As you may have read recently or noticed, shares of BioXcel Therapeutics (NASDAQ:BTAI) recorded a 627% gain in seven months after SanaCurrents’ December 20, 2019 report that forecast positive outcomes for two, separate phase III trials for BioXcel’s drug BXCL501.

The 627% figure represents the largest gain on a single SanaCurrents catalyst forecast in the past four years. There have been previous catalyst forecasts that posted gains between 170% and 220%, but never 627%, as demonstrated by BioXcel’s share price increase to $60.42 on July 20, 2020 from $8.31 seven months earlier.

The gains from stocks like BioXcel and Arcturus Therapeutics (NASDAQ:ARCT), as well as the deep hits from GenFit (NASDAQ:GNFT) and Cassava Sciences (NASDAQ:SAVA), prompted us to conduct a comprehensive back study of our performance, presented in a summary below.

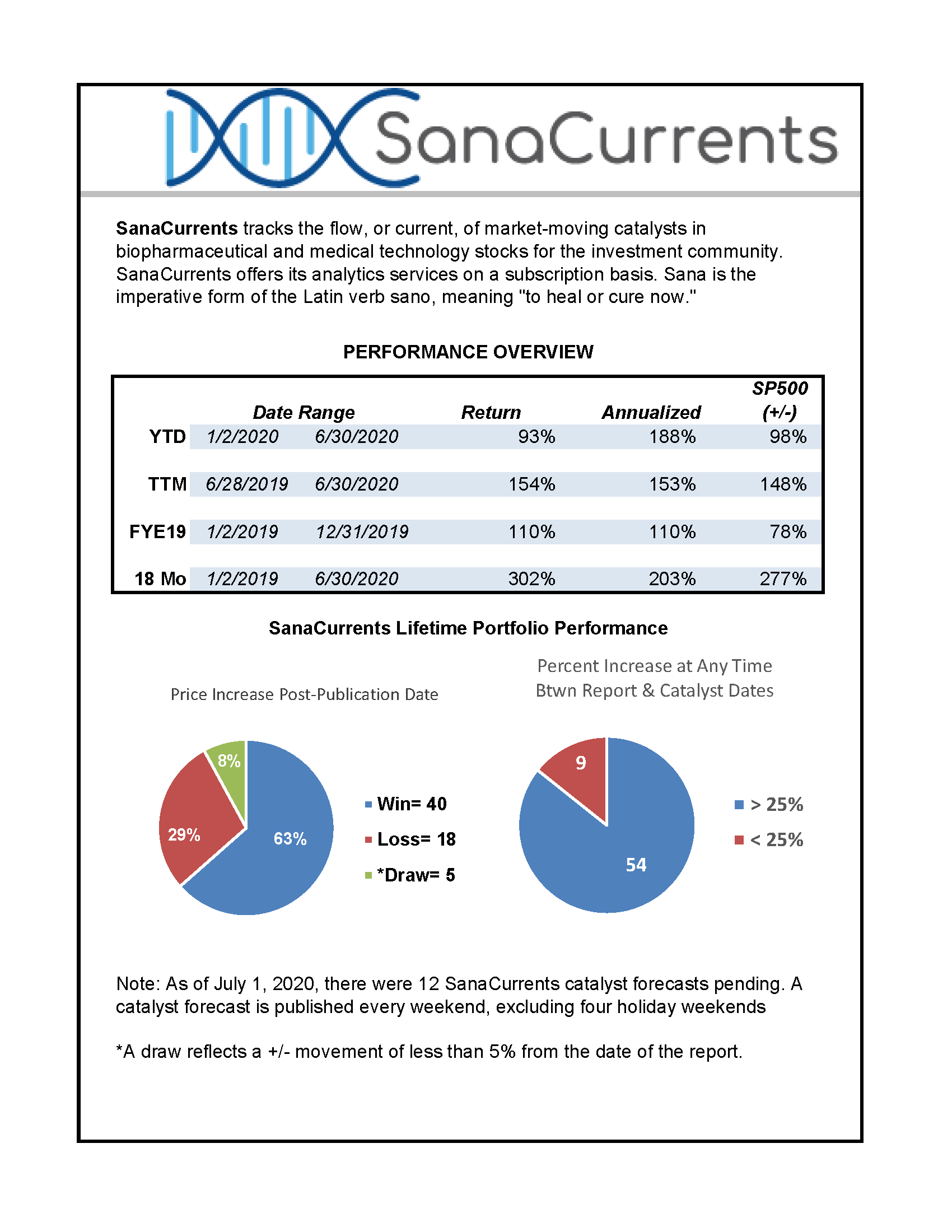

The results reflect the cumulative increase in the value of a $1 purchase in each SanaCurrents catalyst forecast that has been realized and reinvested. The performance figures cited include all positive and negative catalyst outcomes. To provide a specific example, a negative 50% result is included in all performance calculations as well as a 220% positive gain, each percent representing the performance of a particular stock, post catalyst.

The methodology assumes $1 is invested in a SanaCurrents catalyst at the time of the report. As a catalyst is realized, positive or negative, the capital is reinvested evenly across all remaining SanaCurrents catalysts. For example, if a realized catalyst yielded $1,000 in total capital remaining and there were 10 pending catalysts, the model assumes one would re-invest $100 more into each of the companies with pending catalysts. In the model, the re-investment enhances cumulative gains and helps compensate for missed catalysts, leading to the strong overall gains.

The two pie charts demonstrate 65% of SanaCurrents’ catalyst forecasts were accompanied by an increase in a company’s stock price stock price at the time of the catalyst. In 54 out of 63 closed catalysts through July 1, 2020, the company’s stock price increased at least 25% at some point after the report was issued up to the date of the catalyst. Returns after the date of the catalyst were not considered.

Balancing reinvestment as described above can be accomplished easily by a spreadsheet but is not an easy exercise in practice. Constantly rebalancing positions to maintain the right number of shares (for equitable distribution of capital in pending catalysts) can be a little tricky, especially if capital allocation is an issue. As a result, it is not a surprise many SanaCurrents subscribers prefer to pick and choose the catalysts that interest them and invest at different points in the cycle.

These results are presented to demonstrate one method in which SanaCurrents may work for you. Phil and I started the company because we were convinced when important treatments achieved key clinical or regulatory milestones, the values of the companies would increase. Equally important, patients would benefit from improved treatment.