GeoWire Issues Here