Summary

- On August 7th, UTSI filed an amended 13D/A , inclusive of a Binding Term Sheet, where nearly 12 million shares are planned to be sold between investors for a premium of over 200% of the current share price

- The company danced around the topic on its recent conference call and avoided giving any further information on the transaction

- Despite this, the company noted that the buyer was a “strategic investor” and reiterated that they think, in the midst of a turnaround, that the company is significantly undervalued

- UTSI is priced right around its cash value and at an over 30% discount to its book value per share. It also has a $230M net operating loss carryforward that may make it appealing to a strategic buyer

- Due diligence leads us to believe the company could be on the cusp of a material transaction that could result in meaningful appreciation of shares within 60 days

Synopsis

We think we have uncovered a unique binding transaction between UTSI shareholders and a strategic investor interested in acquiring a significant amount of the company in a single transaction at a price of $6.08. Shares currently trade at about $2.00. We believe a 13D/A recently filed could foreshadow material events on or before October 31, 2015 for UTStarcom.

Those who are aware of the transaction may be taking it with a grain of salt due to the deceit and games played by many U.S. listed China companies/firms over the past several years. Our due diligence has led us to believe there’s a high probability that the transaction will consummate.

The 13D/A details a transaction between a person we believe to be a prominent Chinese strategic investor and two parties who are current UTSI shareholders: Shah Capital and the Lu Family.

Based on our due diligence and our understanding of the parties involved, we believe there may be a material event that could be beneficial to UTSI shareholders in coming months. Shah Capital’s well-known reputation, based in North Carolina, combined with UTSI’s attractive current valuation and $230 million net loss carryforward give us reason to believe there is some legitimacy to this transaction and that the buyers and sellers may follow through. We don’t think Shah would risk taking part in a dubious transaction at the expense of hurting its reputation. The fact that the strategic buyer also operates a business similar to UTSI gives us more reason to believe that the transaction will take place. We believe the fact that this transaction was only briefly mentioned on the conference call, combined with it being filed “under the radar” in a 13D/A without an accompanying press release means that retail may have missed what could be a large clue to UTSI’s future.

The Details of the Transaction

UTStarcom Holdings Corp.’s (NASDAQ:UTSI) core business is providing next generation broadband products, solutions and services. As a global telecom infrastructure provider, it focuses on delivering innovative carrier-class broadband transport and access (both Wi-Fi and fixed line) products and solutions, optimized for mobile backhaul, metro aggregation, broadband access and Wi-Fi data offloading.

On August 07, 2015, UTSI filed an amended 13D/A which includes the following verbiage:

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

On August 6, 2015, the Shah Parties and the Lu Parties entered into a Binding Term Sheet (“Term Sheet”) with The Smart Soho International Limited (“Smart Soho”) setting out certain terms of a proposed transaction for the sale of 11,739,932 Ordinary Shares held by the Shah Parties and the Lu Parties to Smart Soho and additional purchasers to be designated by Smart Soho at a price of US$6.081 (the “Transaction”). The detailed terms and conditions regarding the Transaction shall be promptly negotiated in good faith by the parties to the Term Sheet and set forth in a mutually satisfactory definitive share purchase agreement for the sale and purchase of the Sale Shares. Smart Soho has agreed to deposit US$1 million into escrow as provided under the Term Sheet which amount shall be credited against the purchase price should the Transaction be consummated. Among other items, the Term Sheet sets out certain non-exclusive conditions that must be fulfilled as a condition to Smart Soho’s obligation to sign a share purchase agreement and complete the Transaction. Further, under the Term Sheet the parties have agreed to an exclusivity period during which to negotiate the share purchase agreement and complete the Transaction. The Term Sheet also provides that none of the parties is obligated to enter into the share purchase agreement, or to close the Transaction unless a mutually satisfactory share purchase agreement has been reached and the closing conditions there under have been satisfied.

