In staying with the same theme as our June 2023 Geowire Monthly Newsletter, we are glad to present another installment of “Peer Stock Pitches”.

Before I launched Geoinvesting in 2007, you could say that I somewhat secluded myself to a cave, searching for stocks that fit my own mold, based on a research process I trusted. Luckily, GeoInvesting and the way the internet/social media has evolved led me down a path to be able to develop some great relationships with successful investors.

You learn quickly that amazing talent exists outside your world. In fact, one of the first multibaggers at GeoInvesting came due to a 20 minute conversation I had with a GeoInvesting Subscriber in 2009. We had written a bullish opinion on a stock, but he said that we needed to be looking at the warrants, and laid out his pitch to me. Well, we relayed this message on GeoInvesting and the warrants went from about 20 cents to over $6.00 in a few weeks.

So, today, part of my research process extends beyond what I know, to keeping an open mind to what others have to say. As a famous nursery rhyme goes:

“There was an old owl who lived in an oak, The more he saw, the less he spoke; The less he spoke, the more he heard; Why can’t we all be like that wise old bird?”

This task is still not easy since the internet is rife with numerous articles and robust content on microcap stock pitches, varying in quality and reliability. But, we’ll do our best to bring you ideas from around the web and social media.

By the way, we also sort through the stock picks that our premium subscribers publish on our platform (over 80 and counting) to try and find some timely selections.

Having accumulated over three decades of experience in researching and analyzing Tier 1 microcap companies, our team possesses the expertise required to thoroughly review microcap pitches from fellow investors. With this perspective, let us go over 2 pitches from the web that in aggregate call for 209% upside – one that we noticed was a simple Twitter post on Gravity Co., Ltd. (NASDAQ:GRVY) asking for feedback on the basic thesis of the author’s investment, and another by MS Microcaps, detailing the reasoning for its bullish stance..

–

Title: Bullish EPS Guidance on Superior Group of Companies (SGC)

- Company: Superior Group of Companies, In (NASDAQ:SGC)

- Author: MS Microcaps

- Article Date: May 22, 2023

- Price at time of Article: $9.36

- Current Stock Price: $8.86

- Percentage Change from time of article: -5.34%

- Author Price Target: $14

- Author’s Projected Percent Increase: 49.50%

What They Do:

Superior Group of Companies, In (NASDAQ:SGC) is a company that provides a wide range of products and services in the promotional products, uniform, and corporate apparel industries. We plan to interview management to validate the thesis below.

Join today to see if our due diligence supports a case where a 49.5% return is in the cards.

Why We Chose Super Group of Companies

The stock recently got annihilated on weak earnings. However, management has put in place a plan to quickly address issues. If successful, the stock could move substantially higher in a short period of time.

SGC operates in diversified business segments, with its call center business being in a good position to drive growth amid de-globalization trends and job demand shifts. Although the company has been facing challenges in its branded and healthcare segments (uniforms and branding products), positive signs like improved cash flow, price increases on its services, and reduced risk of supply issues suggest potential for a sharp bounce back.

Overview of the Pitch From the Author’s Point of View:

Superior Group of Companies, Inc. (SGC) operates in three segments: branded products and uniforms, healthcare apparel, and call centers. The call center business is currently driving the company’s growth, benefiting from the increased need for jobs due to de-globalization trends and a lack of job demand in the US by consumers. SGC’s financials have been affected by weak performance in the branded segment, higher labor costs in the call center business, and stalled growth in the healthcare segment since the COVID-related boost in sales has subsided. However, since the lousy quarter that caused the stock to fall, the company has experienced improved cash flow, increased selling prices to combat inflation and wage increases, and a resolution of supply chain issues in the healthcare segment.

The stock has faced downward pressure due to these challenges, but there is potential for a bounce back based on bullish 2023 EPS guidance of $0.92 to $0.97 compared to reported EPS of $0.62 in 2022. The company is also rolling out a new website to accelerate healthcare product sales. However, there are some risks to consider, such as exposure to a recession in the branded division, another prolonged supply issue event in the healthcare division, and high interest expense that could impact debt covenants.

The lowside valuation of SGC indicates a price target of around $9.00 based on a P/E of 10 using the 2023 EPS guidance, offering downside protection in a bases-case scenario. If business conditions improve across all divisions and debt continues to decrease, there is a potential for the stock to reach a price target of $14.00, or 15x times the EPS estimate range for 2023. It is essential to closely monitor the recession risk in the branded business and the management’s debt reduction goals to gauge the company’s future performance accurately and any potential for an expansion in the stock’s valuation multiples. Overall, SGC could be an attractive stock to consider based on its potential for growth if the business conditions improve as projected.

