Summary

- Cannabidiol (“CBD”), a cannabis-based substance, is the focus of INSY and GWPH, two companies competing to develop CBD for the treatment of Dravet Syndrome, a form of childhood epilepsy.

- Contrary to what appears to be respected analysts’ expectations, INSY managed to receive orphan drug designation for the treatment of Dravet Syndrome.

- We believe analysts were misled into believing that GPWH had exclusivity to pursue CBD for Dravet syndrome.

- Given that INSY already has licenses in place to manufacture and distribute cannabis-derived products in the US, it appears much better suited for success than one that doesn’t, namely GWPH.

- INSY offers a much better valuation proposition than GWPH; our best case valuation for INSY is $86/share, or over 218% upside; for GWPH, $52/share, or around 40% downside.

GeoInvesting readers will recall that the GeoTeam published a bearish article on Aegerion Pharmaceuticals Inc. (NASDAQ:AEGR) on March 28, 2014. Our research at the time revealed AEGR was promoting its sole drug, JUXTAPID, off-label. The motivation for doing so was obvious. The drug treats what is estimated to be a one-in-one-million population condition. With such a limited population of eligible patients, AEGR had to push the envelope if it was to convince the Street of its viability. Shortly after we published our article, AEGR reduced its 2014 revenue guidance and the stock’s price has declined by 30% since then. The moral of the story is that hype and blue sky scenarios are pervasive in the pharmaceutical space and investors should proceed with caution.

This brings us to two other pharmaceutical stories that caught our eye. As we have been closely following the hot cannabis industry, we noticed two companies that are working to develop competing Cannabidiol (“CBD”) compounds to treat epilepsy in children – INSYS Therapeutics, Inc. (NASDAQ:INSY) and GW Pharmaceuticals plc (NASDAQ:GWPH). INSY is our bullish call that has been quietly making progress (while insiders buy) without the fanfare and GWPH, our bearish call that in our opinion is making fanfare without properly telegraphing the risks that it faces for its CBD to reach the market (while insiders sell).

- INSYS Therapeutics – go long the substance overhype

- GW Pharmaceuticals – sell the promotional hype

We rate GWPH a SELL with around 40% downside, and INSY a BUY with more than 200% upside potential.

This story becomes even more compelling in light of analysts’ price targets. With respect to GWPH, the price targets are clearly overweighed with an assumption that the company will eventually gain approval for its CBD. However, price targets on INSY have not accounted for this same kind of approval assumption. We find this very odd since both companies have received orphan drug status from the FDA for their CBDs and only one would be able to ultimately gain final FDA approval. We believe that once INSY begins informing analysts and investors about its progress with its CBD initiative that price targets will have to be raised. We detail in this report why we believe that INSY has the clear advantage in this race, including the key role the Drug Enforcement Administration (“DEA”) will play in the FDA approval process for GWPH which has to import its raw material from outside the U.S.

Background

The valuation arbitrage between GWPH and INSY centers on the compound Cannabidiol. CBD is a compound derived from marijuana for which medicinal applications are still unknown. A simple Google search of “Cannabidiol Epilepsy” yields significant anecdotal evidence that CBD has the potential to treat Epilepsy in children. The interest in and use of CBD was amplified by a compelling CNN documentary available here.

The Medical Marijuana Market Offers Great Opportunities, But Be Careful

The issue at hand is the development and marketing of CBD. There is a great deal of excitement about the drug’s potential for treating epilepsy. GWPH has engaged in a heavy promotional campaign and potentially misrepresented certain key points to Wall Street analysts who bought the story, leading investors to push the stock price up by more than 1,000% in the last 12 months, translating to a market cap of over $1.7 billion for the company. Rather than attack the drug itself, we choose to focus on management statements and rosy projections versus the business environment and legal realities.