According to the filing, these 11,739,932 shares account for 31.6% of the total outstanding shares of the company. Out of the shares to be sold, Shah is selling 10.65 million shares and the Lu Party is selling 1.09 million shares. We believe that Shah Capital is a fully audited U.S. based capital management company, which we believe adds legitimacy to this transaction.

The agreement notes a “Binding Term Sheet,” which denotes this transaction may be more serious than usual “non-binding” agreements. In addition, the company also posted the detailed binding term sheet along with the 13D/A filing on the SEC’s website. As part of the detailed conditions and terms of this agreement, the term sheet states that:

“ ……The Parties will endeavor to effect the closing of the Transaction by October 15, 2015 and not later than October 31, 2015;

……if the closing under the agreement shall not have occurred by October 31, 2015 for any reason other than a failure by either the Sellers or Investor to perform the covenants and agreements set forth therein to be performed by them or to satisfy the conditions set forth therein to be satisfied by them, either Party may terminate the agreement and neither Party shall have any liability or obligation to the other;”

It seems like all of the parties involved want to complete this transaction by October 31, 2015, at the latest.

Behind the Details

On the August 14, 2015 earnings call the company brought up this transaction, despite refusing to disclose any further information regarding the transaction other than the binding term sheet. We believe that if we can figure out the rationale behind this deal between “Smart Soho International Limited” and “Shah Capital & the Lu Families,” the risk/reward of being a UTSI shareholder may be tipped to benefit those long the stock. We believe the deal marks some type of coming material event, we just need to figure out what type of scenario this could be telegraphing.

Several analysts, inclusive of our team, asked about the composition and nature of this agreement on the company’s conference call last week. The company said nothing about the details, leading us to believe that this transaction could eventually result in a material development.

You can read the entire transcript of the call here.

This was the first analyst exchange:

Analyst – Great, thanks guys. One more question. Could you also give us more color on how recently some Chinese listed company purchased all shares from Shah Capital at over $6 per share?

William Wong – Chief Executive Officer, Director

As I stated during the call earlier, the binding term sheet is currently at the term sheet’s base right now. So we’re not in a position to speculate on such an arrangement between individual investors. However, as I stated again, we do very much welcome investors who see the promises and particularly the underlying value with the UTStarcom and who see the long-term strategic value that the company is bringing, because if you look at the business we are in the blink of turning around.

At the same time, there is plenty of cash in the company with very little or actually zero debt and a very substantial sizeable investment portfolio that we have and we are beginning to show tell tales of monetizing those investments that you see with the return of money from IPTV and ESA. So hopefully, more and more investors will begin to see the true value of the company and we welcome investors who would want to join the investment group for UTStarcom.

Min Xu – Chief Financial Officer

Just a few more comments, so as indicated by the 13D filing filing, the timeline for this deal is expected to close late October and so at this point, it’s just kind of private transaction between investors. If there are any company-specific events, we will definitely put out an update.

And the answer we were given:

William Wong – Chief Executive Officer, Director

Yes certainly, as I say that there is not a whole lot we can comment upon this at this moment, the only thing that I would add is that this is a strategic investor. I mean if you look at the premium they are offering obviously there is a lot of [indiscernible] in this investment and this is the extent that we can talk about it. I’m sure as they get closer to a more definitive agreement and so forth then at such time there may be more information can be revealed by the investors and of course by the time if and the deal closes, then I am fully sure investor and the company would have a full-blown detailed discussion of the strategy moving forward.

What’s intriguing to us is why “Smart Soho International Limited” wants to pay $6.08 per share to purchase UTSI stock while it’s currently trading around $2.00. This just doesn’t seem to make sense given the documents that have been disclosed, unless there’s future documentation to be filed that would round out other terms of this agreement.

Could a Major China A Share Strategic Investor be Involved?

We first performed due diligence on “Smart Soho International Limited” and the person who signed the binding term sheet, Guoping Gu. Little information was found regarding the company named “Smart Soho International Limited,” but we did find one person named Guoping Gu, who appears to be a well-funded, strategic investor in the China A share market.

