Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

We are not averse to taking a critical eye on the microeconomics of the stocks we follow. The financial ecosystems we get exposed to in our microcap research tend to have their own set of idiosyncrasies, making it imperative to comb through the caveats associated with each instance.

Can macroeconomic events and sentiments bleed through to the internal dynamics of the companies in our research funnel? Sure, sometimes. Do we think it is important to heed caution when warranted? Of course.

But let’s be serious for a second. The success of a microcap company often boils down to its own set of specific circumstances and criteria that can sometimes be detached from the overarching externalities that affect their large cap counterparts, especially microcaps targeting niche markets.

In the most extreme of market environments, public expert commentary isn’t typically conveyed with the smaller company in mind.

CNBC, in true brand-name mainstream media format, makes it perfectly clear that it will take the negative over the positive…it just makes for better provocative investor banter and retweet fodder. It’s not the only outlet that does this, but we’re going to use them as the example of their complicit omission of any positive comments that might come out of a source that screams fire on a regular basis…say those of, for example, JPMorgan Chase & Co. (NYSE:JPM) CEO Jamie Dimon.

Like him or not, Dimon is a provocateur in his own right. And CNBC likes that. We’d venture to say that the cabal of mainstream outlets breathlessly run with replays and snippets of his interviews and conference call commentary because it will invariably fit the expected narrative.

The water cooler talk anticipation of his most recent interview with CNBC must have been palpable, especially after Dimon’s bold, yet boring and tiringly old prediction in April 2022 that he saw “storm clouds’ ahead for the U.S. economy later this year.” It wasn’t exactly a prophecy unique to him, but it predictably resonated with his well-crafted echo-chamber of individuals that invite this type of sentiment with open arms.

Then, the NASDAQ by June 2022 declined by ~27% to a trough prior to a temporary relief rally. It was a perfect scenario for Dimon to usher in another similar sentiment that sought to galvanize his point of view, stating that people should brace themselves “for an economic hurricane caused by the Fed and Ukraine war.”

In July, CNBC took another scheduled jab by highlighting that “JPMorgan CEO Dimon sums up U.S. economy in one paragraph — and it sounds bad.”

Get the point yet?

As “luck” would have it for Dimon, the NASDAQ reconvened its downward festivities to a print of 10,088 last Thursday, or 31% lower from his initial prediction.

Apparently, according to Dimon, we are not done. Cited by CNBC after another interview earlier this October, Dimon warned “‘the U.S. is likely to tip into recession in 6 to 9 months.”

Interestingly, some market participants who are on the other side of the argument agree with us.

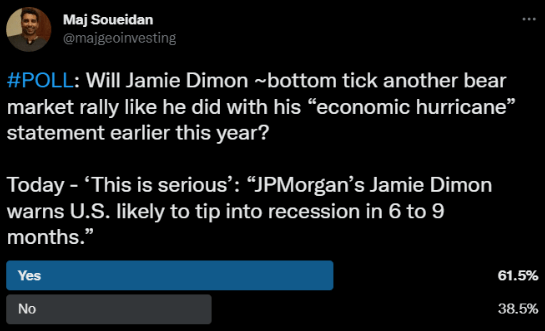

#POLL: Will Jamie Dimon ~bottom tick another bear market rally like he did with his “economic hurricane” statement earlier this year?

Today – ‘This is serious’: “JPMorgan’s Jamie Dimon warns U.S. likely to tip into recession in 6 to 9 months.”

— Maj Soueidan (@majgeoinvesting) October 10, 2022

Hold on though. Wasn’t it already determined that the U.S was in a recession after it showed GDP retraction 2 quarters in a row, which has historically been the technical indicator defining a recession? Many dispute this criterion as the sole culprit, stating that there are many more things wrapped into a recessionary environment that make the determination a little more hairy. Regardless, Dimon is obviously part of the latter group.

But, is it possible to find any silver linings anywhere within the litany of instances where it is easy to cherry pick the “Dimon negative” to unveil a positive? Most definitely, but in most cases we’d venture that you likely won’t find it on the mainstream media.

Instead, you might have to do a little digging of your own. Staying on the theme of Dimon, you actually don’t have to dig too deep to find the seed of something that might sprout into something on a larger scale, when in JPM’s third quarter 2022 earnings release, he said,

“I think I’d say – we’re in an environment where it’s kind of odd, which is very strong consumer spend. You see it in our numbers. You see it in other people’s numbers, up 10% prior to last year, up 35% to pre-COVID. Balance sheets are very good for consumers. Credit card borrowing is normalizing, not getting worse. You might see – and that’s really good, so you can go into a recession, you’ve got a very strong consumer.”