–

Title: Gravity Co. A Mobile Gaming Company Estimated to Increase 160%

Gravity Co. Gravity Co., Ltd. (NASDAQ:GRVY) is a mobile game company trading at ~2.0x EBITDA with +70% of market cap in net cash by year-end and inflecting earnings.

Below is the summary thesis (link in the next tweet).

Any feedback / comments / pushback is appreciated! pic.twitter.com/0O9OTLvE9N

— Clark Square Capital (@ClarkSquareCap) July 9, 2023

- Company: Gravity Co., Ltd. (NASDAQ:GRVY)

- Author: Clark Square Capital

- Article/Post Date: July 9, 2023 (Tweet)

- Price at time of Pitch: $72.30

- Current Stock Price: $75.10

- Percentage Change from time of pitch: 3.32%

- Author Price Target: $115.68

- Author’s Projected Percent Increase: 160%

What They Do:

Gravity Co. (GRVY) is a South Korean gaming company that develops and publishes online and mobile games, including the popular MMORPG (Massively Multiplayer Online Role-Playing Game) “Ragnarok Online.”

Why We Chose GRVY

Gravity Co. (GRVY) is an interesting stock after reporting strong 1st quarter results, due to the successful launch of its videogame Ragnarok Origin and because it has plans to expand globally. The company has a substantial net cash balance, while shares have a low valuation. Additionally, according to the author, the company’s growing cash reserves provide options for shareholder friendly moves.

Overview of the Pitch From The Authors Point Of View:

The investment thesis highlights several reasons why the author believed investing in GRVY is a compelling proposition:

- Gravity’s sales and profit growth accelerated in Q4 2022 with the launch of Ragnarok Origin in Taiwan/HK. I expect that the momentum in top-line and EBIT will continue as the company releases Ragnarok Online in Southeast Asia and globally.

- GRVY’s valuation is extremely asymmetric. GRVY is currently trading at ~2.0x ‘24 EBITDA or a +35% FCF yield, but the downside is limited by the company’s net cash balance ($50+ net cash/share vs. $72 current price).

- The company’s growing cash pile provides for significant optionality through possible repurchases, dividends, or thoughtful M&A.

- The company’s game pipeline could provide valuable diversification of earnings and further upside if the company develops another hit game.

The author suggests a potential 160% upside from the current stock price, with a target price of at least $180 per share.

______________________________________________________________________

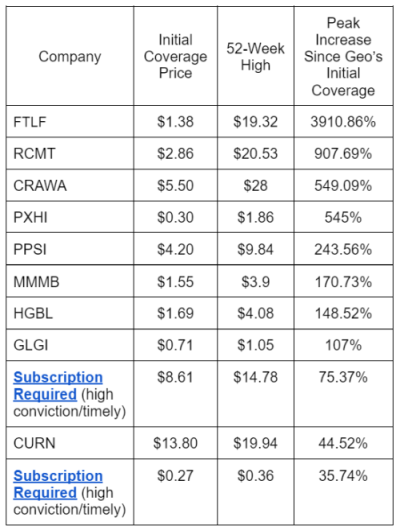

GeoInvesting Progress and Stat Summarizations

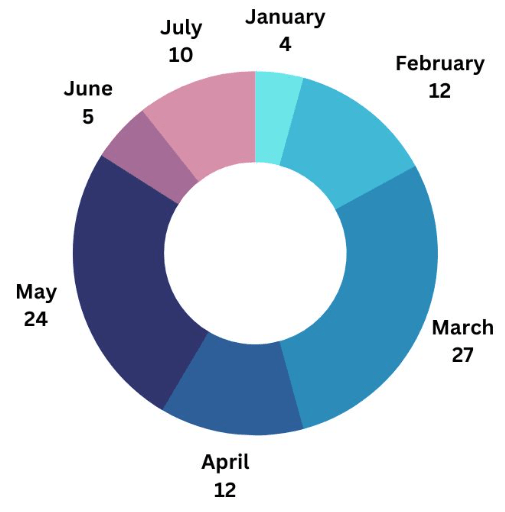

In July, we processed 10 quarterly earnings reports. By comparison, only 5 of our covered companies published earnings in the prior month. The bulk of the second quarter microcap earnings season is about to heat up.

As each quarter passes by, we get to see which companies are adapting to the new market environment. We are excited to start processing Q2 2023 earnings reports, using a new smart press release product I created. Stay tuned for more details on this here.