For investors who choose to avoid the hype and instead focus on substance we have identified INSY as an opportunity to access the exact same opportunity that GWPH touts but with far less hype and uncertainty. INSY received FDA Orphan Drug Designation on July 1, 2014 for exactly the same compound for which GWPH had been previously granted orphan status. However, a major difference is that INSY has a market cap of only $925 million and existing robust revenues and cash flows from Subsys, a drug that has already been FDA approved and has been successfully marketed since March 2012. Furthermore, GWPH has not received FDA approval for any of its drugs as all of its revenues are generated outside the U.S.

For investors who desire exposure to the medicinal marijuana market, they can do so by buying INSY, where it is almost a free option, as opposed to being long GWPH, a company that faces more business and regulatory challenges and thus a much lower probability for success. GWPH does, however, excel at heavy promotional activity, including the issuance of misleading statements about its business.

In this report, we show:

- GWPH appears to have made misleading statements that mask the actual and relatively low probability for success.

- GWPH’s promotional tactics have apparently been successful as analysts have been misled enough to incorporate materially false assumptions in their reports, which in our opinion indicates poor or even a lack of due diligence by these analysts.

- INSY is a far safer and higher probability investment for those hoping to capitalize on the bull case for medicinal marijuana.

Valuation and Competition

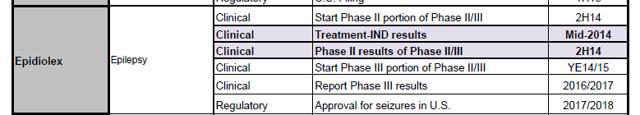

Wall Street analysts are extremely bullish on the market for CBD as an epilepsy treatment. In their valuations of GWPH, a probability discounted forecast still yields valuations equal to GWPH’s current share price of around $90. This is evidenced by excerpts from respected analysts, shown in the screenshots below. (note: GWPH uses the trade name “Epidiolex” for the compound CBD.)

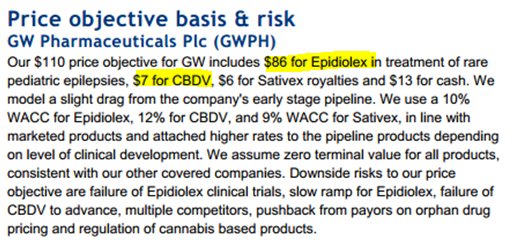

On June 30, 2014, Merrill Lynch (“ML”) assigned a $110 price target for GWPH with 85% of that value attributed to Epidiolex and CBDV. That’s $1.3 billion of the company’s current $1.5 billion market cap:

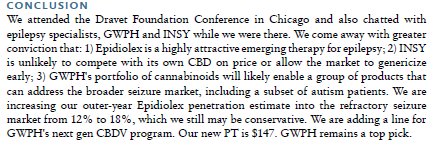

Piper on June 30, 2014:

Morgan Stanley (NYSE:MS) on May 12, 2014:

The problem with the bullish assumptions is not drug efficacy related. We are not doctors, and do not intend to try to debate science. We are solely interested in securities valuation. Contained within these analyst reports are certain assumptions regarding the probability of success that are simply untrue. In an April 22, 2014 note, MS backs up valuation claims with the following statement:

MS appears to believe that GWPH has exclusivity to pursue CBD for Dravet syndrome.

Piper Jaffray (Piper) also makes a key incorrect assumption in the, as seen below:

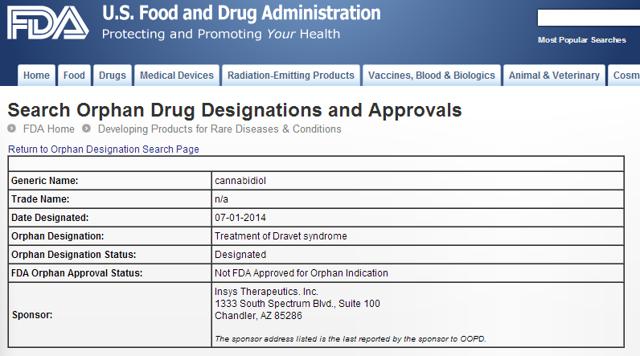

Unfortunately for Piper, INSY received Orphan Drug Status for CBD the following day. The following screen shot was obtained on the FDA website that is open to anyone:

