On a July 25, 2016 we published a research note titled SkyPeople Fruit Juice — SPU — Lighting Up U.S Listed China Stocks. We summarized a potential transaction between one of SPU’s subsidiaries, Shaanxi Guoweiduomei Beverage Co,. Limited and a State Owned Enterprise (SOE) in China, Shaanxi New Silk Road Kiwifruit Group Inc. (NSR). The definitive agreement calls for NSR to purchase a 51% stake in Guoweiduomei. NSR will have to pay $46 million (we presume in cash or in NSR shares) to complete the transaction if certain conditions are met. The deal values the subsidiary at $100 million or $25.00 per SPU share.

On a July 25, 2016 we published a research note titled SkyPeople Fruit Juice — SPU — Lighting Up U.S Listed China Stocks. We summarized a potential transaction between one of SPU’s subsidiaries, Shaanxi Guoweiduomei Beverage Co,. Limited and a State Owned Enterprise (SOE) in China, Shaanxi New Silk Road Kiwifruit Group Inc. (NSR). The definitive agreement calls for NSR to purchase a 51% stake in Guoweiduomei. NSR will have to pay $46 million (we presume in cash or in NSR shares) to complete the transaction if certain conditions are met. The deal values the subsidiary at $100 million or $25.00 per SPU share.

SPU Pumping Again

Here is an excerpt from our initial research note:

SkyPeople Fruit Juice Inc. (NASDAQ:SPU) (~$17), a producer of various concentrated fruit juices sold mainly in China, lit the candle. On July 13, 2016 SPU closed at $2.95 compared to its current price of $18.00 pre-market this morning. The stock is pumping on a delayed reaction to an 8k released on June 21, 2016 that the company reached an agreement to sell 51% of its main subsidiary to Shaanxi New Silk Road Kiwifruit Group.

Shares suffered a steep pull back to around $6.00 after reaching $20.95. But SPU, a microcap with only 4 million shares outstanding, is pumping again. SPU rose 58% in yesterday’s (August 29, 2016) trading session to close at $9.50.

Since our initial SPU research note, as promised, we conducted on the ground due diligence (OTGDD). We want to verify if this transaction is actually on the table. Trust or the perception of trust means everything in the U.S. Listed China Space.

See our findings here which includes a conversation with a high-ranking representative of the SOE that is attempting to buy a stake in the above-mentioned SPU subsidiary.

[hide]

Due Diligence Findings

Here is what we found so far:

- Through a phone conversation with NSR we spoke to a high ranking representative. He stated that there is a deal where the SOE plans to acquire SPU’s subsidiary. However, he did not offer any further details.

- Shaanxi Guoweiduomei Beverage Co. is an SPU sub established in 2014 which owns:

- Mei County subsidiary

- Yidu County subsidiary

- Suizhong County subsidiary

Based on our findings, Mei County subsidiary is conducting regular business operations. Yidu County subsidiary is still under construction, with plans to begin production in 2017. Our China team has yet to visit Suizhong County subsidiary in Northern China. But we plan to soon.

- We are still in the process of valuing Guoweiduomei’s three subsidiaries to determine whether NSR’s valuation (USD 46 million for 51% shares) of Guoweiduomei is reasonable.

- We also visited the legacy subs of SPU

- Zhouzhi County subsidiary

- Jingyang County subsidiary

Based on our findings, both of these subs are conducting regular business operations. However, please note that the legacy subs were the subject of fraud allegations in 2011. A report claimed that management was lying about sales, earnings and production volumes in SEC filings. In 2012 SPU reached a settlement in a defamation law suit it brought against one of its accusers.

Not Done Til The Fat Lady Sings

Please note that Investors also need to be aware that the closing of transaction is subject to conditions.

Pursuant to the Agreement, NSR will acquire 51% of the equity shares of Shaanxi Guoweiduomei Beverage Co,. Limited, a wholly owned subsidiary of Hedetang (the “Shares”). The tentative total transfer price for the Shares is 300 million RMB (approximately $46 million) and is subject to and will be settled according to the final price in the valuation report to be issued by an appraisal firm jointly engaged by both parties. NSR shall pay the total transfer price to Hedetang within six months of the effective date of the Agreement.

If NSR fails to pay the total transfer price within 6 months due to the delay of the approval process from the local authority, NSR can receive a payment extension for up to twelve months from the effective date of the Agreement upon the negotiation and agreement by the parties. Because NSR is a state-owned enterprise in China and its investment needs to be approved by a higher level administrative authority in China, NSR has the right to terminate the Agreement unilaterally if it fails to receive the approval from such administrative authority within one year from the date of this Agreement.

It is also unclear if NSR intends to complete the transaction by

- Paying $46 million cash (would likely need to obtain financing in China), or

- Paying for Guoweiduomei through $46 million worth of NSR stock

Obviously, investors will probably treat a cash transaction more favorably.

NASDAQ Giving SPU Time

SPU is delinquent in filing its 10-K for the period ended December 31, 2015, its Form 10-Q for the period ended March 31, 2016 and its 10-Q for the quarter ended June 30, 2016. But apparently NASDAQ won’t drop the gravel yet.

Previously, in a notification letter dated June 24, 2016, NASDAQ had granted the Company an exception until October 11, 2016 to file its delinquent Form 10-K for the period ended December 31, 2015 and Form 10-Q for the period ended March 31, 2016 (the “Initial Delinquent Filings”) based upon the initial plans of compliance (the “Initial Plans of Compliance”) submitted by the Company to NASDAQ. This extension represents the full extent of the discretion afforded to staff of the Listing Qualifications Department of NASDAQ pursuant to Listing Rule 5810(c)(2)(F)(ii). As a result of this additional delinquency of Form 10-Q, the Company is provided until September 1, 2016 to submit an update of the Initial Plans of Compliance to regain compliance with respect to the filing requirement.

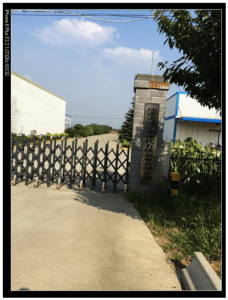

Facility Pictures

Mei County subsidiary

Yidu County subsidiary

Zhouzhi County subsidiary

Jingyang County subsidiary

[/hide]