Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Over the last several months, we have been in the process of making some serious changes at GeoInvesting:

- The look and feel of the front-facing website (geoinvesting.com)

- The look and feel of the of the premium portal (portal.geoinvesting.com)

- The type of content we deliver to you.

- The way we show this content to you.

- Rethinking, and now ready to implement, the purpose and layout of the Model Portfolios.

**Before we get into the crux of why we are giving you this update, we just wanted to let you know that Twitter changed its API, and we are working hard to reestablish the connection between our Premium Twitter feed and your email inbox, if that is the way you receive our real time alerts.**

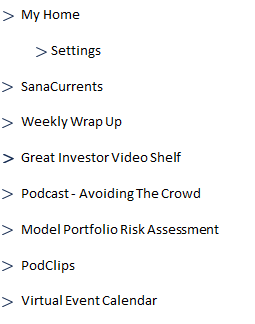

Actually, you may have already noticed some of our changes on the front end. However, during this process, some menu items that were present on the previous site layout are missing as we work to redefine the menu structure to improve your navigational experience. For example, the prior version of our website provided the following menu:

In the meantime, I wanted to point you to a few of these important pages that you might have a hard time finding until we implement the new structure on the front-facing site.

Premium content on the front-facing site (http://geoinvesting.com)

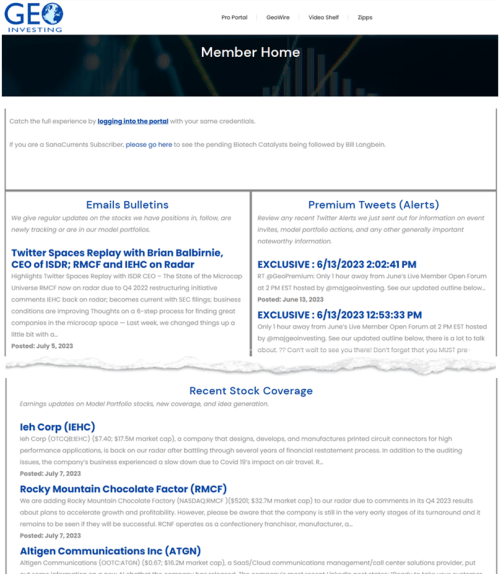

- Member Home – Member Home (geoinvesting.com): This has been currently structured to give you a glance of parts of the Pro Portal to see what’s going on with our Emails, Research and Alerts. We strongly suggest you frequent this if you can’t make it to the portal.

Upcoming Events/Meetings – GeoInvesting Virtual Meeting Calendar | GeoInvesting – Updated with the next upcoming events as they are scheduled. You can read more on what this is about at the link above.

Weekly Wrap Ups (GeoWire) – GeoWire | GeoInvesting – A recap of the past week of GeoInvesting coverage.

PodClips – PodClips | GeoInvesting – Periodic short audio segments breaking down various research on specific stocks.

–

And on our Pro Portal (https://portal.geoinvesting.com):

Past emails – https://portal.geoinvesting.com/v2/dailybulletins.aspx (I’d definitely recommend you go here first) – This is the log of emails that we send to our premium members. They contain information/research on existing and new coverage.

Research – https://portal.geoinvesting.com/v2/georesearch.aspx?spotlight=true – This is basically ongoing coverage of all stocks in our coverage universe.

Articles – https://portal.geoinvesting.com/v2/reports.aspx – An archive of all the articles we’ve written since the inception of GeoInvesting.

Alerts – https://portal.geoinvesting.com/v2/instantnews.aspx – We send premium tweets that quickly echo the sentiment of our research.

RFTs (Reasons for Tracking) – https://portal.geoinvesting.com/v2/georesearch.aspx?rft=true – There are select company write-ups that we decide to do a deeper dive into, but still try to keep it reasonably short.

Select Model Portfolio Stocks – https://portal.geoinvesting.com/v2/screen.aspx?id=28

Some of our favorite stocks – https://portal.geoinvesting.com/v2/screen.aspx?id=92 – Disclosures of what we view as our top long Model Portfolio stocks.

Top 5 favorite stocks – https://portal.geoinvesting.com/v2/screen.aspx?id=99

Video Content Section – https://portal.geoinvesting.com/v2/videos.aspx – Search and filter our Video content.

On a related note, our growth roadmap includes making many changes to the presentation of premium content. Here are two important changes.

The first has already been implemented on the homepage of the premium portal by shifting a few things around. We’ve flipped the position of the Russell 2000 Index chart with our most recent video content, and included an additional section for quick access to just video clips.

We are continuing to consider making additional enhancements and cleanup to the portal homepage. So, stay tuned for that.

Secondly, we are revisiting the model portfolio rankings page, as well as the general framework of our Model Portfolios. Most of the stocks included in the model portfolios were added during a very different stock market and economic environment. The bull market that ensued after the 2008 recession led to an incredible bull market, mainly led by growth stocks, not traditional value.

And, before it imploded, it was a great ride for us, since we were able to pick so many stocks that benefited from that environment.

Of note, into July 2021…

- 2020 was a strong year with returns of 145%. On average, our stock picks in 2020 handily beat the indexes.

- Since 2009, we added over 500 stocks across various model portfolios (which included our GeoBargain/Special monikers pre-2014). 33% of those reached multibagger status.

- Our overall hit rate for high conviction stocks was 65%. Almost two-thirds were higher since our initial call.

- 56 Stocks picks were acquired at a premium since 2009.

With GARP back on a broad basis in the microcap space, I think we will even improve upon these numbers.

Now, as I have written about, I am going all in on Growth at a Reasonable Price investing, betting that GARP is leading/will lead the next bull market. It’s what drove my success prior to the 2008 crisis which marked a change to a 15-year bull market, mainly led by growth stocks, not GARP.

Now, the shift to GARP has been validated by some of our newer picks like Richardson Electronics, Ltd. (NASDAQ:RELL), Spok Holdings, Inc. (NASDAQ:SPOK) and Data Communications Management (OOTC:DCMDF), stocks that also embody our BigCapMicro theme. Unfortunately, Harte-hanks, Inc. (NASDAQ:HHS) was in this category and did not pan out in the end.