Note the Orphan Designation for the treatment of Dravet syndrome. So is it possible for multiple parties to have an Orphan Drug Designation prior to approval? In order to confirm this evidence, we retained FDA counsel who was very clear in saying that there is no such thing as orphan exclusivity prior to FDA approval. We are not sure if the MS analyst is an FDA attorney, but it does not show up in his bio. We believe the analyst was misled by GWPH’s management, as we doubt he invented this idea on his own. More troubling though is that he apparently made no meaningful effort to validate management’s claim of exclusivity.

Simply said, our basic search of orphan drug designations and approvals clearly refutes Piper’s assumption that there would be no competition for GWPH from ISNY or anyone else.

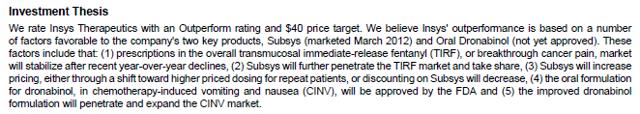

What about analysts that cover INSY? This is where the opportunity exists. INSY has been quiet about its CBD program even as insiders purchase stock in the open market. Following is an excerpt from an Oppenheimer report on INSY published the same day that INSY received Orphan Designation:

Notice there is no mention of CBD at all. So a compound that ML says is worth over $1.3 billion to GWPH has NO value to INSY?! This presents considerable upside for INSY shareholders and appears to be undetected by the Street.

Misrepresentation of ongoing “Trials” and Poor Due Diligence:

Although physician-sponsored trials are ongoing, GWPH is NOT currently conducting any clinical trials for Epidiolex approval, despite convincing the Street that they are. One of the reasons analysts have continued to be excited by GWPH is that they believe the company is rapidly pursuing clinical trials. This is evidenced by the following from Merrill Lynch on June 30, 2014:

Also, from Piper on June 30:

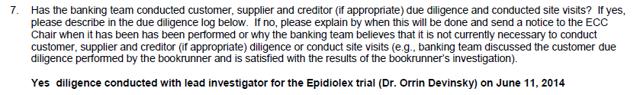

In a particularly disturbing piece of evidence, GWPH management also seems to have confused ML’s investment banking team with claims that the company is currently conducting clinical trials. In an ML internal document found on a private wealth advisor’s website, we see that when ML did due diligence for GWPH’s recent equity offering, they also believed that clinical trials were taking place:

In order to confirm the progress of these trials referenced, we went to clinicaltrials.gov. A search for “Cannabidiol” and “Epilepsy” yields the following shocking result:

GWPH is not currently conducting any FDA clinical trials for Epidiolex. But what about Dr. Orrin Devinsky, the doctor that ML spoke to? Who is he and what were they referencing?

Dr. Devinsky is a respected researcher. The “trial” that so many Street analysts mention is actually just an investigational study at NYU. Many online resources regarding this study reference this article from a pro-legalization blog which gets information from GW’s chairman. Dr. Devinsky does appear to care deeply about helping families affected by epilepsy. He argues for the investigation of medicinal marijuana and epilepsy in a NYTimes Op/Ed available here. Within the article, he argues:

“There is no reason such studies cannot be done with other products derived from marijuana, such as the oil with high CBD and low THC sold in Colorado that was used by Charlotte Figi.”

This implies Dr. Devinsky is more interested in proving that OTC CBD in dispensaries could be helpful to patients. He does NOT appear to be specifically interested in the approval of Epidiolex. It would be negative for any valuation scenario if the leading researcher on the topic were to argue that there is no need for a prescription drug, but we will address that later.