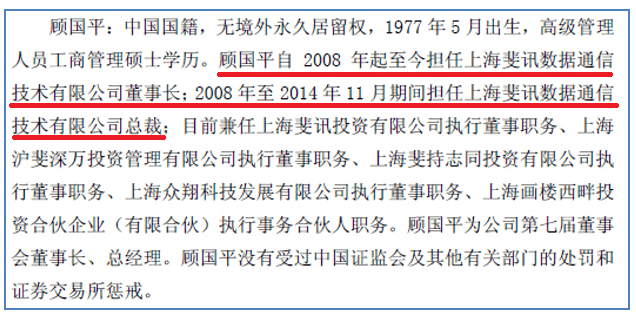

After performing our due diligence, we found one Guoping Gu ( 顾国平 in Chinese), whose background and experience seem to fit the Guoping Gu whose name is on the binding term sheet. Based on our research, Mr. Gu has engaged with one China A share company, 600556, since 2014. Below is the Chinese introduction of Mr. Gu from an announcement made by 600556.

Here’s the translation for the red-underlined text:

“Guoping Gu has been the Chairman of Shanghai Feixun Communication Co., Ltd. (Chinese name: 上海æ–讯数æ®é€šä¿¡æŠ€æœ¯æœ‰é™å…¬å¸) since 2008; [and] CEO of Shanghai Feixun Communication Co., Ltd. between 2008 and November 2014. “

On July 29, 2014, 600556 released an announcement that Mr. Gu was participating in a private placement of the company’s shares, and pursuant to which, Mr. Gu agreed to subscribe 194 million shares of the company’s newly issued shares at a price of RMB 3.65 per share, with an aggregate of RMB 708.3 million (~USD 110.7 million) offered.

The stock was trading at RMB 4.34 when it was halted due to material news on March 28, 2014 (reopened on July 29, 2014). Pursuant to the subscription agreement, if it went through, Guoping Gu would hold 18.68% of the expanded total outstanding shares of the company. However, On August 29, 2015, 600556 put out a release stating that its private placement proposal had been declined by the China Securities Regulatory Commission (CSRC) and that the company would disclose further details after it receives the official documents from the CSRC.

Currently, the stock is trading at RMB 10.10 per share as of August 31, 2015.

Below are a few clues why we think Mr. Gu may be the same person from UTSI’s binding term sheet:

- According to 600556’s announcement on November 05, 2014, Guoping Gu purchased 15 million shares from another party at price of RMB 9.5 per share (a large premium), where he would have been able to purchase the company’s shares at price of RMB 3.65 per share once the private placement was approved by CSRC.

This RMB 9.5 per share purchase represented a 160% premium compared to the private placement price. What’s also worth noting is that, on November 05, 2014, the stock was trading at RMB 10.07 per share. We think there may have been some reason to compel him to purchase the stock closer to the market price instead of waiting for the approval of the private placement.

According to this Chinese news report article, Guoping Gu was eager to become a shareholder of the company (purchased shares by Guoping Gu accounts for 3.8% of the total outstanding share of 600566) and get onto the board of directors. On November 11, 2014, 600556 announced that it appointed Guoping Gu as the general manager of the company and Mr. Gu was also elected into the Board of Directors. On December 30, 2014, the Board of Directors elected Guoping Gu as the Chairman of the Board.

This purchase he made in 2014 may run parallel with what is happening with UTSI’s block share transaction between “Smart Soho International Limited” and “Shah Capital & Lu Families.” The difference being that Gu still paid close to the market price in 2014, but now he would be paying a 200% premium to UTSI’s current price level.

