Introducing SanaCurrents

- Introducing SanaCurrents, a research service for the serious and sophisticated biotech investor.

- Founder of SanaCurrents, Bill Langbein, finally brings his service to the mainstream to enable biotech investors to track catalysts through the lens of varying levels of sentiment.

- After much preparatory collaboration with SanaCurrents, GeoInvesting is proud to add the service to its research tool set.

It’s been 11 years since we launched GeoInvesting, but the biotech industry has had a solid presence since 1975. Publicly traded biotechs have been prominent for decades, as has the allure of capturing high returns by finding the next Amgen Inc. (NASDAQ:AMGN) or Intuitive Surgical, Inc. (NASDAQ:ISRG).

Biopharmaceuticals are still a rapidly emerging sector, creating opportunity and risk across the microcap and small cap space – especially among companies valued less than $2 billion. For example, last year, Amarin Corporation (NASDAQ:AMRN) just saw its shares increase nearly 700% in just a couple weeks after it released surprisingly positive data from its five-year REDUCE-IT trial for its drug Vascepa.

These moves are not uncommon across the biotech universe and related market sectors, like medical device companies. Noting this, we recently stepped up our efforts to find recurring revenue medical device companies to invest in and share with our GeoInvesting community. To go further down this path and complement our already existing work on the outskirts of the industry, we believe now is the time to turn to experts to take us on a deeper dive.

We are proud to introduce you to a duo of biotech experts with a proven analysis service called ‘SanaCurrents’ that they, and their institutional clients, have used for the past two years to gain clarity on investing in the biotech space.

SanaCurrents is now making its service available to retail investors, exclusively through GeoInvesting.

This move goes hand in hand with our long-term goal of complementing our premium research platform beyond our in-house team to give current and prospective GeoInvesting members additional options to receive quality, deep-dive research in areas we may not be fully covering.

No doubt, investing in biotech is a risky business. Many stories sound great at face value to the average investor but fail to deliver in the end. As such, having an edge is vastly important.

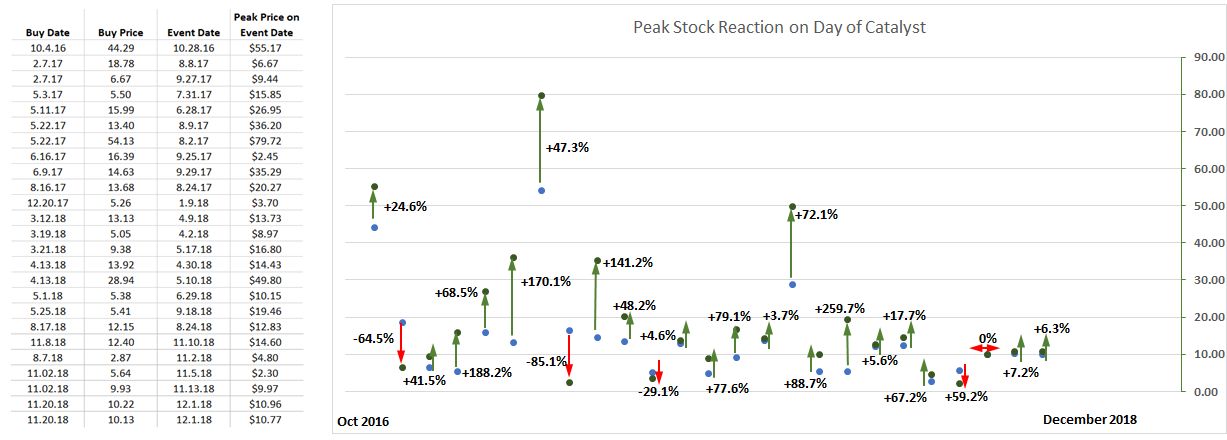

The founder of SanaCurrents, Bill Langbein, describes in a podcast link how SanaCurrents developed a set of objective data points related to clinical testing and the value proposition of drugs and devices in development. SanaCurrentsapplies these data points to forecast how likely a company will be able to advance a drug or device prior to pivotal announcements, such as clinical study results or an FDA decision. The team identifies and alerts its members to what they believe are under-priced stocks prior to a key event that may yield high returns. Since October of 2016, positive outcomes resulted in 20 favorable sentiments expressed by SanaCurrents on 27 biotech stocks.

Since teaming up with GeoInvesting in November, SanaCurrents calls, 3 stocks, Eidos Pharma (EIDX), Karyopharm Therapeutics (KPTI) and Cara Therapeutics (CARA), reacted positively to expected catalysts, 1 stock, Galmed Pharma (GLMD), was nearly neutral and 2 experienced negative declines. Left out of the chart is a company that has yet to report results. One of the two stocks that declined, ADMA Biologics (ADMA), did so because of FDA inaction, which will be resolved in a few months. The other, Verona Pharma (VRNA), was a missed call.

[hide]

In the second quarter of 2018, three biopharmaceutical companies disclosed clinical study results following SanaCurrents forecasts that were issued 21 to 60 days prior to their data announcements. Following the phase II announcements, the three stocks increased 77%, 79% and 88%, respectively.

[/hide]

The new promise of the sector lies in a recent surge of scientific innovation, the integration of technology (such as artificial intelligence with science) and a more accommodating FDA environment.

In 2018, the FDA approved 59 novel drugs, surpassing the 2017 total of 56. In 2016, only 22 novel drugs were approved.

The FDA and Congress also are committed to introducing more competition to respond to the well-publicized price increases of the past two years. FDA commissioner Scott Gottlieb told Congress in July that his agency was not going to wait a decade for new biosimilar drugs to enter the market, acknowledging the sector needs more price competition.

Last year, 73 biopharmaceutical companies priced IPOs, raising nearly $10 billion in capital. Moderna, Inc. (NASDAQ:MRNA) capped the 2018 IPO class by raising $604.3 million and at a valuation of approximately $7.5 billion, the largest IPO ever for a biotech company.

The valuations of these small cap and microcap companies tend to fluctuate wildly, largely because most have no revenue and are valued by potential and news of development progress. SanaCurrents, in partnership with GeoInvesting, stays ahead of a company’s development steps to alert subscribers to key catalysts. When the catalysts are positive, such as Amarin’s Vascepa trial results, a significant increase in valuation follows.

We recently spoke with Bill during a podcast to introduce the service and pick Bill’s brain.

Before starting SanaCurrents, Bill Langbein spent more than 20 years as a life science business journalist, with stops at Reuters Health, In Vivo and California Medicine. During that time, he wrote on genomic discoveries, the emergence of biologics, and the emergence of precision medicine. He founded SanaCurrents to serve the more focused biotech market of the 21st century.

Phil Greyling joined SanaCurrents while he was a graduate student and helped develop the company’s analytics model before becoming a partner. He previously earned an undergraduate degree in molecular biology. While biologists typically start their careers with a limited business and investment background, Philip completed a professional science master’s (‘PSM’) program. The masters program provided advanced training in innovative scientific techniques, while also integrating complementary biotechnology business skills in management and analytics.

GeoInvesting has had a penchant for picking high quality microcap stocks for nearly a decade based on fundamental analysis and information arbitrage. We’re proud of our expertise in microcaps and recognize it is the direct result the of success by our co-founder, Maj Soueidan, has had for nearly 30 years in the microcap space. And we are now excited for SanaCurrents to complement our research tool set.

Updated January 20, 2019 to reflect updated numbers and stats.