Dr. Deinvsky also appears to do his best when trying to bring expectations back to earth in a conference call organized by GWPH on June 17, 2014. Within the same call, the transcript shows that Stephen Wright of GWPH makes promotional statements such as:

“So, before heading on to Dr. Devinsky, if I could just draw some key conclusions, firstly, we interpret these data as showing promising signals of efficacy, especially in Dravet syndrome.”

This is immediately followed up by Dr. Devinsky saying:

“It has been as Dr. Wright said, an open-label trial, so that both the parents and children who are cognitively aware, as well as the investigators are aware of the medication, the active substance that’s been given, so this is not the randomized or double-blind trial…it is an open-label study, and obviously not as valuable data as we would get from a randomized, placebo-controlled trial.”

This is to say, this is in no way a proper clinical trial that can be used for FDA approval. As seen above, the actual FDA trials are not yet underway.

This is clear evidence that GWPH is not actually very far ahead of INSY in the race for FDA Orphan Approval.

INSY’s Home Field Advantage

Part of the reason GWPH will likely struggle is that it does all of its manufacturing in the UK. Since CBD is a Schedule 1 substance, the commercialization of Epidiolex would require GWPH to get a license from the DEA to import it for commercial purposes. This would be the first license of its kind ever issued by the DEA so it is not likely to happen.

In a presentation to investors on May 22, 2014, GWPH lists as a development milestone that:

Well, not really. Under pressure from other government bodies, the DEA has allowed the importation of schedule I substances for purely research purposes only. This is how Dr. Devinsky is able to use Epiodiolex in the NYU study. This makes sense; one can easily see the benefits of medical research that could help the sick.

As noted in the company’s recent prospectus, GWPH still has not requested nor received approval from the DEA for the importation of Epidiolex for sale. From the June 20, 2014 prospectus:

“Moreover, Schedule I controlled substances, including BDSs, have never been registered with the DEA for importation commercial purposes, only for scientific and research needs“

Well, if you can’t import it, do they at least have the right to make it? Further on in the prospectus, you can see that they don’t:

“In the United States, the DEA regulates the cultivation, possession and supply of cannabis for medical research and/or commercial development, including the requirement of annual registrations to manufacture or distribute pharmaceutical products derived from cannabis extracts. We do not currently conduct any manufacturing or repackaging/relabeling of either Sativex or its active ingredients, or any product candidates, in the United States [bolded for emphasis]. In the event that we sought to do so in the future, a decision to manufacture, or supply cannabis extracts for medical research or commercial development in the United States would require that we and/or our contract manufacturers maintain such registrations, and be subject to other regulatory requirements such as manufacturing quotas, and if the DEA failed to issue or renew such registrations, we would be unable to manufacture and distribute any product in the United States on a commercial basis.”

Additionally, in an article about GWPH, a doctor from the very same NYU center doing the study says:

“You can’t pretend this stuff isn’t marijuana,” ASA’s Aggarwal says of Sativex. “That’s like saying to a judge when you get caught with pot brownies that this is something different. Marijuana shouldn’t be cordoned off for the sake of FDA drug applications or patents.” [bolded for emphasis]

We consulted FDA attorneys on the topic, and it is clear that the type of licensing for import versus domestic production is a very different and could take years. We engaged a law firm familiar with DEA regulations, and the law is quite clear. If importation is NOT for research purposes, then the company would have to demonstrate that the US is lacking in sufficient supply. Given commercial production of medicinal marijuana is booming, and the existence of INSY’s manufacturing, this process could take a significant amount of time even if CBD were to gain FDA approval. It places a huge question mark on GWPH’s commercial strategy. We believe the company will have to enter into a domestic production agreement with a third party or engage in production itself as a result of the legal environment. This is a significant challenge for any proper clinical trial, as approval would have to be based on clinical trials using the identified manufacturer. We believe that GWPH is taking a great risk by not addressing this problem first.