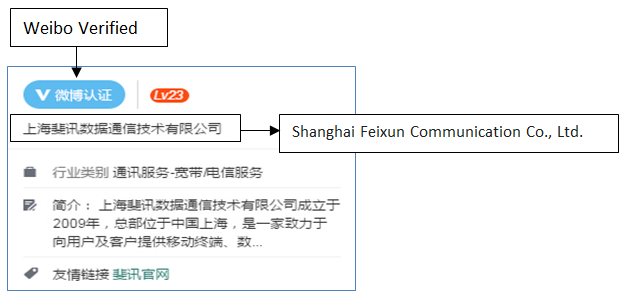

- We took snap shots of the official Weibo account (similar to Twitter in China) of Shanghai Feixun Communication Co., Ltd. to further confirm our beliefs. The first snapshot below is the introduction of the official account

The snapshot below contains an interesting findings in that the official Weibo account retweeted content on August 24, 2015 posted by another Weibo account, which includes a WeChat (chat/communication software in China operated by Tencent) post by the Chinese name “顾国平” (English translation: Guoping Gu). Below is the retweet from Shanghai Feixun’s official Weibo account. The content from that WeChat post, if translated and paraphrased, is as follows:

“Xiao Ling Tong” used to be the flagship cell phone product offered by UTSI in China, but as more advanced cell phones by other companies came onto the market, the “Xiao Ling Tong” business from UTSI faded away almost completely many years ago. We have no evidence to determine if this WeChat account really belongs to Guoping Gu, the Chairman of Shanghai Feixun, but the fact that the official Weibo account of Shanghai Feixun retweeted this post gives us confidence that this Guoping Gu and Shanghai Feixun are highly likely to be related to this high premium transaction with UTSI.

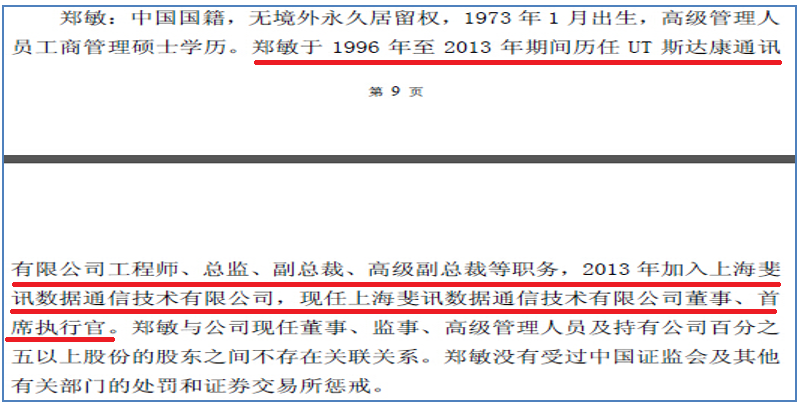

- Another clue comes from the current CEO of Shanghai Feixun Communication Co., Ltd., Mr. Min Zheng. According to the Chinese introduction of Min Zheng from the announcement of 600556:

Translation for the red-underlined text:

“Min Zheng was working in positions as an engineer, principal, vice president, and senior vice president in UTStarcom Telecom Co., Ltd between 1996 and 2013, and [he] joined Shanghai Feixun Communication Co., Ltd. in 2013. He is currently the director and CEO of Shanghai Feixun Communication Co., Ltd.”

In addition, Min Zheng is also currently on the Board of Directors of the aforementioned China A share company, 600556, since end of December, 2014.

Min Zheng’s previous UTSI’s working experience has further strengthened our belief that Smart Soho International Limited might be related to Shanghai Feixun Communication Co., Ltd. and its Chairman, Guoping Gu.

- According to the profile of Shanghai Feixun Communication Co., Ltd.’s Chinese LinkedIn page, the company has five business units and one of them is called SOHO BU, which aims to provide products and services such as DSL, EPON/GPON, Home Switch, WiFi AP, etc. The name of the company who is buying shares in UTSI is called “Smart Soho International Limited.” The name looks similar to that business unit name, although it’s not identical. We wonder if this “Smart Soho International Limited” is a subsidiary established by Shanghai Feixun Communication, Ltd. or its related parties.

Why UTStarcom, Why Now and Why Such A Large Premium?