2023 Quarterly Earnings Reports Processed, YTD

11 companies from GeoInvesting’s Model Portfolios reached new 52-week highs in July 2023

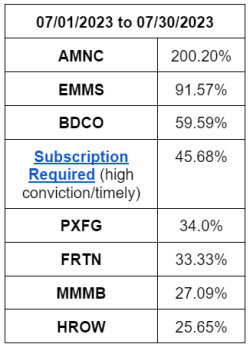

Top 8 Performers Across GeoInvesting’s Coverage Universe, July 2023

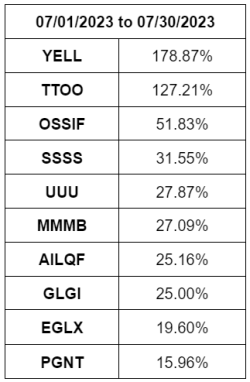

Top 10 Research Contributor Returns, July 2023

—

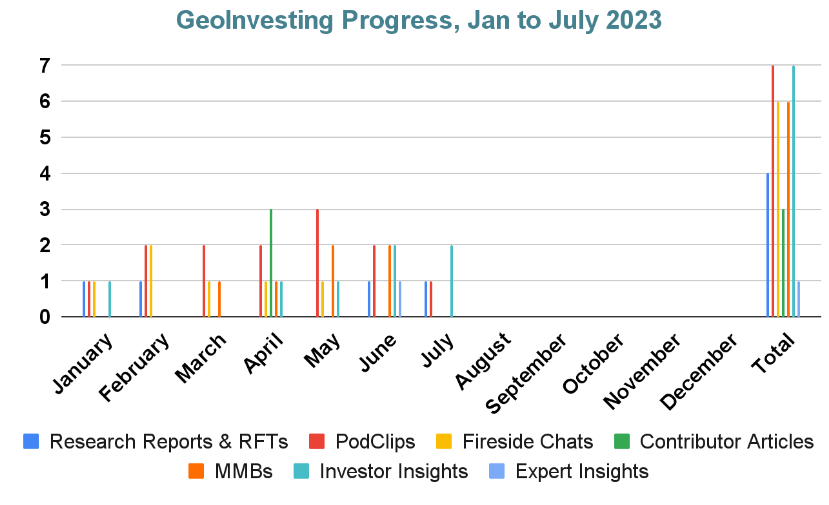

So far in 2023, apart from daily emails and weekly GeoWire Content, we have published a combined 40 pieces of Premium content across the following segments:

4 Research Reports & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

13 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

6 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

6 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

7 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

1 Skull Session Expert Insights (NEW) – Recorded and live podcasts that feature conversations with industry experts.

3 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

5 July 2023 GeoWire Weekly Issues – Premium Subscriber Insights and Pitches

Skull Session Clips – Meet Jeffrey Korn, New CEO Of CXDO (GeoWire Weekly No. 90)

Last week we had a busy Wednesday, first hosting a Skull Session with the management team of Crexendo, Inc. (NASDAQ:CXDO), and a little later in the day invited the CEO of Issuer Direct Corporation (NYSE:ISDR), Brian Balbirnie, to hop on a Twitter Space to talk about the State of the Microcap space.

Urgent Email On GeoInvesting Service – Please Read [GeoWire Weekly No. 91]

Over the last several months, we have been in the process of making some serious changes at GeoInvesting:

- The look and feel of the front-facing website (geoinvesting.com)

- The look and feel of the of the premium portal (portal.geoinvesting.com)

- The type of content we deliver to you.

- The way we show this content to you.

- Rethinking, and now ready to implement, the purpose and layout of the Model Portfolios.

**Before we get into the crux of why we are giving you this update, we just wanted to let you know that Twitter changed its API, and we are working hard to reestablish the connection between our Premium Twitter feed and your email inbox, if that is the way you receive our real time alerts.**

Post July 2023 Forum Follow Up – Model Portfolio Review [GeoWire Weekly No. 92]

Fresh off Thursday’s Open Forum reviewing the past month’s activity and coverage at GeoInvesting, there are a few clips that we feel are important, being that they are related to one of our main topics covered in the July 9, 2023 Weekly Wrap Up. They encompass the need for an assessment of our model portfolios and holdings.

How Quant Investor Ryan Telford Achieved 40% CAGR In Microcaps [GeoWire Weekly 93]

On July 14, 2023, I had a marathon conversation with DIY quant investor Ryan Telford, during which we discussed quantitative investing strategies, insights into microcap and nanocap stocks, and delved deeper into other approaches to microcap investing. And by marathon, I mean it lasted over three hours. Quite frankly, we could’ve probably spoken for another two. But don’t worry, we’ve extracted a few clips from the conversation for this week that we found interesting, and hope you will as well. We’ll also be working a ton more to dissect the video.