This puts GWPH at a competitive disadvantage to INSY.

INSY has manufacturing facilities in Austin, Texas, and is fully licensed by the FDA and DEA for the manufacture and distribution of cannabis-derived products.

Whereas GWPH has NEVER obtained FDA approval for ANY drug in the US, INSY has already been through the process. It is our belief that a company, namely INSY, that already has manufacturing and licenses in place is better suited for success than one that doesn’t, namely GWPH.

INSY Set Up To Under Promise And Over Deliver

In May of 2013, GWPH CEO Justin Gover was interviewed by Forbes. A notable fact about the interview, available here, is that Epidiolex is not even mentioned. His big growth story in the US is Sativex, a drug with a much smaller market than is anticipated for CBD. In fact, in order to find any mention of Epidiolex from GWPH, one would need to fast forward to November of 2013, after the stock price had already moved up 300% and the marijuana stock hype had begun. On the November 19, 2013 earnings call, management mentions Epidiolex 19 times, up from ZERO times in the previous transcript. With a new stock price justification and an exciting program, Gover celebrated by dumping 500,000 shares in the market on November 26, 2013, only one week after the earnings call. This was followed by equity raises in January of 2014 and June of 2014. His sale was done the same day as the publishing of Piper’s favorable report regarding GWPH.

INSY management has done the opposite. After mentioning CBD in his opening comments on the May 13, 2014 earnings call, INSY CEO Michael Babich does not say CBD or Cannabidiol for the entirety of the Q&A section. From May 15 until June 16, 2014 INSY management invested nearly $6 million into INSY stock in the open market. This is far from the promotional behavior displayed by GWPH insiders, and we believe shows INSY’s management team puts their money where their mouth is:

Recent Event Makes INSY An Even Greater Bargain

It is important that investors have perspective on INSY’s flagship drug, Subsys, and a recent event that unjustifiably resulted in INSY’s stock price falling sharply. Subsys accounted for 97.5% of INSY’s $41.6 million in revenues in Q1so any news concerning the drug is going to move the stock.

Between July 31 and August 1, 2014, INSY dropped sharply from $30 to an intraday low of $22.50 on August 1 before recovering to $28 in recent trading. The volatility was based on news that Express Scripts (NASDAQ:ESRX), the largest Pharmacy Benefit Manager (“PBM”) with around 30% market share, announced it would be adding Subsys to its excluded medications list for the national formulary beginning January 2015. The second largest PBM, CVS Pharmacy, did not follow suit to restrict Subsys. Oppenheimer and JMP Securities (“JMP”) analysts quickly weighed in with sharply divergent views on the impact of Express Scripts’ decision. The Oppenheimer analyst estimated $50-$60 million in revenues and 25% of INSY’s EPS in 2015 was at risk and surmised that Subsys’ growth potential without Express Scripts would be severely impacted. The JMP analyst concluded the Express Scripts scare was overblown and that weakness in INSY’s share price was a buying opportunity. We are putting more weight in JMP since the analyst explicitly mentioned that he spoke with INSY management, while the Oppenheimer analyst made no such statement. Following is an excerpt from the JMP report published on August 1, 2014:

“Concerns over reimbursement coverage overblown, buy on weakness; reiterate Market Outperform rating and $65 price target on Insys Therapeutics. INSY shares have been under pressure yesterday and this morning due to concerns that Subsys may be added to Express Scripts’ (“ESI”) exclusion list for 2015. While we do not have insight into whether or not Subsys will be added to ESI’s exclusion list, we do not believe that such a change would materially impact the product’s sales or growth trajectory. This is because the product already has prior authorization requirements and is not currently included in any PBM preferred formulary positions. We also had the opportunity to speak with management who believes that the product’s inclusion on the ESI exclusion list would have little to minimal impact on overall Subsys business. We view this weakness as a buying opportunity. Our $65 price target is derived through a risk-adjusted DCFanalysis, including Subsys and pipeline candidates.