One possible rationale for Gu getting involved is that he may have sensed that the private placement he was involved with in the China A share market was going to encounter difficulties and risk not getting approved by CSRC. The announcement on August 29, 2015 from 600556 confirmed to us that this PIPE did not receive approval.

We don’t know why this private placement was stopped by regulators, as the company didn’t disclose further details regarding the matter. However, we believe this incident is an added positive factor for the UTSI transaction to go through, as UTSI may now be Gu’s first priority and because successfully acquiring the controlling shares of the company may be a path for Gu to make his way into the U.S. capital markets.

In addition, Gu may also look to find synergies between his current business units and UTSI, especially since UTSI management has been pounding the table stating that its multi-year restructuring process will begin to pay off in the near future.

It’s also possible Gu’s doing this to avoid the RTO route in the U.S. markets due to their poor reputation. UTSI has been public since around 2000, it still has some business in the telecom sector (although declining) and it seems to be compatible, to some extent, with Gu’s current business.

Another possibility is that Gu wants to take some control of UTSI and, after a certain period, he may try to privatize the company. After the privatization, he may look to incorporate UTSI into another company in the China A share market.

Regarding the huge premium that Gu is paying for these ~11 million shares, we speculate that one of the reasons may be related to the trading volume of the company. UTSI’s average trading volume in the past 3 months is just 54,635 shares. The block transaction in this deal is 11,739,932 shares, which is about ~220 times the daily average trading volume of UTSI. Thus, it is not unreasonable to imagine that if Gu tried to purchase this amount of shares on the open market, the average share price Gu would need to pay would be significantly higher than the proposed one in the 13D/A transaction. In addition, according to UTSI’s 2014 20-F filing, the company has a $230.6 million net operating loss carryforward, while the non-GAAP quarterly revenue in Q2 2015 was only $16.7 million. It is possible that the NOL carryforward has also added value to the buyer when considering this transaction.

UTSI is just cheap enough for this to potentially make sense, trading at about 0.7 times book value and about 1 times cash on hand with no debt.

Noted Caveats

Of course, when speculating based on a single transaction like this there’s a significant amount of caveats that need to be addressed. Here are some items that we feel those contemplating a speculative long position in UTSI must be aware of.

- Hong Liang Lu, of the Lu Family who are selling around 1.1 million shares (basically liquidating their whole position in UTSI), and the co-founder of UTSI, have close ties with the current Chairman and CEO of Softbank, Masayoshi Son. According to the 2014 20-F from UTSI, 46% of the company’s revenue comes from Japan, and

“our net sales to Softbank totaled approximately $57.0 million, representing approximately 44 % of our total net sales. We anticipate that our dependence on Softbank will continue for the foreseeable future. “

A concern is that once the Lu Families liquidate their position, UTSI’s business with Softbank might go away or that the Lu Family is selling knowing that business with Softbank is set to decline.

- UTSI changed its auditor from PwC to GHP Horwath on July 21, 2015, which may be a red flag.

- It is unclear to us what Guoping Gu’s follow-up plan is for the company and it is also uncertain whether, or to what extent, the minority shareholders will benefit from this transaction, given the high premium between these two parties. Even if the deal is completed as stated, and completes before October 30, 2015, common shares of UTSI may still trade at a price (much) lower than the transaction price of $6.08. LITB is a recent example of this dynamic. Recently, a China A share company, 603001, bought ~25.7% of the total shares of LITB at price of $6.30 per ADS in June of this year, but LITB’s stock is still trading at $3.20 as of August 31, 2015.

- Although there is a “binding term sheet” for this high premium block-share transaction, there is still a possibility that the deal might not go through before October 30, 2015. If that happens, the stock price might be affected negatively

Conclusion

It’s important that we make sure we have these caveats on the front of our mind when we continue to investigate this scenario. The risks of trying to make a long term call on a company based on such a transaction is obvious. However, we look at UTSI as a potential short term trade (~3 months) with a potential upcoming material event.

Knowing what we know, we have staked a small speculative long position in UTSI.

Disclosure: Long UTSI

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.