This is actually the sentiment of Maj’s first tweet of his well received tweet thread last week.

Of course, CNBC would probably not prefer not to make Dimon’s quote the lead, and probably not even bury on page 5. Heck, if they had their choice, they might even pay Dimon not to say this kind of stuff at all, else risk flipping the narrative to something more that suits their style.

Interestingly, they addressed this in a Friday headline, “U.S. consumer is soldiering on despite soaring inflation and recession risk, credit card giants say”, but chose to keep Dimon and JPM out of the headline even though they highlight the quote in the body of the article, begging the question, did they use his seed to begin a little due diligence on their terms, where they have been given an unspoken permission to open the slit to a conversation on that silver lining?

So, one might surmise that we have “Good CNBC” and “Bad CNBC”, a 20/80 split perhaps? But one thing can be certain, they have an endless supply of water coolers to drum up the next headline to bait you into group think.

Now, we are not discounting the fact that we are certainly in some unprecedented and unpredictable times, and potentially to the detriment of the economy and companies.

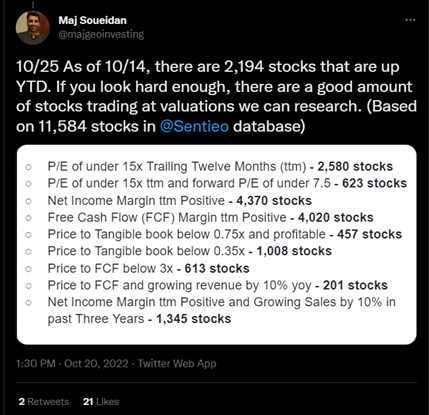

Our point is, one’s perceived lost hope does not have to equate to a lost hope of the collective. There’s always money to be made in the stock market, even in uncertain times, and it’s GeoInvesting’s job to find those opportunities. For example:

10/25 As of 10/14, there are 2,194 stocks that are up YTD. If you look hard enough, there are a good amount of stocks trading at valuations we can research. (Based on 11,584 stocks in @Sentieo database) pic.twitter.com/OGmWuYtS3h

— Maj Soueidan (@majgeoinvesting) October 20, 2022

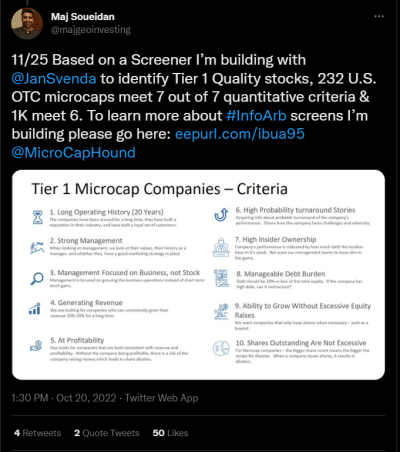

11/25 Based on a Screener I’m building with @JanSvenda to identify Tier 1 Quality stocks, 232 U.S. OTC microcaps meet 7 out of 7 quantitative criteria & 1K meet 6. To learn more about #InfoArb screens I’m building please go here: https://t.co/ZADcOQb6un @MicroCapHound pic.twitter.com/9XSRvwodev

— Maj Soueidan (@majgeoinvesting) October 20, 2022

What we do think CNBC should be talking about is that the market environment is now basically the time to dig hard and start following a value investing strategy to beat the market. Stocks that are growing revenue and earnings with strong or improving balance sheets, and selling at reasonable valuations, are going to do well, even if the broader market does not.

Thus, CNBC’s headlines should encompass the theme that “stock picking is finally back”, after a 15 year hiatus during which investors were blindly buying stocks with a low regard to quality of business and valuation.

14/25 Over the last 15 years, GARP took a backseat to investing in companies aggressively growing sales and in “story” stocks with little regard to the value or earnings part of the equation. GAAP: Growth at any price.

— Maj Soueidan (@majgeoinvesting) October 20, 2022

15/25 Now, It just makes sense that the new riskier environment we are in will reward stock pickers and punish those who invest in companies that can’t make money as we exit an everything goes up investment era.

— Maj Soueidan (@majgeoinvesting) October 20, 2022

16/25 That doesn’t mean speculative & high multiple fast rev growth Cos won’t rise. It just means more investors will place greater emphasis on valuing stocks based on earnings, cash flow & balance sheets vs solely on sales & pipe dreams, a marked divergence from the last 15 yrs

— Maj Soueidan (@majgeoinvesting) October 20, 2022

Have a great week!

—

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.