Subsys success has been achieved even with reimbursement road blocks and insurance companies recognize its medical necessity. We highlight that Subsys is currently subject to reimbursement restrictions, as has been the case since the product was launched. The product is not currently included in any PBM preferred formulary positions. Therefore, we view the potential impact to Subsys becoming an excluded product for ESI as different (i.e., substantially less negative) from a scenario where a drug that was previously included on a formulary is removed and placed on a PBM’s exclusion list. We note that, typically, prior authorization is required for an insurance company to grant reimbursement access for Subsys. As such, physicians prescribing Subsys are accustomed to securing patients’ access to drug by gaining prior authorization approval from insurance companies, including attesting to the product’s medical necessity. Insys also has infrastructure to provide assistance to physicians with insurance coverage determination and the prior authorization process.”

In our view the JMP analyst put the concerns over the Express Scripts’ decision to rest. We recommend investors pay close attention to INSY’s Q 2 release and conference call on August 12, 2014 as the Express Script decision and impact on Subsys will almost certainly be prominently discussed. If management echoes JPM statement we would expect shares of INYS to approach the pre Express Scripts scare levels.

Valuation – GWPH Grossly Overvalued, And INSY A Screaming Buy

We note that Infitialis has previously said that there will be no market for CBD because people will just go to dispensaries rather than have insurers pay for an expensive Orphan Drug. We are less convinced. We believe the appropriate case study is GSK’s drug Lovaza. Lovaza is fish oil. Unlike OTC fish oil, the FDA inspects the manufacturing and has reviewed data regarding Lovaza. Other fish oil products are exempt from FDA inspection or regulation because of the Dietary Supplement Act. Despite fish oil being far more widely available than marijuana products, Lovaza still manages to generate approximately $250 million in revenues per quarter. See data here.

We believe that, while pricing might fall short of Street expectations, parents will want FDA quality CBD when giving it to their epileptic children and insurers will cover the costs. In fact, we believe that the synthetic CBD produced by INSY will be superior because its consistency can be better controlled than extractions from plants.

Rather than speculate on the market size, we will rely on Street analyst expectations for CBD, but will handicap probabilities based on our research.

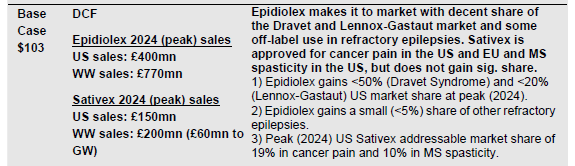

The probability adjusted present value of CBD for Epilepsy has a wide range. Piper believes it could be worth up to $2 billion, while ML has a more conservative $1.6 billion estimate. How does this translate to stock prices? MS thinks that if Epidiolex fails, GWPH is worth $9 per share. These are DCF based calculations using a 9% WACC. As these WACCs take into account materially false information (such as exclusivity, clinical trials that have not yet begun, and direct competition from a seasoned rival), we think that 10% far too bullish. Adjusting this discount rate to 20%, we get roughly half the ML’s valuation for CBD, or $800 million. At that valuation for Epidiolex and an additional $9 a share from MS, we get to a best case $52/share for GWPH or around 40% downside.

This is in sharp contrast to our valuation of INSY. INSY has conservative management, manufacturing licenses, US based production, and a track record of having gained FDA approvals. It’s everything that the Street wishes GWPH had. We believe a 10% WACC could be fair for INSY’s CBD program. Using $1.6 billion and 34.2 million shares outstanding, we derive $46/share for CBD. Adding existing programs that Oppenheimer values at $40/share, we can see a blue-sky valuation of $86/share. This presents over 200% upside.

A hedged investment in CBD for Epilepsy of being short GWPH and long INSY is a rare opportunity in capital markets.

Also – 44% of INSY’s float has been shorted – a juicy long proposition for us.

Disclosure: Long INSY, Short GWPH

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.