Welcome to The GeoWire GeoWire is your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

This week, we thought we’d share a small excerpt of the Fireside Chat we had with a company that distributes products and supplies for the personal hair care industry. We know, not very exciting, but you don’t need an extravagant business plan to have an exciting movement in your stock price. Sometimes boring is beautiful. And this is the multi-bagger setup we think we have here.

If you were able to attend, great. If not, the full replay is available at our pro portal, In prior communications, we elaborated how the company fits into a rare group of GeoInvesting multi-bagger candidates that adhere to the bulk, if not all of our 10 Tier 1 quality microcap criteria. You can see them here at our events page that lists upcoming chats and forums accessible by our premium community.

In the following snippet, our guest conveys an optimism towards the company’s gross and EBITDA margins as the company grows its revenues and scales in multiples.

“I think that as we scale, there is room on the gross margins. I think that over time, what this business looks like if you if you run the math that you’re talking about, and you look at it as it scales to $15, $20, $30, $40, $50 million and beyond, we should definitely be – we’ve done double digit margins – we just did that in 2020. I think what ended up being about a 12 and a half EBITDA margin. So of course, we can get back there in the short term, and longer term I think 15 is a reasonable number, if you just think about the leverage on the SG&A.

We don’t really model a lot on the gross margins in terms of expanding that. But we think that there’s certainly room over time, but not in the near term. So yeah, I think a 15 margin is about right

Now, having said that, that’s going to take more scale, so we can leverage the fixed SG&A expenses we’ve got. And the way to think about it is we’ve looked at some private companies that are really well run in this space. And funny enough, we kind of have a higher G&A burden than them because even though we’re on the OTC, we still have a board of directors, we’ve got a CEO, we have a CFO, and they don’t have any of these things.

So, if you think about it, can we get there? Over time if we scale, those expenses don’t really affect us as much. So, we could get to those kinds of margins. I think 15 is about right.”

We urge you to try and make future events to get a priority peak at the companies that we are taking hard and serious looks at for inclusion in our featured model portfolios. To be clear, these companies are not asking or paying us to speak with our community. It is by invite that they participate in our chats. We thought you should know that.

~Maj Soueidan

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

Back in the spotlight is a debate on whether or not lawmakers should be allowed to own individual stocks. It’s not an entirely new debate, but it is garnering a little more attention after House Speaker Nancy Pelosi dismissed the notion of entirely disallowing her and her colleagues from buying stocks due to what some argue is a conflict of interest, or basically trading on non-public information under SEC Rule 10b-5. Her detractors cite the “Stop Trading on Congressional Knowledge Act of 2012”, also known as the STOCK Act, which was enacted to prevent members of the House and Congress from advantageously using their potential intimate knowledge of one-off company or market-moving events to profit from any resultant price movement in stocks.

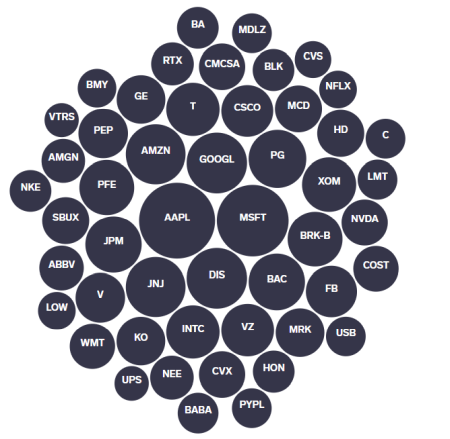

An interactive chart from Business Insider displays, in a ticker tag cloud, the 50 most popular stocks owned by Congress and the Chamber. Go here to view it.

Business Insider contends that:

“49 members of Congress and 182 senior-level congressional staffers had violated the so-called STOCK Act, which requires public disclosure by themselves and family members within 45 days of sales or purchases of individual stocks, bonds and commodity futures.”

The publication posits that 52 members of Congress have violated the STOCK Act. Business Insider’s series of findings on the matter is part of a compilation of data and research duly called, “Conflicted Congress’: Key findings from Insider’s five-month investigation into federal lawmakers’ personal finances.”

What do you think? Do you agree that our lawmakers have a substantive upper advantage, or is the playing field level?

Vote and get a free peak into GeoInvesting’s premium service…

Notable Tweets

Three terrible reasons to buy a stock:

-It has fallen by so much.

-Hearsay from friends, colleagues and brokers.

-The dividend yield is so high!— Thomas Chua (@SteadyCompound) June 3, 2021

As a concentrated investor, I am regularly asked: How can you handle only owning 5 stocks?

A: You only need to diversify if you’re wrong.

I focus entirely on making sure I’m not wrong.

High conviction, High reliability, asymmetric return bets

— Trey Henninger (@TreyHenninger) November 28, 2021

99% of the bad stuff that happens in trading starts and ends between your ears.

Take responsibility for that shit, own it, soak it in and learn from it.

It’s the only way to overcome it.

— Open Outcrier (@OpenOutcrier) November 9, 2021

Featured Video

xxx

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.